- Bitcoin may create a brand new all-time excessive in This autumn with a rally pushed by a number of catalysts.

- Nonetheless, profit-taking actions may proceed to stifle the short-term rally.

Bitcoin [BTC] traded at $63,663 at press time after an 8% achieve prior to now seven days. Because the final quarter of the 12 months attracts close to, hypothesis is rife that the biggest crypto may very well be heading in the right direction to create a brand new all-time excessive.

In its weekly report, 10x Analysis outlined three key elements that would see Bitcoin surpass $73,000 within the coming months.

The primary is the US presidential elections set for the fifth of November. This political occasion may spur optimistic momentum available in the market. The report additionally mentions the distributions to FTX collectors as one other potential catalyst to Bitcoin’s rally as the method will coincide with a bull market. The report acknowledged,

“FTX creditors are expected to distribute $16 billion to customers between December 2024 and March 2025, with the market likely front-running this expectation. We anticipate $5-8 billion to flow back into the crypto space,”

Thirdly, MicroStrategy has raised extra funds to fund its Bitcoin purchases. This increase may set off a surge in demand for Bitcoin.

Nonetheless, amid these speculations, are different macro elements and on-chain information aligning to help a bull run?

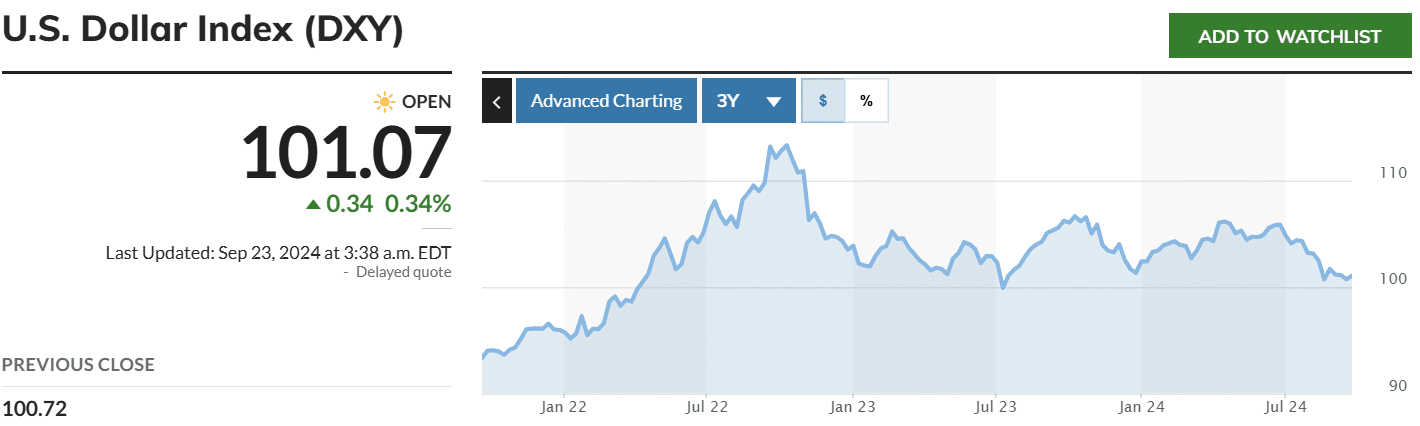

The greenback index is at vary lows

The US greenback index (DXY) has been trending downwards. At press time, this index stood at 101 and has been transferring at vary lows of $100-$101 since August.

The DXY measures the energy of the US greenback in opposition to different high world currencies. A decline on this index alerts a weakening greenback, which in flip stirs optimistic sentiment round Bitcoin.

Traditionally, each time the DXY weakens, Bitcoin typically data positive factors. As such, if the DXY falls beneath 100, Bitcoin may turn out to be enticing as an inflation hedge.

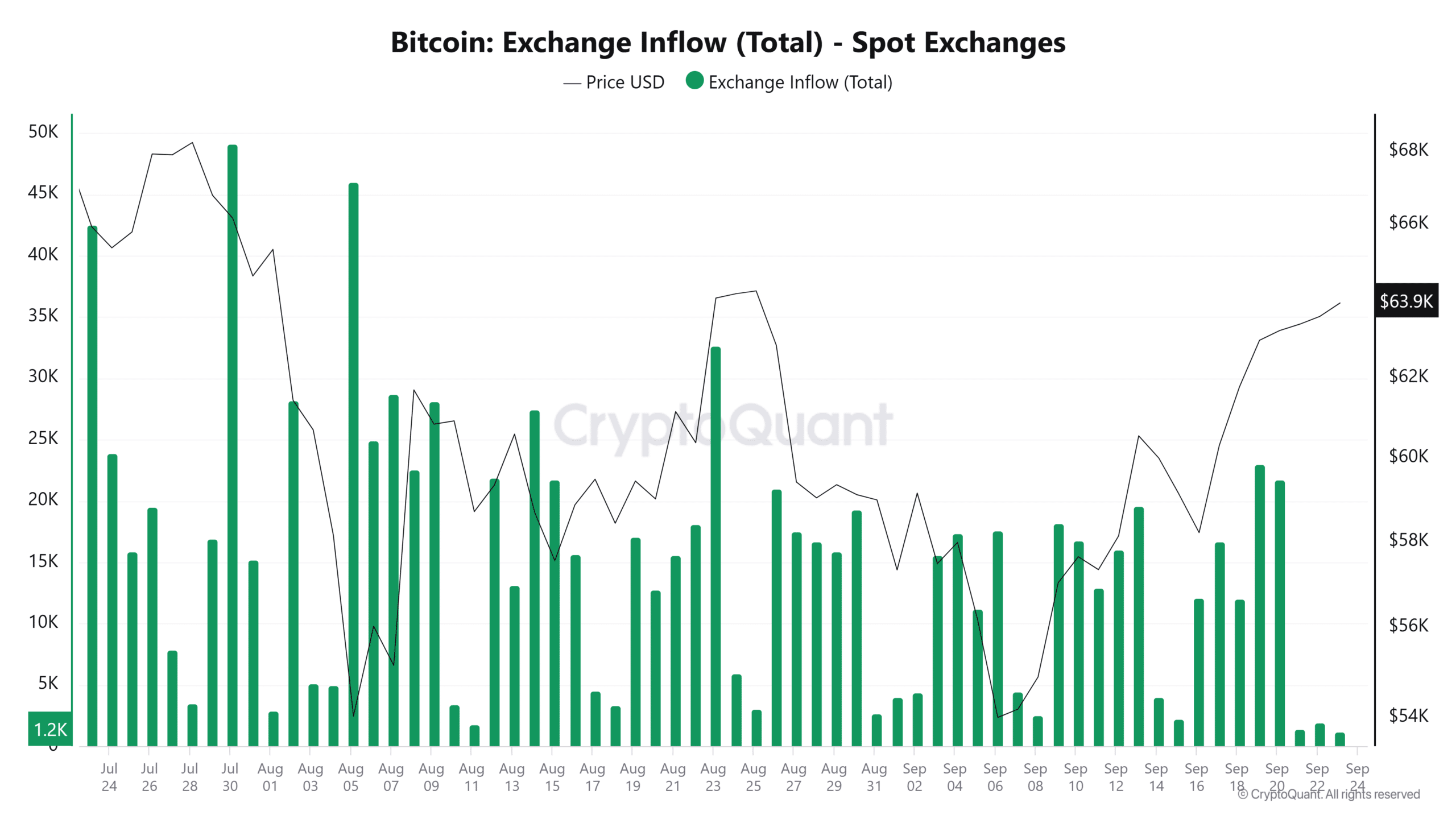

Bitcoin alternate inflows

Knowledge from CryptoQuant reveals that Bitcoin alternate inflows remained subdued over the weekend after a interval of intense profit-taking.

This decline means that merchants may very well be gaining confidence in Bitcoin’s rally and its means to maintain costs above $60,000.

Nonetheless, it is very important word that weekends are sometimes related to low buying and selling volumes. To substantiate that profit-taking actions have slowed down, merchants ought to be careful for the shift in move information throughout the week.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

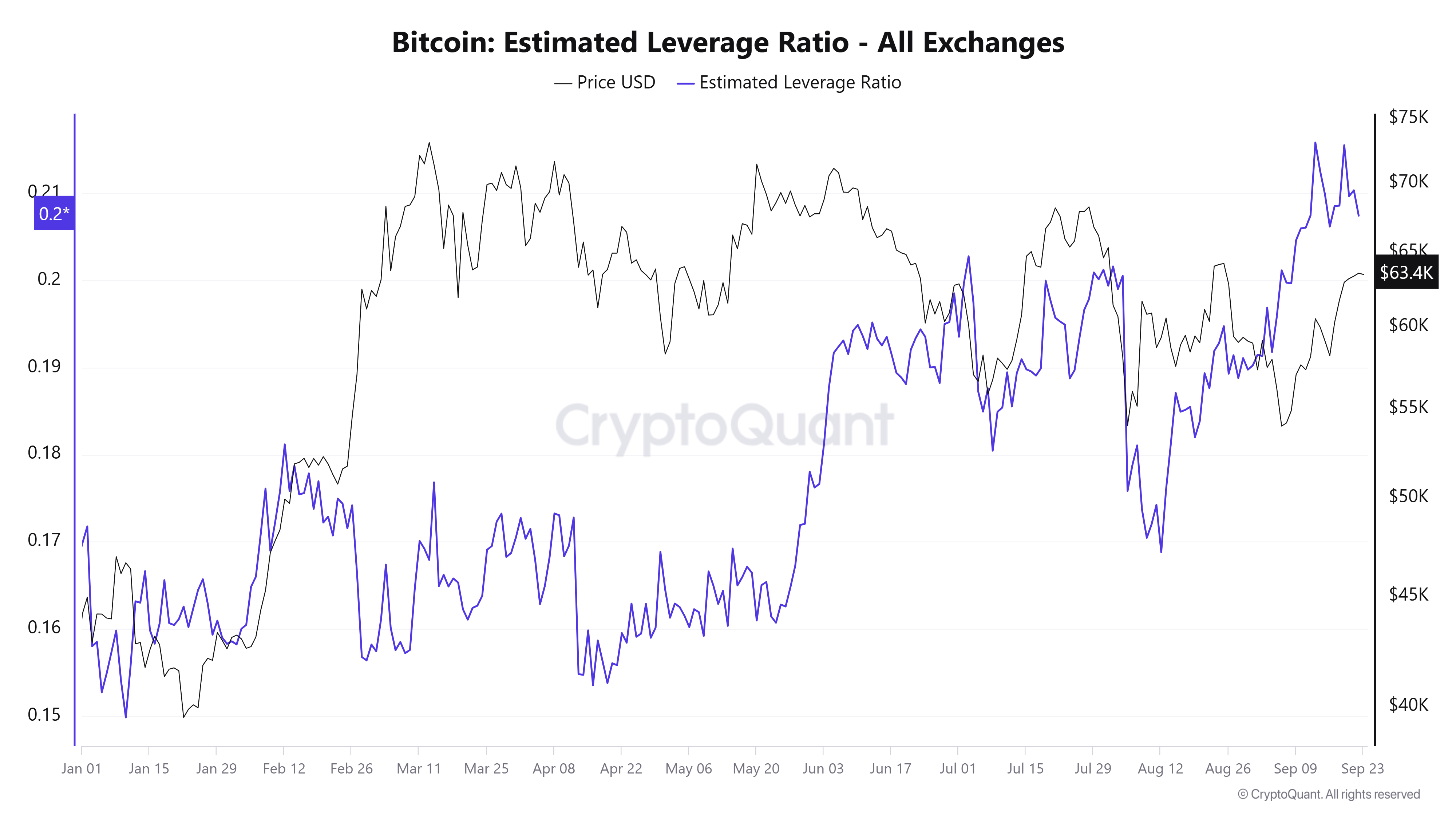

Moreover, the estimated Bitcoin leverage ratio has been rising, and it presently sits on the highest degree year-to-date.

A excessive leverage ratio normally displays rising bullish sentiment as merchants improve their margin positions on BTC. Nonetheless, an increase on this metric may additionally level in the direction of incoming volatility.