- Bitcoin confirmed indicators of restoration with a 2.7% improve, buying and selling above $60,842 at press time.

- Analysts predicted both all-time highs or a drop to $48K, primarily based on upcoming financial information.

Bitcoin [BTC] is as soon as once more at a crucial juncture. After reaching an all-time excessive of over $73,000 in March, Bitcoin has gone by way of a rollercoaster journey, marked by vital fluctuations.

At present, Bitcoin confirmed indicators of recuperation, having elevated by 2.7% within the final 24 hours to a buying and selling worth of roughly $60,842.

The current weeks have seen Bitcoin oscillate inside a slender vary, hinting at an underlying uncertainty in market sentiment.

This era of consolidation got here after a sequence of declines and recoveries. Given this, the query now’s whether or not Bitcoin can maintain this nascent restoration and embark on a path again to its peak ranges.

Technical outlook from analysts

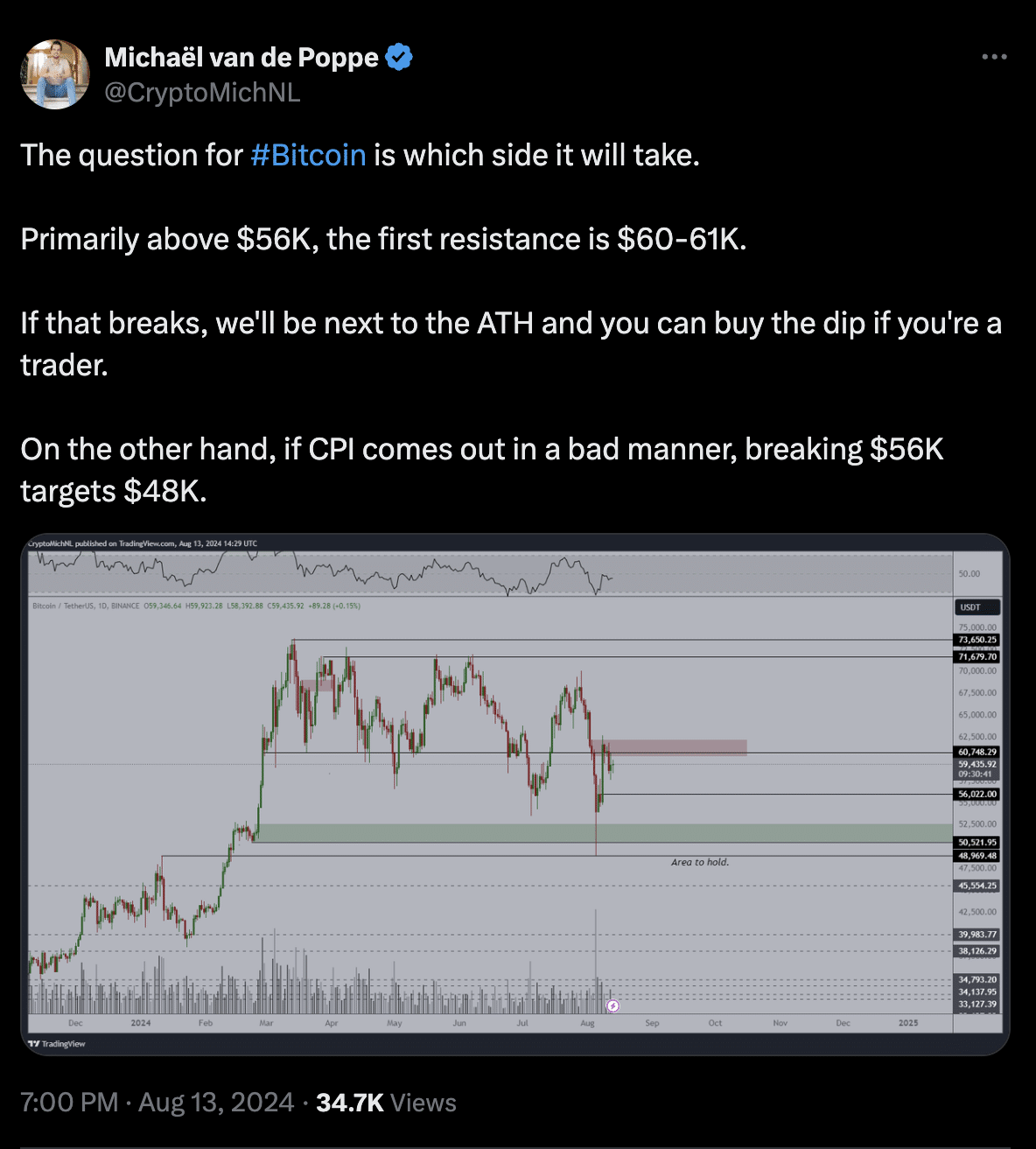

Michael Van De Poppe, a notable determine within the crypto evaluation house, has not too long ago provided his insights into Bitcoin’s potential instructions.

He outlines a bifurcated path relying on key resistance ranges and upcoming financial indicators, explaining,

“If Bitcoin maintains support above $56,000 and breaks through the $60-61K resistance, the path to retesting its all-time highs is clear.”

Conversely, adversarial developments, resembling a disappointing Client Worth Index (CPI) information, may push Bitcoin down in the direction of the $48,000 mark.

Including to the dialogue, one other esteemed analyst, RektCapital, emphasised the significance of buying and selling quantity in confirming the restoration’s power. He remarked,

“Elevated buy-side quantity is promising, however sustaining this momentum is essential for overcoming current highs.“

A each day shut above roughly $61,700 would sign a robust bullish affirmation.

Is Bitcoin heading for one more dip?

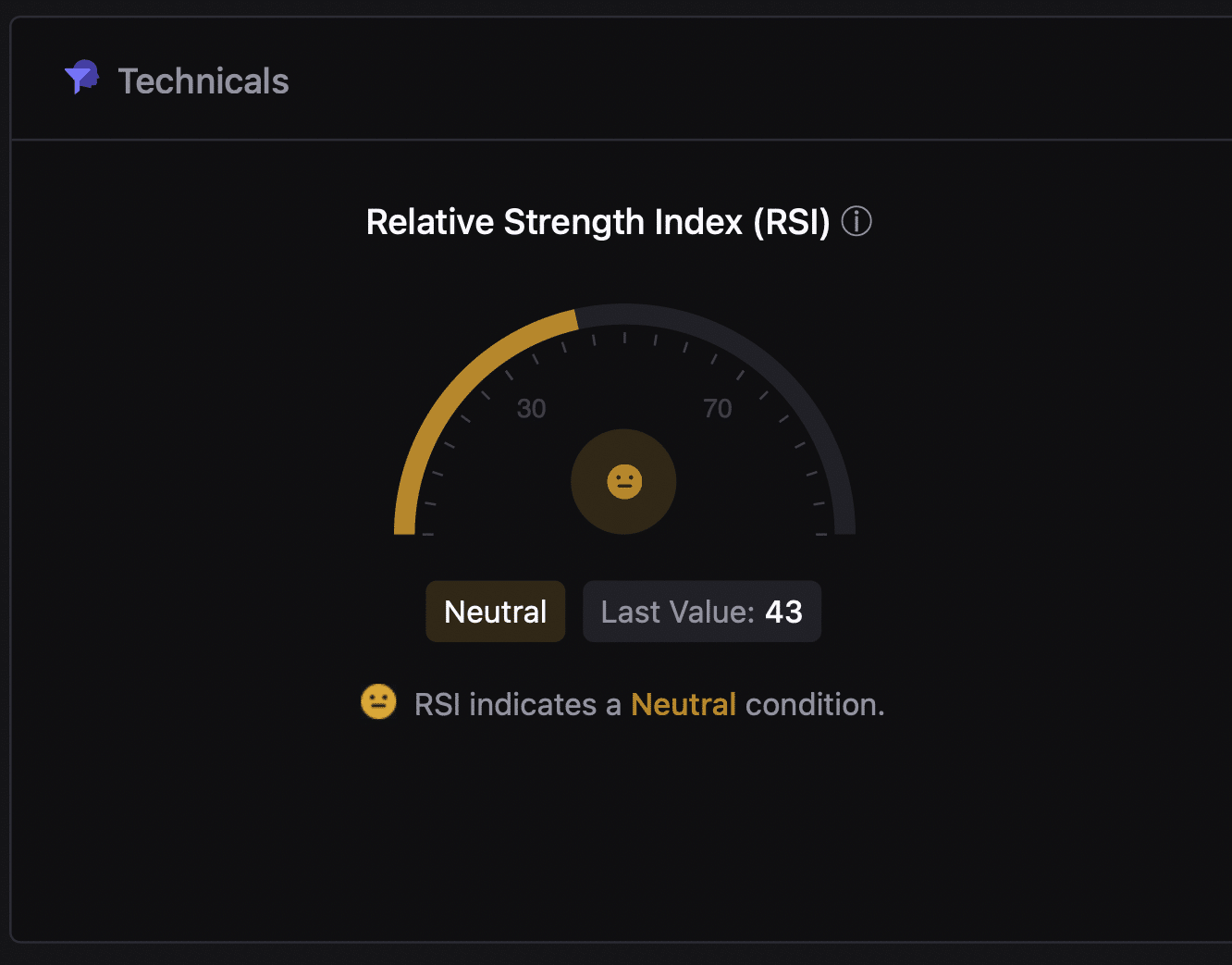

By way of Bitcoin’s technical well being, the Relative Energy Index (RSI), a device used to gauge market momentum and potential value reversals, stood at 43 at press time.

This impartial studying instructed that Bitcoin was neither overbought nor oversold, offering little directional bias and highlighting the market’s present indecision.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

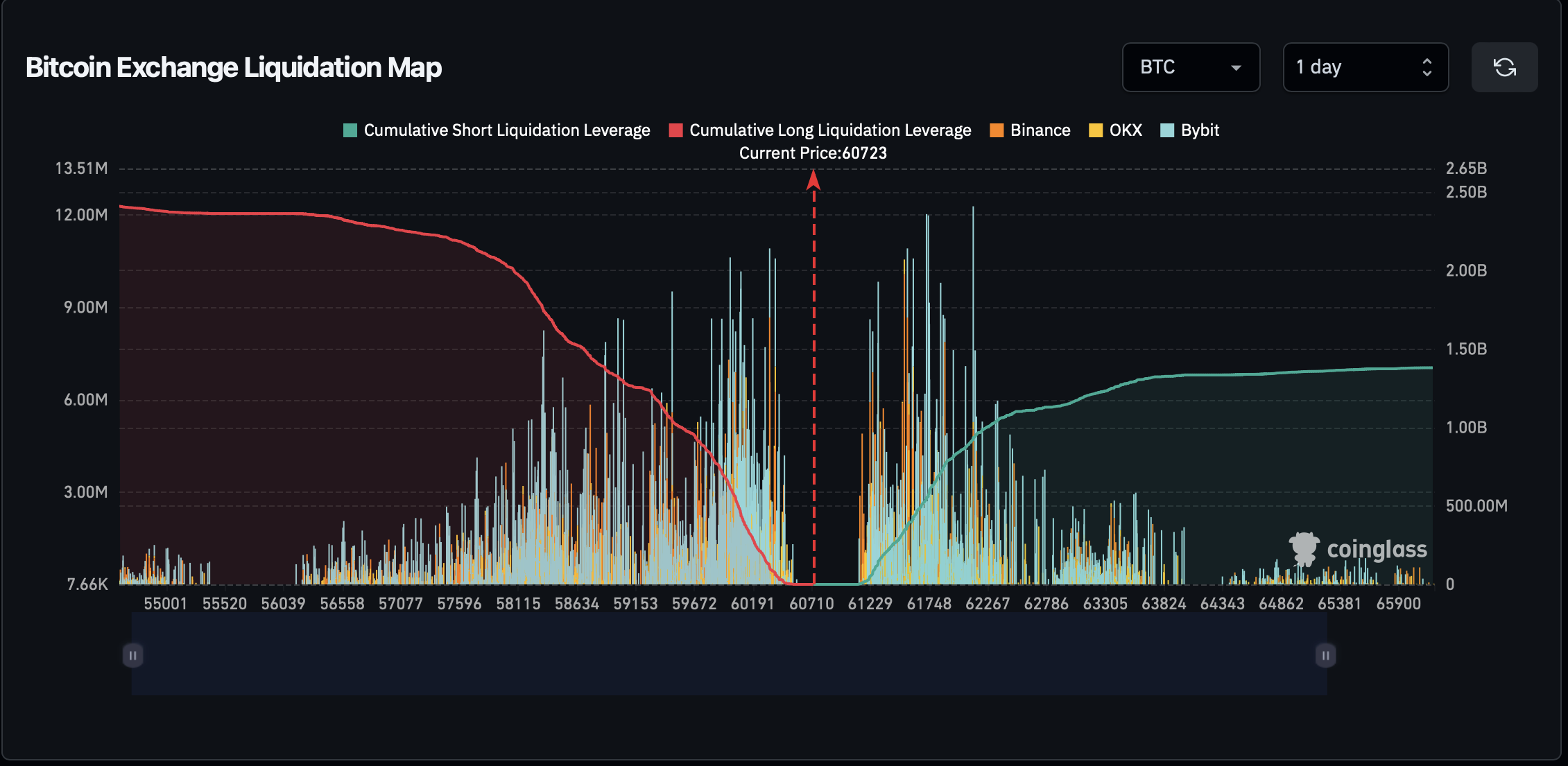

Furthermore, liquidation information from Coinglass revealed a big tilt in the direction of quick positions. If Bitcoin’s value ascends, it may set off liquidations value $2.41 billion, including gas to the upward motion.

Nevertheless, a value drop may liquidate round $1.38 billion in lengthy positions, intensifying a downward pattern.