Merchants,

As at all times, I’m trying ahead to sharing my high swing concepts with you for the upcoming week, together with my precise entry and exit targets for setups that may have important follow-through.

My concepts have been remoted to particular person names and outlier situations for a number of weeks somewhat than the general market. That’s as a result of the general market lacks a development and route proper now. I’ve mentioned this in additional element in my weekly assembly within the SMB Inside Entry.

Sticking with that theme and doubling down on endurance, permitting the market to indicate its hand higher earlier than I get extra aggressive with swing concepts, listed here are my high concepts for the upcoming week.

Continuation in Alphabet

Incredible earnings, together with the buyback and dividend bulletins. Following the earnings hole, it had a number of days of profit-taking, proper again into the upward-moving 5-day MA. After failing to interrupt down on Friday and shutting close to the highs, I’m on the lookout for the next low and a multi-day transfer again to the highs.

Right here’s my precise plan:

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the affect, if any, of sure market elements equivalent to liquidity, slippage and commissions.

Clear assist at Friday’s low, following the multi-day selloff, at $164. Resistance stands agency at Friday’s excessive, close to $168. Ideally, I need GOOGL to push above and maintain above Friday’s excessive. That might be my sign to enter lengthy, with a cease on the day’s low as soon as it has been confirmed.

I’m seeking to take off half of the place towards $172, a possible resistance zone, and 1 ATR from the $168 entry zone. At that time, I’ll path my cease on the 15-minute timeframe, utilizing increased lows, and look to scale out of the place slowly if it makes appreciable intraday increased highs.

Decrease Excessive / Blowoff in GME

GME skilled a implausible squeeze on Friday, ending the week up near 40%. This was an incredible transfer, and from an intraday standpoint, there have been some wonderful momentum-long alternatives on Friday.

Nonetheless, with it so stretched from the multi-day VWAP on no basically altering information, I’m on the lookout for both a blowoff or a decrease excessive versus Friday’s excessive to enter brief.

Right here’s my plan:

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the affect, if any, of sure market elements equivalent to liquidity, slippage and commissions.

There are two potential entry setups. Firstly, If the inventory pushes towards Friday’s excessive and fails, engulfing the morning push increased, I’ll enter brief versus the excessive of the day. My first goal, the place I’ll look to cowl as much as half of the place, could be a transfer to the 2-day VWAP, which might be close to $15. After that, I’ll look to path the cease utilizing decrease highs on the 5-minute timeframe or reclaim the intraday VWAP. In the end, scaling out of the place on extensions from VWAP intraday for a place of as much as two days.

Alternatively, if GME holds VWAP and pushes above Friday’s excessive, I might be hands-off and look forward to a transparent high and bottom affirmation. As soon as that’s confirmed and the uptrend has damaged, I’ll give attention to shorting a decrease excessive with the identical exit targets as specified by the above situation.

Further Concepts to Monitor:

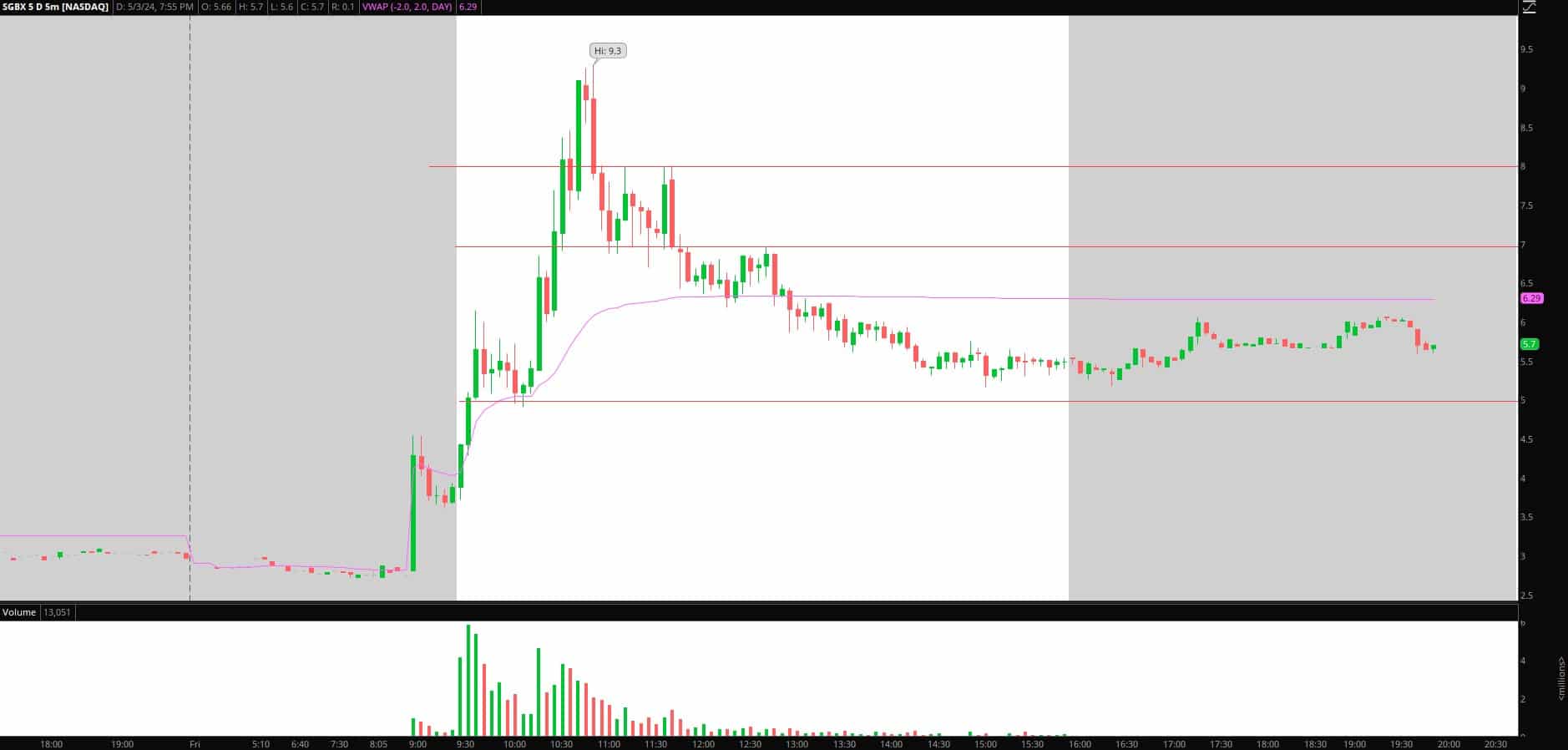

SGBX: Small float, so I’m not if this goes sideways and quantity dies down, probably establishing a liquidity lure. Somewhat, I might be centered on it if the primary transfer is to the upside, into potential provide zones of $7 – $8, for failure and a brief versus the excessive of the day for a transfer again to $5.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the affect, if any, of sure market elements equivalent to liquidity, slippage and commissions.

BABA: Lovely continuation to the upside in China names final week. I definitely gained’t chase up right here. On the lookout for 2 – 3 day pullback or sideways motion after which concentrating on the next low or breakout for continuation to the upside.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the affect, if any, of sure market elements equivalent to liquidity, slippage and commissions.

JAGX: The lengthy performed out properly from final week. Ideally, this has some continuation to the upside, $.40 – $.60, and blowoff motion, establishing a wonderful short-swing alternative for the eventual elevate and transfer again to actuality.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the affect, if any, of sure market elements equivalent to liquidity, slippage and commissions.