- Trump proposes a strategic Bitcoin reserve, positioning it with conventional commodities as nationwide reserves.

- Peter Schiff warns Bitcoin reserve may result in U.S. hyperinflation and greenback devaluation dangers.

In July, former U.S. President Donald Trump made headlines by pledging to determine a strategic Bitcoin [BTC] reserve.

This daring initiative, if executed, would place BTC alongside conventional commodities like petroleum, pure fuel, and uranium as a part of the U.S. nationwide reserves.

Designed to guard towards unexpected provide disruptions, this transfer underscores BTC’s rising function within the nation’s financial technique and its shift towards digital asset integration.

That being stated, the potential creation of a strategic Bitcoin reserve by Trump may affect BTC’s worth motion, although whether or not it is going to result in a bullish or bearish development stays unsure.

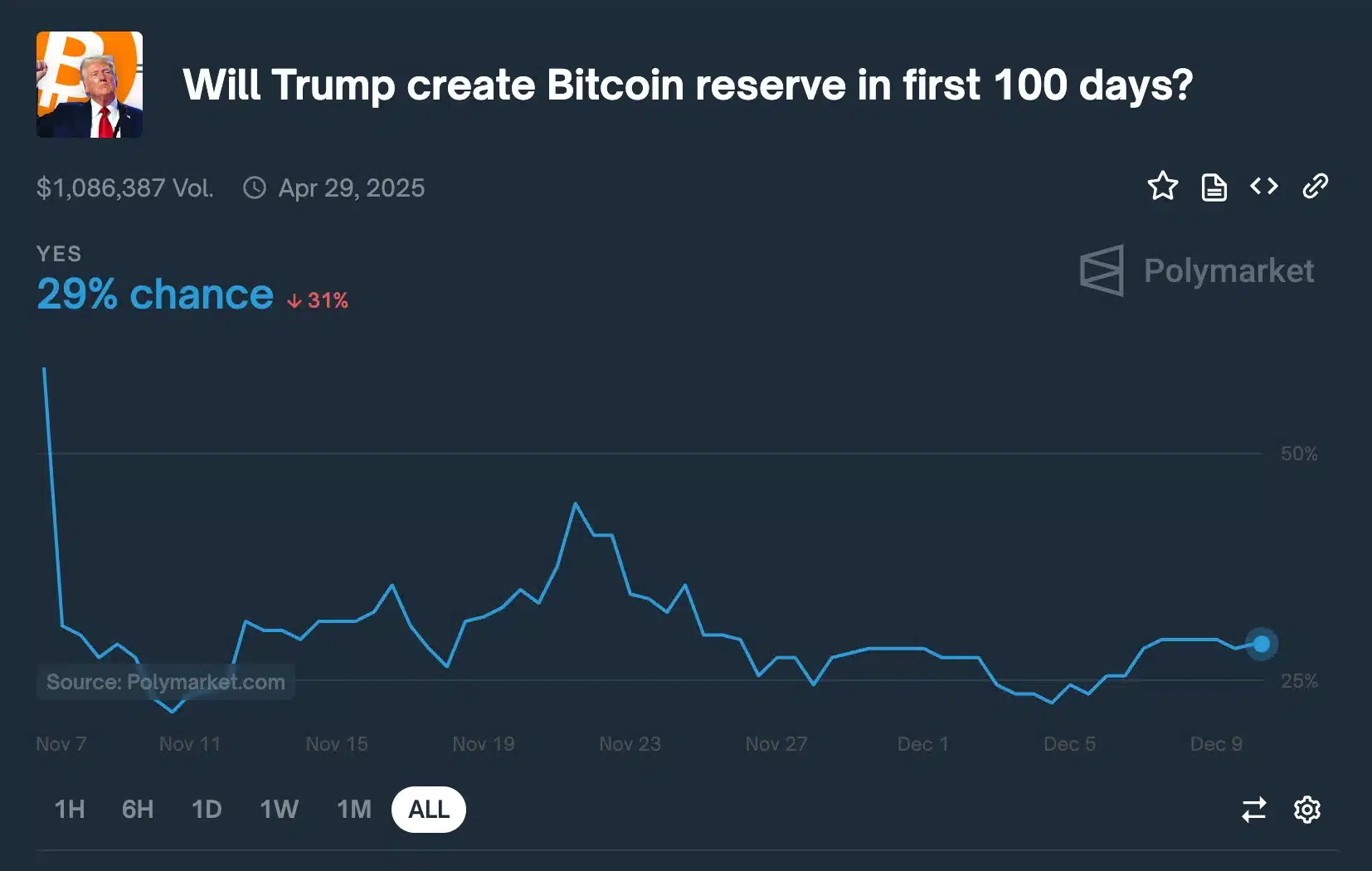

Polymarket development on US Bitcoin Reserve

Nevertheless, based on predictions from Polymarket on the query, “Will Trump create a Bitcoin reserve in the first 100 days?” the probability stands at 29% as of the newest replace.

This can be a slight enhance from the earlier 27%, although it beforehand touched a peak of 45%.

The present development means that investor confidence within the reserve’s realization remains to be cautious, with fewer than 50% betting on its institution, reflecting uncertainty inside the crypto trade.

Execs weighing in

But, a number of key figures and entities are actively supporting the concept of a strategic Bitcoin reserve.

For example, Senator Cynthia Lummis, a outstanding advocate for digital belongings, has strongly really useful that the U.S. transfer ahead with establishing such a reserve.

Mathew Siggel, head of digital belongings analysis at VanEck, has additionally expressed full help for the proposal, highlighting its strategic potential.

Moreover, Anthony Pompliano, founder and CEO of Skilled Capital Administration, has proposed that the U.S. ought to instantly print $250 billion and use it to put money into BTC, emphasizing its worth as a hedge in unsure monetary occasions.

“The United States should print $250 billion on the first day of Donald Trump’s presidency and put 100% of the proceeds into Bitcoin.”

Not all shared the identical boat

As anticipated, not everybody shares the identical perspective on the proposal.

For example, Peter Schiff not too long ago raised issues, arguing that its approval may have implications for each the U.S. greenback and Bitcoin.

He acknowledged,

“Ultimately, so many dollars would be printed to buy Bitcoin that the U.S. would experience hyperinflation, rendering the dollar completely worthless. Once the dollar is worthless, the U.S. could no longer keep buying Bitcoin.”

Including to the fray was former US Secretary of the Treasury Larry Summers who stated,

“Of all the prices to support, why would the government choose to support by accumulating a sterile inventory, a bunch of Bitcoin? There is no reason other than to pander to generous special interest campaign contributors.”

Thus, with uncertainty lingering amongst buyers, it stays to be seen whether or not Trump’s plan will materialize or stay a mere imaginative and prescient.

In the meantime, as of the newest knowledge from CoinMarketCap, BTC is buying and selling at $98,451.73 following a 1.43% decline over the previous 24 hours.