- Bitcoin declined by 8.42% on the weekly charts, fueling a hike in bearish market sentiment

- Accumulation development rating nearing 0 might have implications for the cryptocurrency

Over the previous few months, Bitcoin has seen some excessive volatility on the value charts. Whereas 2024 has seen BTC hit a document excessive of $73k and better market favourability for the reason that launch of ETFs, it has additionally seen greater volatility.

On the time of writing, BTC was buying and selling at $54,239 after an 8.42% decline over the previous week.

And but, it’s nonetheless displaying some indicators of life with a latest hike in buying and selling quantity. The truth is, figures for a similar surged by 63.13% to $48.6 billion over the past 24 hours. What does this imply for BTC’s market outlook over the quick and long run although? Can Bitcoin totally get better now?

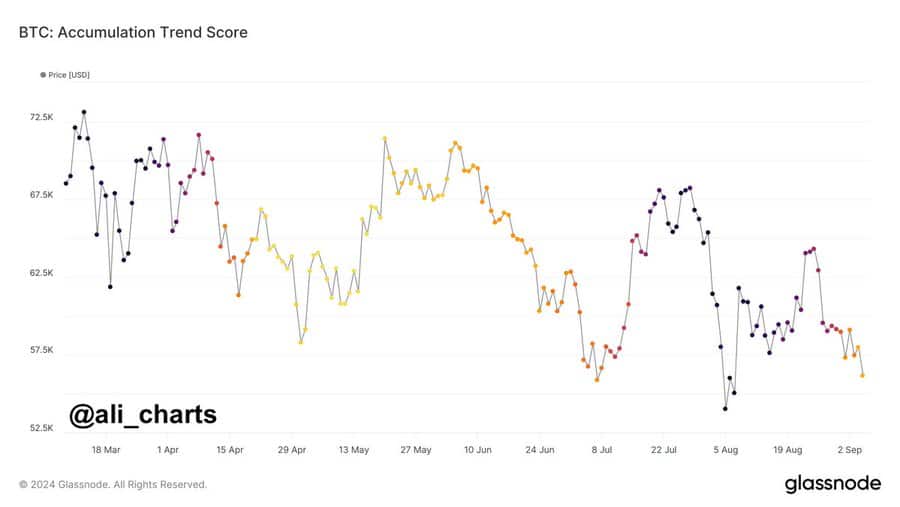

Nicely, in line with well-liked crypto analyst Ali Martinez’s suggestion, BTC could also be seeing lowered participation. He made this assertion by citing the declining accumulation development rating.

Market sentiment evaluation

In accordance with Martinez, the buildup development rating is nearing 0 proper now. Which means that market contributors are both distributing or not accumulating BTC.

In context, the buildup development rating displays the relative dimension of entities which can be actively accumulating cash on-chain by way of BTC holdings. A price near 1 means that contributors are accumulating cash. A price nearer to 0 signifies contributors are distributing their holdings.

Thus, when the buildup development rating flashes 0, it suggests no consumers from any cohort and implies distribution. Each time BTC hits a low in a bear cycle, it sees a hike in accumulation as traders purchase the dip. Nonetheless, after the bear market cycle persists, a scarcity of accumulation happens as they lack confidence within the cycle.

Based mostly on this evaluation, the buildup rating is nearing 0 from the tip of August to early September 2024. This implies better distribution and weakening accumulation amongst contributors. Such a state of affairs suggests bigger gamers and long-term holders aren’t shopping for – A sign of bearish sentiment.

That is additionally an indication of insecurity amongst traders over the near-term rally. These market situations end in promoting stress, resulting in a worth decline on the charts.

What do the value charts say?

Now, whereas the metrics highlighted by Martinez supplied an in depth outlook of the prevailing market sentiment, the broader market did bear the burnt of its latest restoration.

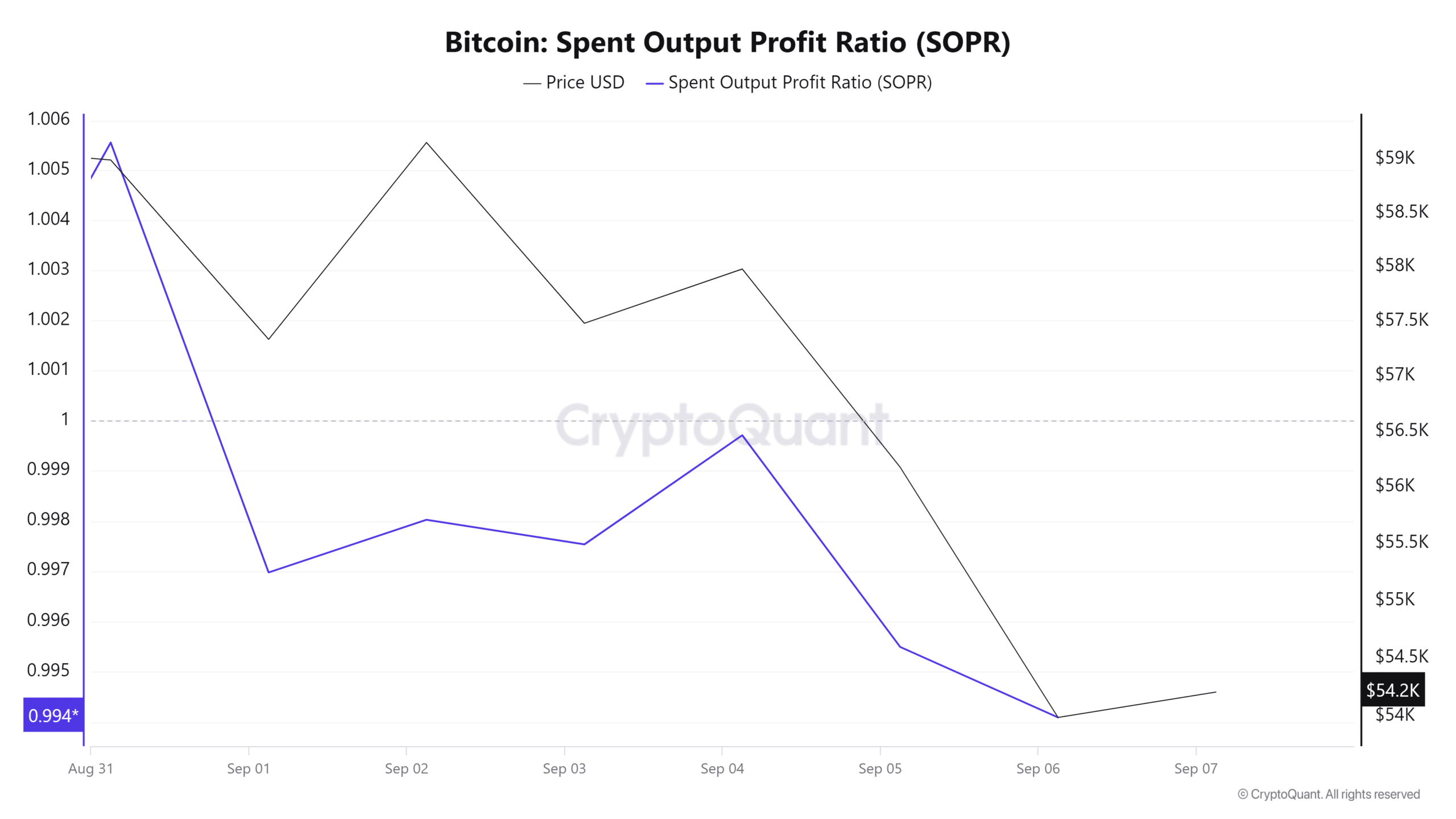

For starters, Bitcoin’s giant holder SOPR has declined from 2.4 to 1.6 over the previous 7 days. This confirmed that though long-term holders are promoting at a revenue, the size of the revenue is lowering. Subsequently, merchants are promoting at a loss as they’re changing into much less assured within the short-term to medium-term outlook for the asset.

This state of affairs additionally appeared to counsel that traders are pessimistic about future worth hikes and they’re making ready for an extra bearish state of affairs.

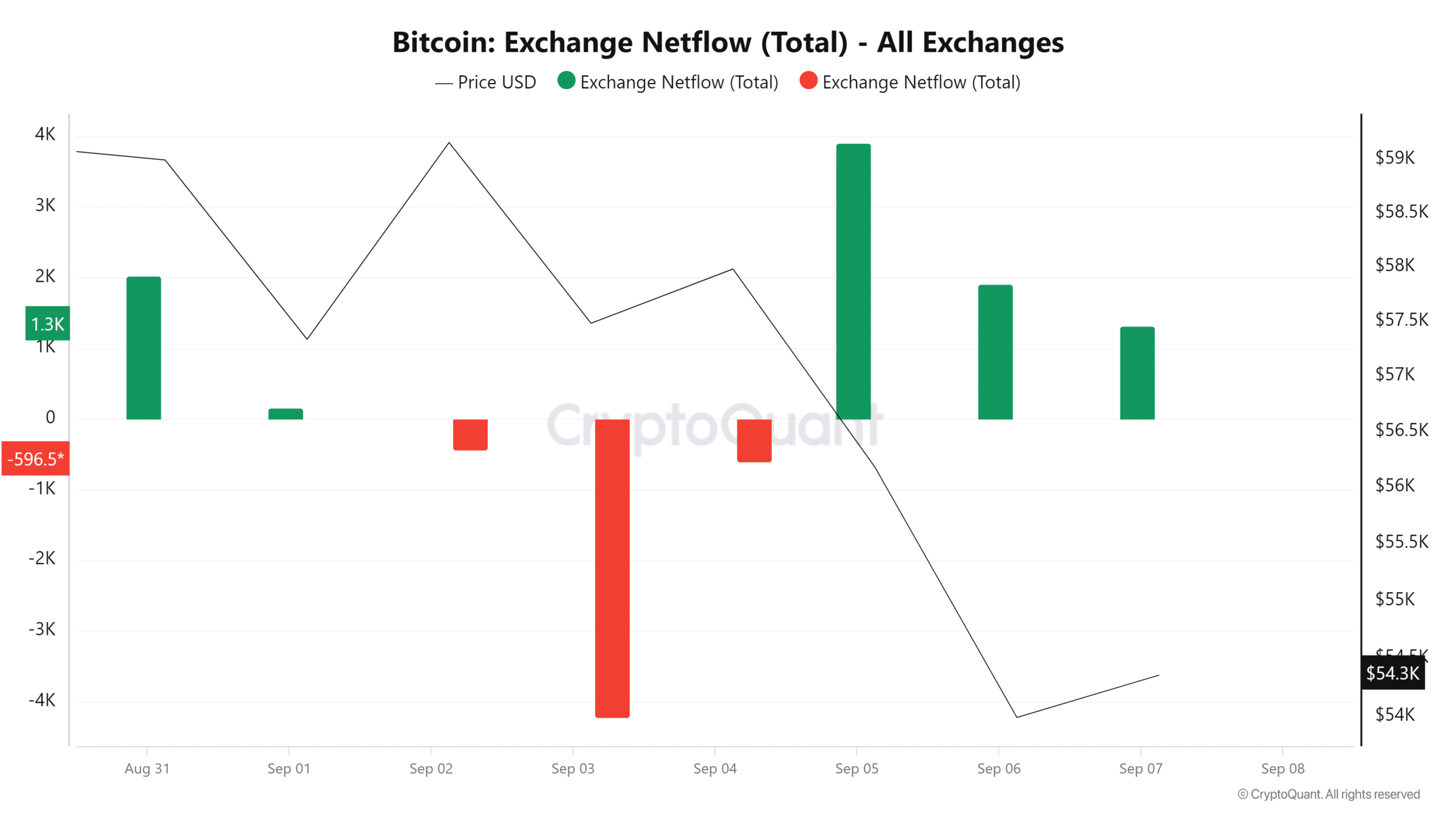

Moreover, Bitcoin’s trade netflows have remained comparatively optimistic over the previous 7 days. In 7 days, 4 days have seen optimistic trade netflows – An indication that extra traders are making ready to shut their positions. Right here, a hike in inflows into exchanges may end up in distribution, if it results in promoting.

In gentle of all these components, it may be predicted that if the promoting stress persists, BTC will threat declining under $50k.