- The crypto market maintained its over $2 trillion capitalization.

- Anticipation concerning the FOMC and CPI studies have contributed to the crypto decline.

The crypto market has skilled a large decline within the final 24 hours, with thousands and thousands of {dollars} wiped off the market capitalization.

The declines in Bitcoin [BTC] and Ethereum [ETH] have performed a big function on this downturn.

Extra particularly, the upcoming U.S. Federal Open Market Committee (FOMC) assembly and Shopper Value Index (CPI) studies have contributed largely to the decline of the 2 largest crypto property.

The rationale why crypto is down immediately

AMBCrypto’s evaluation of the crypto market capitalization on CoinMarketCap confirmed a big decline in the previous few days.

Up to now 48 hours, the market cap has dropped from over $2.5 trillion to round $2.47 trillion as of this writing.

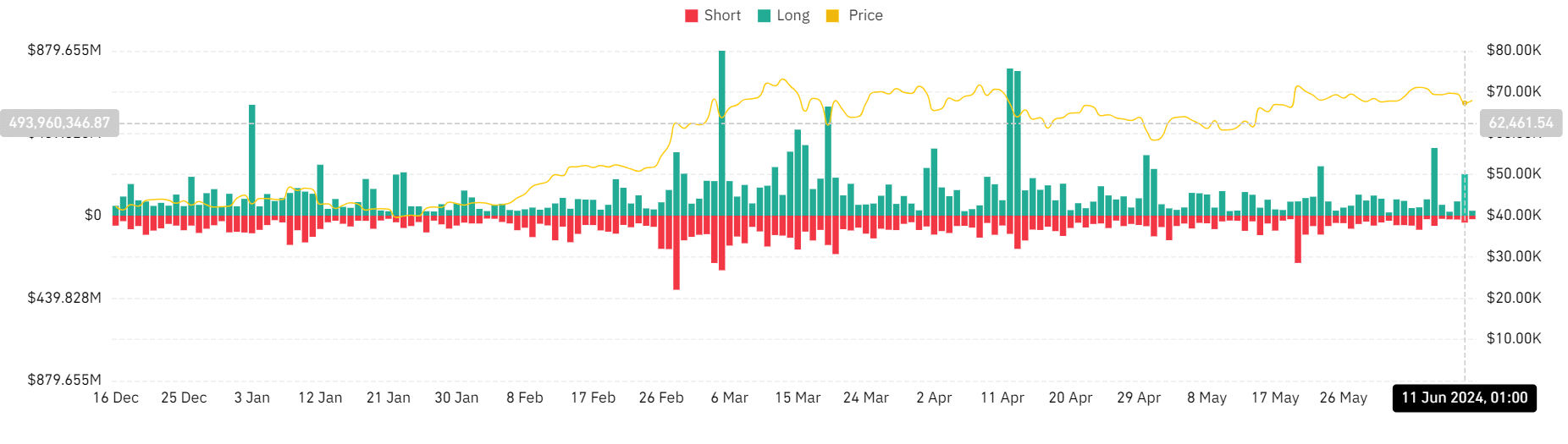

Additionally, the liquidation chart on Coinglass confirmed that crypto liquidations on the eleventh of June had been fairly vital. The chart indicated that lengthy positions skilled extra liquidations than brief ones as costs sharply declined.

Lengthy liquidation quantity was over $221 million, whereas the brief liquidation quantity was round $37 million.

Bitcoin, Ethereum lead market dip

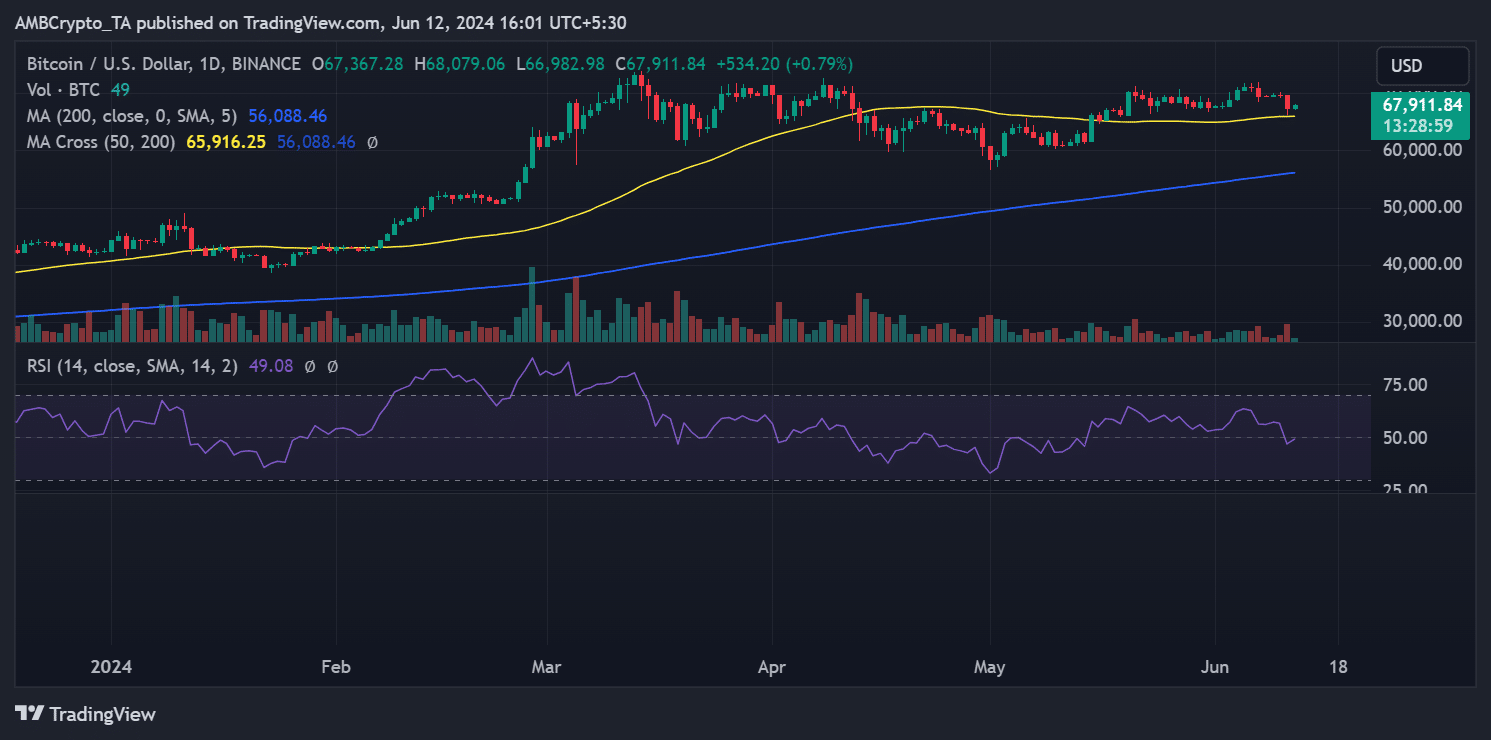

Taking a look at Bitcoin on a each day timeframe confirmed, AMBCrypto noticed that on the eleventh of June, it declined by over 3%. The chart indicated that this drop decreased its worth to round $67,377.

BTC’s liquidation chart revealed that this decline led to over $66 million in liquidation quantity.

Particularly, lengthy liquidations accounted for over $52 million, whereas brief liquidations had been over $14 million.

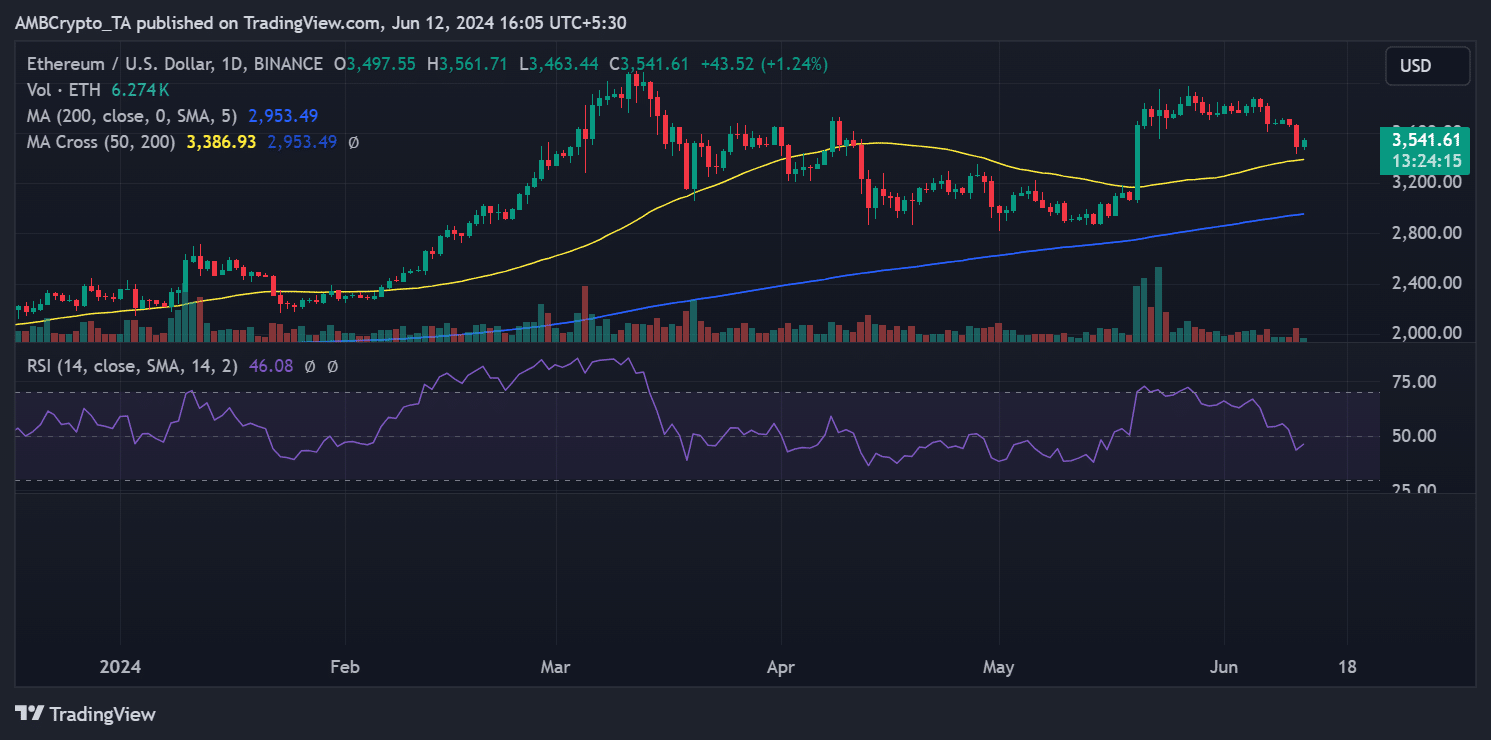

Ethereum, in the identical timeframe, confirmed an nearly 4.6% decline as its worth fell to round $3,500. The liquidation chart confirmed that over $69 million was liquidated because of the decline.

Of this, lengthy liquidations accounted for round $62 million, whereas brief liquidations had been over $7 million.

CPI and FOMC inflicting panic

Traditionally, when the Shopper Value Index (CPI) knowledge is launched or the Federal Open Market Committee (FOMC) adjusts rates of interest, the crypto market typically experiences vital fluctuations.

It is because buyers regulate their danger publicity in response to those financial indicators. Sometimes, an increase in CPI correlates with a drop in Bitcoin’s worth.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Will increase in important items cut back the quantity of disposable earnings individuals have, resulting in decreased funding in crypto.

The FOMC is anticipated to take care of the present rates of interest between 5.25% and 5.50%. In the meantime, the CPI is predicted to point out a modest improve, staying throughout the vary of 0.1% to 0.3%.