- Bitcoin’s Accumulation Development Rating was at 0.021.

- This confirmed that giant entities had been distributing their holdings or not accumulating extra cash.

Bitcoin’s [BTC] Accumulation Development Rating was trending in direction of zero at press time, signaling a rise in coin distribution by bigger entities, based on Glassnode’s knowledge.

This metric measures the exercise of various BTC pockets cohorts. It particularly tracks whether or not they’re shopping for or promoting the coin.

When its worth is nearer to at least one, it signifies that bigger entities or a good portion of the community are accumulating BTC.

Conversely, a rating nearer to zero means that these entities are distributing or not accumulating. As of this writing, BTC’s Accumulation Development Rating was 0.021.

The transfer in direction of this worth could also be because of the coin’s slender value actions up to now few weeks. It has continued to face important resistance on the $63,000 value stage.

At press time, the main cryptocurrency exchanged fingers at $62,003, based on CoinMarketCap’s knowledge.

BTC’s on-chain exercise within the final month

An on-chain evaluation of BTC’s whale exercise confirmed the decline in accumulation by its giant pockets teams.

Based on Glassnode, the variety of distinctive addresses holding a minimum of 1k cash has decreased within the final 30 days. At 2113 at press time, it has dropped by 0.1% throughout that interval.

This fall in whale accumulation on the BTC community mirrors the final decline in exercise on the community.

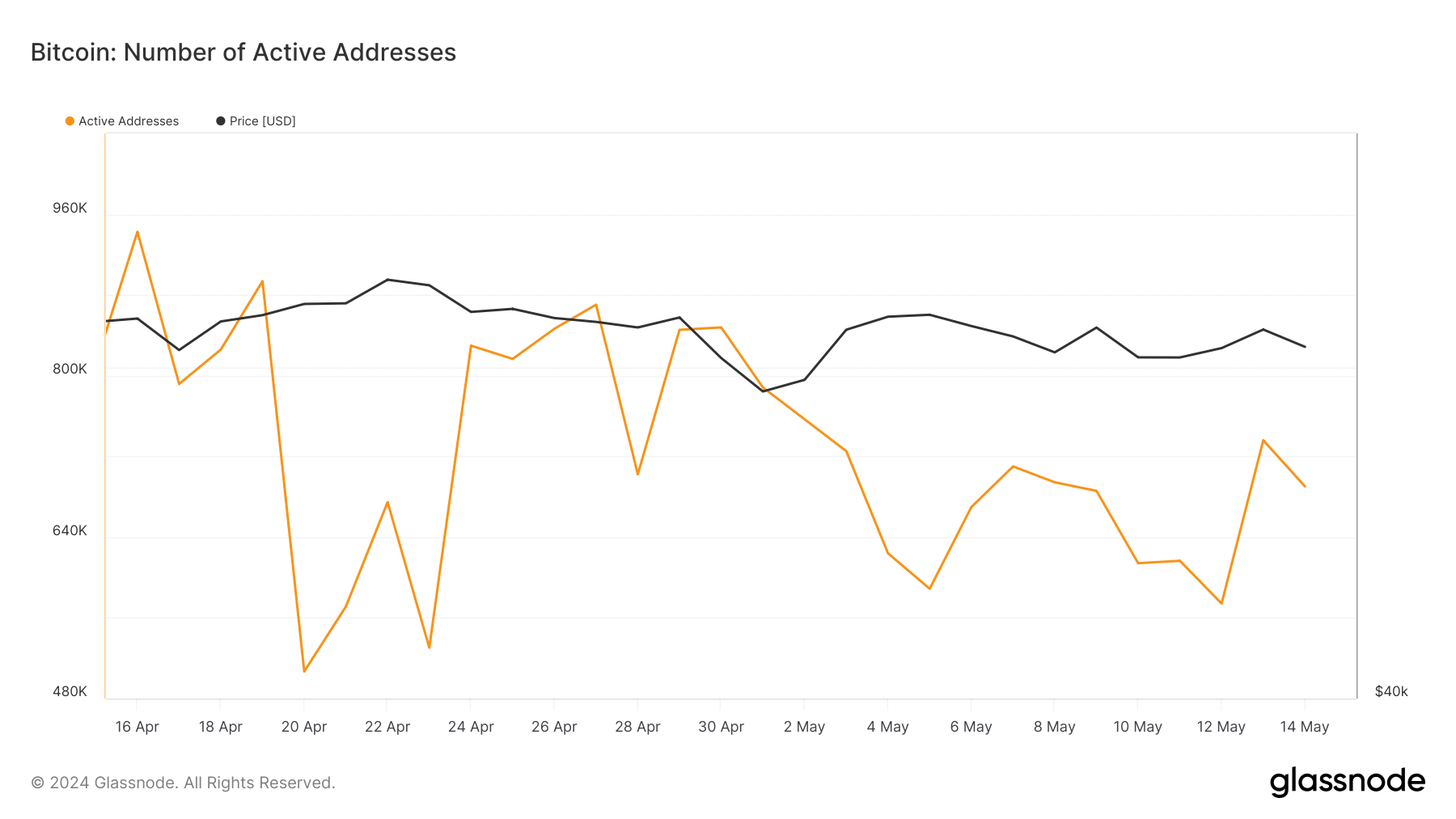

Glassnode’s knowledge reveals a 27% lower within the variety of distinctive addresses energetic within the community as senders or receivers within the final month.

Throughout the identical interval, there was a notable fall in new demand for BTC.

Based on the on-chain knowledge supplier, the variety of distinctive addresses that appeared for the primary time in a BTC transaction has decreased by 35% over the 30-day interval in overview.

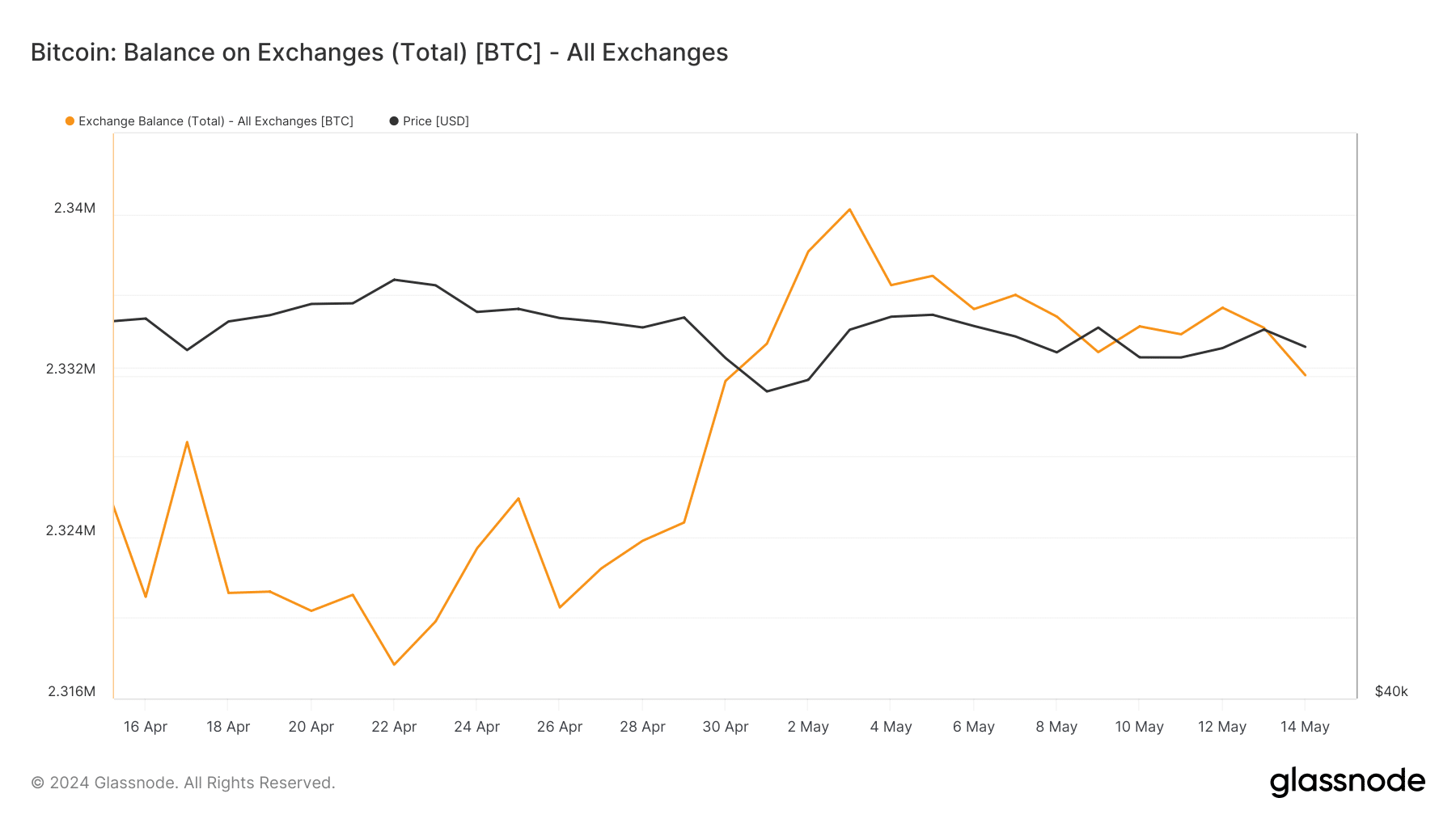

Whereas the day by day depend of energetic and new addresses buying and selling BTC has dropped, the variety of cash despatched to cryptocurrency exchanges has surged.

At press time, 2.33 million BTC had been held on change addresses, rising by 1% within the final month.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

When BTC’s change reserve climbs this manner, it suggests a hike within the coin’s sell-offs.

BTC bulls might discover it difficult to interrupt above the $63,000 resistance stage within the quick time period if normal market individuals continues to realize momentum whereas it fails to draw new demand.