- Bitcoin is closing in on $65K resistance because it holds above the $61.3K 21-week EMA for 2 weeks.

- Market indicators sign optimistic momentum, however merchants ought to look ahead to potential consolidation quickly.

Bitcoin [BTC] is approaching a vital weekly shut because it trades at $64,503, exhibiting a 2.53% worth improve within the final 24 hours.

Crypto analyst Rekt Capital famous that BTC is on the verge of closing above the 21-week Exponential Transferring Common (EMA) of $61,360 for the second consecutive week, which might sign continued bullish momentum. Holding above this stage might affirm a stronger uptrend for Bitcoin.

Along with the 21-week EMA, BTC can be nearing a detailed effectively above a significant downtrend line after retesting this stage twice prior to now two weeks.

Merchants are ready for Bitcoin to maintain its place above each these key indicators, which can permit bulls to push the value additional in direction of the $65,000 resistance zone.

Key assist and resistance ranges for Bitcoin

Help across the $61,360 mark, which corresponds with the 21-week EMA, is taken into account an important stage for Bitcoin. If Bitcoin closes above this assist, it might point out a sustained transfer larger, consolidating its bullish pattern.

Then again, resistance round $65,000 is predicted to be the following key barrier for Bitcoin.

This space has traditionally been a troublesome stage to interrupt, however with rising bullish sentiment, a breakout above $65,000 might pave the way in which for larger worth targets within the coming weeks.

Market indicators recommend optimistic momentum

The day by day chart of BTC/USDT reveals Bitcoin buying and selling between the higher and decrease Bollinger Bands, with the newest worth motion touching the center band. That is seen as an indication that the uptrend might proceed, particularly if the value breaks above the higher Bollinger Band within the subsequent few days.

The Superior Oscillator (AO) is above the zero line, indicating optimistic market momentum. Nevertheless, the shrinking histogram bars recommend a potential slowdown within the shopping for stress.

This might imply that Bitcoin may enter a consolidation section earlier than making its subsequent transfer. The Aroon indicator additionally displays a powerful uptrend, with the Aroon-Up line at 71.43%, signaling that consumers are nonetheless in management.

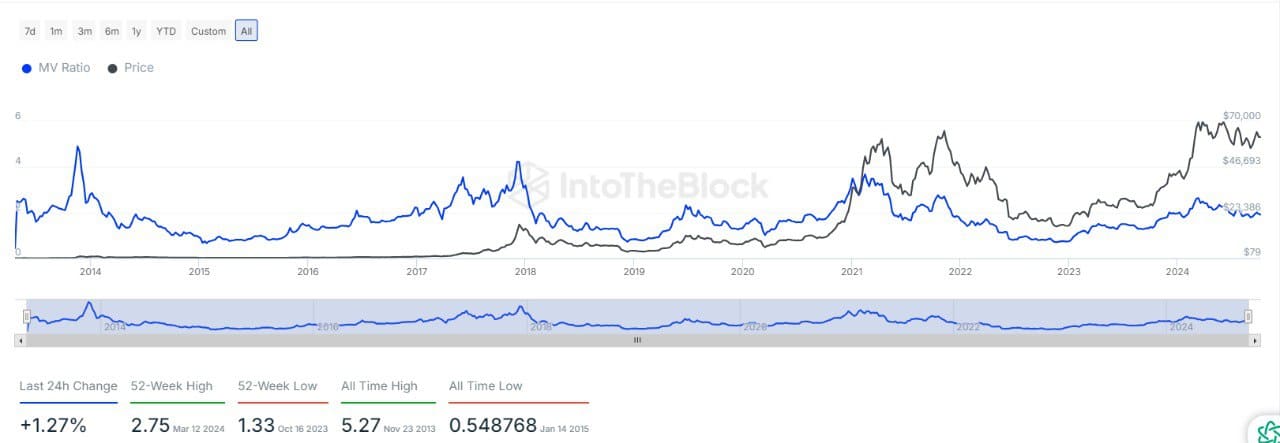

MVRV ratio displays rising bullish sentiment

The Market Worth to Realized Worth (MVRV) ratio for Bitcoin is at the moment at 2.75, indicating that Bitcoin is buying and selling at a premium in comparison with its realized worth. Traditionally, when the MVRV ratio exceeds 3, it has typically pointed to overvaluation and potential corrections out there.

Nevertheless, with the ratio nonetheless under this threshold, there’s room for additional worth appreciation.

Bitcoin’s present MVRV stage means that the market stays in a bullish section, however merchants ought to stay cautious as an rising MVRV might point out a better probability of market corrections.

The final 24 hours noticed a 1.27% improve on this ratio, exhibiting that market contributors stay optimistic about future worth beneficial properties.

Supply: IntoTheBlock

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

As of press time, Bitcoin had a market capitalization of roughly $1.27 trillion, with a 24-hour buying and selling quantity of over $28 billion. This rise in exercise helps the present bullish outlook, as larger buying and selling volumes typically align with important worth actions.

Moreover, on-chain knowledge from DefiLlama reveals a Complete Worth Locked (TVL) of $1.084 billion and 609,844 lively addresses over the previous 24 hours, reflecting regular person exercise and curiosity within the community.