- Bitcoin consolidated at $68K, presumably needing to the touch $65K earlier than aiming for its all-time excessive.

- On-chain metrics and bullish dealer exercise present stabilization, with potential for a surge post-consolidation.

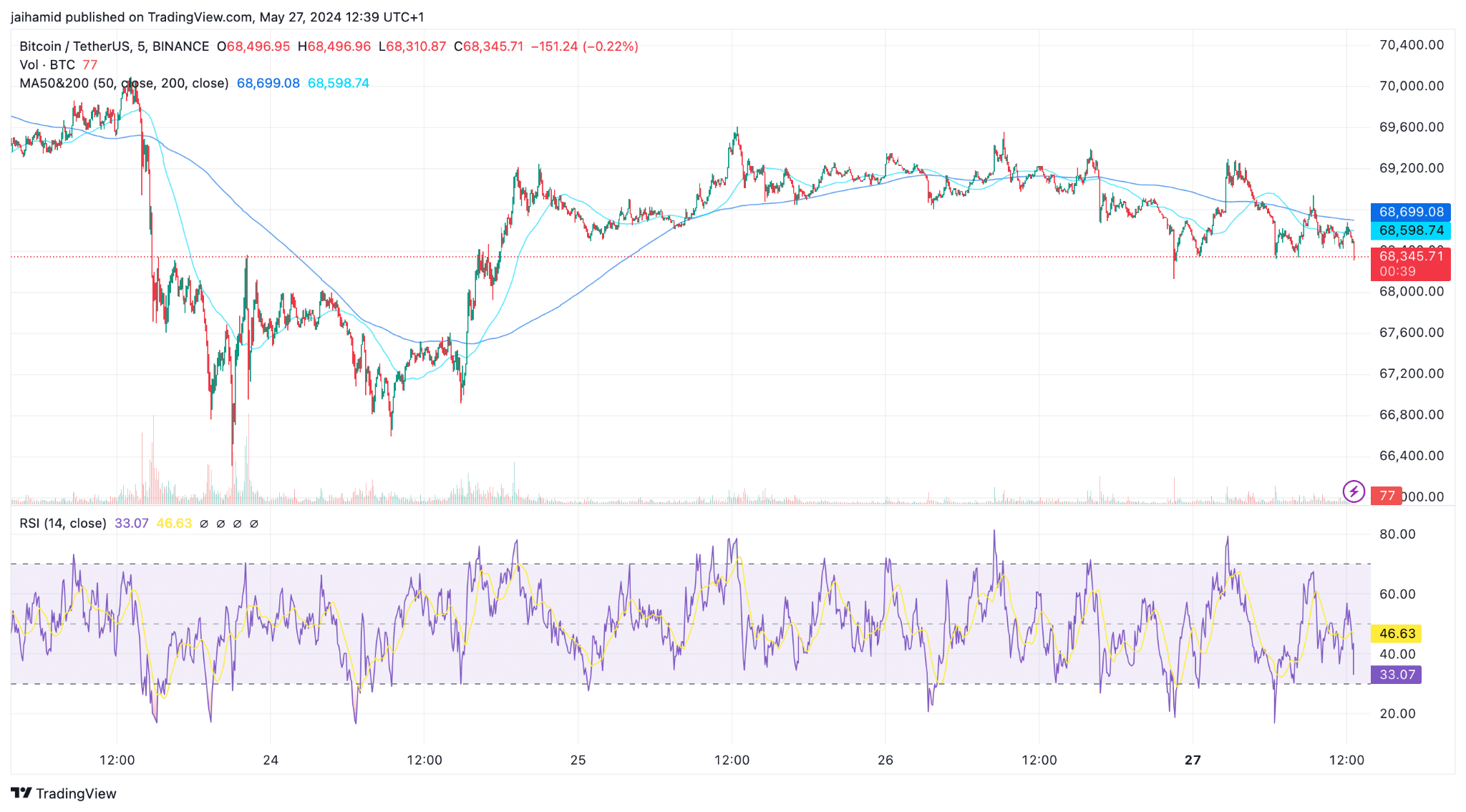

Bitcoin [BTC] has been experiencing a interval of consolidation after hitting $70K final week, due to the Ethereum [ETH] ETF hype. With the market exhibiting indicators of a possible slowdown, Bitcoin would possibly consolidate additional earlier than making its manner again to the all-time excessive.

On-chain metrics and investor habits

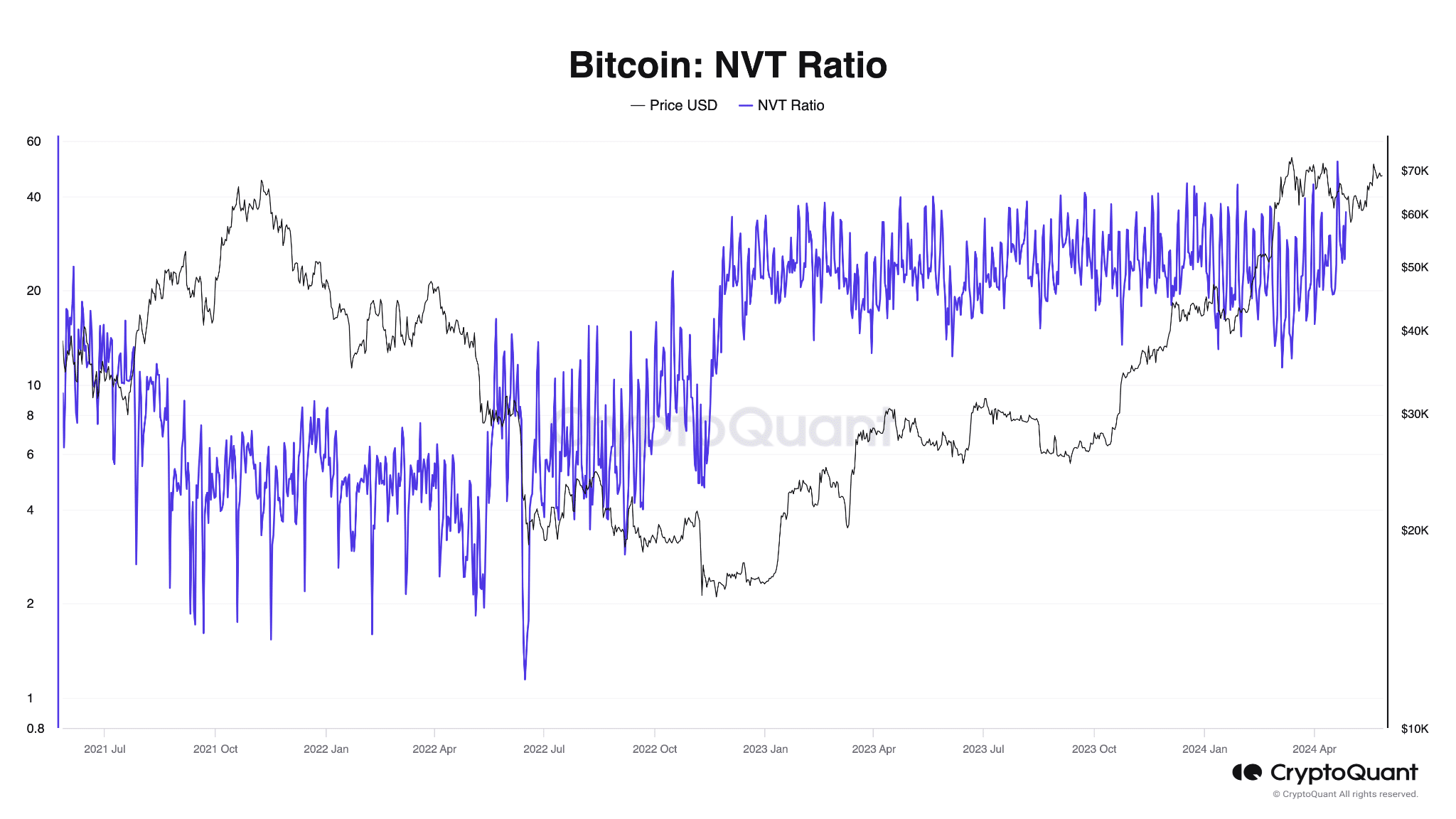

Presently, the NVT ratio seems elevated, which might point out that Bitcoin’s value is considerably overvalued in comparison with the financial exercise on its blockchain.

This mismatch often results in extra consolidation because the market seeks equilibrium between value ranges and transaction volumes.

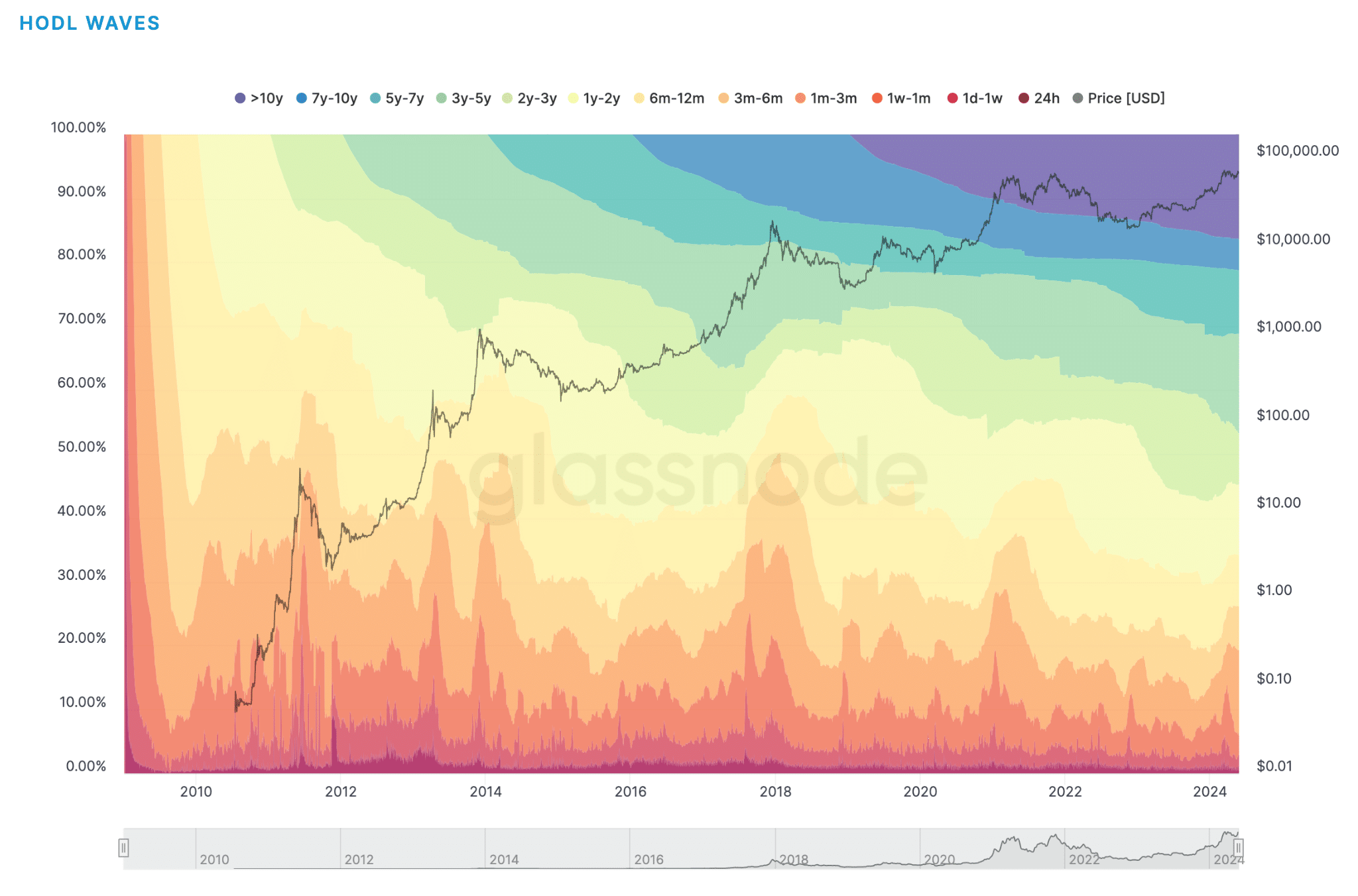

The HODL waves chart confirmed a historic holding sample that clearly means that Bitcoin would proceed to see value consolidation as long-term holders select to carry by this cycle, awaiting increased valuations.

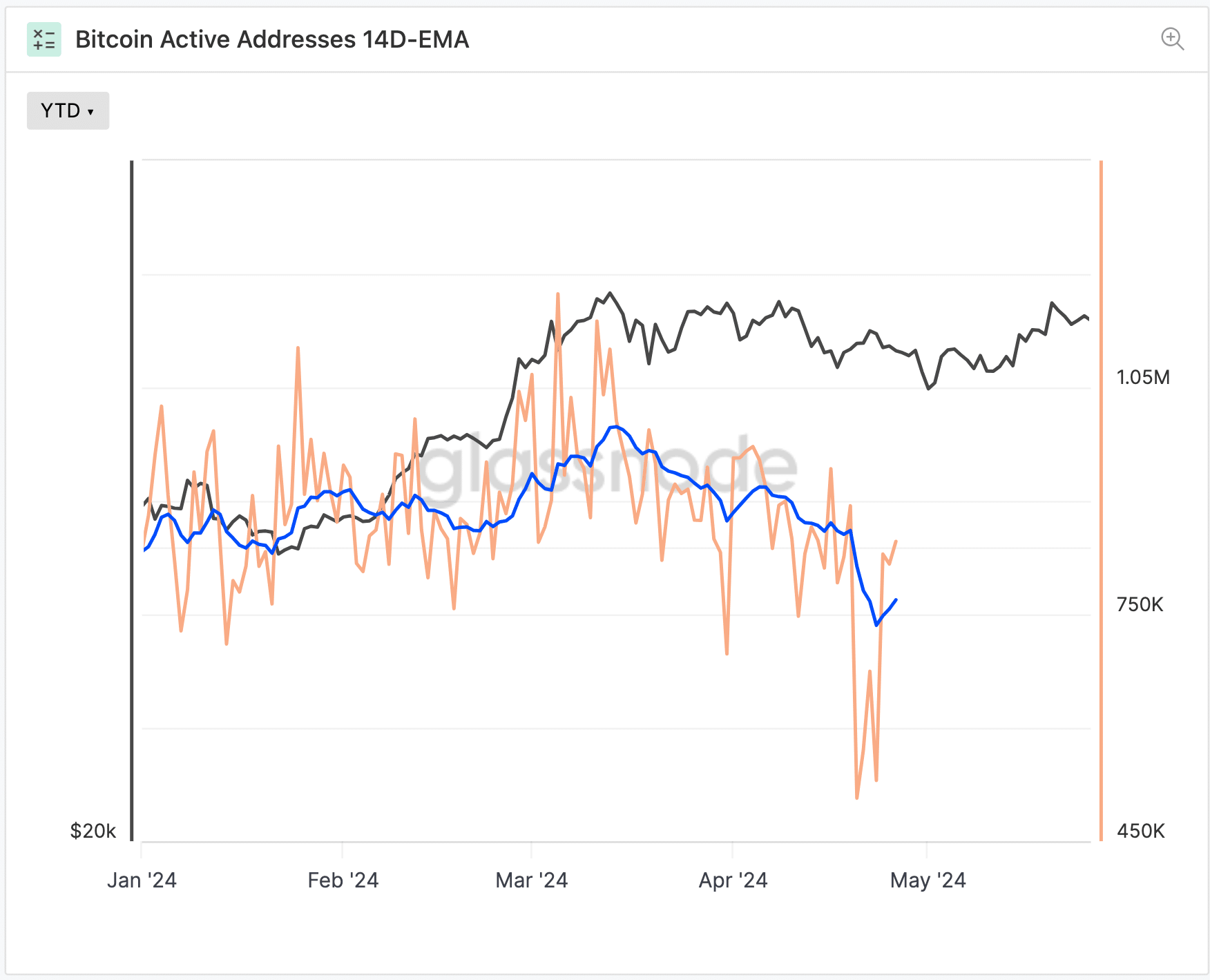

Regardless of the decline in energetic addresses, Bitcoin’s value line stays comparatively steady, suggesting a consolidation section the place the worth isn’t closely affected by the change in energetic customers. This sample usually precedes a bull run.

Technical evaluation and resistance ranges

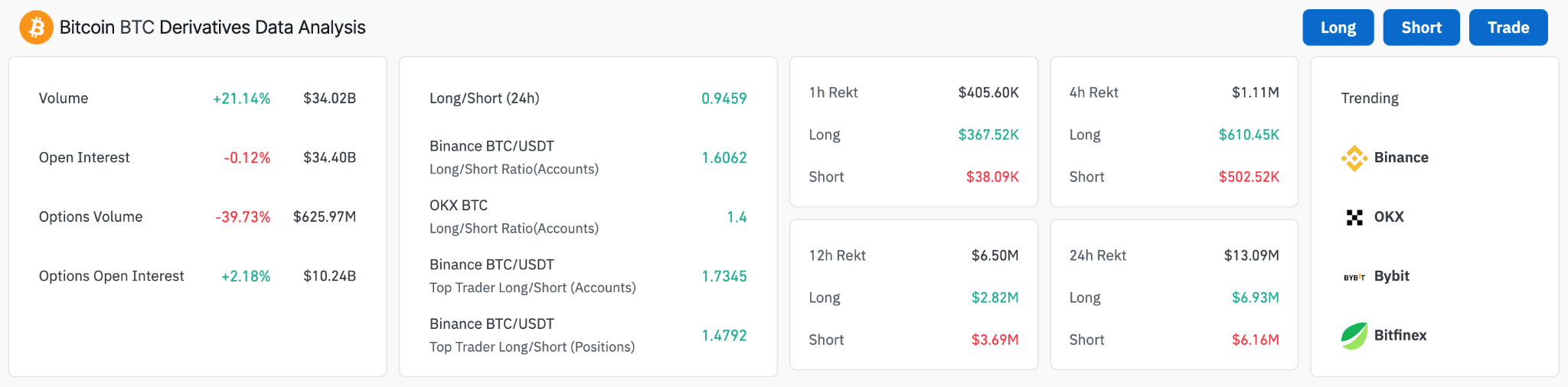

Bitcoin’s buying and selling quantity has elevated by 21.14%, indicating a spike in dealer exercise and a robust bullish sentiment. Nevertheless, the slight lower in open curiosity by 0.12% suggests some hesitancy amongst merchants.

A distinction is seen within the choices market, the place buying and selling quantity decreased 39.73% regardless of a slight improve in open curiosity of two.18%.

The lengthy/quick ratios throughout main platforms like Binance and OKX present a predominance of lengthy positions, reinforcing a usually bullish outlook amongst merchants.

Nevertheless, the upper liquidation values on lengthy positions within the quick time period warning about potential volatility and value corrections that might have an effect on the market sentiment transferring ahead.

Talking of value, if the $66,800 assist is damaged, a possible retracement in direction of $65,000 would possibly happen, however it will additionally present a stronger base for the subsequent leg up.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

The RSI is round 46, which signifies neither overbought nor oversold situations, supporting the consolidation section.

As soon as Bitcoin efficiently breaches the $70,000 mark, it’s anticipated to try to achieve its all-time excessive of round $73.8K