- USDT noticed a surge in exercise following regulatory scrutiny.

- Nonetheless, a standard buying and selling technique that would have benefited BTC did not materialize.

The U.S. authorities has reportedly launched one other investigation into Tether [USDT], a transfer some are calling the most recent “Tether FUD” tactic.

The timing raises eyebrows, with some speculating that is an orchestrated try and inject concern and shake out the market earlier than a possible Bitcoin [BTC] breakout.

Provided that over 70% of cryptocurrency trades contain USDT pairs, analysts at AMBCrypto warning concerning the dangers tied to Tether’s centralization.

Any disruption to USDT may ship shockwaves via your entire market. Notably as BTC heads into the ultimate week of the “Uptober” frenzy.

USDT dominance hits new highs, however there’s a catch

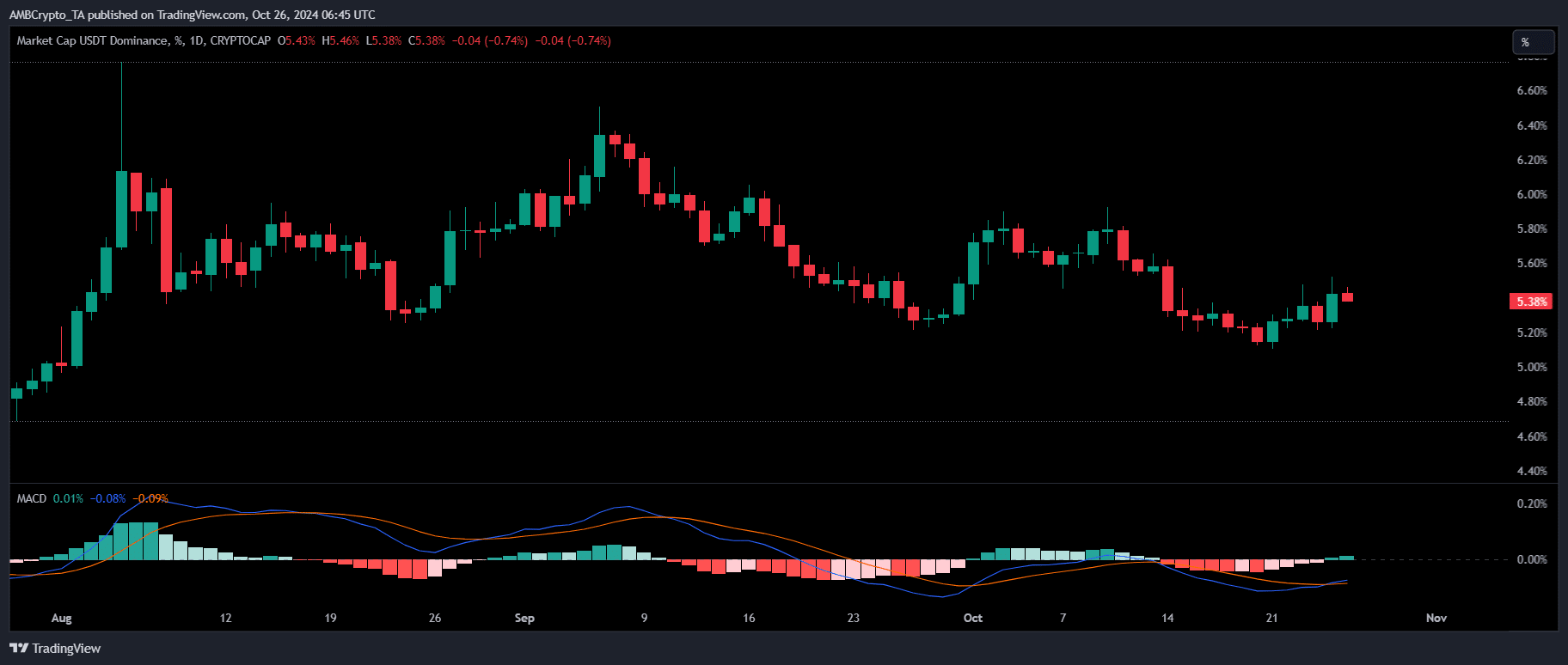

Prior to now week, USDT dominance has steadily elevated, with every day good points exceeding 2%. Traditionally, an increase in USDT dominance typically coincides with BTC reaching market tops.

This was harking back to its earlier shut close to $70K.

Nonetheless, the surge in USDT demand, pushed by rising panic, has positioned important downward strain on BTC, which is presently buying and selling at $67K.

This example underscores the rising affect of USDT on Bitcoin’s worth dynamics. Due to this fact, it’s essential to observe the results of the latest scrutiny surrounding Tether intently.

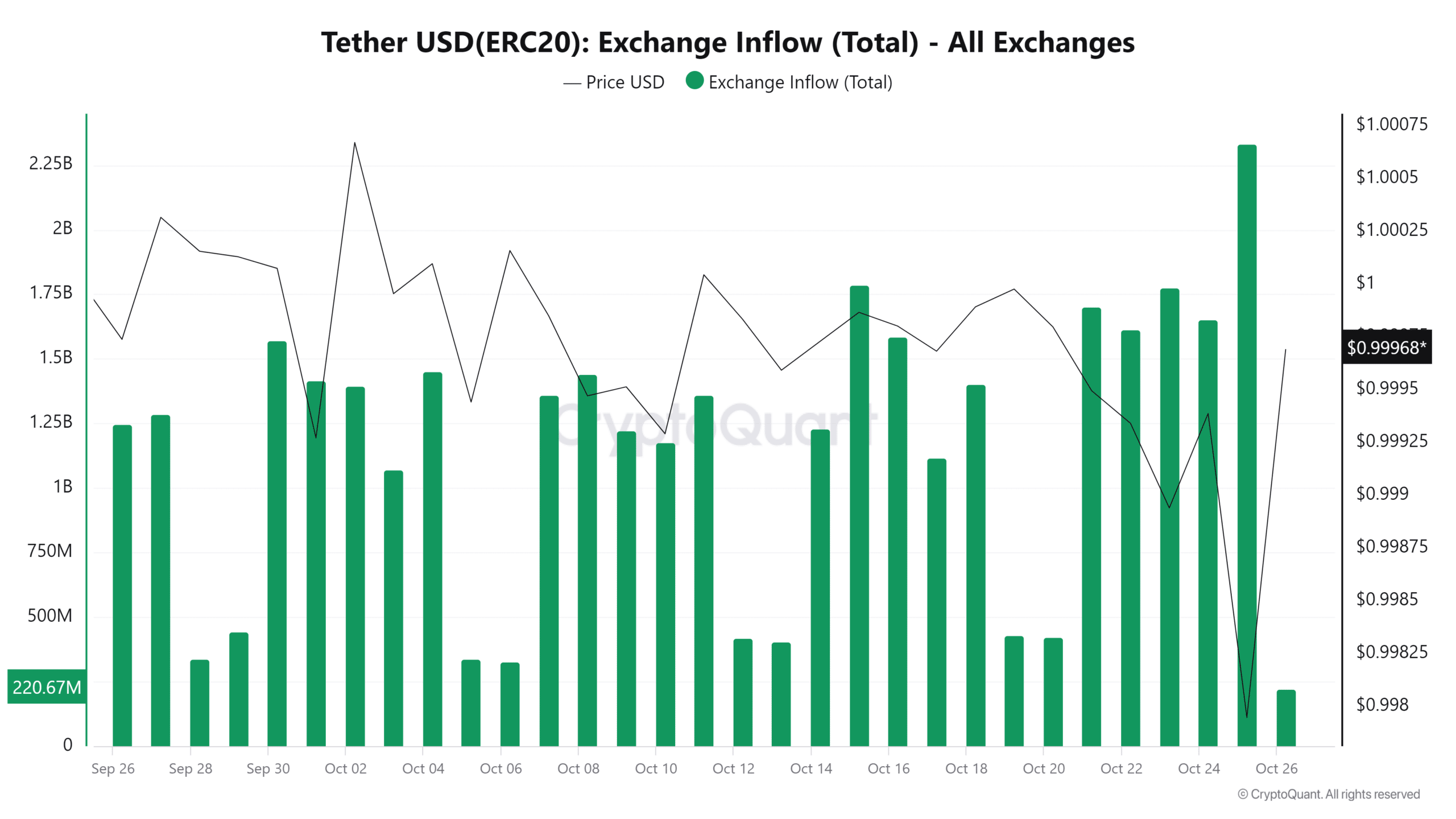

Apparently, through the late buying and selling hours when the information circulated, USDT inflows into exchanges surged dramatically, hitting a two-month excessive of over $2.3 billion.

Regardless of this spike, USDT dominance remained sturdy, posting a every day acquire of practically 3%. This means that many merchants perceived the information as exaggerated or deceptive, opting to take care of their web imports.

Nonetheless, there’s a robust risk that within the coming days, USDT deposits into exchanges may surpass web outflows.

If the present BTC worth seems to be a market backside, it could entice important liquidity, doubtlessly driving its worth larger.

On the flip facet, stakeholders would possibly shift their property into different high-cap altcoins or memecoins, seizing the chance to change USDT for extra inexpensive options.

The final week of October might convey elevated exercise within the crypto market, with a number of cash poised for a possible parabolic rally.

Odds of capital shifting into BTC

At present, USDT stands at a crossroads. The investigation information triggered investor panic and big promoting strain. But, the every day chart confirmed a bullish MACD crossover for USDT dominance.

The elevated volatility available in the market – sparked by Bitcoin’s dip to close $67K – has fueled hypothesis a couple of potential pullback to $64K, the place the subsequent backside may kind.

Furthermore, regardless of 12 hours passing because the information broke, which generally prompts buyers to dump USDT for BTC, merchants have but to comb the lows.

This situation reinforces the potential for a retracement, making the present worth a much less interesting entry level.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

The approaching week is essential for BTC, as its destiny hinges in the marketplace’s response to USDT. At present, the chance of buyers strategizing for a parabolic rally seems restricted.

This might dampen the possibilities of the crypto market closing October on a bullish notice.