- Bitcoin has traditionally been bearish for essentially the most half in September, however this time may very well be completely different.

- NASDAQ embracing Bitcoin and bettering international liquidity circumstances may favor a bullish end result in September.

Bitcoin [BTC] will shut August within the purple in comparison with its month-to-month opening worth, if it doesn’t rally above its present weekly excessive within the subsequent three days.

This implies the burden of delivering optimistic month-to-month positive factors will push ahead into September.

So, ought to we count on a bullish month for Bitcoin in September? Traditionally, this has been some of the bearish months for the cryptocurrency.

The king coin delivered a bearish efficiency in eight out of 11 Septembers since 2013.

This implies that Bitcoin has a bearish bias in September, however will this play out equally this 12 months? There are key elements that time to the likelihood that BTC could prove extraordinarily bullish within the coming month.

Latest information revealed that international liquidity is recovering and is now at new highs. Whereas Bitcoin has not acquired an enormous share of that liquidity to date, the truth that liquidity is again on a optimistic development is optimistic for the market.

The rising international liquidity coupled with the count on charge cuts in September may present the increase that Bitcoin wants for optimistic returns through the month.

A CryptosRus evaluation recommended {that a} mixture of charge cuts, rising liquidity, the halving and the U.S. elections intently resembled Bitcoin in 2016 and 2020. BTC went via a sturdy rally in each situations.

Bitcoin is breaking into mainstream markets

Entry to Bitcoin is now increased than ever earlier than, particularly with ETFs launching earlier this 12 months. This increasing entry may quickly come to the inventory market courtesy of the newest NASDAQ submitting.

The latter seeks to roll out Bitcoin choices buying and selling, which may additional increase optimistic sentiment amongst buyers.

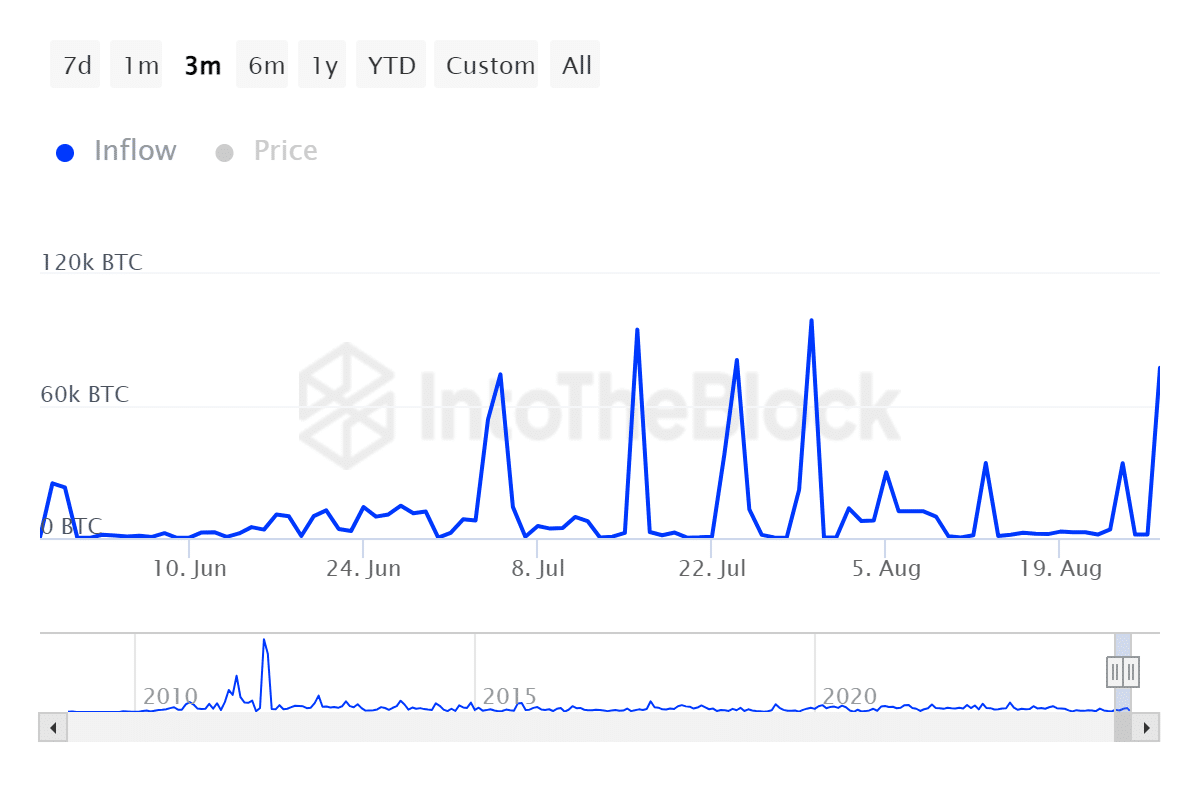

Bitcoin buyers may additionally be getting ready for a worth rally in September. Giant holder inflows spiked within the final 24 hours, to the fourth-highest degree noticed within the final three months.

Inflows peaked at 77,400 BTC throughout the identical interval, with solely 11240 in outflows recorded throughout the identical interval.

This comes after Bitcoin dipped under $60,000 as soon as once more, after beforehand elevating hopes that the value will head in direction of $70,000. So, buyers’ optimism remained excessive, judging by the depth of accumulation at decrease costs.

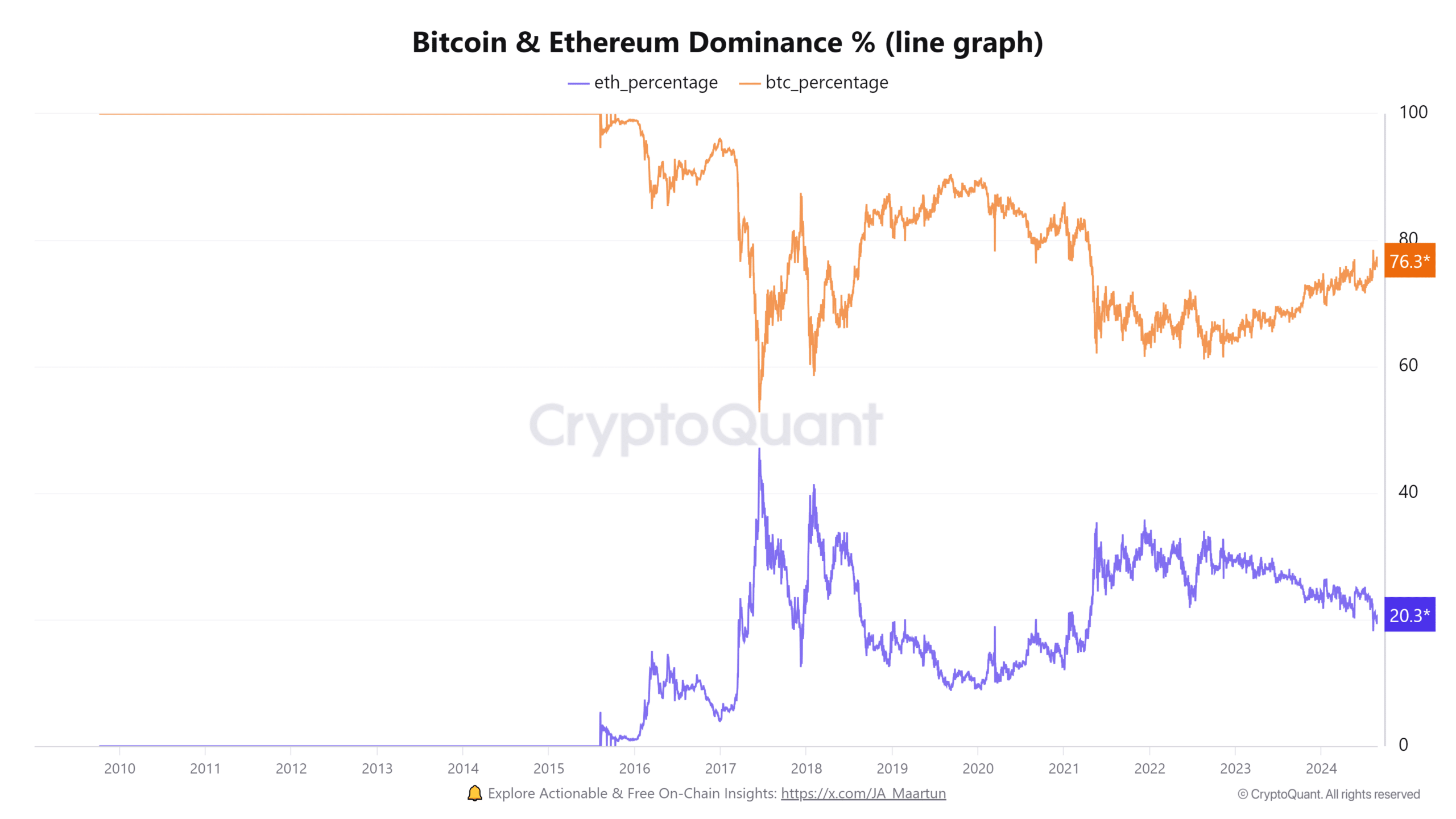

Bitcoin has additionally maintained important dominance towards Ethereum [ETH] and different altcoins. This implies it’s strategically positioned to make the most of many of the liquidity flowing into the crypto market.

Thus, Bitcoin nonetheless commanded most mainstream consideration regardless of the presence of many altcoins.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

In conclusion, Bitcoin is about for a probably bullish September if rates of interest come down.

Bettering international liquidity and the bettering adoption within the mainstream markets may favor BTC’s efficiency earlier than the tip of the 12 months.