- Bitcoin faces essential resistance as market dynamics trace at potential volatility forward.

- Stablecoin dominance and concern indicators highlight rising investor warning within the crypto market.

The cryptocurrency market is at a essential juncture as buyers weigh the potential for a broader market correction. With Bitcoin[BTC] struggling to regain key assist ranges and altcoins exhibiting indicators of fatigue, issues a few crypto crash are rising.

By inspecting essential market indicators and sentiment knowledge, we are able to assess the probability of a downturn and establish doable situations.

Bitcoin’s worth struggles to carry key ranges

Bitcoin’s latest worth motion highlights the market’s fragility. AMBCrypto’s evaluation exhibits that the cryptocurrency has slipped beneath the essential $95,000 stage, sparking fears of additional draw back.

Regardless of sustaining assist above the 200-day transferring common, the Relative Energy Index (RSI) at 46.77 signifies waning momentum, teetering close to the bearish territory. Failure to reclaim the $97,500 resistance might push Bitcoin into deeper correction territory.

Market cap tendencies sign consolidation

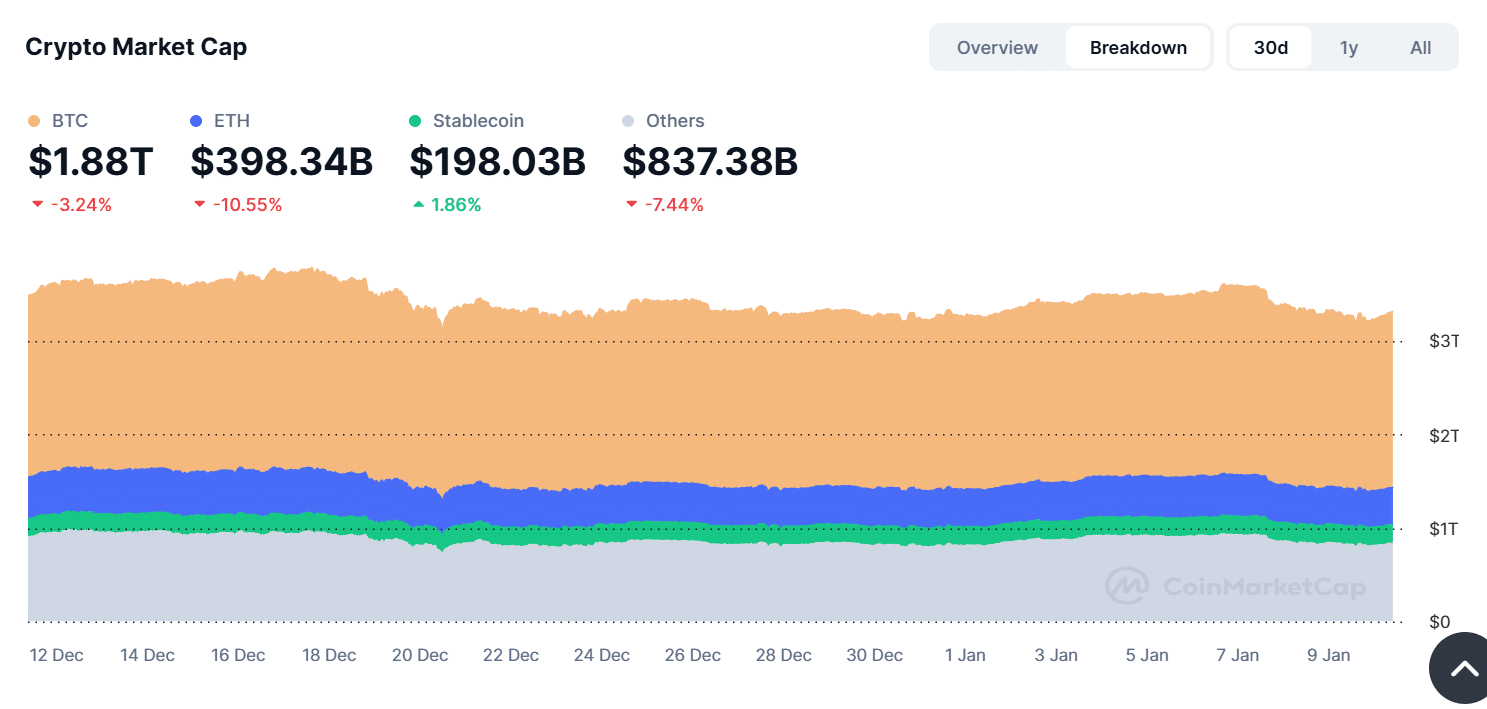

The entire cryptocurrency market cap at the moment sits at $3.24 trillion, as proven within the Crypto Whole Market Cap chart. Over the previous 30 days, the market cap has declined by 3.24%, reflecting a market-wide consolidation part.

Whereas Bitcoin stays a key participant, Ethereum[ETH] and altcoins have confronted sharper declines, contributing to the general market contraction. This pullback raises issues concerning the broader market’s resilience, particularly if bearish sentiment persists.

The Crypto Market Cap Composition chart reveals an uptick in stablecoin dominance, rising by 1.86% over the previous 30 days. In distinction, Bitcoin and Ethereum have seen declines, signaling a flight to security as buyers look to guard capital.

This rising allocation to stablecoins suggests heightened warning, usually a precursor to broader market instability.

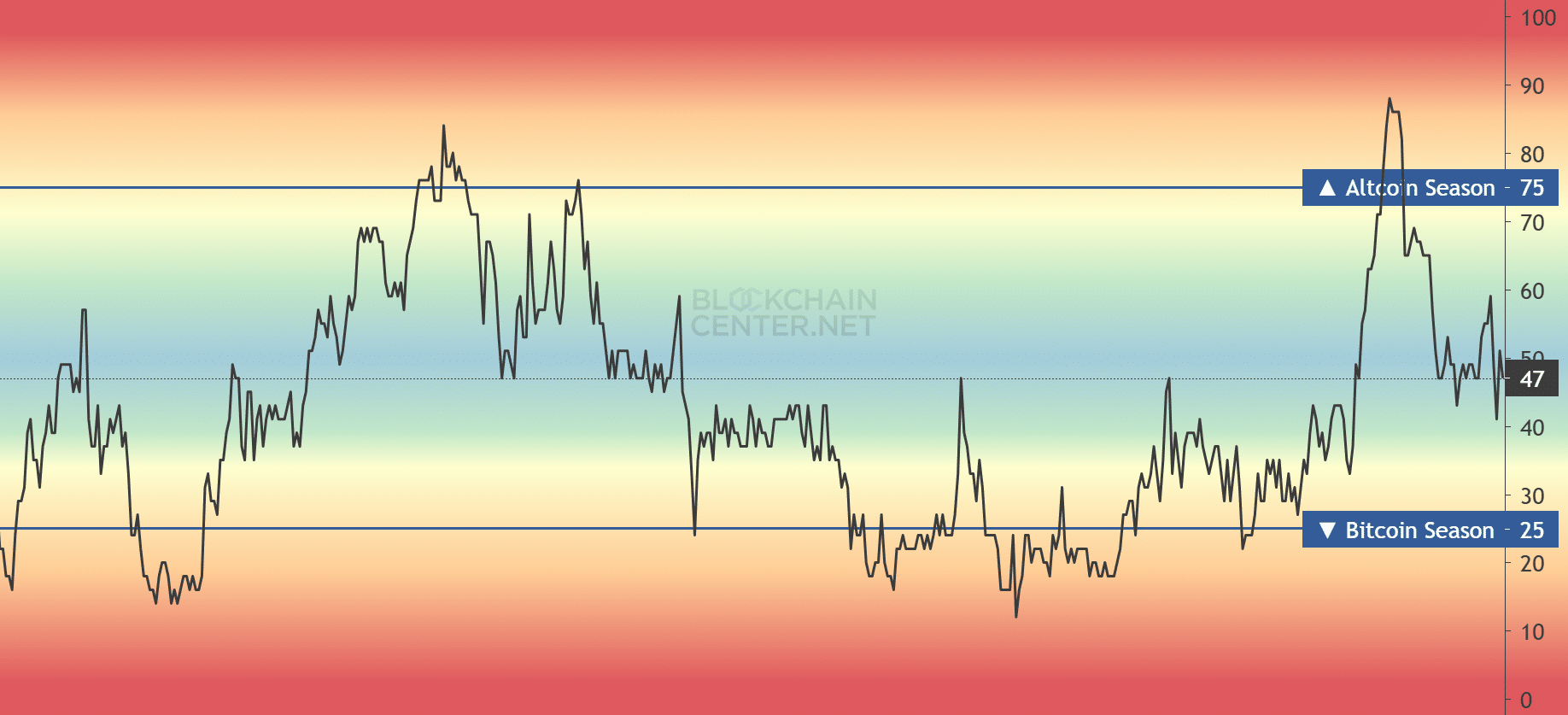

Altcoin Season Index displays impartial sentiment

The Altcoin Season Index has dropped to 47, signaling a impartial stance. Evaluation of the metric exhibits that the market is neither firmly in Bitcoin season nor altcoin season, highlighting rising uncertainty.

Traditionally, such impartial readings precede market shifts, with altcoins sometimes extra susceptible throughout corrections.

This uncertainty places added stress on altcoin efficiency, elevating the probability of a downturn if Bitcoin fails to steer a restoration.

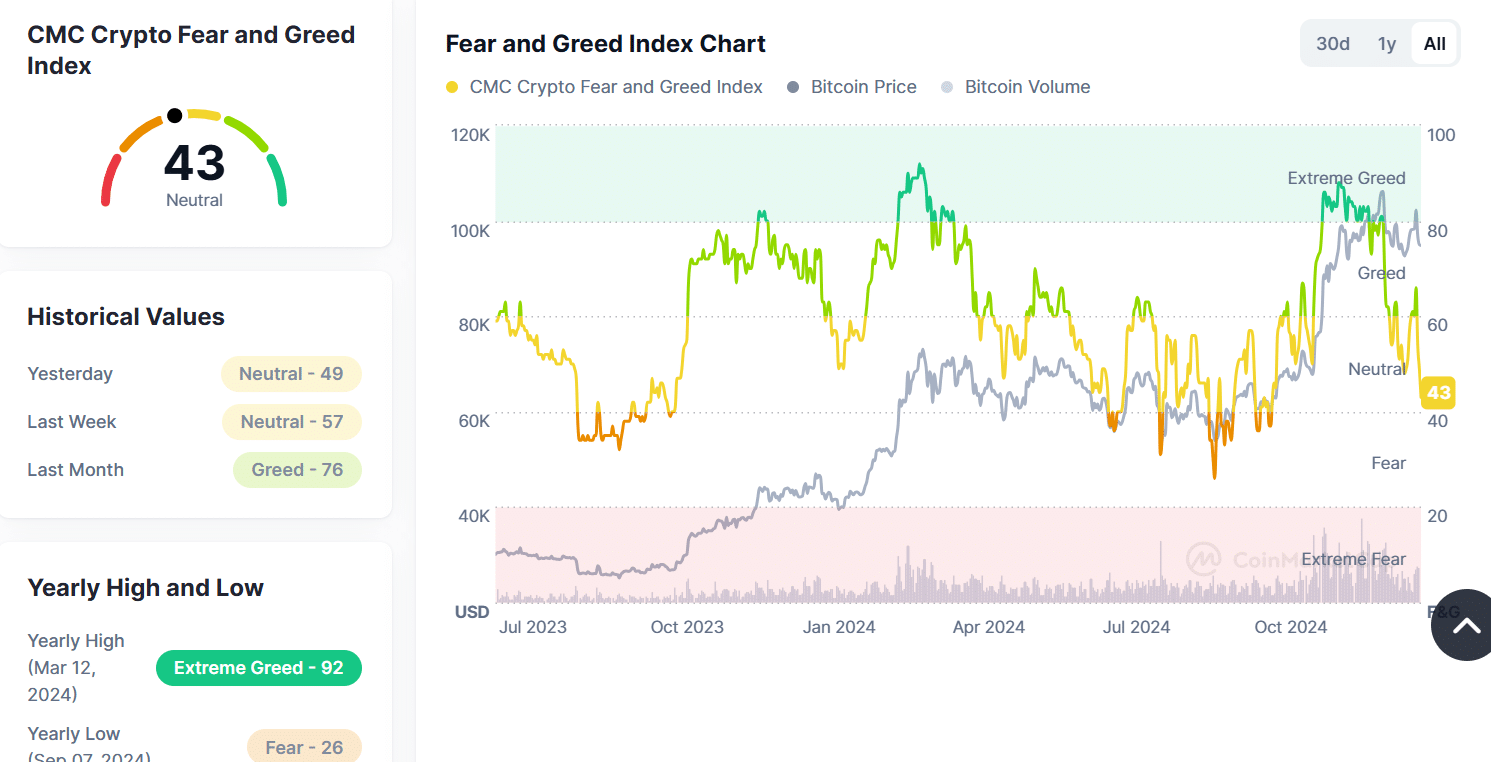

Sentiment weakens: Worry vs. Greed Index

Investor sentiment has cooled considerably. The Worry and Greed Index is now at 43, a pointy drop from final month’s 76 (indicating “Greed”).

This shift to a impartial stance displays rising warning amongst buyers and suggests profit-taking could also be underway. Traditionally, such sentiment adjustments usually foreshadow elevated market volatility and potential selloffs.

Is a crash seemingly?

Whereas no definitive crash is assured, market indicators counsel elevated warning. Bitcoin’s struggles to reclaim essential ranges, mixed with a consolidating market cap and declining sentiment, level to a precarious state of affairs.

Altcoins stay significantly susceptible, whereas the rise in stablecoin allocations underscores investor unease.

The percentages of a big crash hinge on Bitcoin’s skill to stabilize above key assist ranges. Buyers ought to put together for heightened volatility and contemplate danger administration methods to navigate this unsure interval.