Merchants,

I look ahead to sharing my prime concepts for the upcoming week, together with my exact entry and exit targets, and explaining the precise setups and eventualities I’m searching for.

This week’s define will differ from final week’s. Final week, my plans have been concentrated and remoted to the A+ imply reversion setup in a basket of Chinese language shares. My plans and concepts are extra unfold out for the upcoming week, and not using a clear A+ alternative but.

So, with out additional ado, let’s soar straight into it!

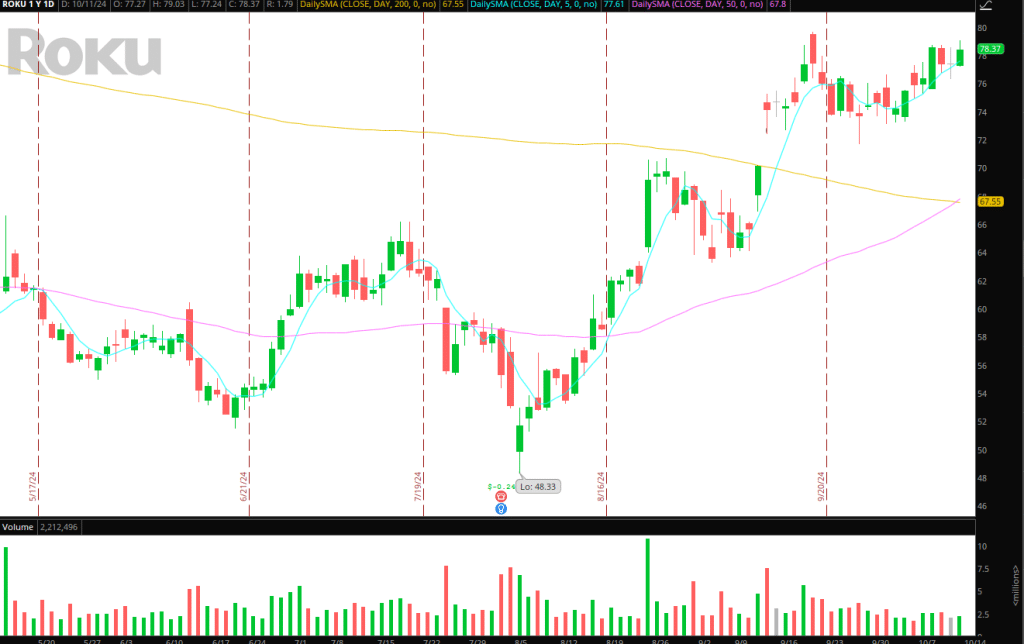

Consolidation Breakout in ROKU

The Plan and Thought: ROKU, set to report earnings on November 6, has spent over a month consolidating in a bullish formation after reclaiming its 200-day SMA. Given the inventory’s ATR and beta, I’ll use smaller sizes and a wider cease. If the inventory breaks and holds above Friday’s excessive, I’ll enter lengthy vs. the LOD. After that, I’d look so as to add to my place above the $79.65 pivot excessive, indicating a better timeframe breakout. From there, I’ll search for an ATR up transfer to start scaling out of the place whereas trailing my cease utilizing greater lows on the 15-minute timeframe.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components similar to liquidity, slippage and commissions.

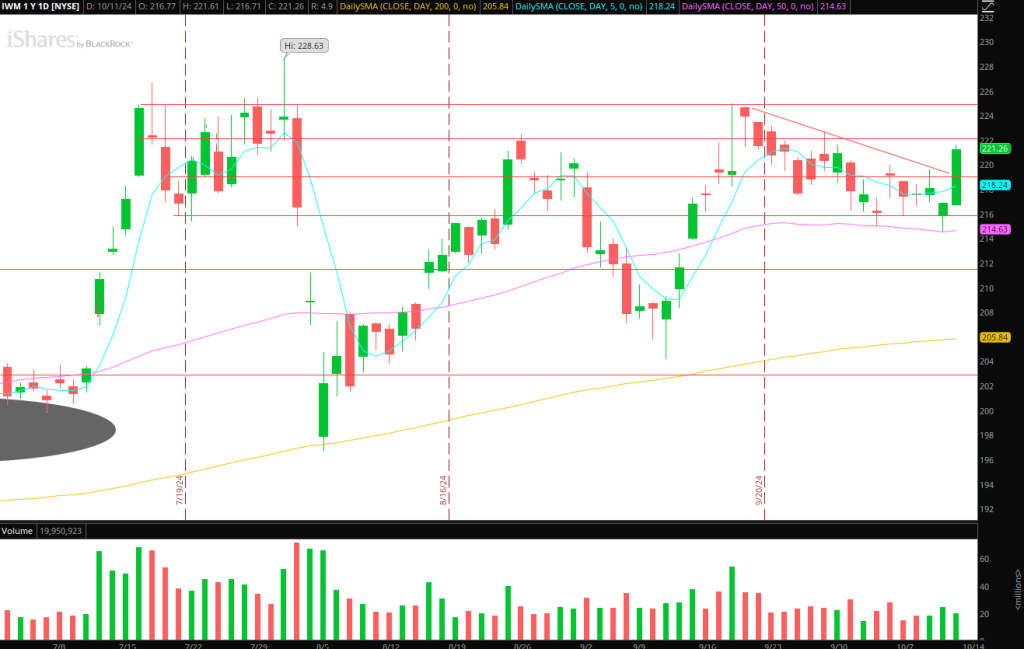

Continuation in Small Caps

The Plan and Thought: As I discussed in my newest Inside Entry assembly, I will likely be hands-off till the IWM reclaims $220. On Friday, it did simply that. Subsequently, I’m now searching for a better low and affirmation of consumers stepping as much as assist Friday’s shift in momentum. If market internals stay favorable and the IWM can verify a better low close to its multi-day VWAP beginning Friday, I’d search for a protracted versus the day’s low. After that, I’d look so as to add above Friday’s excessive, holding for a transfer towards $225 resistance whereas trailing my cease towards the day prior to this’s low. If the transfer builds momentum and holds above $225, I’d search for a longer-term swing commerce whereas trailing versus the day prior to this’s low and sustaining a core place.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components similar to liquidity, slippage and commissions.

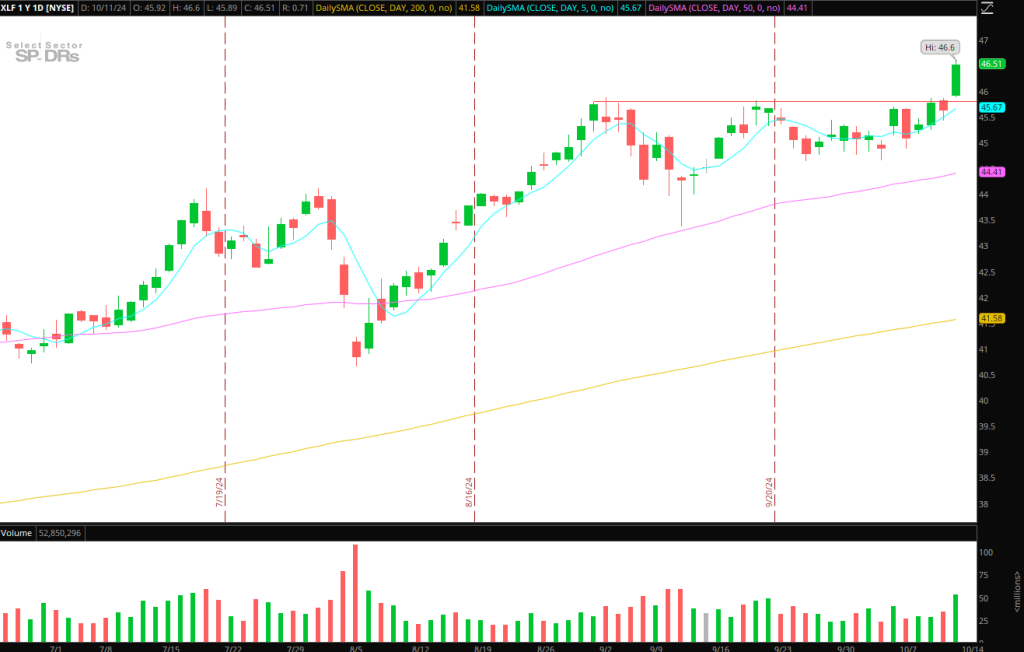

Continuation in Financials

The Plan and Thought: The homework I gave in my newest Inside Entry assembly, forward of the breakout in financials, may have paid off. As I discussed, It’s all the time a good suggestion to have an inventory of probably the most promising names positioned for additional upside / displaying relative energy when a sector is close to a big inflection space. The sector broke out on Friday, buoyed by main names posting stable earnings, specifically JPM. Going ahead, I’ll monitor the XLF for a multi-day continuation alternative, ought to the sector ETF pullback intraday – reclaim vwap (lengthy entry vs. 5-minute greater low) and take out Friday’s excessive.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components similar to liquidity, slippage and commissions.

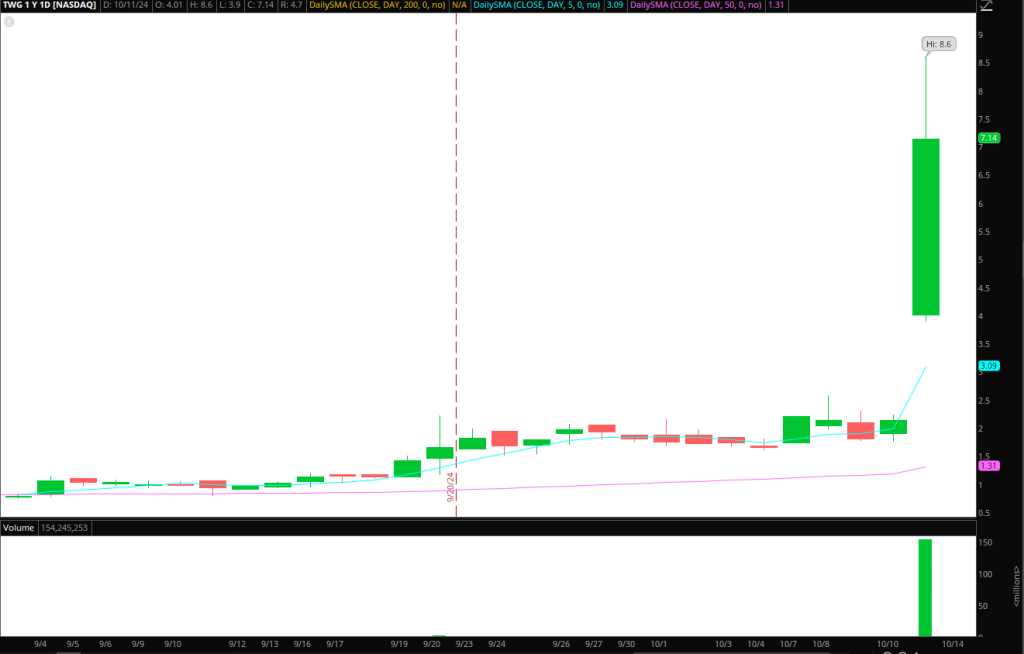

Monitoring TWG for Bottom

The Plan and Thought: On Friday, the corporate introduced a big providing of 27 million shares at $0.4 per share, anticipated to shut on October 14. The inventory closed simply above $7 earlier than fading within the AHs. This isn’t one I’ll look to battle if it holds over VWAP / multi-day VWAP on Monday. As a substitute, I’ll solely give attention to it if 1) it goes parabolic and exhausts cussed shorts, establishing a imply reversion alternative intraday, or 2) it stays heavy sub vwap, providing momentum quick scalps for a possible liquidation setup.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components similar to liquidity, slippage and commissions.

Extra Names on the Watchlist:

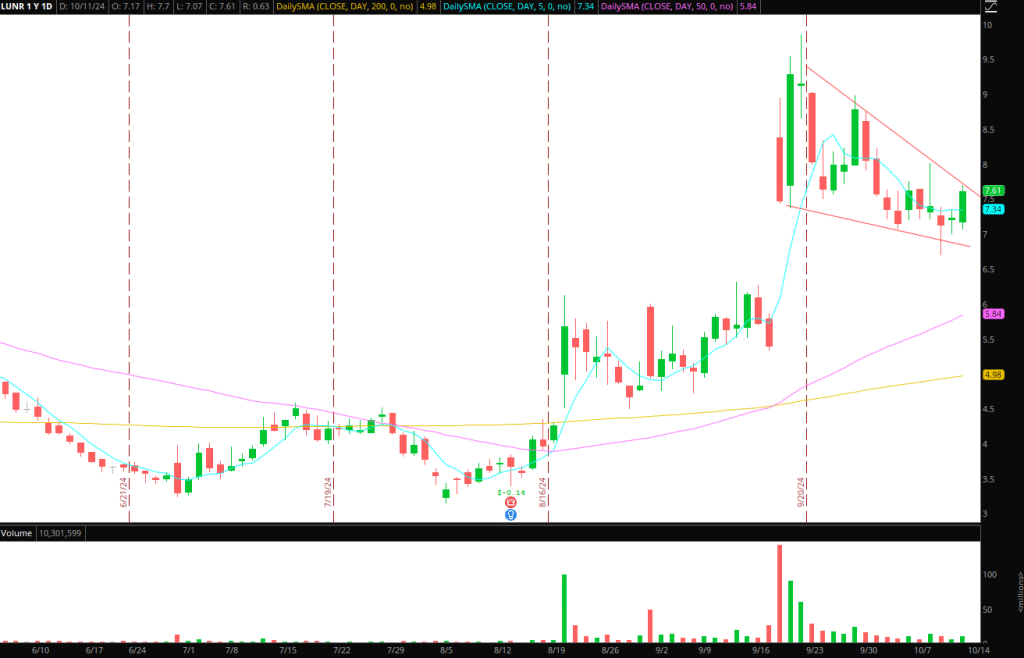

LUNR: Falling wedge sample. Stable shut on Friday above its flattening 5-day SMA. Watching this for a maintain above $8 for a possible lengthy entry.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components similar to liquidity, slippage and commissions.

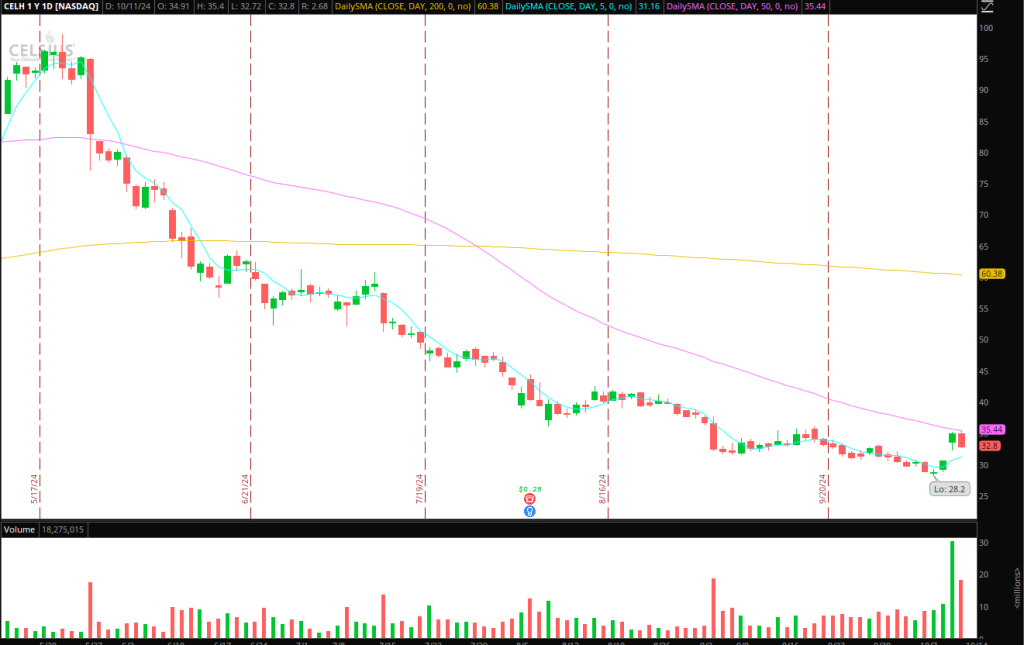

CELH: Stable bounce on Wednesday and Thursday. Monitoring this for sideways motion and a possible second leg greater above final week’s excessive and 50-day SMA for a transfer towards $40.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components similar to liquidity, slippage and commissions.

Get the SMB Swing Trading Analysis Template Right here!