- Bitcoin bulls confirmed up in response to fee hikes because the market receives a confidence increase.

- Evaluating the danger of lengthy liquidations as volatility makes a comeback.

Bitcoin [BTC] responded positively to the Federal Reserve’s newest announcement concerning rate of interest cuts. The extremely anticipated determination revealed that charges will come down by 50 foundation factors.

Buyers responded to the rate of interest cuts by participating in a Bitcoin shopping for spree that pushed the value above $62,000 for the primary time this month.

This was consistent with earlier hypothesis, since decrease charges are anticipated to have a constructive impression on liquidity flows in risk-on property. However the actual query is, the place does the market go from right here?

A bumpy journey forward for Bitcoin?

There are excessive expectations round Bitcoin, particularly now that rates of interest are coming down. Whereas this may increasingly help extra upside within the subsequent few months, it additionally paves the best way for extra volatility.

Translation, extra surprising pullbacks and extremely risky value actions.

A basic instance of why Bitcoin will face extra volatility is that top expectations result in extra optimism and a better urge for food for leverage. Extra lengthy positions are prone to be executed now.

In the meantime, whales and institutional gamers see this as open season for liquidations.

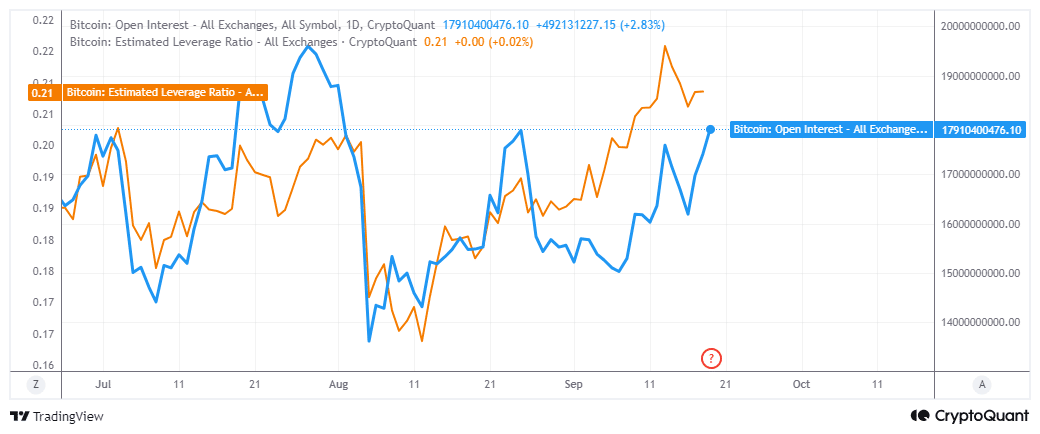

Market knowledge coincides with the above expectations. For instance, Open curiosity simply soared to its highest degree within the final seven weeks.

The estimated leverage ratio which exhibits the extent of leverage at any given time has been rallying since August lows.

It pulled again barely for the reason that thirteenth of September however is poised to tick increased with current enchancment in market sentiment.

Talking of sentiment, the speed cuts announcement seems to have had a constructive impression on Bitcoin ETFs. There was roughly $52.83 million price of Bitcoin ETF inflows on the 18th of September.

Constructive ETF flows and anticipated liquidity injections ought to set the stage for a wholesome Bitcoin run-up. Nonetheless, it could additionally pave the best way for heavy liquidations and pullbacks alongside the best way.

Assessing current demand

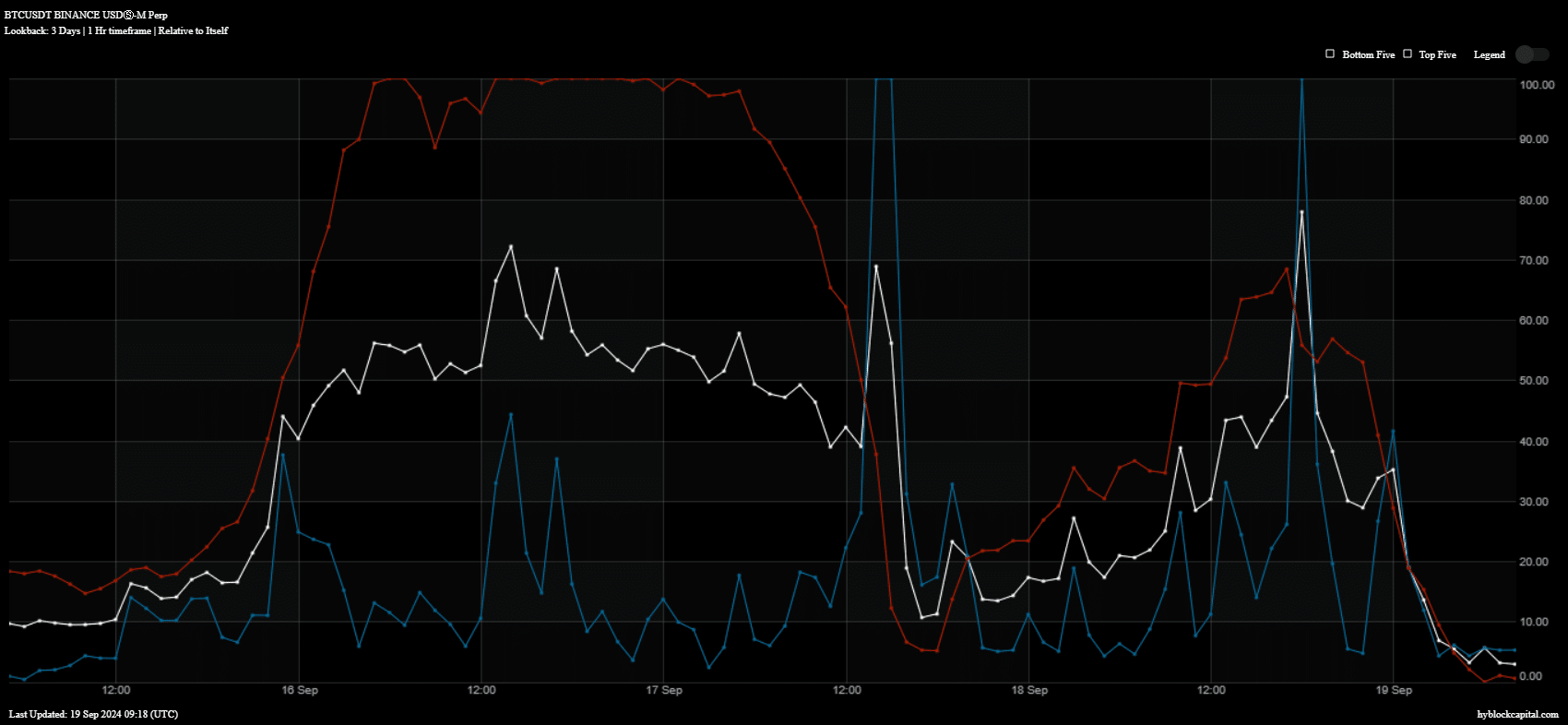

Bitcoin remains to be vulnerable to liquidations which will happen quickly. On-chain knowledge revealed that the current wave of liquidity injection into Bitcoin has already dissipated, evidenced by the purchase quantity (blue).

We additionally noticed a spike in longs (crimson) which can be vulnerable to liquidation if the market pulls again unexpectedly.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

The presence of extremely leveraged lengthy positions could pave the best way for whales and establishments to control costs.

Regardless of the probabilities of a retracement, increased liquidity flows are anticipated to push Bitcoin increased within the subsequent few months.