Merchants,

One other eventful week! As all the time, I sit up for sharing my high concepts for the upcoming week with you all, together with entry and exit targets.

As I discussed in my earlier watchlists and studied and reviewed intimately in my Inside Entry conferences, it continues to be an opportunistic tape for momentum, move-to-move buying and selling.

As mentioned in my most up-to-date IA assembly, as soon as we see the market form up in a particular style, that focus would possibly shift again to swing buying and selling.

So, let’s get proper into this week’s high focuses.

(NASDAQ: TCTM) Alright, beginning off this week with a small cap. TCTM was Friday’s small-cap taste of the day. The inventory punished cussed shorts early on, and supplied unbelievable momentum longs above vwap, till the vary and vol expanded, blowing out shorts and providing an A+ intraday parabolic quick and reversion again to VWAP – what I used to be searching for.

Given the float, SSR, and the unbelievable quantity traded on Friday, I don’t assume it’s performed. I’m not saying it will probably make new highs. Nonetheless, I feel on the very least, contemplating T+1 and potential failure to ship, it may see a pushback towards $1 early subsequent week.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market components reminiscent of liquidity, slippage and commissions.

With that chance in thoughts, I’ve two commerce potentials. First, I’m trying to quick the inventory if it swipes early on Monday towards .9 – $1+ and stuffs / fails to comply with by. I’d quick versus the HOD and be affected person with a cease trailed focusing on a canopy towards the shut.

Alternatively, suppose the inventory has a push early on Monday and consolidates above 0.9, churns, and traps shorts. In that case, I’d search for a consolidation breakout lengthy, focusing on a transfer nearer to Friday’s excessive. This is able to simply be an intraday momentum lengthy.

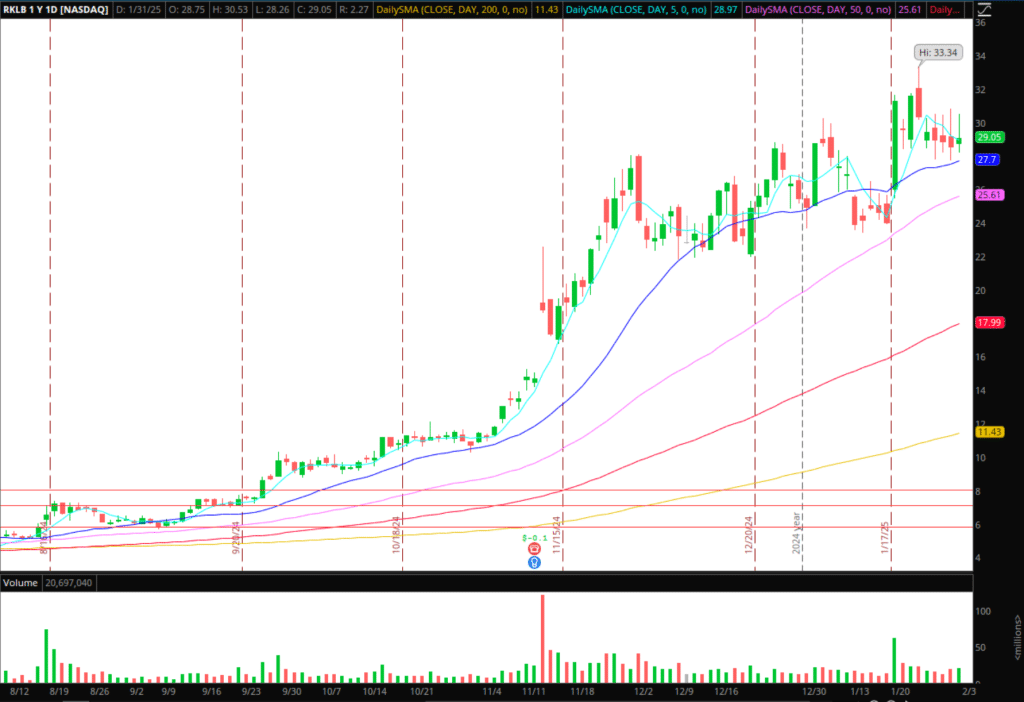

(NASDAQ: RKLB) The most effective swing longs from final yr, having mentioned the breakout alternative at $8 with Inside Entry. Unimaginable follow-through and development for the corporate. Nonetheless, with the inventory having nearly an inside week and holding above its 20-day and 5-day, I’m targeted on short-term momentum. I’m inclined for a breakout lengthy intraday, given the place the inventory is. Nonetheless, if RKLB takes out final week’s low and breaks its 20-day, I’ll be searching for intraday momentum shorts, probably focusing on its rising 50-day. If the inventory takes out its excessive from final week, i’d look to get lengthy and goal a transfer towards overhead resistance close to $32.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market components reminiscent of liquidity, slippage and commissions.

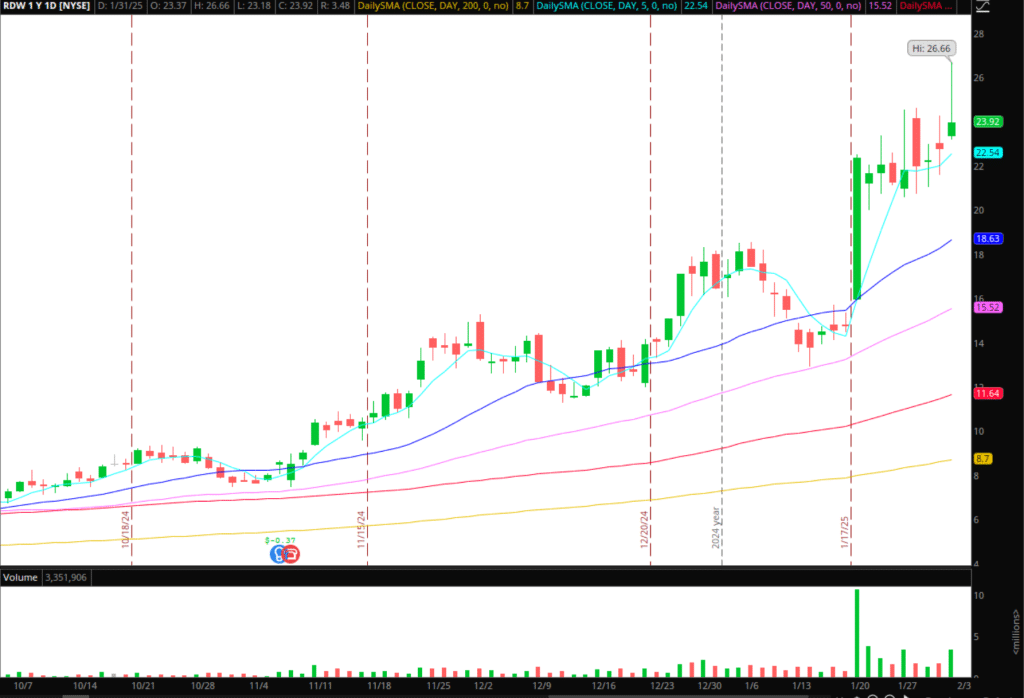

(NASDAQ: RDW) One other area title. Given it’s shut on Friday, I’m inclined to organize for a possible failed follow-through setup. If we see some air come out of area names, for instance, if RKLB fails under key ranges, I’ll look to get quick RDW on a decrease excessive, given Friday’s failed transfer greater, for a possible fast transfer decrease. Very best entry could be a stuff towards it’s 2-day or multi-day VWAP from Friday, for a transfer again towards help close to $22. Once more, only a momentum IF/THEN situation.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market components reminiscent of liquidity, slippage and commissions.

Some Extra Backburner Concepts and Alerts

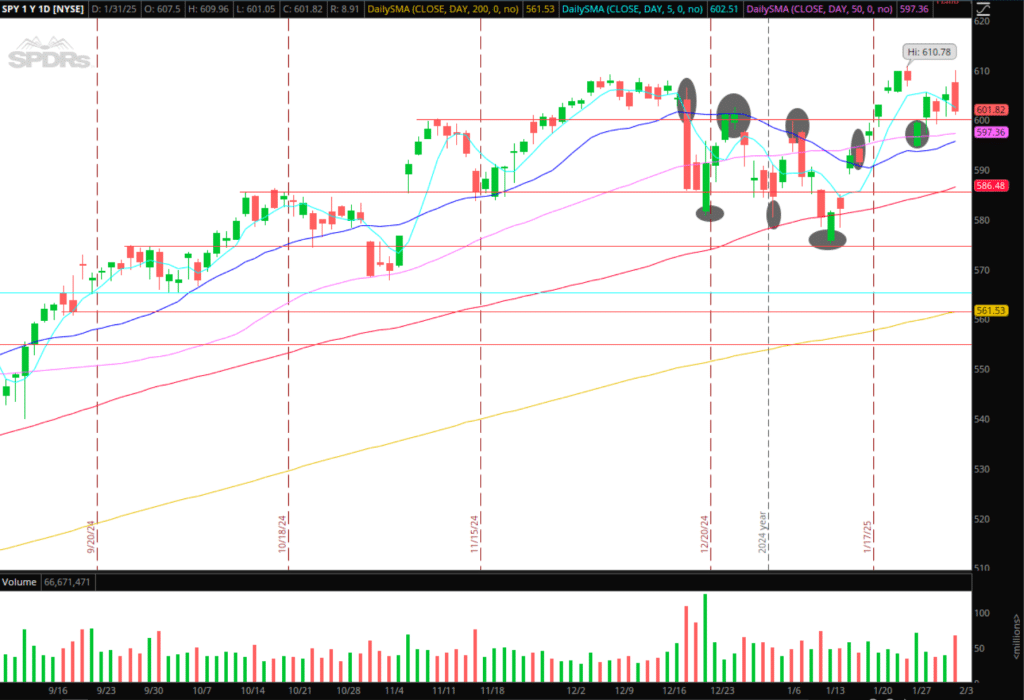

SPY: Weak shut on Friday within the AHs. I don’t need to see us fail to carry the 50-day; if that had been to occur, final week’s low would come into query. Ideally, we get a better low vs. final week’s low and reclaim $600. Related positioning in QQQs. Momentum may simply spill out if we fail to carry the 50- and 20-day.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market components reminiscent of liquidity, slippage and commissions.

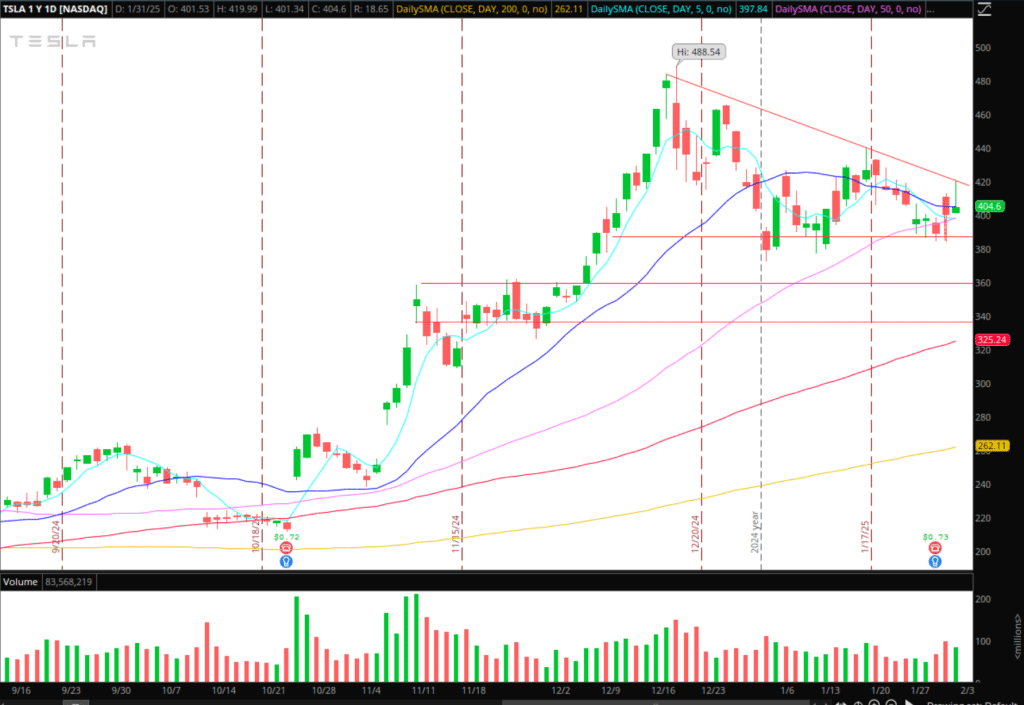

TSLA: Massive ranges are forming on the every day now, with converging 5, 20, and 50-day SMAs in the course of the vary. Subsequent week must be telling for a reactive and directional transfer both above or under key resistance or help. Monitoring relative energy/weak point, for a possible directional momentum commerce above or under final week’s excessive/low.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market components reminiscent of liquidity, slippage and commissions.

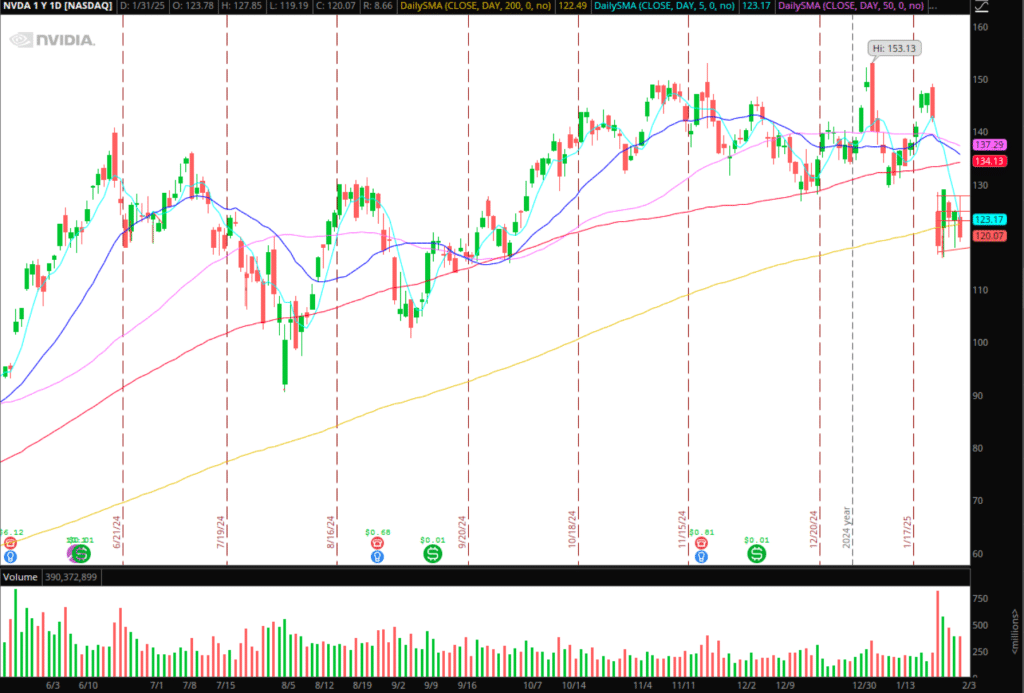

NVDA: It has a big vary and main ranges from final week, much like Tesla. Early within the week, I’ll determine relative energy/weak point relative to its sector and market positioning for reactive trades into help. I’m open to going lengthy if help holds close to $118 and open to going quick if we maintain under key help and lead in relative weak point.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market components reminiscent of liquidity, slippage and commissions.

Get the SMB Swing Trading Analysis Template Right here!