- The crypto market rallied after an aggressive Fed fee lower.

- Trump turned the primary former president to transact utilizing BTC.

The crypto market reacted positively to the primary Fed fee lower in 4 years.

On the 18th of September, the U.S. Fed dropped rates of interest by 0.50% (50 foundation factors), a surprisingly aggressive transfer that caught most economists, who anticipated a 25 bps lower, off-guard.

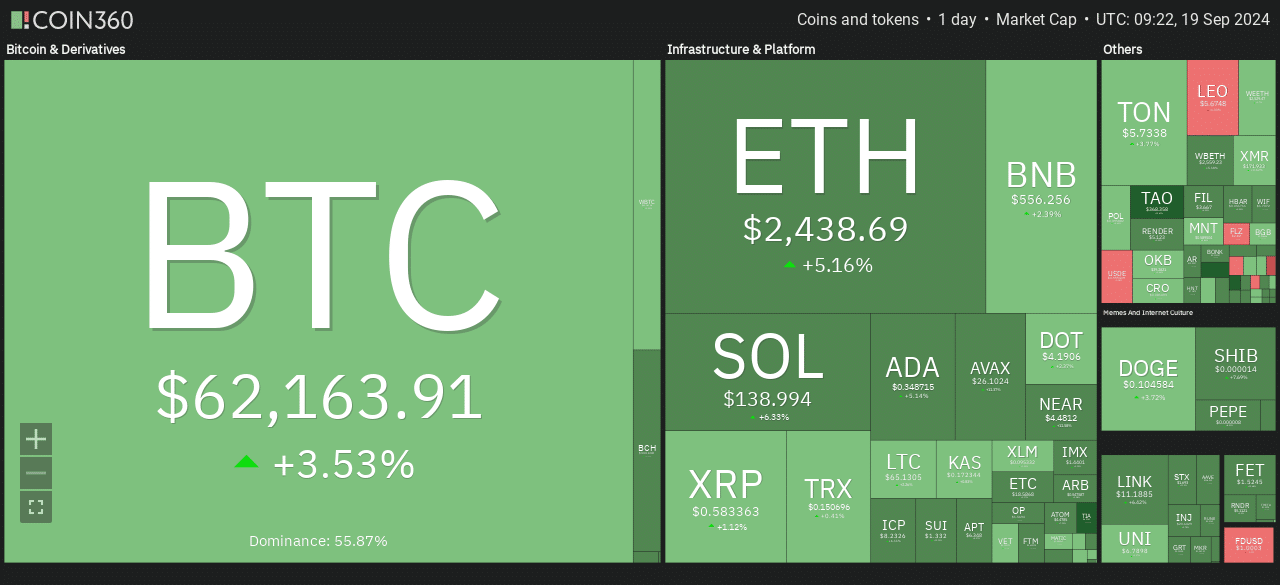

Following the Fed pivot, Bitcoin [BTC] netted 2.3% beneficial properties through the intraday buying and selling session on Wednesday. On the nineteenth of September, throughout early Asian hours, BTC climbed increased to $62.5K.

On the time of writing, the asset was valued at $62.1K, with notable beneficial properties throughout the sector. Ethereum [ETH] was up 5% previously 24 hours.

However Solana [SOL] had the best day by day beneficial properties among the many main belongings, with almost 6.4% beneficial properties over the identical interval.

Nevertheless, market pundits remained cautious, citing that the Fed’s jumbo lower may sign a slowing financial system that might unnerve danger belongings within the quick time period.

BitMEX’s founder Arthur Hayes referred to as the aggressive lower a ‘nuclear catastrophe for financial markets’ that might result in muted costs after two days.

He additional warned that Friday’s BoJ (Financial institution of Japan) determination may very well be one other issue figuring out BTC’s subsequent value route. Hayes famous,

“A weak JPY will mean stronger BTC and vice versa.”

Nevertheless, Antony Pompiliano, a BTC investor, claimed that recession worries solely mattered to short-term speculators. For long-term buyers, the Fed fee cuts had been bullish for BTC.

Trump turns into the primary president to transact utilizing BTC

On the 18th of September, Donald Trump, former US president, stopped on the well-known New York PubKey bar and paid utilizing BTC.

He purchased meals and drinks for supporters on the joint and settled the invoice via BTC. PubKey proprietor Thomas Pacchia termed the motion as “history.”

“The first transaction by a president on the Bitcoin protocol. History!”

In contrast to his first stint on the White Home, Trump has turn into pro-BTC and even introduced plans to ascertain it as a strategic reserve asset if elected president.

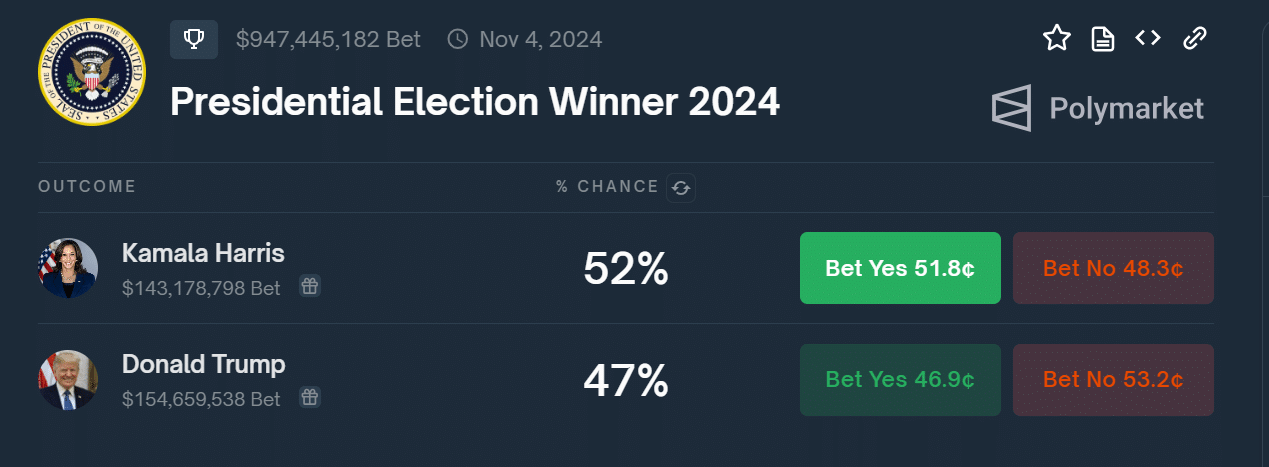

In consequence, BTC value motion has additionally turn into more and more correlated with Trump’s odds of profitable the 2024 US elections.

At press time, possibilities of a Trump win stood at 47%, as Harris dominated with a 5-point lead on the prediction web site Polymarket.

Knowledge Tree unveils RWA platform on Ethereum

Lastly, Knowledge Tree, an asset supervisor with $110 billion of belongings beneath administration, has unveiled an RWA (real-world asset) tokenization platform that may run on Ethereum.

The product, referred to as Knowledge Tree Join, will permit integration between TradFi and DeFi, per the agency. Will Peck, Head of Digital Belongings at WisdomTree, stated,

“With increasing interest in tokenized real-world assets, WisdomTree Connect … will provide access to digital funds to on-chain firms without leaving the ecosystem.”

Knowledge Tree will be a part of different asset managers like BlackRock and Franklin Templeton, which have related merchandise geared toward offering yield-bearing merchandise for crypto companies in search of publicity to US treasury bonds as a reserve.