- Bitcoin holdings appear to have stabilized, with notable shopping for exercise seen amongst distinguished addresses

- Whales are positioning themselves for a possible rally as liquidity inflows into the crypto market rise

Regardless of a market-wide decline, Bitcoin [BTC] has managed to stay above the $90,000-level for weeks now. This stability has restricted its latest losses, with the identical amounting to only 3.97% over the week and 5.49% over the month.

With market sentiment displaying indicators of shifting and merchants ramping up shopping for exercise, BTC might be poised to rally as soon as once more.

Accumulation positive factors momentum

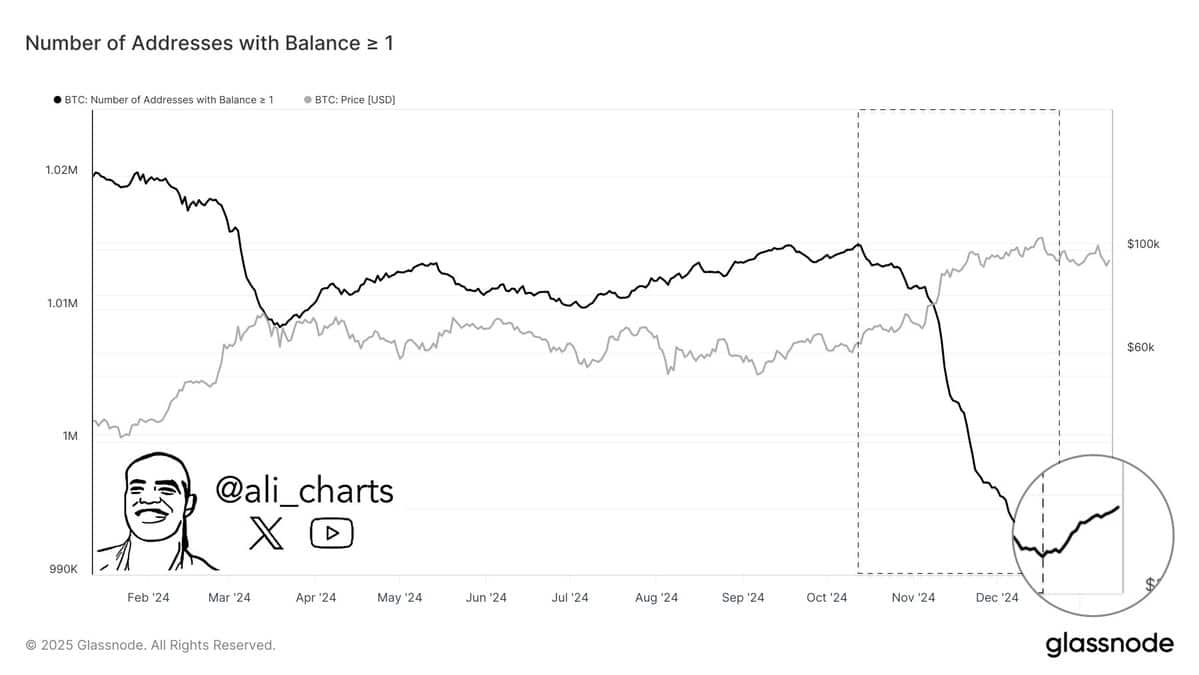

After monitoring the variety of addresses with a steadiness of a minimum of 1 BTC, Glassnode discovered that Bitcoin acquisition has surged this 12 months.

In keeping with its knowledge, there was a big hike within the variety of addresses holding greater than 1 BTC. This marks a notable shift, particularly following a protracted distribution section that started in October, throughout which many BTC holders had been promoting.

Such accumulation usually alerts a renewed sense of confidence out there. When traders shift from promoting to holding, it means they anticipate sustained worth and are more likely to retain the asset – Doubtlessly driving a rally.

AMBCrypto additionally noticed different market actions indicating rising bullish sentiment amongst merchants. This might allude to a possible uptick in BTC’s worth within the close to time period.

Liquidity surge and BTC investor changes

In keeping with Whale Alert, USD Coin (USDC), the second-largest stablecoin issuer within the crypto market, minted 250 million USDC in its treasury over the past 24 hours.

Such minting exercise sometimes alerts rising demand for stablecoins, as merchants put together to amass extra crypto belongings. Traditionally, BTC has usually benefited from hikes in minting exercise like this. If the development holds, BTC’s worth may step by step rise within the coming buying and selling periods, fueled by heightened acquisition curiosity.

Along with elevated liquidity, a notable shift has been seen amongst key BTC traders holding a mixed 2,535 BTC (value over $239 million).

These traders moved their holdings from a cryptocurrency trade, Kraken, to a personal pockets, signaling rising confidence in BTC. Particularly as they opted to retailer their belongings off exchanges for added safety.

The switch, originating from Kraken to an unknown pockets, occurred in three transactions – 620 BTC, 888 BTC, and 1,027 BTC.

By-product merchants unconvinced by BTC’s rally

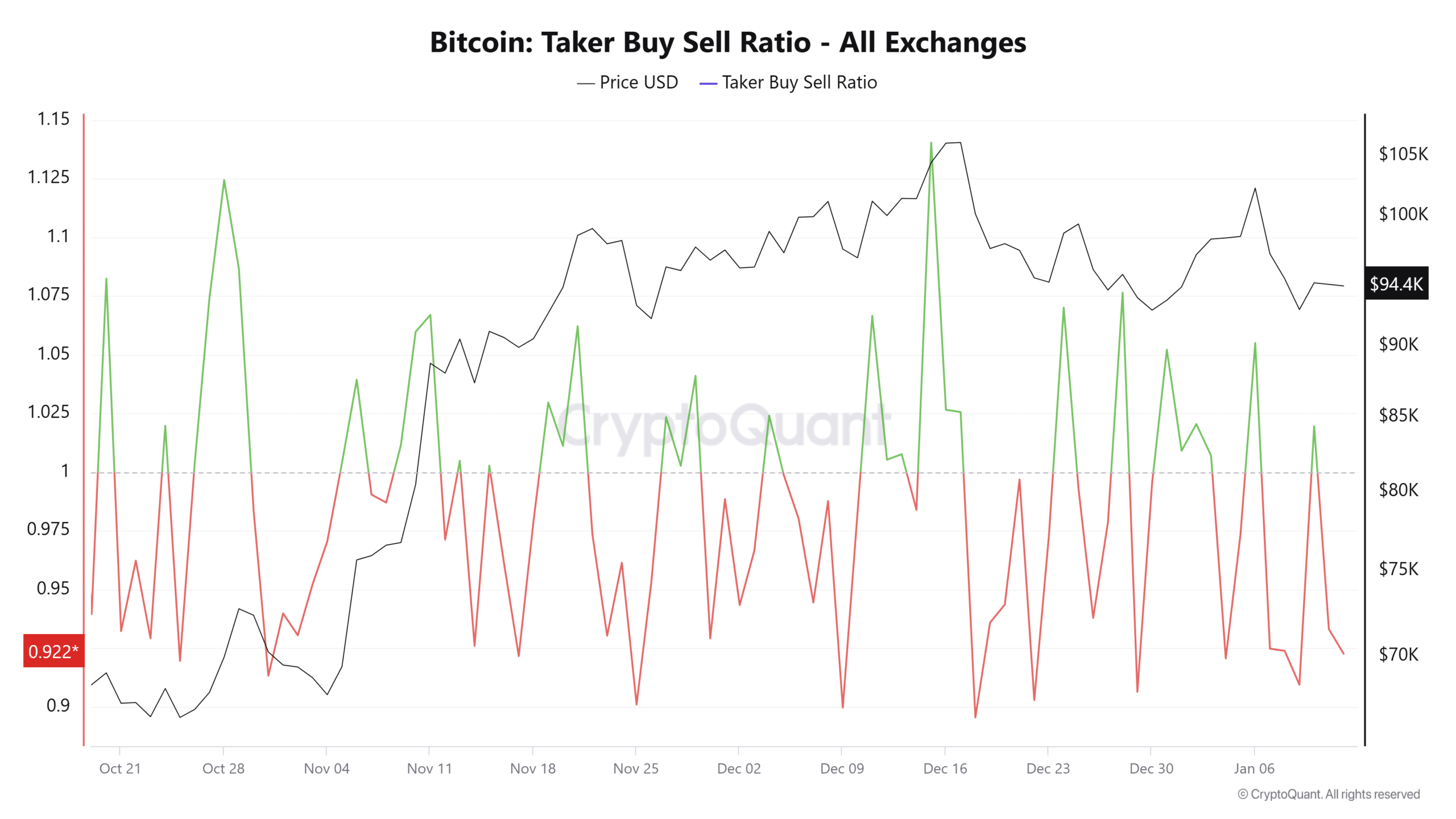

In keeping with the Taker Purchase Promote Ratio on CryptoQuant, which measures the ratio of shopping for to promoting within the derivatives market, sellers presently dominate the market.

On the time of writing, this ratio had dropped under 1, with a studying of 0.922. This indicated that promoting exercise outweighed shopping for. If this metric continues to say no, Bitcoin’s ongoing worth rally may face delays.

Nevertheless, with the hole from the impartial zone being lower than 0.1, an inflow of extra capital into the market and higher BTC outflows from exchanges may positively affect sentiment amongst spinoff merchants. This might enable the asset’s rally to proceed on the charts.