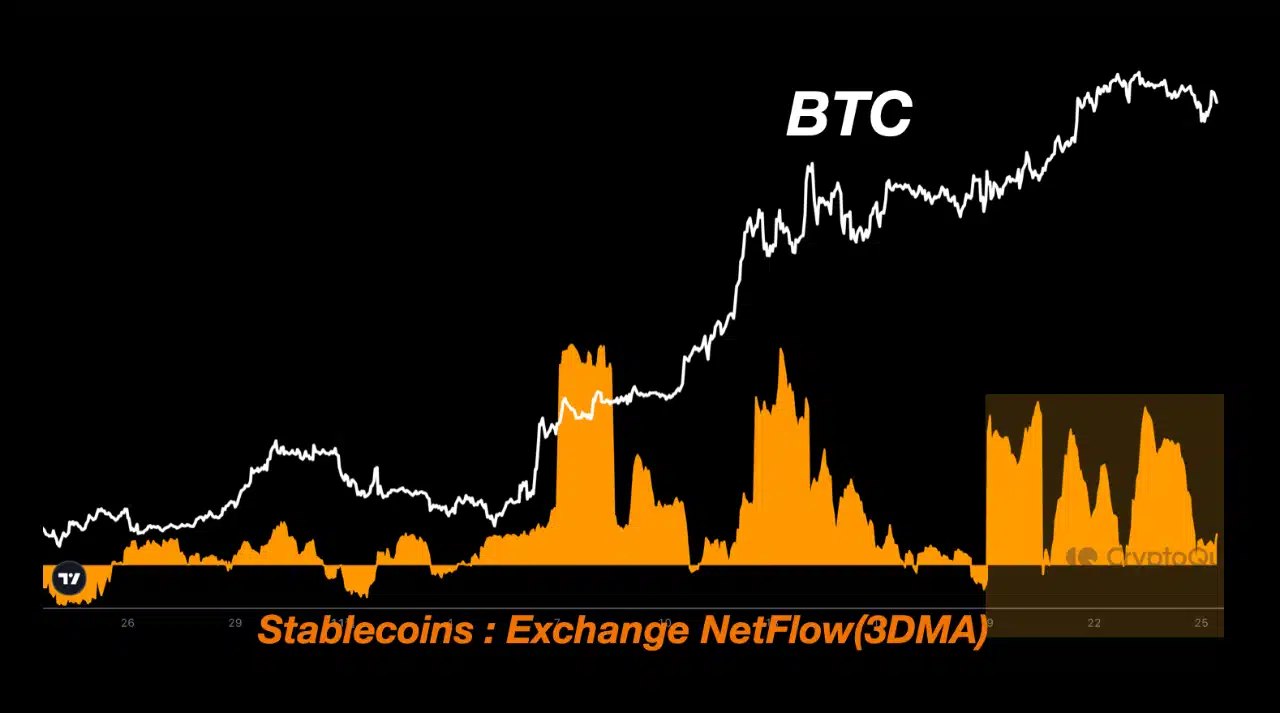

- Constant stablecoin inflows into exchanges are fueling Bitcoin’s value stability above $96,000.

- Bitcoin’s MVRV ratio at 2.69 and rising open curiosity recommend a bullish development with minimal dangers.

Bitcoin’s [BTC] journey towards breaching the $100,000 mark stays carefully watched because the cryptocurrency maintains value stability above $96,000.

Regardless of attaining an all-time excessive (ATH) of $99,645 on twenty second November, Bitcoin has resisted important corrections, buying and selling at $98,083 on the time of writing. This resilience suggests a sturdy basis, with market individuals awaiting its subsequent transfer.

One key statement behind this value stability has been the regular influx of stablecoins into exchanges. In accordance with SignalQuant, a CryptoQuant analyst, the development of stablecoin internet inflows has boosted Bitcoin’s means to maintain greater lows.

SignalQuant famous,

“This has allowed the price to continue to make higher lows. Its price will break the $100,000 mark at any moment without a significant correction based on the net inflows trend.”

In accordance with the analyst, this regular influx has minimized the potential for main sell-offs, reinforcing the bullish momentum seen in Bitcoin’s current efficiency.

Market fundamentals and Bitcoin’s future path

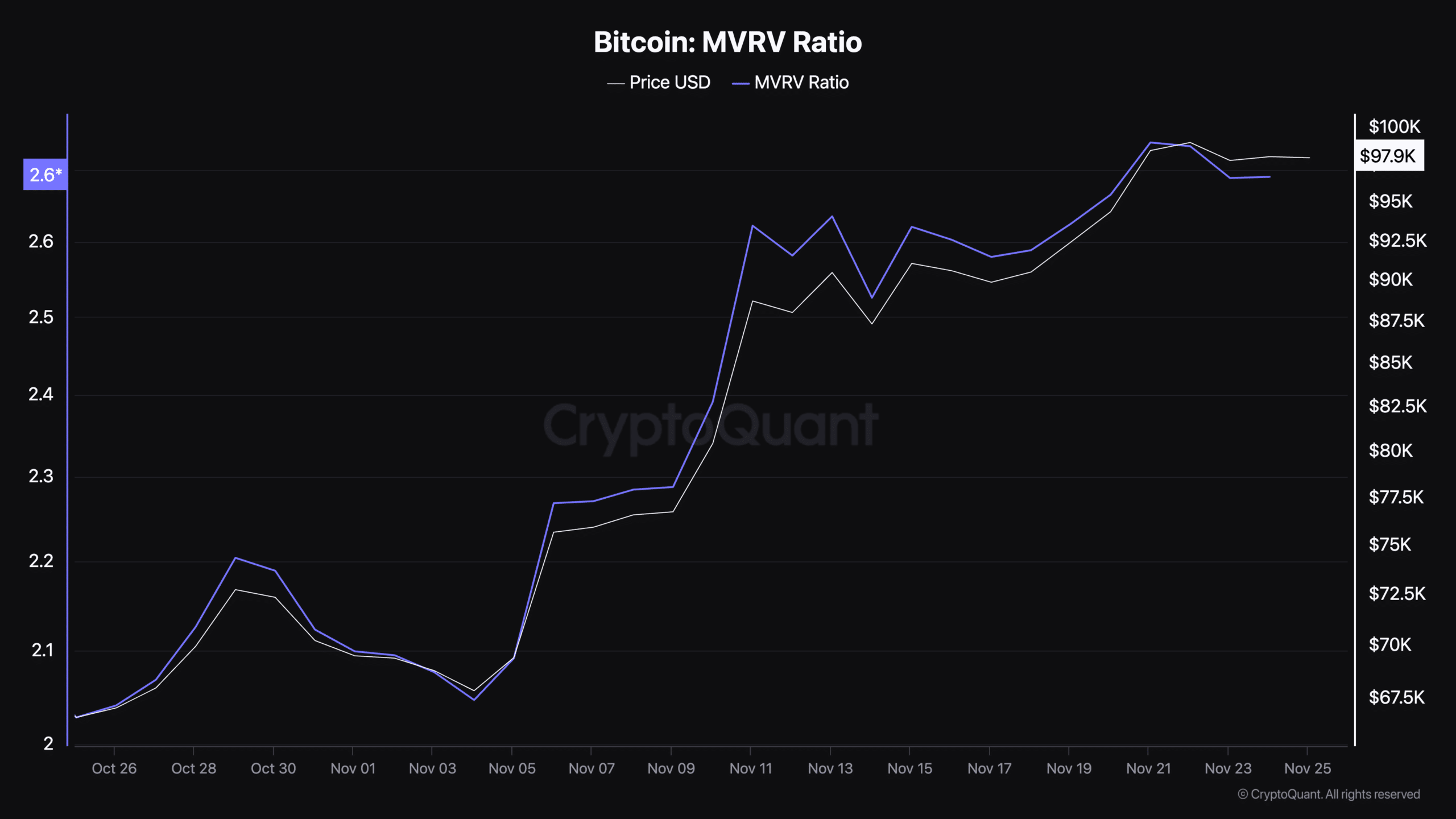

To raised perceive BTC’s potential trajectory, it’s vital to research key market fundamentals. The MVRV ratio, a preferred on-chain metric, offers precious insights.

The MVRV ratio is calculated by dividing Bitcoin’s market cap by its realized cap, reflecting whether or not the asset is overvalued or undervalued.

Traditionally, an MVRV ratio beneath 1 alerts a market backside, whereas values above 3.7 recommend a possible market peak. With Bitcoin’s MVRV ratio at the moment at 2.69, the metric signifies that the market is leaning towards optimism however stays beneath vital overvaluation ranges.

This implies room for additional value development whereas sustaining a cautious stance on overextension.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

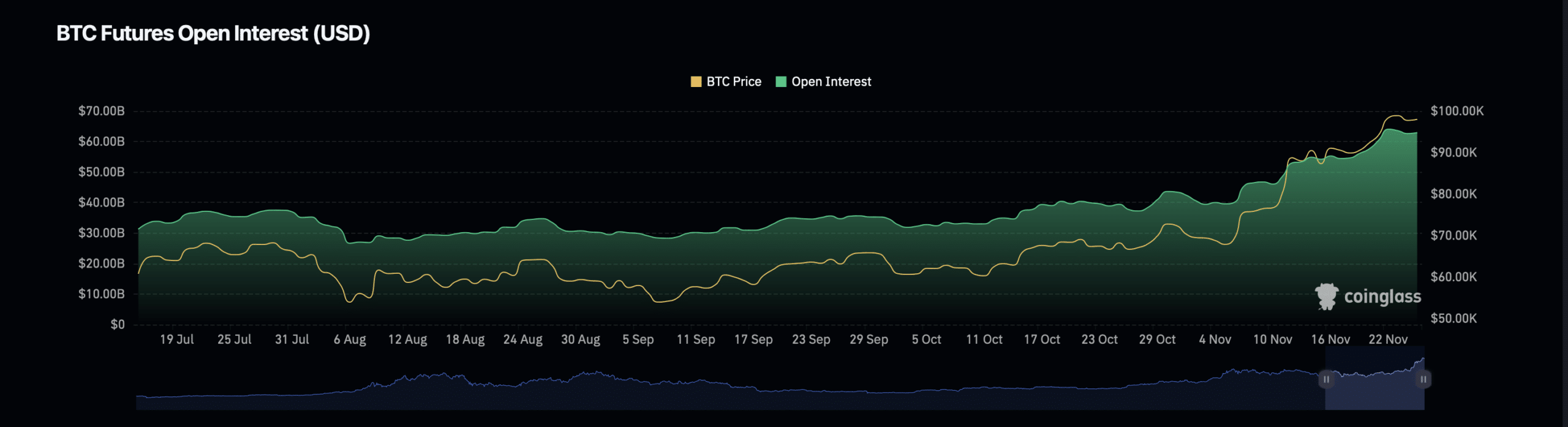

Along with the MVRV ratio, Bitcoin’s open curiosity and quantity metrics present a snapshot of dealer exercise. Information from Coinglass reveals a 0.86% improve in Bitcoin’s open curiosity, bringing it to $63.16 billion.

Equally, the open curiosity quantity has surged by 47.13%, reaching $81.33 billion. These figures spotlight a robust market urge for food for Bitcoin, with merchants positioning themselves in anticipation of additional value motion.