- Will crypto recuperate? It’s the burning query as BTC tumbles again to $94K.

- The trail forward could possibly be unstable – but in addition ripe with alternative for these prepared to carry agency.

Coincidence or not, the FOMC assembly lined up completely with Bitcoin [BTC] hitting an all-time excessive of $108K. A slight ‘blip’ on the macro entrance was all it took to ship shockwaves by the market.

In a matter of days, the positive factors of the earlier week have been worn out, leaving Bitcoin teetering at a important $93K help stage. What appeared like strong earnings is now both cashed out at break-even or hanging on to a loss.

Clearly, these HODLers are holding out for a restoration. However to actually perceive if crypto can recuperate, we should look past the speculations and discover the previous, current, and way forward for this unstable market.

Key components distinguishing the previous from the current

Historical past has rather a lot to show us within the crypto market, and the quantity ‘four’ appears to carry a particular significance. Each fourth yr, the market faces an important check, with the next three years feeling the ripple results.

Assume again to 2020, when Bitcoin was thrust into the highlight because the pandemic disrupted conventional funding avenues like bonds, banks, and authorities yields.

In response, Bitcoin surged almost 320%, leaping from $10,000 in October 2020 to $42,000 by January 2021. This marked the start of a brand new period for BTC.

Quick ahead to at this time, and Bitcoin has risen by roughly 140% over the previous 4 years. This progress is pushed by a ripple impact of things, together with the post-halving surge, election liquidity, and inconsistent macro tendencies.

However the actual game-changer? Institutional capital injecting into BTC. As AMBCrypto notes, this inflow will likely be essential within the coming months. Not solely will it assist the crypto market recuperate, nevertheless it might additionally steer BTC by the unstable path forward.

Nonetheless, there’s a draw back rising this yr: ‘overleveraging’. Over the previous 4 years, borrowed capital has flooded the market, creating an added layer of threat.

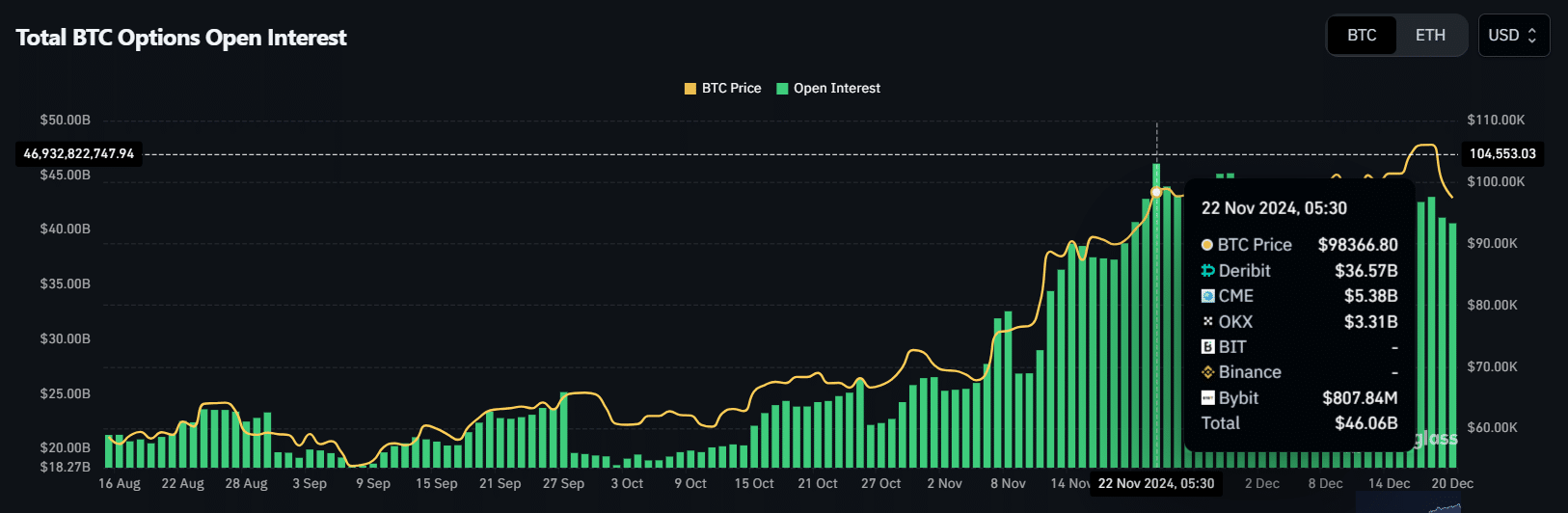

The influence is evident within the surge of open curiosity (OI), which lately reached an all-time excessive. As Bitcoin neared the $100K mark, the market noticed a staggering $47 billion in leveraged positions, with merchants betting on each instructions – up and down.

With these components in thoughts, when will crypto recuperate?

The subsequent help line for Bitcoin is shaping as much as be a battleground, and for now, the bears are firmly in management.

Nonetheless, there’s extra to this than simply market mechanics. AMBCrypto raises an necessary level: the FOMC fee reduce by 25 foundation factors was supposed to sign a “healthy” financial system.

The logic behind that is easy: decrease borrowing prices ought to result in larger buying energy, which ought to theoretically help Bitcoin progress.

However the reverse is going on. As a substitute of fueling Bitcoin’s rise, the greenback is strengthening. This means that retail traders are flocking to conventional safe-haven belongings, just like the greenback and bonds, quite than taking up threat within the crypto market.

This dip could possibly be precisely what the market must reset and recuperate. In truth, a robust entry level might emerge across the $90K mark, reigniting FOMO and bringing patrons again into the fold.

That mentioned, the stakes are excessive. With $671 million in internet outflows from Bitcoin ETFs, it’s clear that traders have gotten extra cautious.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Clearly, we’re at a crossroads right here. This could possibly be a make-or-break second for Bitcoin.

As we transfer ahead, it’s important to keep watch over the greenback index, ETF flows, and most significantly – who’s holding sturdy. That is the time for diamond fingers to shine, however the street forward will certainly be rocky.