Merchants,

It’s election week, so right here’s my recreation plan and changes for the week forward, together with my prime commerce concepts with entry and exit targets.

Because of the election on Tuesday the fifth, this week’s watchlist shall be completely different. Like final week, I’m focusing much less on swing trades and extra on intraday momentum buying and selling till the election passes.

Whereas final week’s watchlist had robust accuracy, your essential takeaway must be to reverse engineer and examine profitable setups to higher perceive my methods and key variables. That’s the aim every week—that can assist you refine your buying and selling abilities.

Listed below are my prime focuses and concepts for the week, together with election eventualities and particular person performs.

Promote the Information in DJT

The Plan and Concept: This was the highest alternative of final week, as outlined and mentioned within the earlier watchlist and in nice element in Inside Entry. As I discussed, that is merely a proxy for the election, whereas nothing basically has modified for the corporate.

Consequently, one of the best alternative and situation for me is that if the inventory gaps into main provide between $45 – $55 on a Trump win. Or maybe will get chased even increased within the early hours of November 6. In both situation, I’d search for a fast, short-lived hole and push increased, adopted by important promoting and notable heavy value motion. I’d have to see early affirmation of a sell-the-news occasion.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market components similar to liquidity, slippage and commissions.

In the end, I’d place brief versus the HOD as soon as momentum shifts and I obtain value motion affirmation, concentrating on a LOD shut and doubtlessly sustaining a core place as a swing, so long as the inventory doesn’t reclaim its VWAP after making new decrease lows on the day. If Kamala wins, DJT will considerably hole down, so there might not be a commerce for me, as I’d not chase it. The inventory would want to bounce considerably for a brief entry. Nonetheless, I’d keep away from it on this election final result as the danger reward shall be diminished.

Ideas on Bitcoin (IBIT)

Important failed breakout proper now in Bitcoin, as threat comes off and Trump’s odds have weakened. On a Trump victory, IBIT and related bitcoin-related inventory may be a magnet for a possible swing lengthy ought to value motion agency up on the information. Ideally, in that situation, I need to see a niche increased briefly pull again to earlier resistance and ensure it as newfound help. That will get me to place lengthy for a swing.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market components similar to liquidity, slippage and commissions.

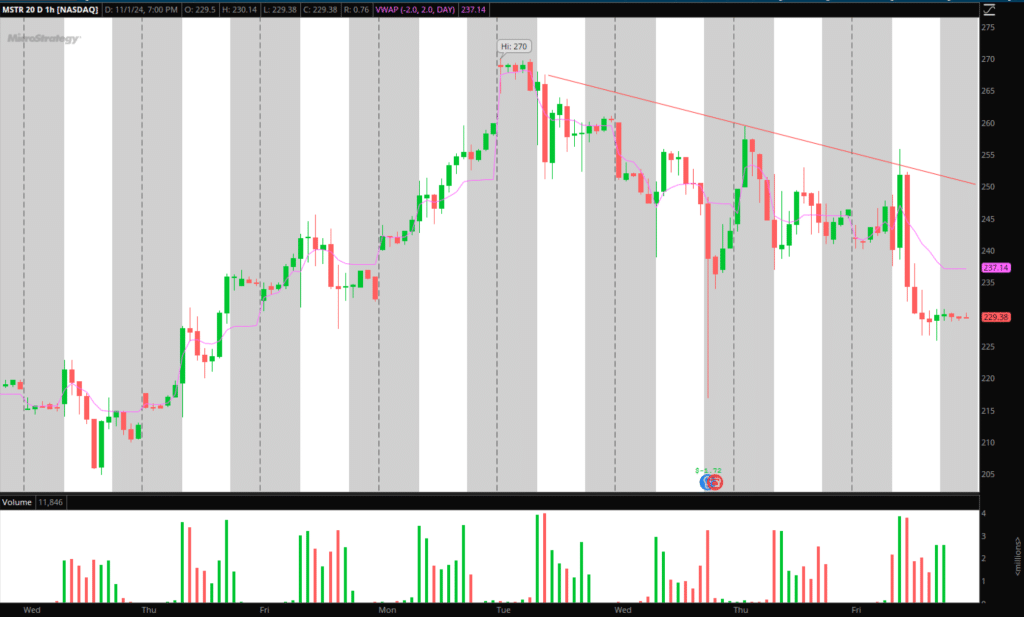

Nonetheless, given the latest value motion, I view momentum brief trades as higher threat: reward. For instance, If MSTR continues to seek out provide and reject close to $250, I’d be centered on brief positions versus the HOD, concentrating on new lows and solely shifting my bias if the inventory made a better excessive on the hourly timeframe. No pre-set plan or bias given the election. I’ll monitor flows and value motion and stay versatile.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market components similar to liquidity, slippage and commissions.

Extra Names on Watch:

Amazon: Dependant on the general market’s course this week. I’m solely within the inventory for reactive trades across the all-important $200 space of resistance. I’ll enter lengthy if the inventory can base above $200, show relative energy, and better lows intraday. If we push again into this and the gives stack and refresh, I’ll scalp it to the brief facet once more.

Carvana: Good profit-taking day on Friday. I’ll have alerts for a transfer towards its 2-day VWAP and $240 space. If the inventory fails to comply with by, I would think about a brief versus the HOD for additional profit-taking.

VKTX: Consolidating above its earlier resistance coming into Weight problems Week, the place the corporate will current. Have to see the response to that and whether or not the inventory begins to base close to the $78 – $80 resistance for potential momentum increased.

SMCI: On shut look ahead to potential breaking information alternatives off recent headlines.

Get the SMB Swing Trading Analysis Template Right here!