Merchants,

It’s been an eventful weekend, to say the least, with the $TRUMP and now $MELANIA meme cash grabbing all of the headlines and a spotlight because the inauguration approaches. No matter whether or not that is good or unhealthy, I believe it offers an perception into what the subsequent 4 years may appear like. For us merchants, it doubtless spells elevated volatility and, with it, alternative.

For this week, my focus will stay totally on move2move buying and selling, as mentioned intimately in InsideAccess lately. With that, my consideration will movement to day 1 in-play names. However coming into the week, listed here are my prime concepts with pre-determined plans and eventualities.

(NASDAQ: DJT) Whereas it seems unlikely, given what has transpired over the weekend up to now with the meme cash and the insane market valuation of the trump coin, it’s value being ready for a possible outlier situation. So what’s that situation? I hope the elevated FOMO and general consideration ends in a ramp greater in DJT on Tuesday towards important resistance and provide between $45 – $50 from pre and post-election. If that occurs on a gap-up or morning chase, I’d be on excessive alert for provide to hit the tape and for an intraday fade versus the HOD. If a downtrend holds agency and the inventory closes close to the day’s low, I’d take a bit as a swing. I’m treating this and categorizing it as a possible sell-the-news alternative. Importantly, to behave, I’d must see the immense provide that now exists from October and November overwhelm any shopping for inside that focused zone. On the off likelihood that this gaps up and holds above VWAP, I’d not brief it.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market components akin to liquidity, slippage and commissions.

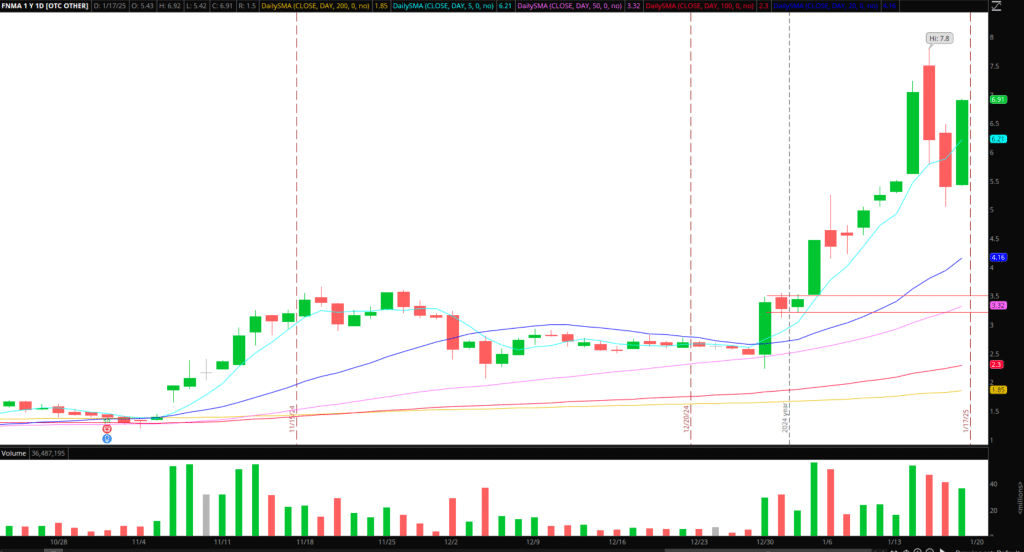

(OTC: FNMA): I missed the bounce entry on Friday, which I used to be trying to place each for an intraday and long-term play. I actually is not going to be trying to chase highs this week. As a substitute, as this story develops and the newfound uptrend positive aspects momentum and growth, I’ll have alerts for greater lows inside this forming consolidation. If the inventory may give me an entry inside this forming vary, close to $6, I’d look to get lengthy versus $5, so long as the narrative stays intact. Ideally, a lengthier consolidation now kinds, permitting the worth to digest and a place to be constructed on dips versus $5.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market components akin to liquidity, slippage and commissions.

(NYSE: RDDT) Straight ahead technical setup right here. Because the inventory continues to consolidate, with a contracting vary and now converging short-term SMAs, so too does its quantity, doubtlessly resulting in a breakout over $180. So, if the inventory can push over $180 together with elevated RVOL / a burst of quantity, I’d look to enter lengthy versus the LOD. RDDT’s a higher-ATR identify, so maintaining dimension and threat in test will probably be necessary so I don’t get shaken out. I’m concentrating on excessive $180s to take half off and path the remaining versus the day’s low, just like the SMTC breakout concept from final week.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market components akin to liquidity, slippage and commissions.

Crypto-Associated Shares

(NASDAQ: HOOD) As I’m penning this, Bitcoin is making new all-time highs, and we’re experiencing meme-coin craziness. So, it’s value maintaining an in depth eye on all crypto-related shares tomorrow. HOOD has proven spectacular power and has been a frontrunner YTD up to now. I like this on dips nearer to earlier resistance $44 – $45. Nevertheless, if this hole is over $50+ and fails to observe via or exhausts, it is going to be on watch for brief intraday alternatives.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market components akin to liquidity, slippage and commissions.

(NASDAQ: MSTR) Once more, with the extent of hypothesis and fomo being off the charts proper now, and Bitcoin at highs, I’d think about we may see a significant hole up in MSTR. I gained’t chase that lengthy. As a substitute, I’d look left at a number of failure zones and overhead between $425 – $445 for a possible intraday brief. The important thing phrase right here is intraday. I’m not trying to place brief for a major transfer. It’s strictly move2move buying and selling.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market components akin to liquidity, slippage and commissions.

Different names on watch aside of crypto/bitcoin theme: BTCT, COIN, RIOT.

There must be no scarcity of gappers and in-play names tomorrow and this week, from small to giant caps, so it is going to be important to slim down the main focus and double down on inventory choice.

Whereas rather a lot will probably be transferring, please keep in mind: simply because one thing is transferring doesn’t essentially imply there’s an edge there. A very powerful are inventory choice, threat administration, and sticking to your course of. And if volatility will increase, that routinely sizes you up, so double down on threat administration.

And lastly, as I spoke about at size in my newest IA assembly, I’ll be paying shut consideration to key resistance and inflection ranges in SPY and QQQs, together with notable setups in market-leading names like GOOGL, AMZN, and META.

Get the SMB Swing Trading Analysis Template Right here!