- Hayes urged aggressive funding amidst market decline.

- Hayes noticed Bitcoin as a hedge amid destructive actual yields, regardless of skepticism.

Properly, probably the most argued subject in and across the cryptocurrency area has been — Is Bitcoin [BTC] a hedge towards fiat foreign money devaluation?

Whereas the Bitcoin halving has been the speak of the city for fairly a while, Arthur Hayes, the previous CEO of crypto change BitMEX, supplied insights right into a strengthening development that might drive BTC’s continued rise.

Arthur Hayes’s left curve method

In his latest essay titled- ‘Left Curve’, Hayes not solely shared methods for funding but in addition criticized conventional monetary knowledge, urging buyers to undertake extra aggressive methods to maximise returns.

He stated,

“Bull markets don’t come often; it is a travesty when you make the right call but do not maximize your profit potential.”

Moreover, emphasizing the significance of maximizing income throughout bull markets, and criticizing promoting crypto for fiat foreign money, Hayes stated,

“If you sold sh*tcoins for fiat that you don’t immediately need for living expenses, you are f**king up.”

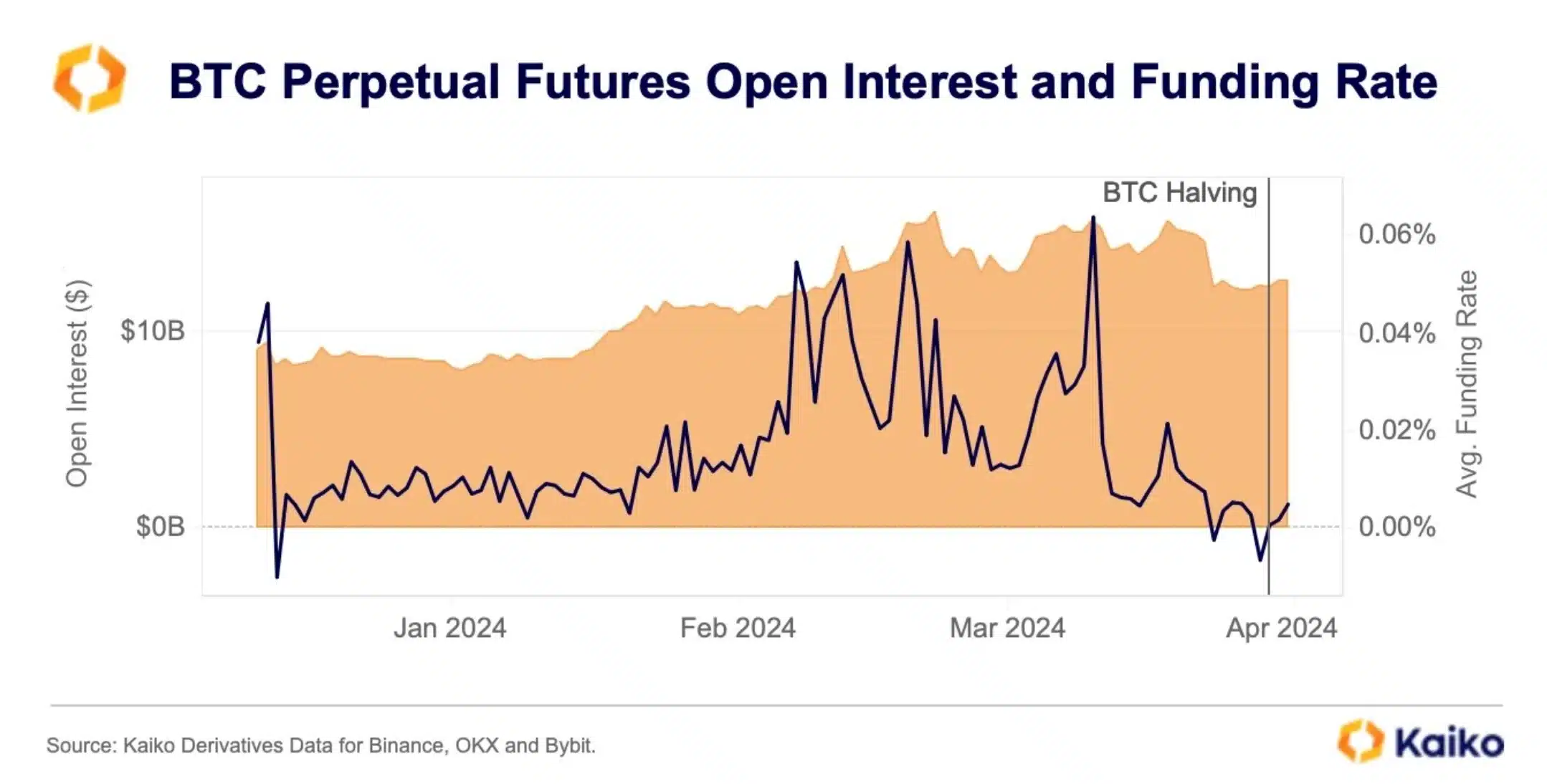

Additionally, shedding mild on the investor’s conduct, Kaiko famous,

“Funding rates for $BTC perps turned negative for the first time since late 2023 in the lead up to the halving.”

This prompt that there was extra promoting stress available in the market, and merchants had been keen to pay a premium to borrow BTC for brief positions.

Bitcoin stands the check of time

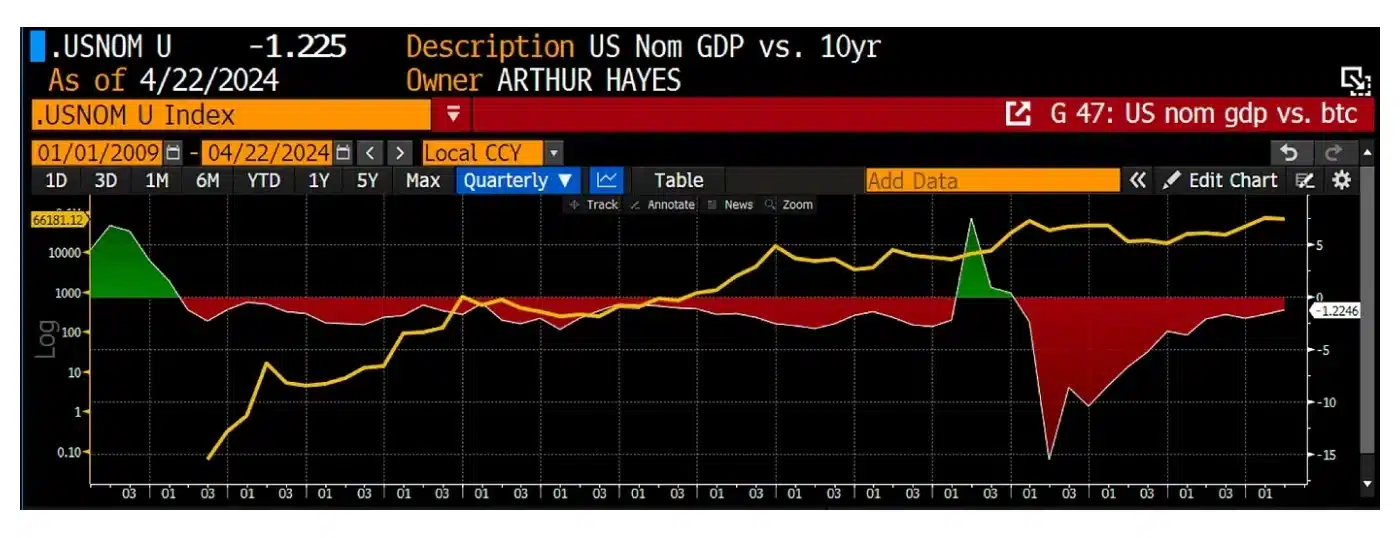

Hayes additionally analyzed the connection between actual bond yields and the Federal Reserve’s steadiness sheet, and the way financial shocks have an effect on yields.

He prompt,

“Bitcoin is rising in a non-linear fashion on a log chart. Bitcoin’s rise is purely a function of an asset with a finite quantity being priced in depreciating fiat dollars.”

This highlighted that BTC has emerged in its place funding during times of destructive actual yields, providing a hedge towards fiat foreign money depreciation.

Nevertheless, being skeptical of Bitcoin’s funding optimism, Peter Brandt, CEO of Issue LLC, factored,

“It is extremely interesting to note that Bitcoin $BTC price (adjusted for inflation) has not made a new high in three years despite halving and Bitcoin ETFs.”

Regardless of such criticism, Hayes was nonetheless assured and prompt that as we transfer into the summer season months, we must always count on crypto volatility to lower.

“This is the perfect time to take advantage of the recent crypto dip to slowly add to positions.”