- BTC has recorded an ATH with its newest worth pattern.

- One other ATH could possibly be on the horizon with the continuing rise within the coin’s realized cap.

The Bitcoin[BTC] market isn’t any stranger to cost volatility, with buyers continuously observing metrics that sign potential shifts. Knowledge on the coin’s realized cap is including weight to a bullish narrative.

Not too long ago, Bitcoin’s realized cap noticed a big uptick, a shift that could possibly be essential in forecasting BTC’s worth path.

What does the rise in realized cap suggest for BTC’s worth pattern?

Bitcoin sees report realized market capitalization

The realized cap is an alternative choice to the market cap that accounts for every Bitcoin’s acquisition price relatively than its present market worth. It displays the sentiment of holders who acquired BTC at totally different worth factors.

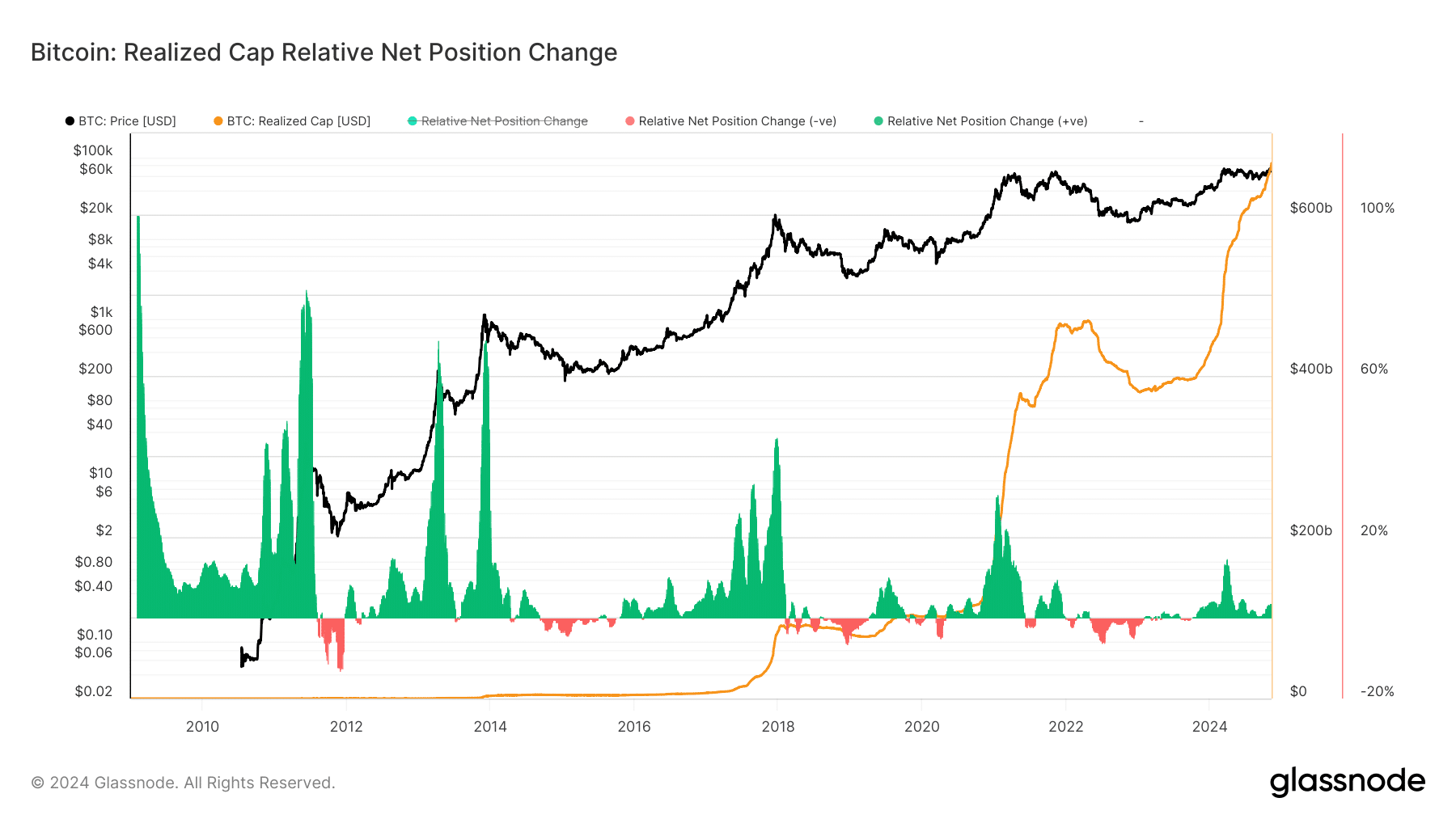

Evaluation of the metric on Glassnode confirmed that it has risen to round $663 billion, the best in its historical past.

A rising realized cap means that cash held by long-term buyers are rising in worth. This can be a optimistic signal of market stability and investor confidence. The current enhance in Bitcoin’s realized cap indicated that extra capital is flowing into BTC, whilst the value fluctuates.

For Bitcoin, an elevated realized cap usually signifies much less promoting stress amongst holders. Evaluation of the realized cap confirmed that over time, when the metric hits an all-time excessive, there may be normally a worth decline, adopted by one other all-time excessive for the coin.

With BTC’s realized cap reaching new highs, it reveals that buyers have added confidence within the cryptocurrency’s future worth progress. This doubtlessly reduces the availability out there for buying and selling.

The influence on BTC’s worth pattern

The upward shift in realized cap may considerably influence Bitcoin’s worth. Because the realized cap grew, it instructed that extra buyers had been holding onto their property relatively than promoting.

This transfer may help BTC’s present worth ranges and supply a basis for additional worth appreciation.

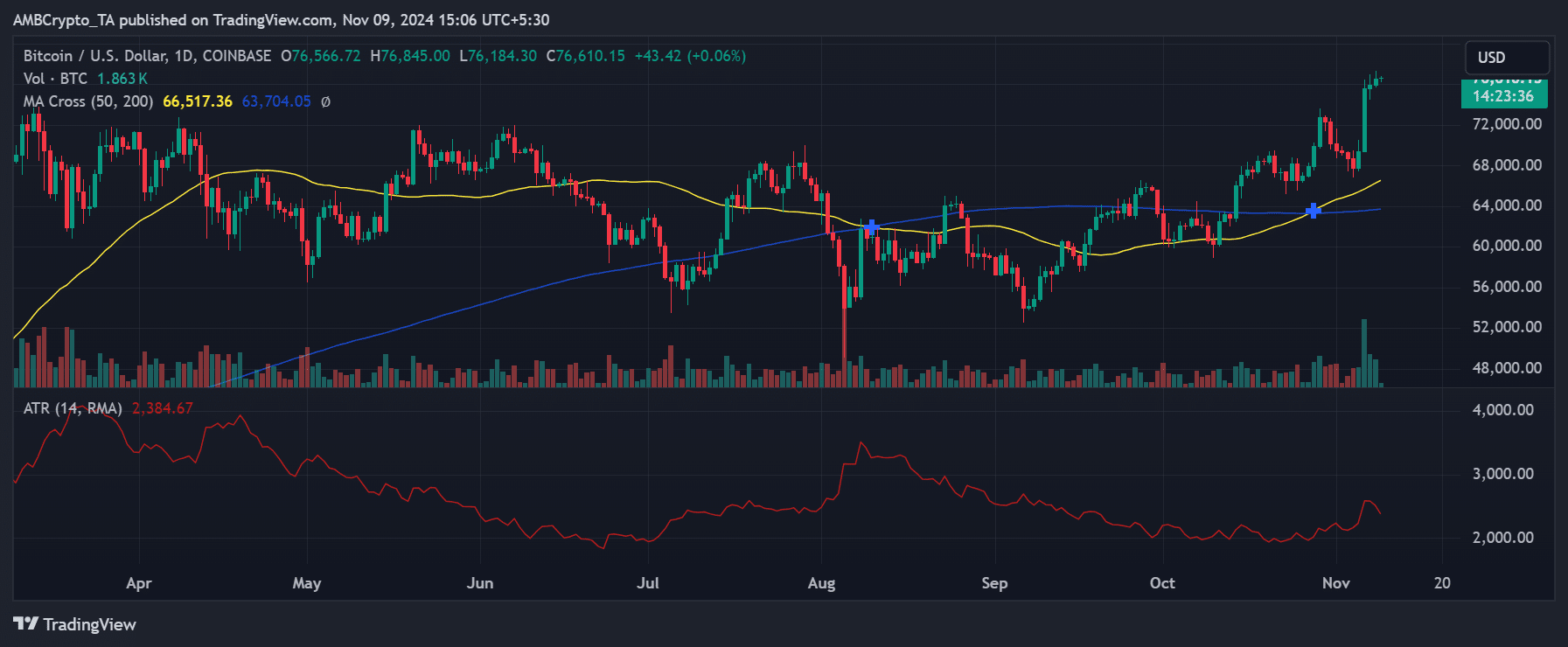

Technical indicators, such because the transferring averages on BTC’s worth chart, corroborate this sentiment. At press time, BTC was trending above its 50-day and 200-day Transferring Averages(MA), exhibiting bullish momentum.

If the realized cap continues to develop, it might encourage extra buyers to purchase and maintain, contributing to sustained worth help at larger ranges.

Key ranges point out BTC’s subsequent transfer

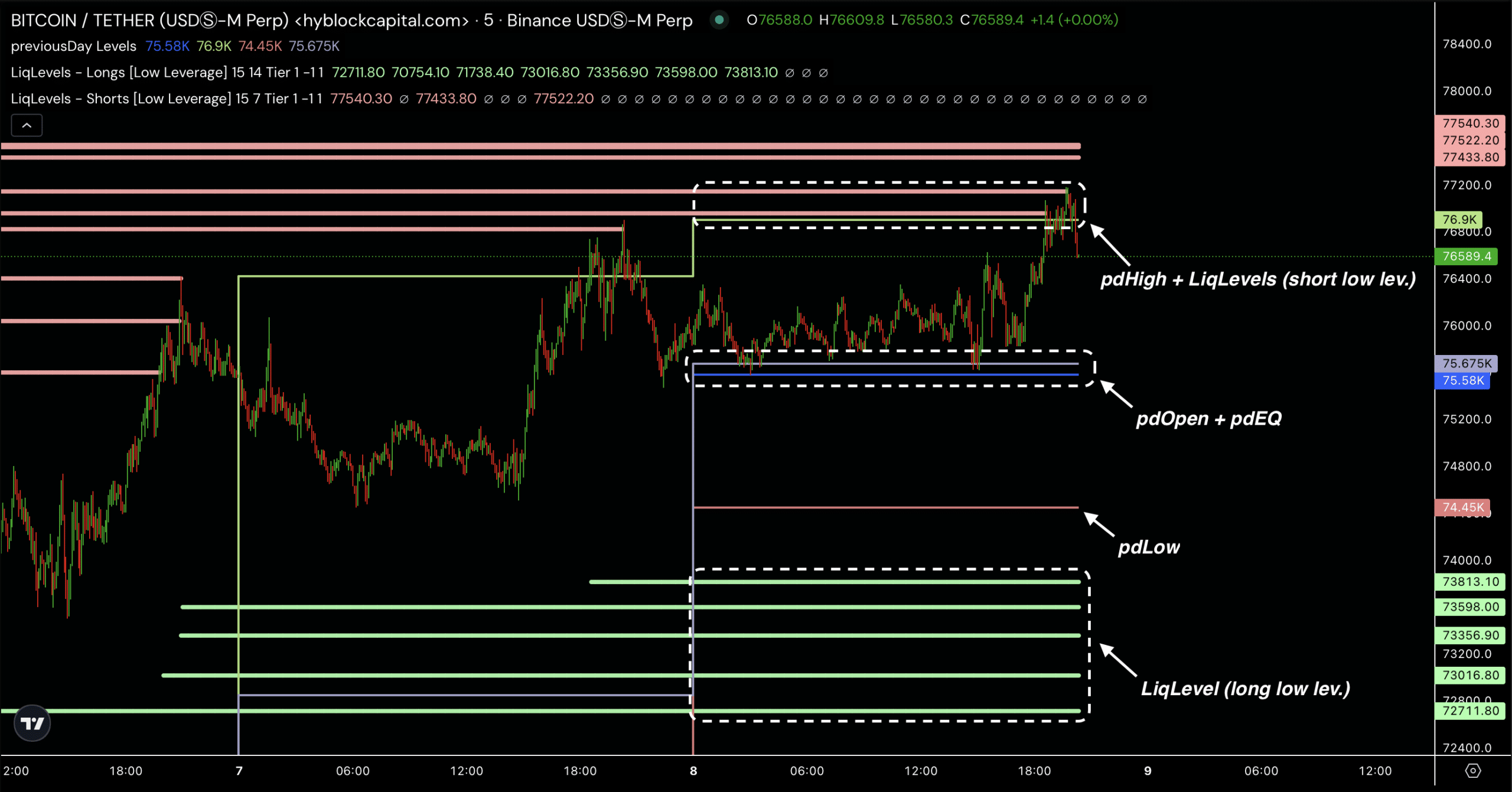

Evaluation of knowledge from Hyblock identified that Bitcoin was buying and selling inside a good vary between the day past’s excessive (pdHigh) and the mixed ranges of the day past’s open and equilibrium (pdOpen + pdEQ). Market dynamics instructed important resistance and help zones at these ranges.

In line with the most recent knowledge, BTC confronted resistance across the pdHigh, the place a cluster of quick liquidation ranges signifies sturdy promoting stress.

If Bitcoin breaches this stage, it may set off quick liquidations, fueling upward momentum.

On the help aspect, Bitcoin discovered power across the pdOpen + pdEQ zone, offering a possible entry level for bullish merchants. Lengthy liquidation ranges beneath the pdLow indicated extra help layers that would stop a pointy decline, particularly if shopping for curiosity will increase.

This consolidation mirrored a market in wait-and-see mode. It aligns with broader developments in Bitcoin’s rising realized cap. This highlights sturdy long-term holder confidence.

What to anticipate within the coming months?

Traditionally, substantial worth positive factors have usually adopted a rising realized cap throughout a BTC uptrend. It’s because investor sentiment stays sturdy, and sell-offs are restricted.

Bitcoin could possibly be positioned for an additional rally if this pattern continues, doubtlessly reaching and even exceeding current highs. Moreover, the Common True Vary (ATR) values point out manageable volatility, offering a steady atmosphere for BTC’s continued progress.

– Learn Bitcoin (BTC) Value Prediction 2024-25

The rising realized cap suggests a powerful basis for Bitcoin’s worth, as long-term holders present minimal intent to promote.

If historic patterns maintain, this pattern may act as a launching pad for Bitcoin to attain new worth milestones.