Merchants,

I stay up for sharing my prime concepts for the upcoming week, together with my entry and exit targets, and explaining the setups and situations I’m on the lookout for.

With the election simply over per week away, my focus will shift to predominantly intraday move2move buying and selling. Whereas the market’s positioning is about up favorably for swing trades, with an election on the horizon, I count on some chop and lack of follow-through with massive caps main as much as it.

So, let’s leap straight to this week’s watchlist with out additional ado!

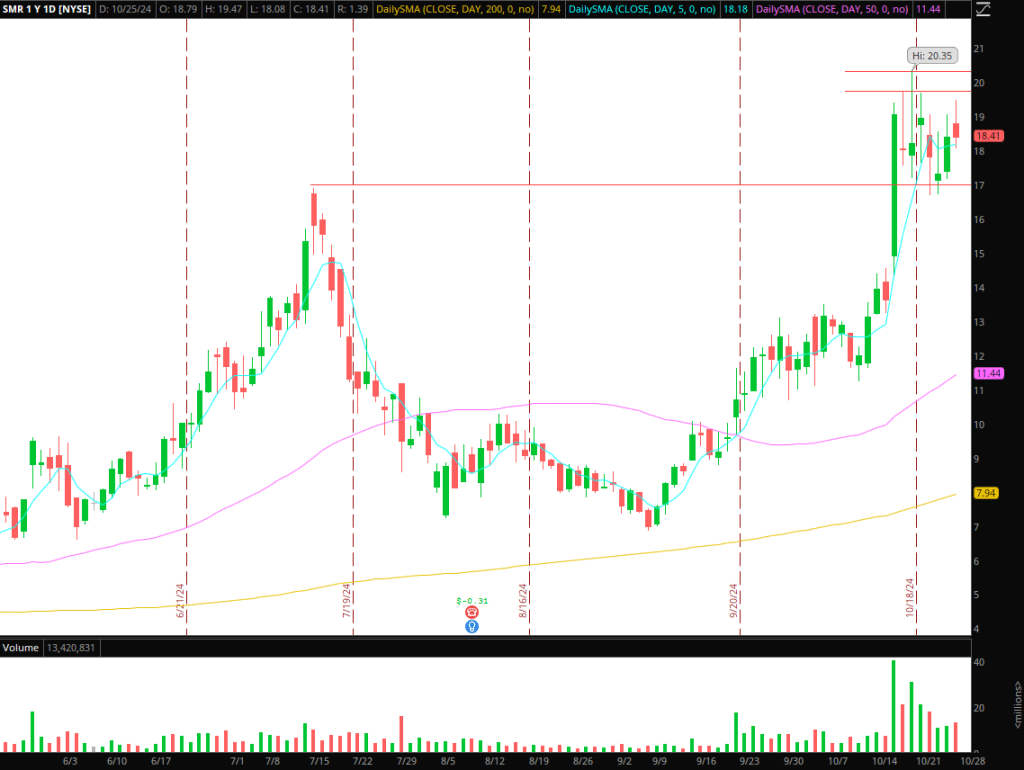

Consolidation Breakout in SMR

The Thought: OKLO, VST, and others are a part of the nuclear power theme. From a technical perspective, SMR is my favourite chart out of the numerous names. The identify has elevated quick curiosity, a fairly small float, and is consolidating above earlier resistance in a bullish formation.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements resembling liquidity, slippage and commissions.

The Plan: As of proper now, that is my solely swing focus for the upcoming week forward of the election. Help close to the low $17s and resistance close to $19 and $20 shine by means of throughout a number of timeframes. I’ll give attention to dip buys so long as the inventory doesn’t start to base beneath the 5-day SMA inside this consolidation. If it begins to agency up above $19 on RVOL, I’ll look so as to add, concentrating on a 1 ATR transfer towards $20+ to take a chunk off and start trailing my place on larger lows on the 5-minute. Finally concentrating on a multi-ATR transfer above $20 if the inventory breaks out and path versus the earlier larger low. Ideally, the vary will likely be additional contracted earlier than breaking out.

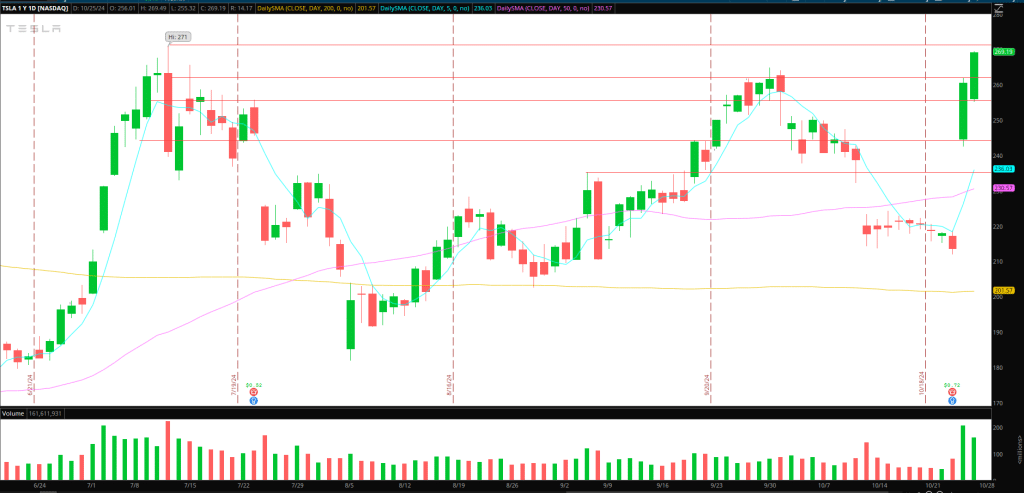

Day 3 Hole Commerce in TSLA

The Thought: Brief-term commerce, ideally units up on Monday. It’s not a swing commerce. I’m bullish on the identify in the long run, however within the quick time period, the inventory is organising effectively for a day 3 hole or failed follow-through quick scalp. Tesla had its earnings hole and follow-through on day 1 and intense day 2 follow-through, and now I must see both a spot on Monday above Friday’s shut or a powerful opening drive larger within the morning for additional affirmation that the setup is forming.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements resembling liquidity, slippage and commissions.

The Plan: If the inventory stuffs or engulfs its opening-drive, or offers again its hole, I’ll look to go quick on a decrease excessive versus the HOD, concentrating on some profit-taking. The plan could be to seize as much as 50% of an ATR, whereas trailing decrease highs on a 5-minute timeframe, or exiting the place manually if the downtrend breaks and the inventory begins to reclaim and base above its intraday VWAP.

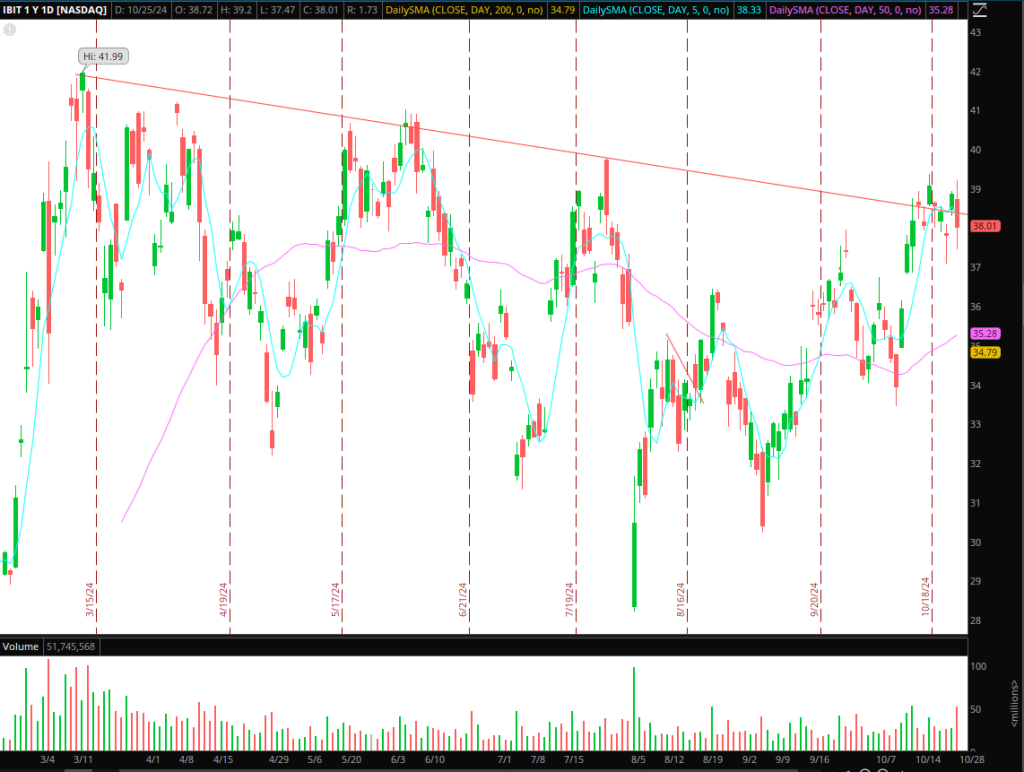

Bitcoin Continues to Type: Consolidation Breakout

The Thought: I’ve spoken about IBIT / Bitcoin at size in current weeks. Now, it’s starting to consolidate and shake out weak palms. For me, that is the perfect situation, doubtlessly organising a consolidation breakout nearer to the election. I don’t plan on taking motion within the coming days. As a substitute, I’ll proceed to watch IBIT / BTC and hope for additional vary and quantity contraction because the election nears. Ideally, the vary tightens, organising a consolidation breakout alternative above $39 for a multi-day breakout and check of highs. This can be a bigger-picture concept that I’ll proceed to watch within the days and weeks forward. What I don’t wish to do is purchase on this consolidation or chase intraday energy and get chopped up. As a substitute, I’m patiently ready for the celebs to higher align for a consolidation breakout with affirmation.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements resembling liquidity, slippage and commissions.

Extra Names on Watch:

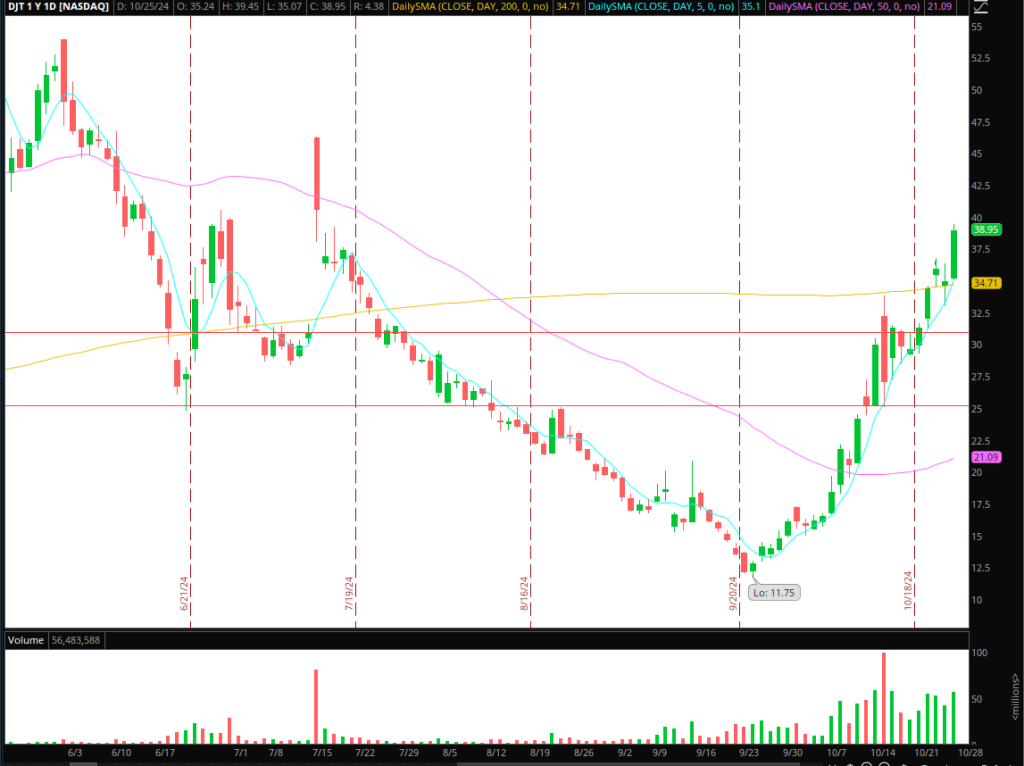

Reversion in DJT: After all, that is now a proxy and buying and selling car, doubtlessly organising for a big sell-the-news alternative on November 5 / post-election. Nonetheless, earlier than then, if the inventory extends on a big hole or intraday blow-off, I’ll be centered on an intraday imply reversion quick or FRD setup. I can’t be swing-focused till the election, nevertheless.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements resembling liquidity, slippage and commissions.

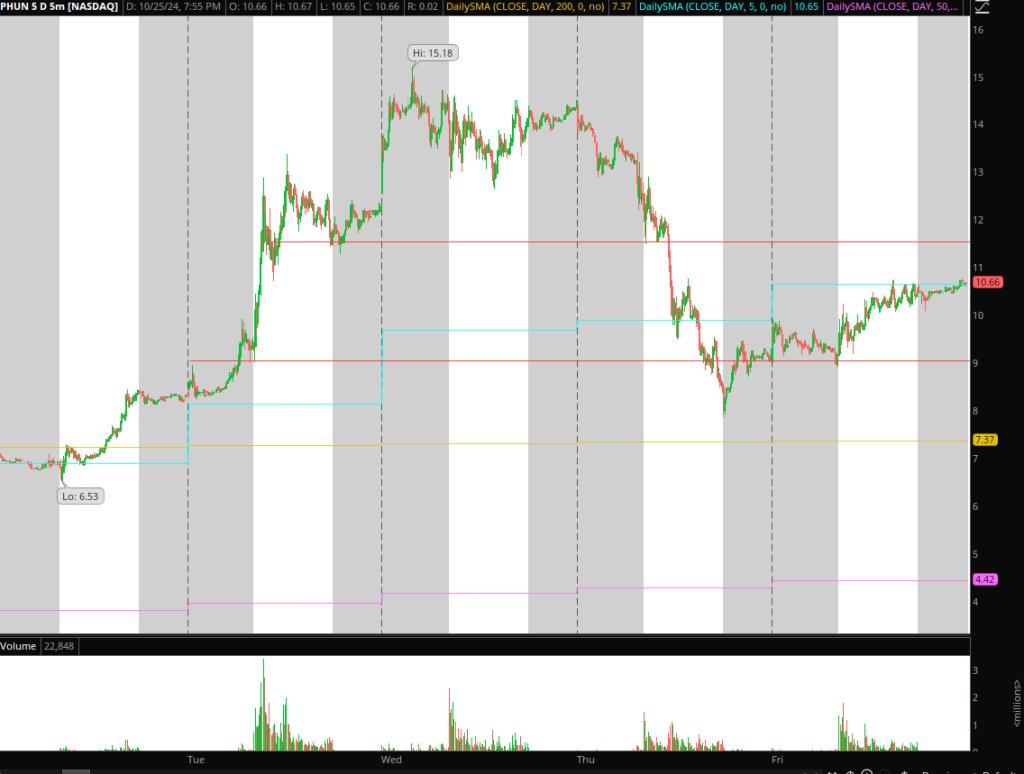

Decrease-Excessive Brief in PHUN: Sympathy mover to DJT and arguably one of many prime opps final week with the FRD setup on Thursday. Ideally, this pushes over $11 – $11.50 and comes into a possible provide and failure zone, failing to comply with by means of, providing a chance to get quick versus the HOD. If that transpires, and the shares fails and holds weak, I’ll look to be quick versus the HOD, concentrating on a transfer towards $9 with a 5-minute decrease excessive path.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements resembling liquidity, slippage and commissions.

Get the SMB Swing Trading Analysis Template Right here!