Merchants,

I sit up for sharing my ideas and high concepts with you for the upcoming week.

This week’s structure will differ barely from earlier weeks as I’m touring this weekend. So there’ll simply be a weblog publish and no video this weekend.

However relaxation assured, I can’t go away you hanging. I’ve a prolonged watchlist of names for the upcoming week, and I’ll present a short and concise plan for every.

As mentioned in my most up-to-date Inside Entry assembly, I noticed a big shift in market sentiment and momentum. With that shift, a number of high swing lengthy setups offered themselves. Most just lately and notably was the ASTS breakout from Friday, as I mentioned in Thursday’s Inside Entry assembly.

For the week forward, my focus shifts from breakouts to larger lows in a number of names that broke out and bucked the pattern, together with some small caps on look ahead to pops to quick.

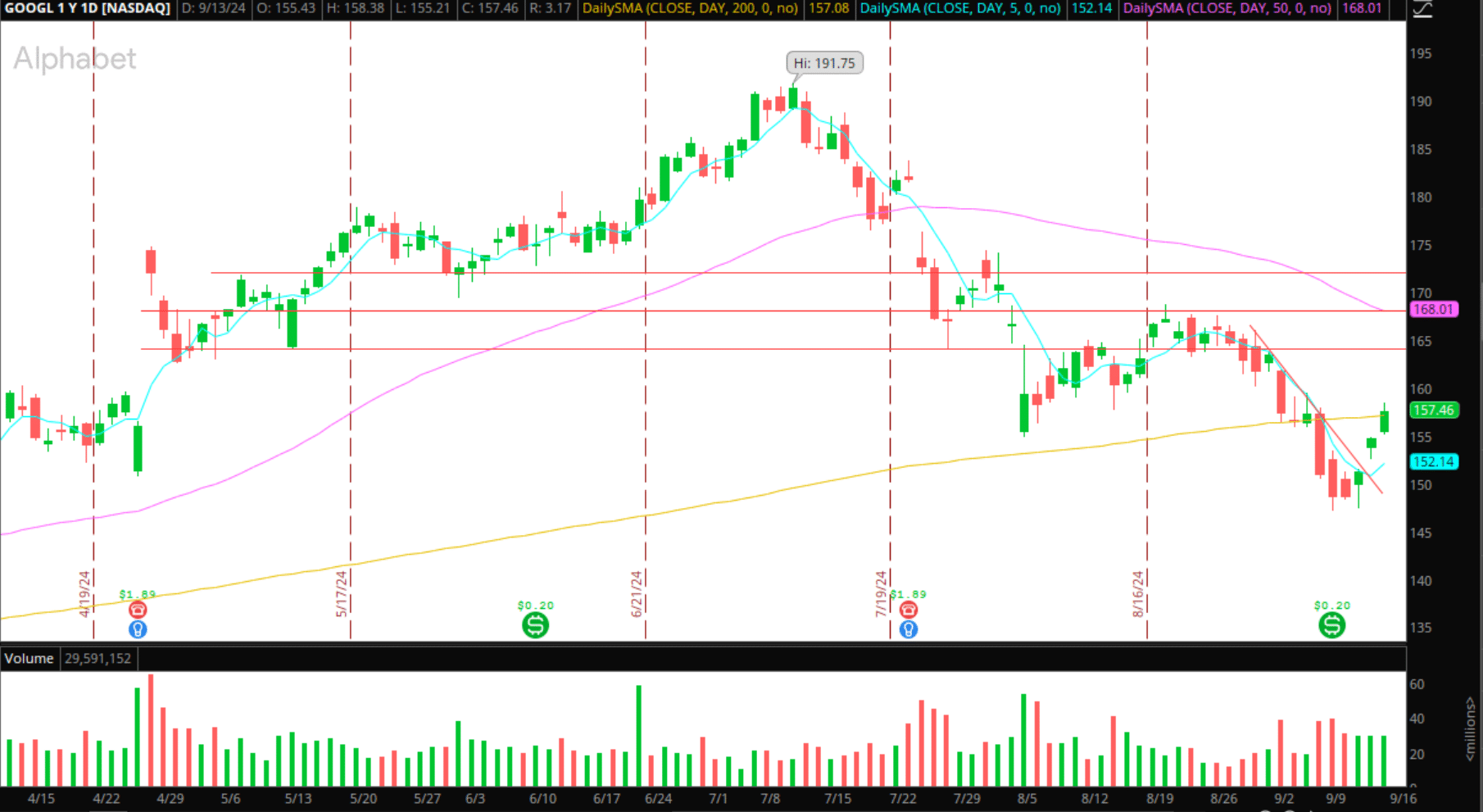

Greater Low in GOOGL

The Concept: Help was discovered, and a better low was fashioned inside a better timeframe (each day and weekly chart). Going ahead, on the lookout for additional construct and continuation to the upside because the bounce continues.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements comparable to liquidity, slippage and commissions.

The Plan: I received’t chase highs. As a substitute, I’m on the lookout for a base to develop over Friday’s low / A better low formation on the hourly chart if the inventory can pull again close to $154 for entry to the lengthy aspect with a cease vs. LOD.

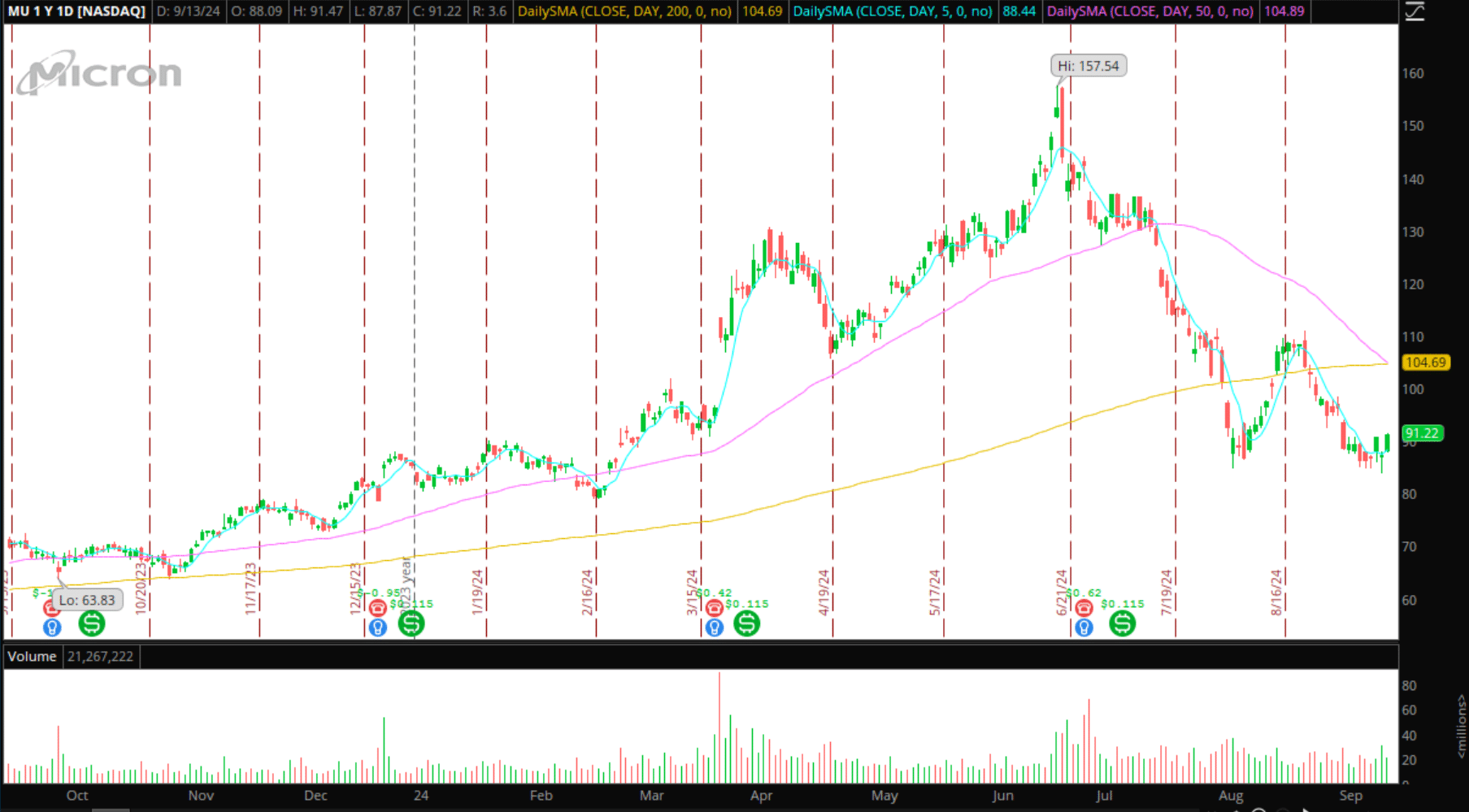

Continuation in MU

The Concept: Double-bottom formation in MU.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements comparable to liquidity, slippage and commissions.

The Plan: Additional construct and assist above Friday’s excessive for an extended entry versus the day’s low. Alternatively, a pullback and better low confirmed close to its 5-day SMA.

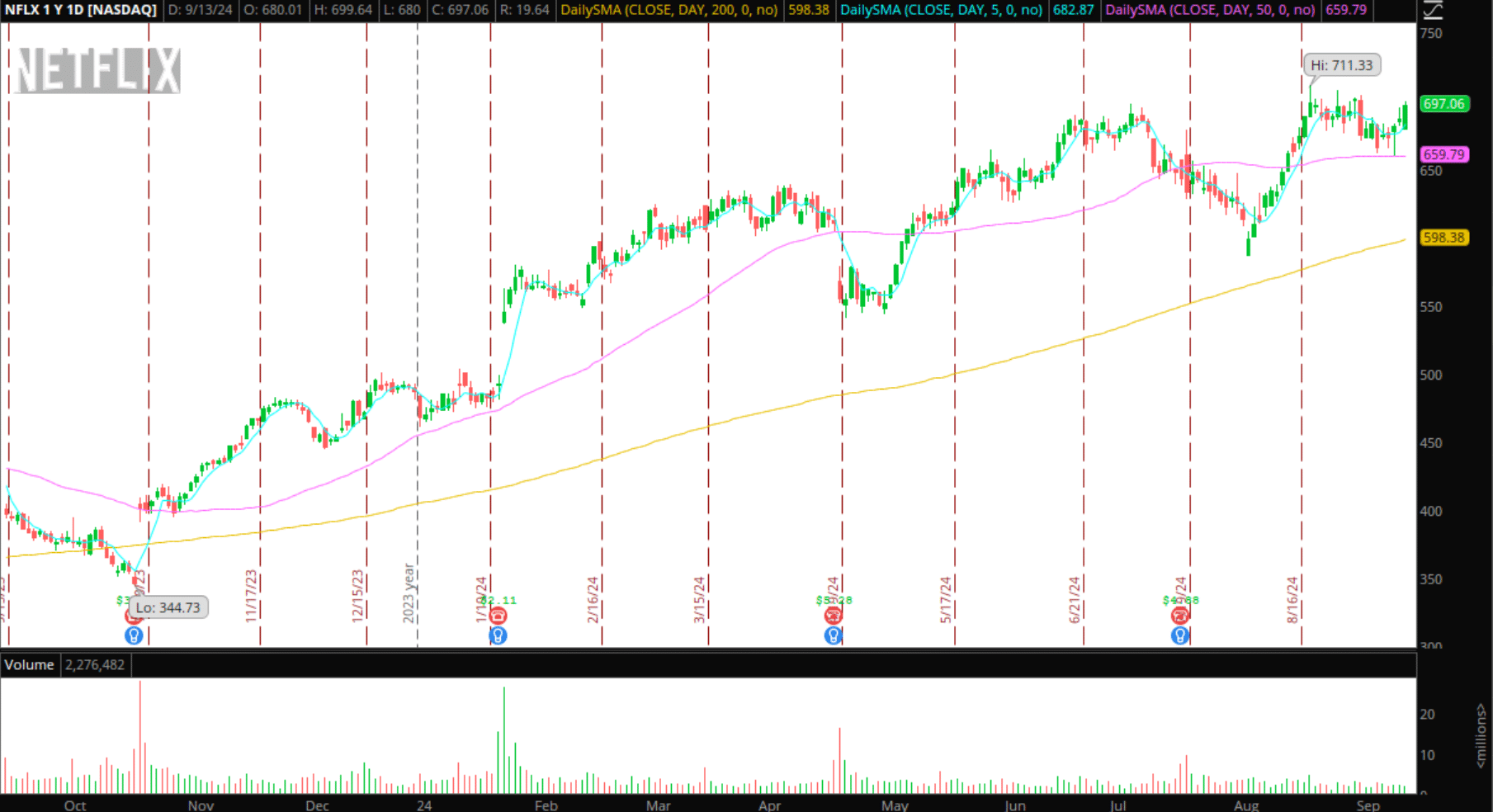

Breakout in NFLX

The Concept: Consolidation close to 52-week Highs, approaching essential breakout zone.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements comparable to liquidity, slippage and commissions.

The Plan: Relative energy on a market pullback, confirming a better low and maintain over the 2-day / multi-day VWAP for a starter lengthy place. I might look so as to add/provoke a place if NFLX breaks above Friday’s excessive with elevated quantity and bases above the excessive – confirming patrons have stepped larger.

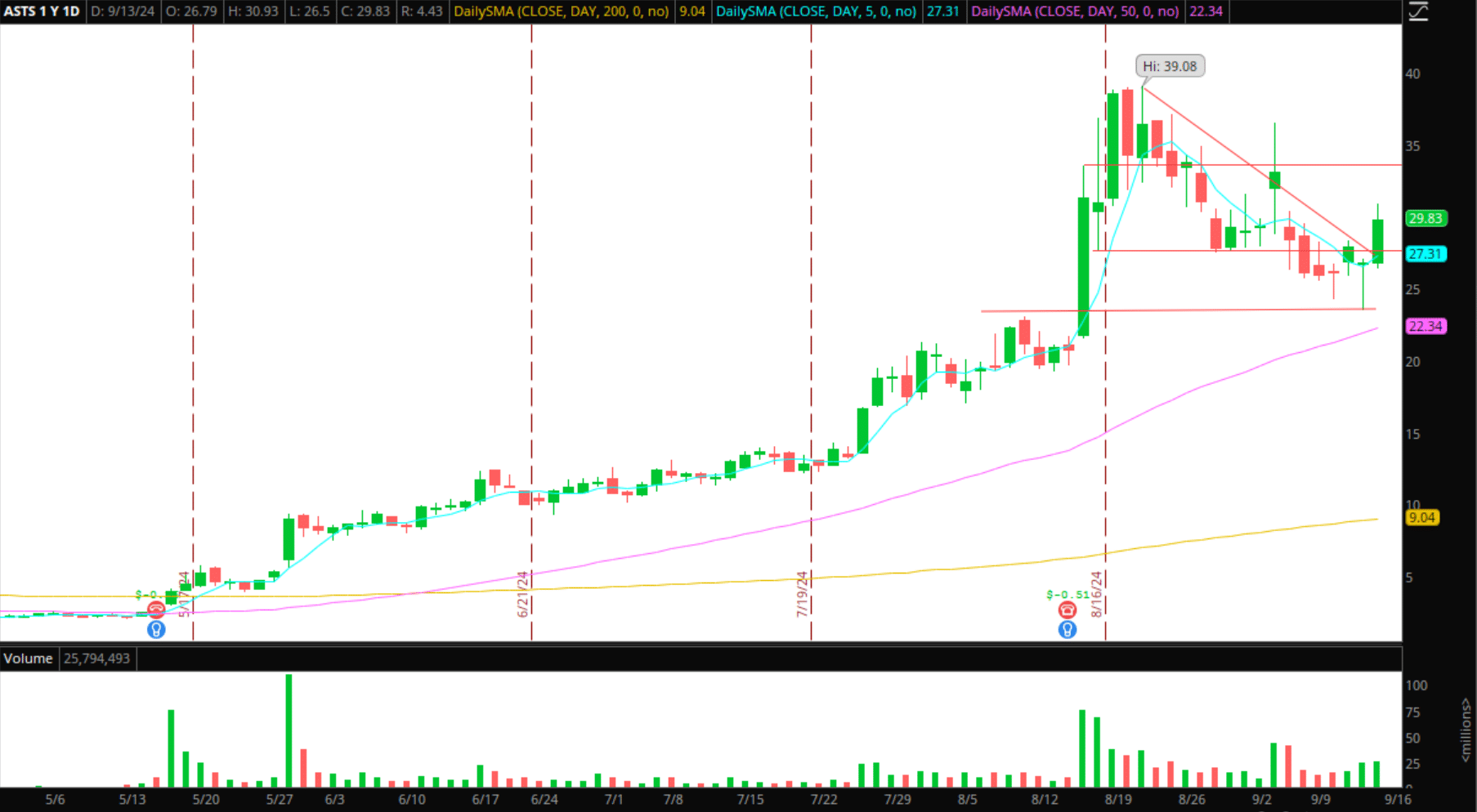

Continuation in ASTS

Following on from the breakout thought given on Thursday within the Inside Entry assembly, I’m now on the lookout for a maintain over the multi-day VWAP and reclaim of $30. After that, I’ll look to be lengthy versus the LOD for continuation, concentrating on a transfer above Friday’s excessive to start trailing my cease on the 5-minute timeframe.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements comparable to liquidity, slippage and commissions.

Small Cap Watchlist

IMRX: Failure to reclaim its 2-day / multi-day VWAP for a brief and momentum to the draw back. Concentrating on a fast push and fail close to $2.20 + and fail for a day two quick.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements comparable to liquidity, slippage and commissions.

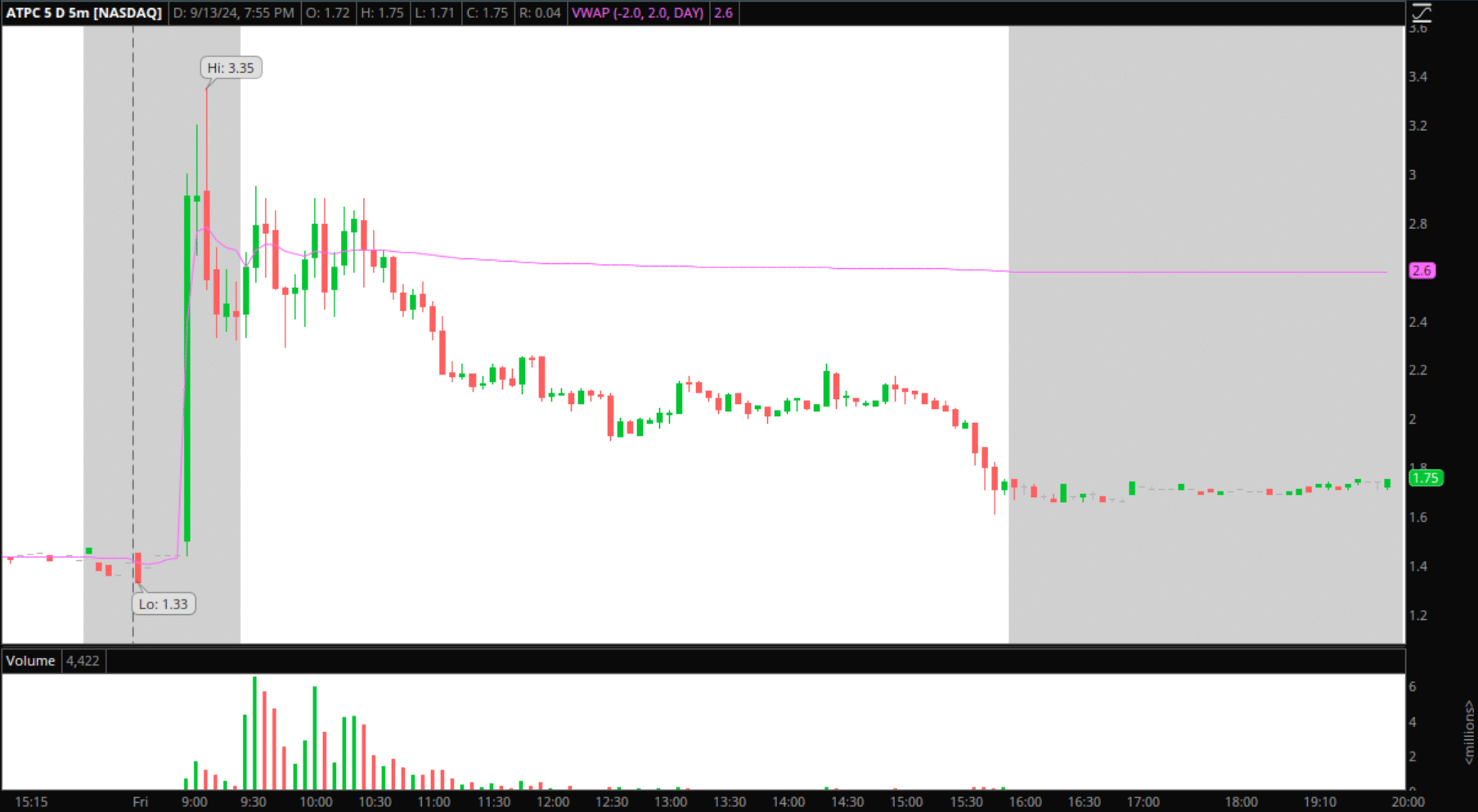

ATPC: Comparable ideas to IMRX. Ideally, a big push close to its 2-day VWAP, $2.2 – $2.5 and fail for the quick.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements comparable to liquidity, slippage and commissions.

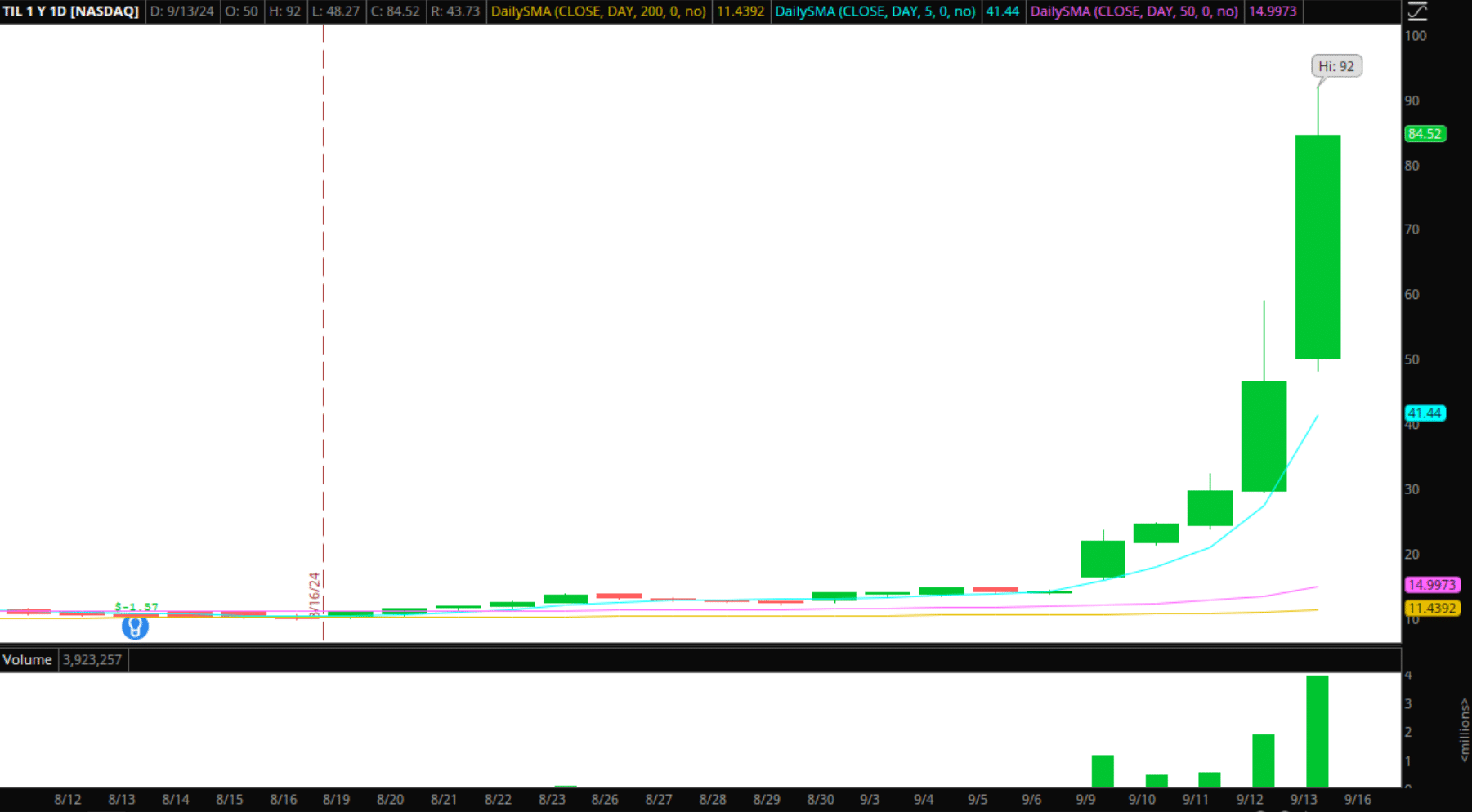

TIL: Little interest in going lengthy at these costs. Certainly, it isn’t a inventory to look at for newer merchants, given the liquidity, unfold, and volatility. As soon as this tops out and confirms the bottom, I’ll search for a decrease excessive quick versus a definitive stage with well-defined threat.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements comparable to liquidity, slippage and commissions.

Get the SMB Swing Trading Analysis Template Right here!