- Supreme Courtroom’s refusal to assessment permits the U.S. to promote seized 69,370 Bitcoin.

- Trump proposes retaining Bitcoin as a strategic reserve if re-elected.

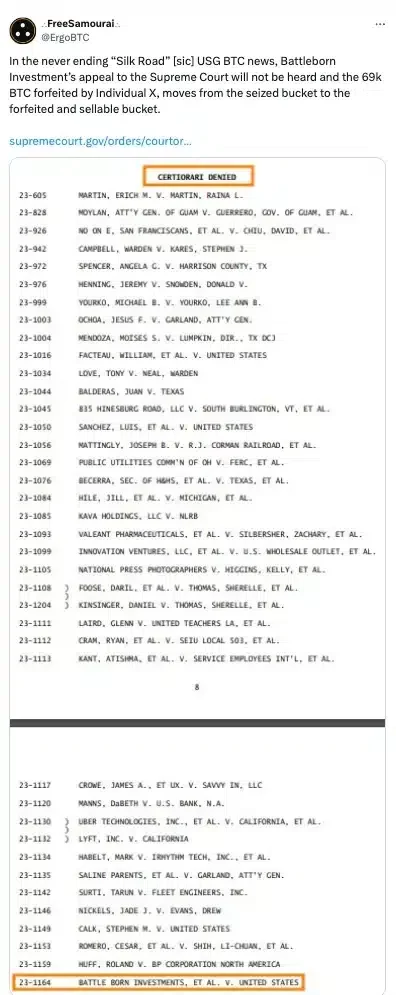

In a notable authorized improvement, the U.S. Supreme Courtroom has declined to assessment an attraction over the possession of 69,370 Bitcoin [BTC], initially confiscated from the covert net Silk Highway market.

This resolution stems from the Supreme Courtroom’s denial to grant certiorari within the case introduced by Battle Born Investments towards the U.S. authorities.

With the Supreme Courtroom declining to listen to the case, the U.S. authorities can now proceed with promoting the seized property, successfully concluding this authorized battle.

What occurred again in 2022?

For these unaware, in 2022, a California federal court docket dismissed claims from Battle Born Investments, which argued it had acquired rights to the seized Silk Highway Bitcoin via a chapter property.

Battle Born claimed the debtor, Raymond Ngan, was “Individual X,” who allegedly stole billions in BTC from Silk Highway.

Missing compelling proof, the court docket dominated towards Battle Born—a choice later upheld by a San Francisco appeals court docket.

Thus, with the Supreme Courtroom’s current resolution to not assessment the case, Battle Born’s authorized avenues at the moment are exhausted, permitting the federal government to liquidate the seized Bitcoin.

How will this impression Bitcoin?

Claims recommend that the U.S. authorities’s potential sale of seized BTC might considerably stress the cryptocurrency market and impression Bitcoin’s value outlook.

And, as anticipated, this announcement itself had an instantaneous bearish impression on BTC’s value, which had been on an upward development till not too long ago.

As per CoinMarketCap, BTC is now buying and selling at $62,651, marking a 1.36% decline over the previous 24 hours.

Transfers made thus far

For sure, up till now the U.S. authorities transferred vital BTC holdings seized from Silk Highway to new wallets.

Between July and August, round $2.6 billion price of Bitcoin was moved, usually indicating preparations on the market.

Nonetheless, these transfers could not point out imminent gross sales, because the U.S. Marshals Service has a custody cope with Coinbase Prime, suggesting the property had been moved for safe holding fairly than liquidation.

Earlier than any sale, regulatory protocols should nonetheless be adopted by the U.S. Marshals or any company concerned.

Different makes use of for the seized Bitcoin

Some U.S. officers are proposing different makes use of for the seized Bitcoin.

For example, Democratic Consultant Ro Khanna instructed the federal government retain these property as a strategic reserve.

Moreover, Republican presidential candidate Donald Trump additionally expressed curiosity in making a BTC reserve if elected.

At a current cryptocurrency convention in Nashville, Trump pledged to determine a “strategic Bitcoin stockpile” if he returns to workplace.

He asserted,

“I am announcing that if I am elected, it will be the policy of my administration, the United States of America, to keep 100% of all the Bitcoin the U.S. government currently holds or acquires into the future.”