- Bitcoin surged previous $89,000, rising by 30% previously week leaving many to surprise what’s behind the surge.

- Rising open curiosity and elevated buying and selling quantity point out sturdy market exercise, however have triggered vital liquidations.

Bitcoin [BTC] has not too long ago captured the crypto market’s consideration, surging by a formidable 30% over the previous week. The main cryptocurrency has been setting new all-time highs for greater than three consecutive days.

The newest peak was recorded at $89,864, with BTC at the moment buying and selling at $89,319—a slight 0.6% dip from its excessive.

This speedy rise in value has positively impacted Bitcoin’s market cap, bringing it to almost $2 trillion, a determine that locations it among the many prime eight largest property globally.

This surge has additionally lifted the broader crypto market, with the worldwide market cap growing by 7.5% to over $3.1 trillion. Furthermore, Bitcoin’s every day buying and selling quantity has seen a major increase, climbing from beneath $50 billion simply final week to over $140 billion at the moment.

Why is Bitcoin up?

As Bitcoin’s bullish momentum continues, a number of components are contributing to the continued rally. One of many key causes to the query “why is Bitcoin up” is the current re-election of pro-Bitcoin politician Donald Trump because the forty seventh president of america.

Trump’s assist for BTC and the broader crypto business has fueled optimism out there.

Buyers are betting that his presidency will carry much-needed regulatory readability, fostering a extra favorable atmosphere for cryptocurrency. Throughout his marketing campaign, Trump’s guarantees—together with the creation of a Bitcoin nationwide reserve—additional boosted investor confidence, contributing to the optimistic value motion.

One other issue answering the query is the current high-profile institutional exercise. MicroStrategy, a distinguished institutional investor in Bitcoin, introduced a $2 billion buy of the cryptocurrency.

The agency acquired 27,200 BTC at a mean value of $74,463 per coin, leading to a direct acquire of over $300 million on this newest funding. Such large-scale purchases from institutional gamers not solely validate Bitcoin’s place as a key asset but additionally affect market sentiment, driving additional value appreciation.

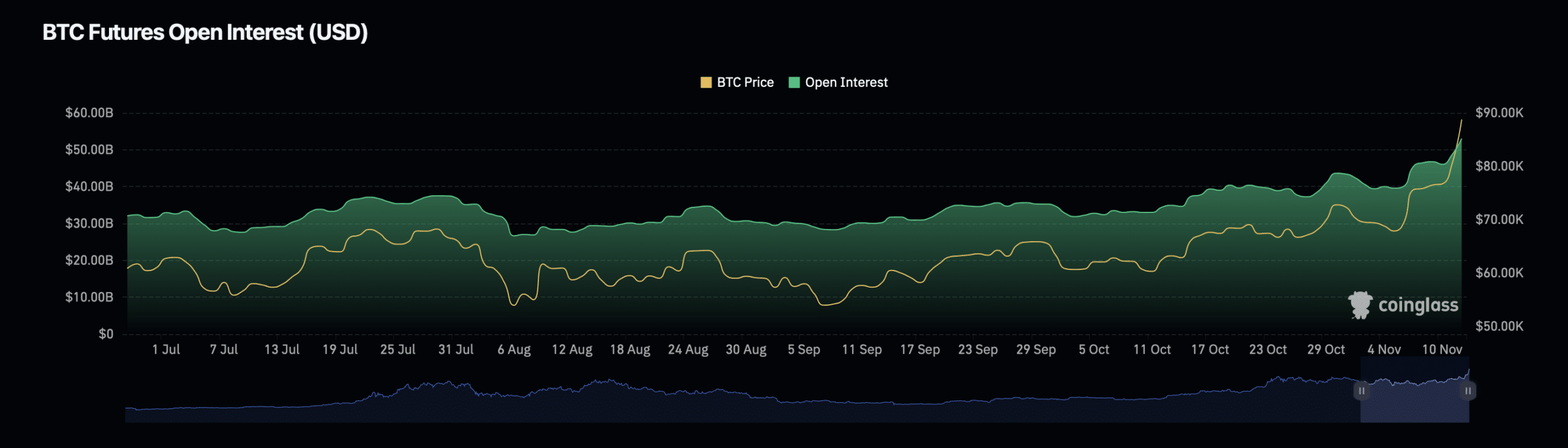

Along with these macroeconomic and institutional components, Bitcoin’s open curiosity has been on the rise.

Knowledge from Coinglass indicated a ten.26% enhance, with a present valuation of $54.38 billion. Open curiosity quantity has surged much more considerably, growing by 111% to succeed in $221.58 billion.

Rising open curiosity suggests rising market participation and heightened curiosity in BTC derivatives, which frequently indicators a rise in buying and selling exercise and market engagement.

BTC liquidation traits

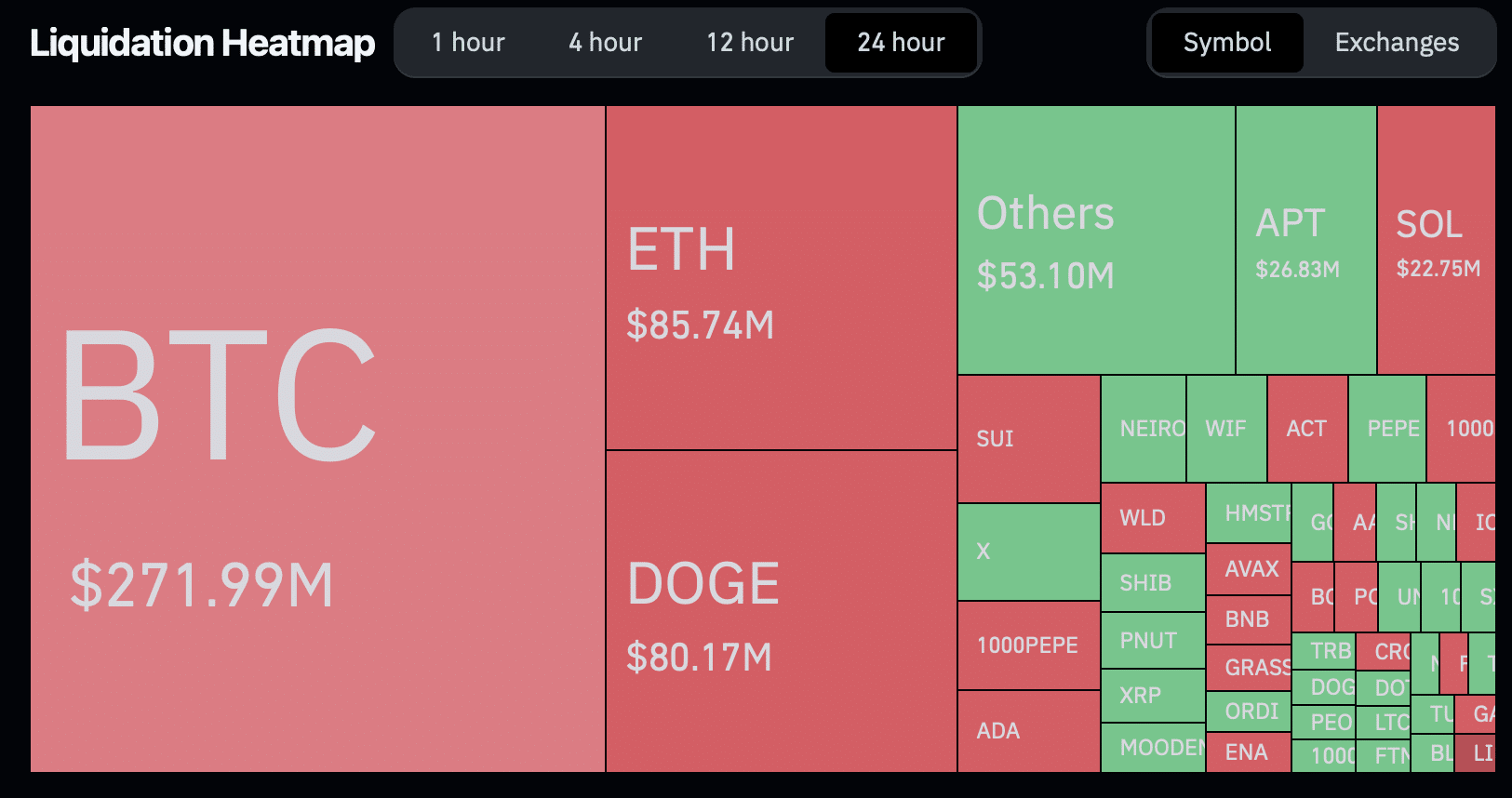

Whereas Bitcoin’s value surge has generated pleasure, it has additionally led to heightened market volatility and dangers for sure merchants.

Knowledge from Coinglass confirmed {that a} whole of 175,515 merchants had been liquidated previously 24 hours, leading to whole liquidations of $693.87 million.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The vast majority of these liquidations concerned BTC and Ethereum, with $271.99 million and $85.74 million in liquidations, respectively.

Notably, brief merchants have borne the brunt of this market motion, with $218 million in Bitcoin brief positions and $48.78 million in Ethereum brief positions being worn out.