The cryptocurrency market has just lately exhibited distinct divergences within the habits of its two main property, Bitcoin and Ethereum. Whereas Bitcoin seems to be stepping right into a section of relative stability, Ethereum’s journey paints a contrasting image of sustained uncertainty, significantly in its choices market.

This divergence is highlighted by the sustained excessive ranges of implied volatility related to Ethereum choices, signaling a cautious outlook amongst buyers concerning its future value actions.

Ethereum Persisting Volatility: A Comparative Evaluation

Implied volatility (IV) serves as an important indicator within the choices market, offering insights into the anticipated value fluctuations of an asset over a particular interval. It displays the market’s temperature, gauging the depth of potential value actions merchants anticipate.

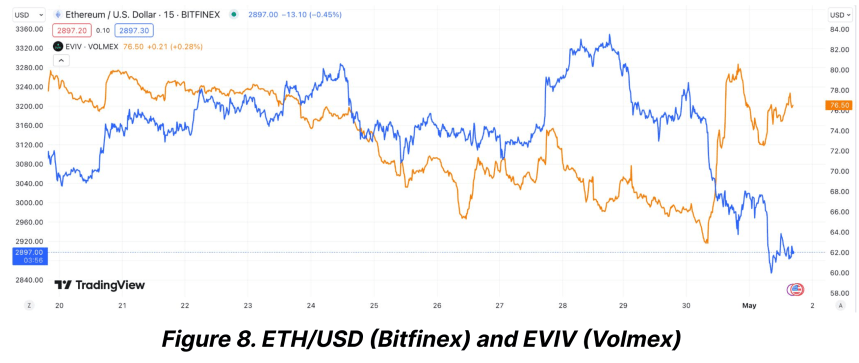

Latest analyses counsel that whereas Bitcoin’s implied volatility has settled down considerably post-halving, Ethereum’s has not adopted swimsuit. As Bitcoin’s IV dipped to a multi-month low, indicating a relaxing market, Ethereum’s IV stays stubbornly excessive.

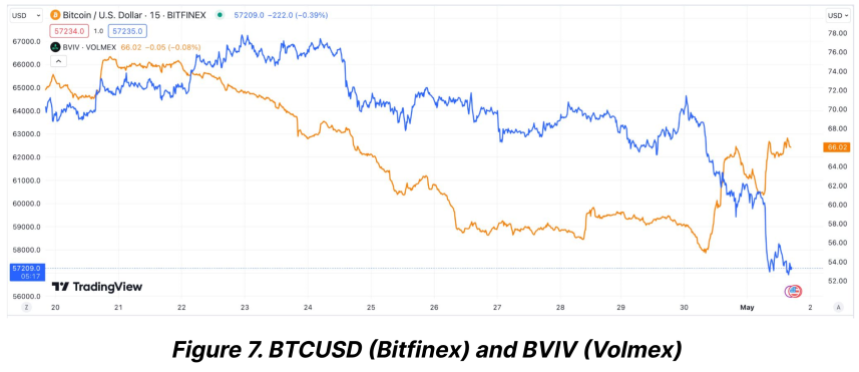

Opposite to the calming waves within the Bitcoin market, Ethereum wrestles with heightened volatility. In accordance with knowledge from Bitfinex Alpha Report, Bitcoin’s volatility index sharply declined from 72% on the time of its newest halving occasion to about 55%.

Alternatively, Ethereum noticed a extra modest discount in its volatility index, dropping from 76% to 65% in the identical interval. This persistent volatility in Ethereum’s market is primarily fueled by uncertainties surrounding vital upcoming regulatory choices and broader market implications.

The Ethereum market is especially jittery in anticipation of the US Securities and Alternate Fee’s (SEC) impending choice on two spot Ethereum ETFs, slated for late Could 2024.

This upcoming regulatory milestone is taken into account a important occasion that would both catalyze a significant market transfer or exacerbate the present volatility.

The Bitfinex Alpha report underscores that regulatory uncertainty is a major driver behind Ethereum’s much less vital drop in its Volatility Danger Premium (VRP) in comparison with Bitcoin’s.

ETH And BTC Present Indicators of Restoration Amid Volatility

Ethereum and Bitcoin have proven indicators of restoration over the previous week when it comes to buying and selling efficiency. Bitcoin has seen a 4.1% enhance, whereas Ethereum reported a extra modest acquire of two.4%.

Nonetheless, the final 24 hours have been much less favorable for Ethereum, with a slight dip of 0.7%, underscoring the continued volatility and investor warning.

Furthermore, Ethereum’s community dynamics additionally replicate a subdued exercise with a marked lower in ETH burn charge attributed to decreased transaction charges.

This technical facet additional enhances a cautious Ethereum market narrative, poised getting ready to probably vital shifts relying on exterior regulatory actions.

Regardless of all these, analysts like Ashcrypto counsel that the present volatility may set the stage for a robust rebound within the yr’s third quarter. Drawing on historic patterns, Ethereum’s speculative forecast is probably reaching the $4,000 mark, supplied market circumstances align favorably.

Featured picture from Unsplash, Chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use data supplied on this web site completely at your individual threat.