Merchants,

On this weekly watchlist, I’ll define my high concepts for the week and supply my entry and exit plans.

Beginning with the highest thought from final week, Tesla.

Increased Low and Continuation in TSLA

Tesla’s FRD setup for a reversion was good final week from the watchlist, and it supplied quite a few alternatives and setups to seize momentum decrease. After three consecutive days of promoting and making a measured pullback, the pullback appeared exhausted Friday because the inventory displayed relative power to the general market. The transfer on Friday relative to the general market indicated a possible backside and better low.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components comparable to liquidity, slippage and commissions.

My Concept and Plan: With Friday’s low close to $309 as the road within the sand, I shall be eyeing a pullback, greater low, dips to get lengthy. Ideally, I’d wish to see the inventory supply one dip and reclaim toget lengthy in opposition to Friday’s low and look to measurement up additional on a HOD break or regular VWAP consolidation breakout. My first goal space is the $328 – $330 area, with my second goal space $336, a big space of earlier help which may act as resistance now.

Liquidity Disaster in MVST

Incredible dealer on Wednesday final week, providing immense vary and liquidity. Now, having had a number of inside days and quantity dropping off considerably from over a billion traded on day one to only 32 million on day three with the inventory nonetheless hanging out above its multi-day VWAP and significant $0.65 space, a liquidity lure and push greater just like FOXO might comply with.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components comparable to liquidity, slippage and commissions.

My Plan: If the inventory creeps towards resistance within the premarket on mild quantity, providing no straightforward exits for short-swings, I’ll look to get lengthy a starter and measurement full above $1 with a momentum cease. Alternatively, if the inventory begins to consolidate above $0.90 on elevated RVOL, I’ll enter lengthy versus LOD, and upon a $1 breakout, I’ll add to the place and transfer my cease to the low of the 5-minute breakout candle for momentum. This could not be a swing commerce.

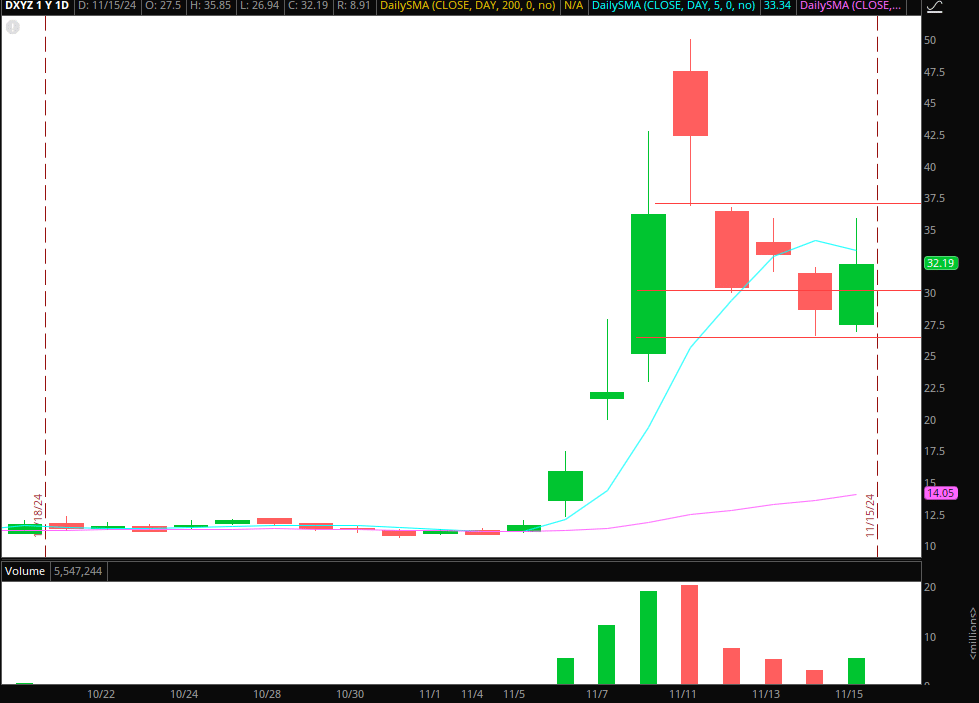

Bottom in DXYZ

My Concept and Plan: Following the election euphoria, an extension to the upside and uptrend break, and a transparent bottom, I’m now searching for a push into prior provide and resistance zones for a failed-follow-through, lower-high brief alternative. The very best case for me can be a fast push towards earlier help turned resistance close to the $36 – $37 space and fail. In that state of affairs, I might be brief versus the HOD. I plan to cowl as much as a 3rd of my place between $32 and $30, areas from the earlier 4 days which may act as short-term help. After that, I’ll path my place decrease highs on the 15-minute, concentrating on a transfer again to the mid-20s for a closing cowl.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components comparable to liquidity, slippage and commissions.

Extra Names on Watch with Alerts:

Watching PLTR Intently for Exhaust and Reversion: Unimaginable transfer greater in PLTR lately. I nonetheless haven’t seen a transparent blow-off, exhaust, failed-follow-through, or FRD setup and rel. weak spot. It’s nonetheless chugging alongside greater, so I’m hands-off and never preventing this frontside. As an alternative, holding it on the side-watch for both of the setups talked about above to materialize, after which I’ll react.

Relative Energy in XLF / Financials: Spectacular endurance close to the 52-week highs in financials currently, specifically the XLF etf and a number of other of its high holdings with the equivalent chart. If the rel. Energy continues and breaks out above final week’s excessive, I would provoke a breakout lengthy with a momentum cease and switch it right into a swing if we shut within the higher quartile on the day.

Alerts in UAVS and MTEM: Comparable plan in each of those small caps. I’ll set alerts in case they push again towards key resistance/breakdown areas from prior days. If both attempt to fails to comply with by way of, I’ll search for a reactive brief intraday for a possible roundtrip.

Get the SMB Swing Trading Analysis Template Right here!