- ETH was down greater than 16% over the week.

- Promoting stress was dominant, with no indicators of whale accumulation.

The world’s second-largest cryptocurrency, Ethereum [ETH], was witnessing intense sell-offs and appeared to be at risk of sinking beneath $3,000.

In line with CoinMarketCap, the main digital asset dipped 5.43% within the final 24 hours, and greater than 16% over the week, owing to a mixture of crypto-specific, macroeconomic, and geopolitical triggers.

The On Steadiness Quantity (OBV) indicator, that measures shopping for and promoting stress, was falling sooner than ETH’s value. This meant that there was a better chance of additional downsides within the days to return.

Be careful for these ranges

In a downtrend, sturdy help ranges grow to be an space of eager curiosity for market merchants.

Outstanding on-chain analyst Ali Martinez flagged the zone between $2,000 and $2,400 as “critical” for practically 9.37 million addresses purchased 53 million ETH at these value ranges.

This urged that if the slide continues, Ether might hit a backside on the aforementioned stage after which bounce.

What are ETH whales as much as?

Whereas discussions on corrections and rebounds occur, whales had been quietly snapping up ETH at lowered costs.

In line with on-chain monitoring platform Lookonchain, two whales had been seen accumulating a mixed quantity of greater than 15,000 ETH cash Monday, value practically $70 million at prevailing market costs.

Apparently, one of many whales staked their share of the withdrawn quantity, round 10,000 ETH, into decentralized finance (DeFi) protocols like Pendle Finance and Renzo.

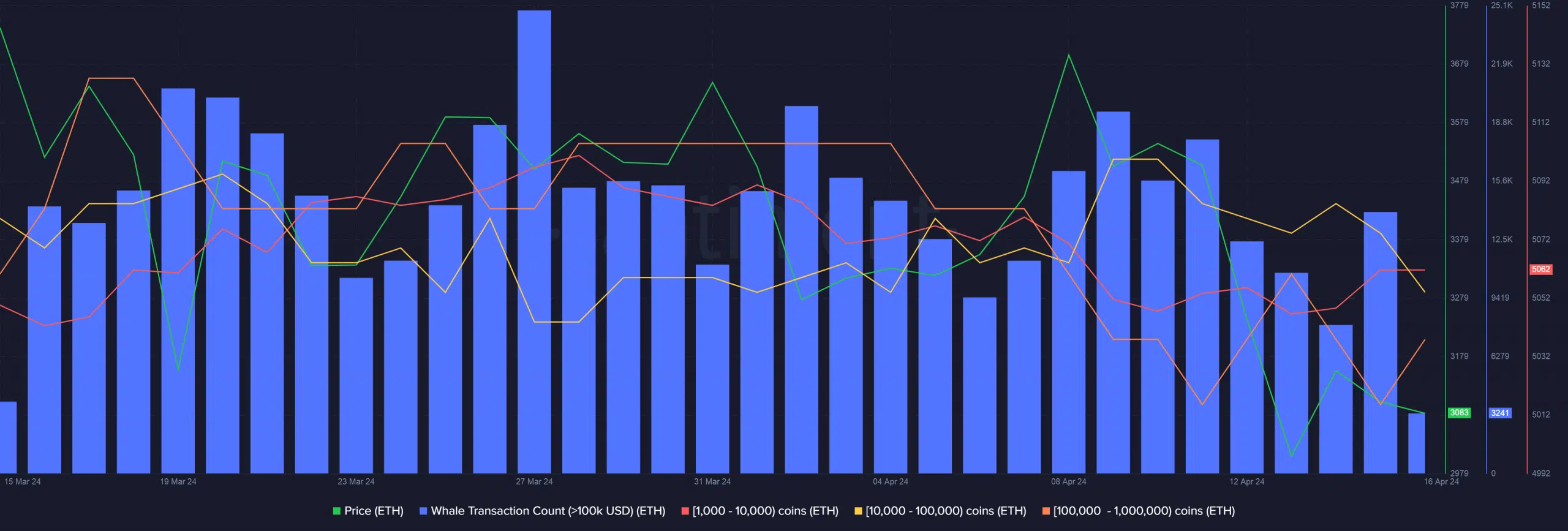

AMBCrypto took a chook’s eye of the ETH market utilizing Santiment, and seen a drop in giant whale transactions in the previous couple of days.

Is your portfolio inexperienced? Try the ETH Revenue Calculator

Furthermore, holdings of main whale cohorts dipped considerably throughout this time, suggesting that the majority buyers had been transferring their ETH to the aforementioned protocols.

In the meantime, the Ethereum Worry and Greed Index flashed a impartial market sign, implying a stability between bullish and bearish sentiments.