Merchants,

I stay up for sharing my prime concepts for the upcoming week, together with my exact entry and exit targets and explaining the precise setups and eventualities I’m on the lookout for.

So, with out additional ado, let’s leap straight into it!

Starting with the newest theme, Chinese language shares.

Now, I gained’t go over the background surrounding the transfer, be it macro or technical, as I already did so intimately in my newest Inside Entry assembly. As an alternative, I’ll define the place I see the chance going ahead and lay out my plans.

Imply Reversion A+ Alternative

The Concept: Firstly, I’m wanting on the most overbought Chinese language inventory, judging by its vary enlargement and RSI. It’s necessary to keep in mind that these Chinese language shares are breaking out of multi-year bases, are actual corporations, and have immense tailwinds coming from Beijing’s measures. So, I’m not on the lookout for a “crash” kind transfer—only a imply reversion alternative.

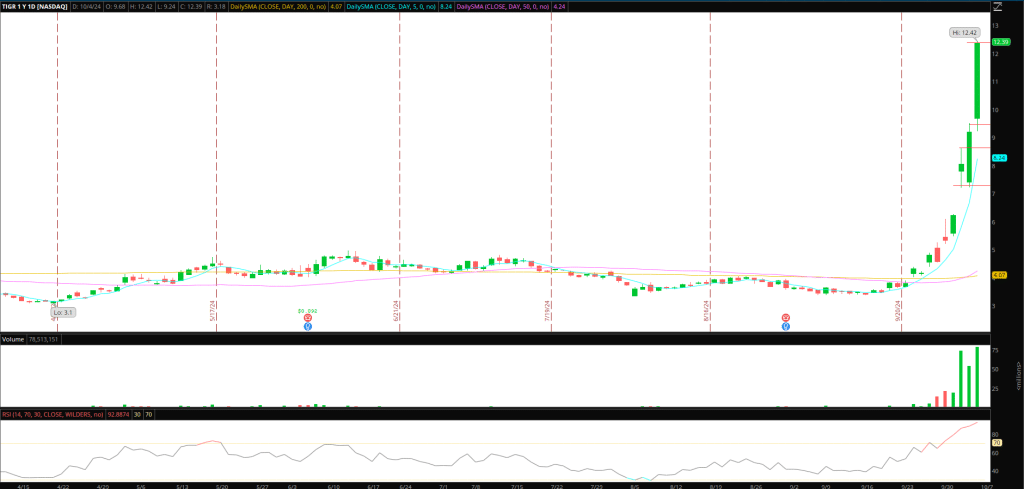

The Inventory in Focus: On account of vary, liquidity, and RSI, TIGR is the perfect inventory for a imply reversion alternative. Once more, it’s a actual firm right here with immense inflows and advantages from rotation into Chinese language shares. Nonetheless, with its RSI now within the mid-90s, it’s arrange nearly completely for a imply reversion commerce.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements akin to liquidity, slippage and commissions.

The Plan: There are numerous eventualities and methods through which this will play out. Every state of affairs has completely different gradings, i.e., A+, A-, and even A++. As I mentioned at nice size in Inside Entry, it’s necessary to sport plan every state of affairs and description IF/THEN statements.

For instance, IF TIGR gaps up on Monday, additional stretching its RSI, has one final push off the open and speedy rejection, THEN that’s A++, and I’ll look to be quick versus the HOD, explicitly focusing on a decrease excessive entry and consolidation breakdown / VWAP breakdown for an add.

Or, if TIGR gaps up on Monday and offers the hole again within the pre-market, I’d downgrade the transfer to A—and look to quick a decrease excessive / failed pre-market excessive try. Ifthe inventory holds weak below VWAP, I would improve its score to A+ and measurement accordingly. These are simply two potential eventualities. There are various extra, with completely different gradings and EV, which can impression my danger.

Different shares I will probably be watching intently, with an identical plan, are FUTU and YINN.

Now, this theme will take up most, if not all, my consideration as a imply reversion alternative units up, adopted by loads of open-minded buying and selling alternatives after that.

So, with that being stated, listed below are simply two extra shares I’ve set alerts in.

Extra Mentions:

ASTS Consolidation Breakout

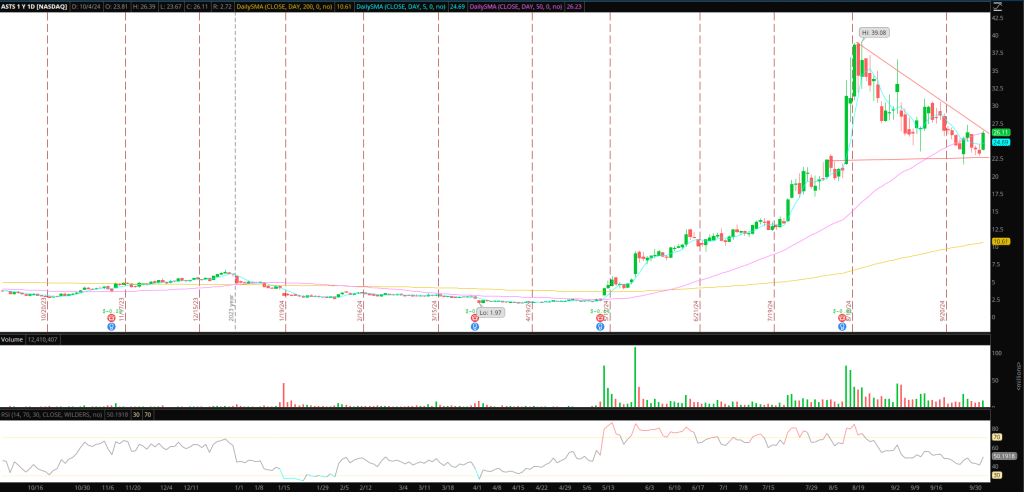

The Concept and Plan: Much like my earlier plan within the identify, the inventory has digested its upmove and stabilized effectively above its rising 5-day SMA. After Friday’s motion, it seems prepared for a momentum transfer greater.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements akin to liquidity, slippage and commissions.

I will probably be on the lookout for additional affirmation earlier than coming into lengthy for a swing. I need to see the inventory maintain above Friday’s excessive and its rising 50-day. If ASTS can spend time with RVOL, holding above that zone, I’ll look to enter with a LOD cease, focusing on a transfer towards $30 as goal 1.

DUO Bottom Quick

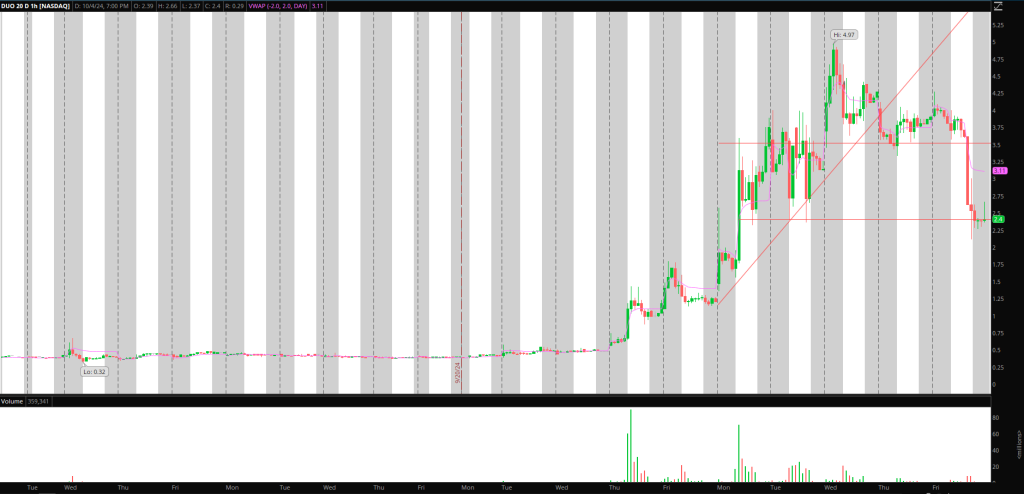

The Concept and Plan: A number of choices had been introduced final week, and at last, a personality change on Friday afternoon. I’m actually not trying to chase weak point within the identify. If it could actually push again towards the $3.5 space of potential resistance, then I’d search for a brief, trailed in opposition to decrease highs, focusing on a transfer towards $2.5 and $2.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements akin to liquidity, slippage and commissions.

BENF Failed Comply with-Via Quick

The Concept and Plan: I’m holding it easy after Friday’s failure. If the inventory pushes again towards $1.9 and fails, I’ll search for a brief scalp that targets $1.6 – $1.5. I gained’t watch the inventory. I’ll have alerts set, and in the event that they go off, I’ll pay nearer consideration to cost motion to react or disregard it.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements akin to liquidity, slippage and commissions.

Get the SMB Swing Trading Analysis Template Right here!