- BTC crossed $70K and hit a 4-month excessive, partly pushed by a liquidity seize.

- BTC was solely 3.5% away from its ATH, however there was a roadblock to clear.

Bitcoin [BTC] crossed the $70K psychological stage and surged to a four-month excessive of $71.5K. The upswing introduced its ‘Upbtober’ features to 11%, marking an efficient breakout from its multi-month consolidation vary since March.

Why is Bitcoin up?

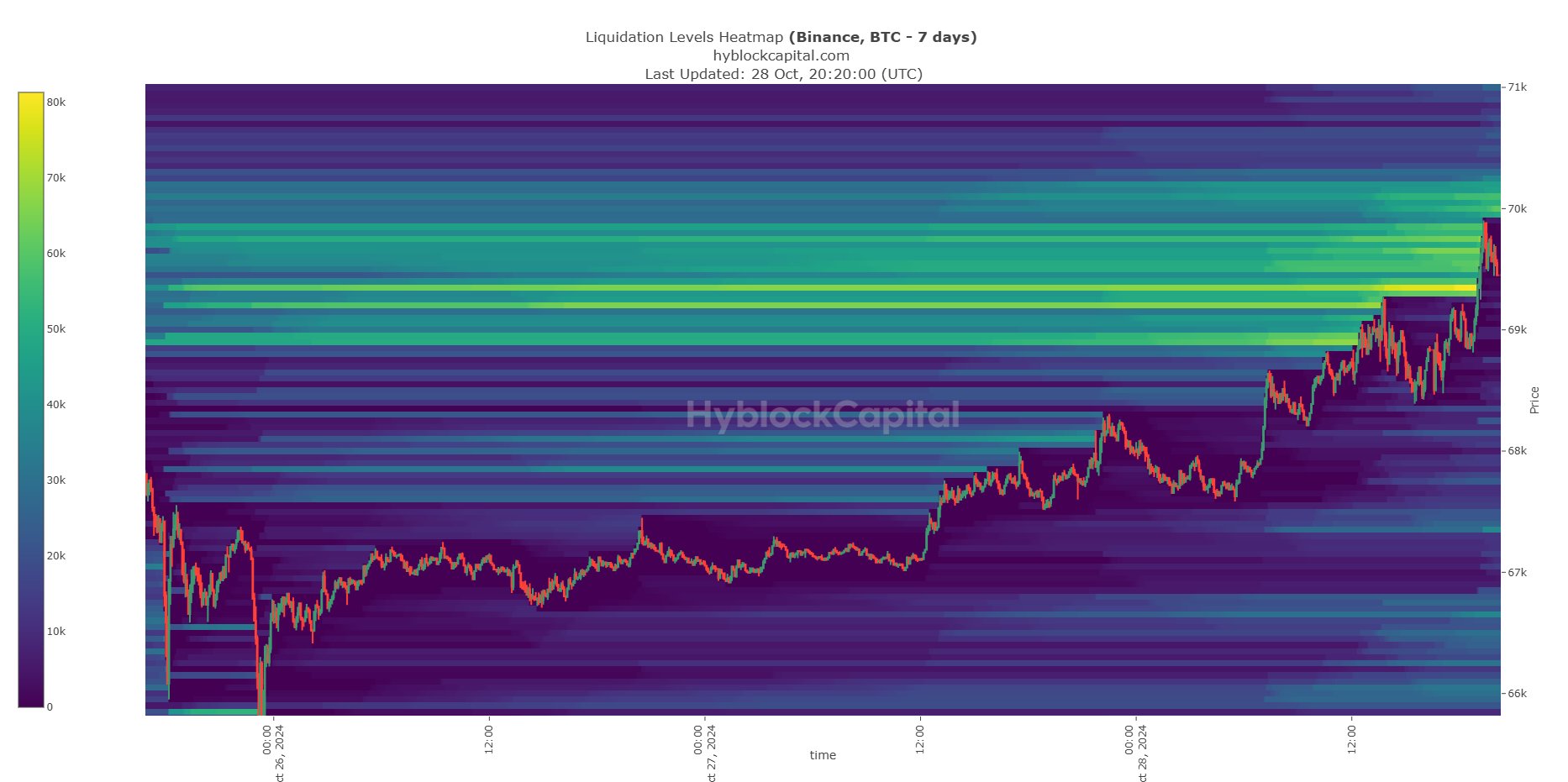

A liquidity seize drove a part of the pump above $70K. There have been appreciable liquidity clusters (quick positions) between $69.4K and $70K, as famous by BTC analyst and dealer CrypNeuvo.

For context, the worth motion tends to observe these liquidation ranges (brilliant yellow), influenced largely by market maker strikes. Therefore, the cluster at $ 70K acted as a magnet for the latest upswing, liquidating appreciable quick positions at $70K.

Over $80 million shorts rekt

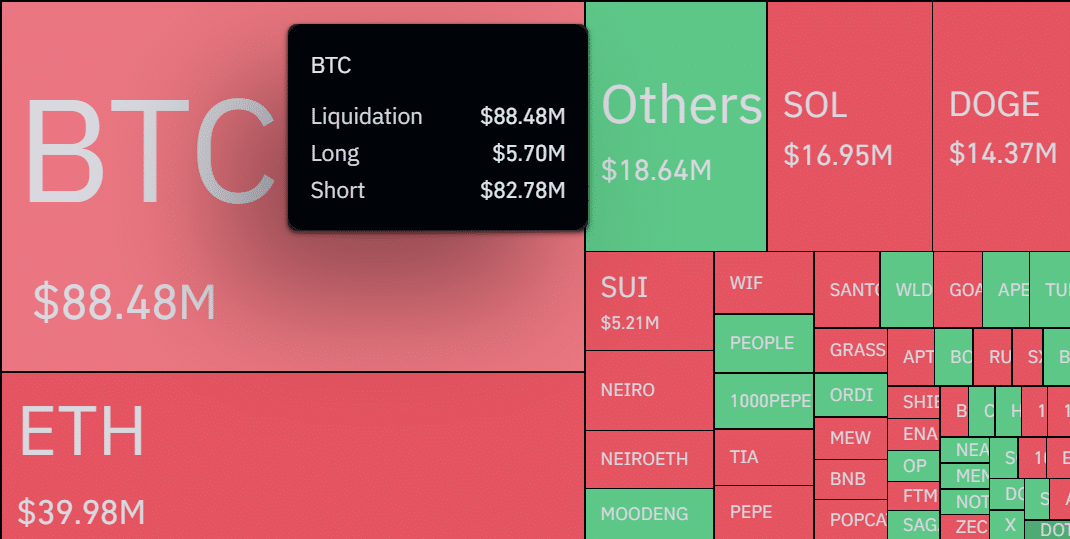

In line with Coinglass knowledge, $88 million positions have been liquidated after BTC broke above the $70K psychological stage.

Speculators who positioned bets for possible value rejection at $70K (quick positions) suffered probably the most, with practically $83 million in losses up to now 24 hours.

By extension, this additionally recommended a robust bullish sentiment because the market awaits US election outcomes subsequent week.

With rising odds of Trump profitable the US elections per predictions websites, Bitfinex analysts believed that US elections may very well be a ‘perfect storm for BTC.’ The analysts acknowledged,

“The convergence of election uncertainty, the “Trump trade” narrative, and favorable This fall seasonality create an ideal storm for Bitcoin, promising an thrilling interval forward no matter noisy value actions heading into the election in two weeks’ time.”

Analyst Peter Brandt shared an identical projection and believed the transfer above $70K would possibly begin the much-awaited post-halving parabolic rally.

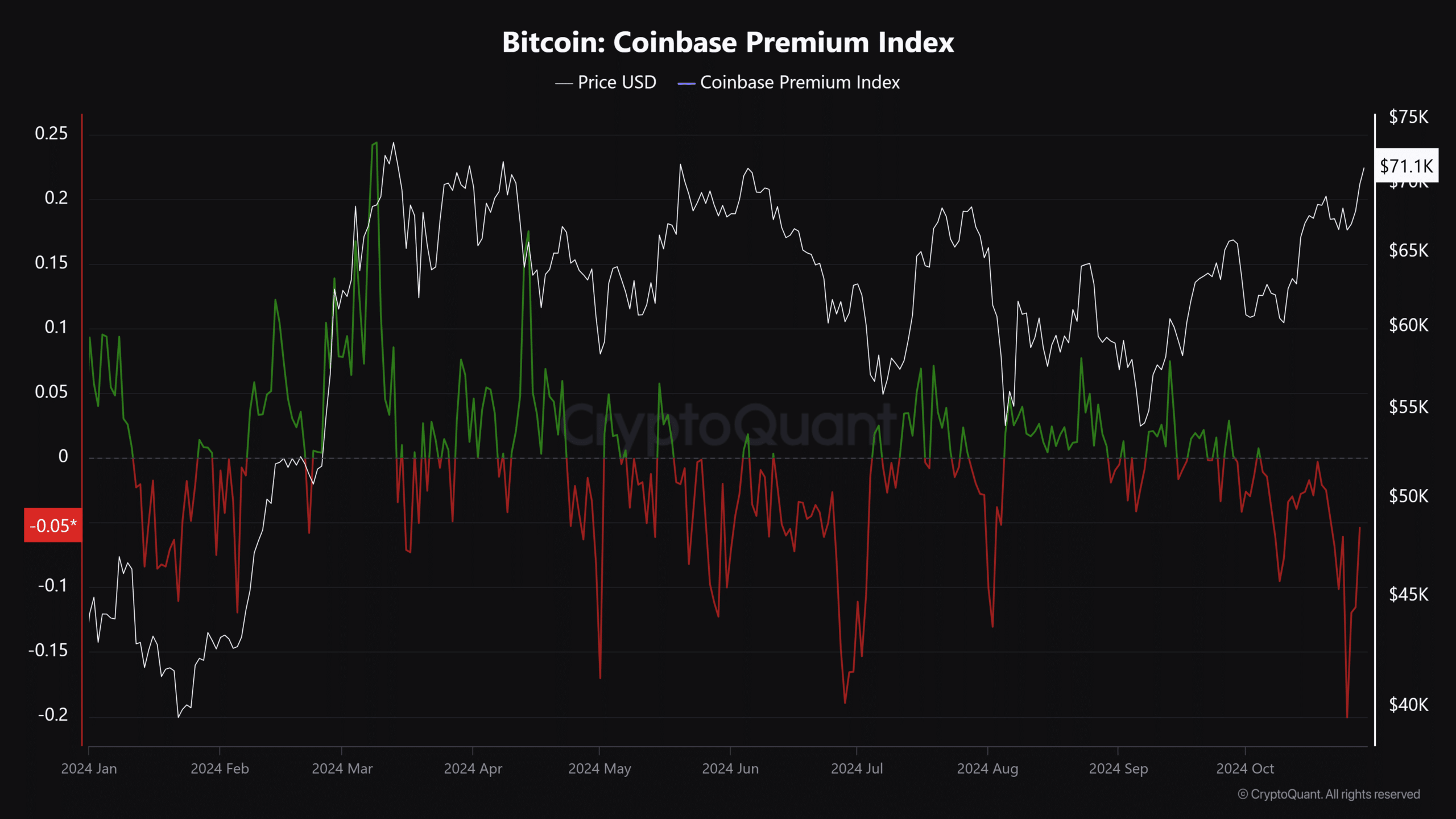

That stated, there was renewed demand from US buyers as BTC soared, as famous by the reversal of the Coinbase Premium Index.

Generally, a robust US demand (inexperienced) at all times coincides with a sustainable restoration for BTC.

Whereas the latest enchancment was nice for BTC, the weak studying meant that investor curiosity was nonetheless comparatively low in comparison with March, when BTC hit a brand new all-time excessive.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

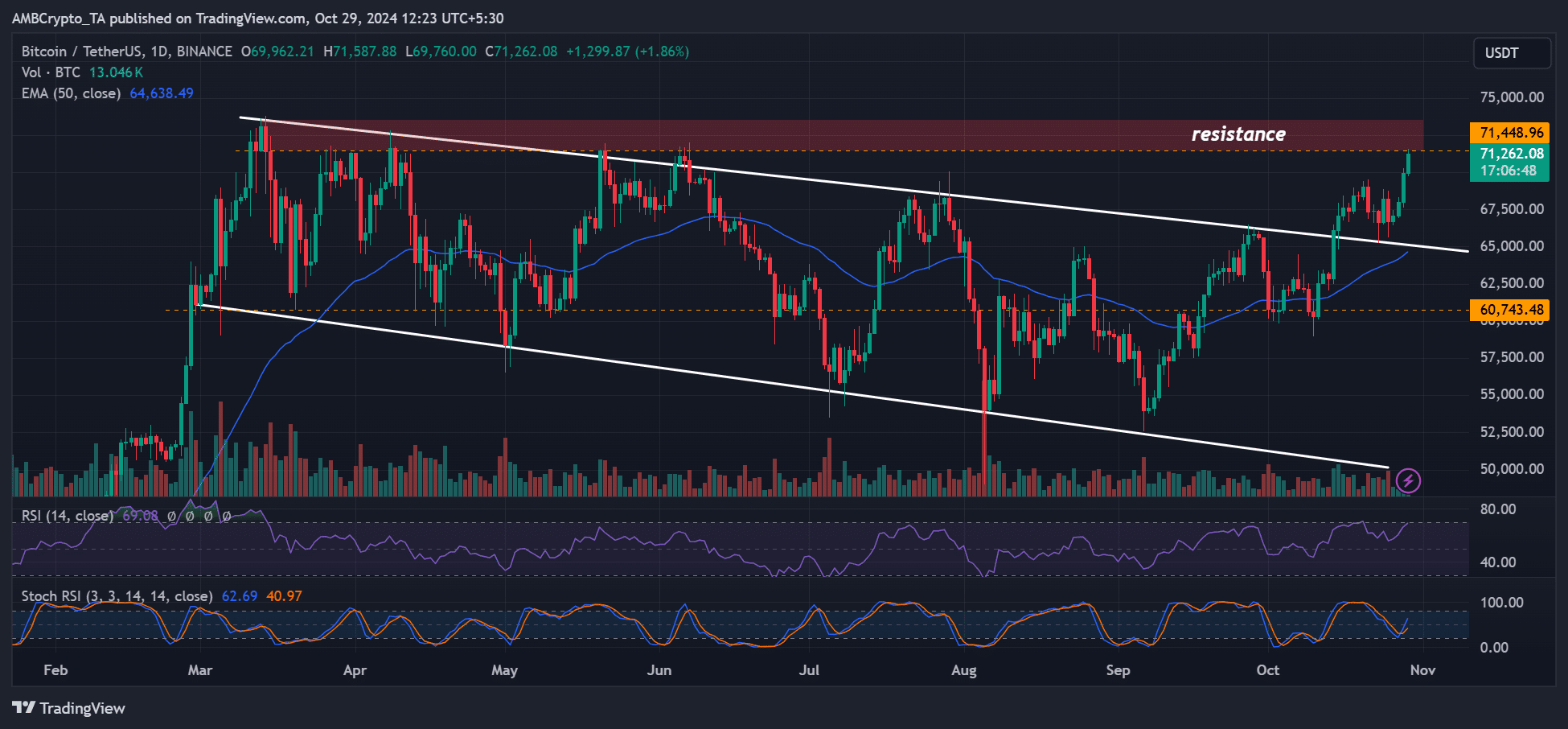

On the every day value chart, BTC was in a bullish market construction. It was solely 3.5% away from its ATH and will quickly hit value discovery.

Nonetheless, it hit resistance, and a bearish order block (pink) fashioned at March’s ATH. For the uptrend to proceed within the quick time period, BTC needed to clear the $71K-$73K roadblock.