- Bitcoin wants the U.S. excessive yield price to drop under 6% or 7% for a sustainable rally.

- Community exercise is reducing, and massive buyers are at the moment inactive.

Bitcoin [BTC] remains to be over $10k under its all-time highs reached earlier this 12 months. The king crypto is struggling to hit even the $65k mark, and up to now? It’s failing.

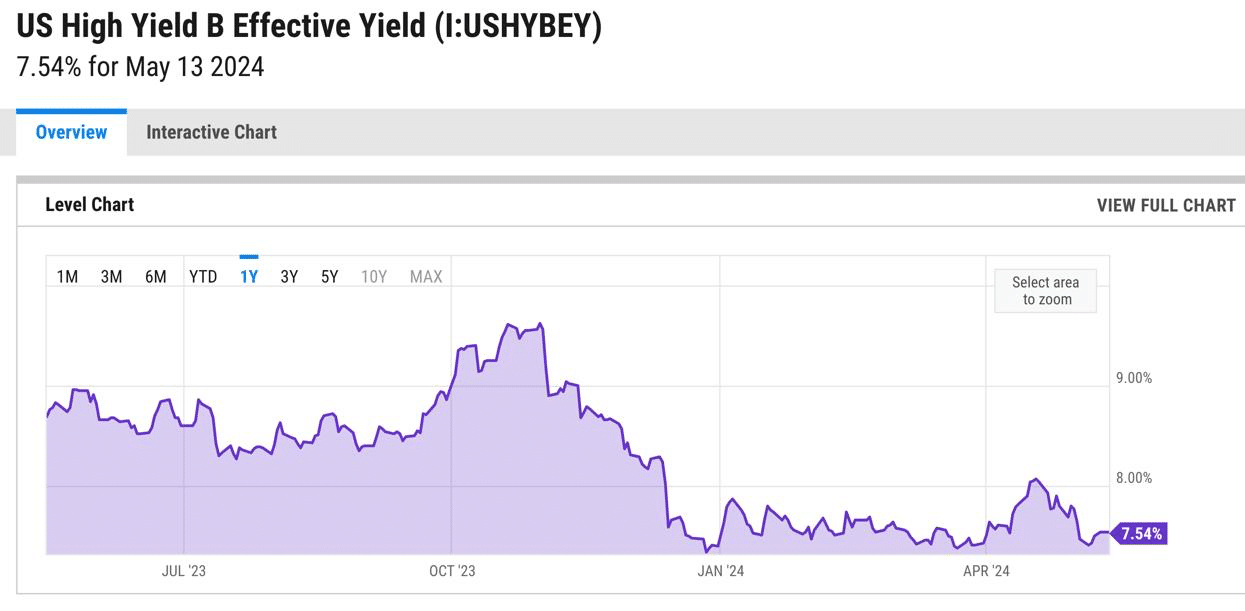

Fashionable monetary analyst Timothy Peterson identified that the U.S. excessive yield price is a key indicator for the market, emphasizing that it should fall under 6% or 7% for Bitcoin to maintain all-time highs successfully.

Financial indicators and Bitcoin’s worth

The U.S. excessive yield price stood at 7.54% at press time, which urged a decent maintain over potential monetary progress and investments, together with within the cryptocurrency market.

Traditionally, when the excessive yield price drops, it usually correlates with an increase in Bitcoin costs, as decrease yields make different investments like Bitcoin extra enticing.

It’s because buyers search larger returns in a decrease rate of interest atmosphere, which cryptocurrency can typically provide.

All in all, the U.S. economic system means rather a lot to Bitcoin buyers. The U.S. Treasury Division’s latest public sale of 30-year bonds noticed robust demand, resulting in downward strain on yields.

Coupled with the most recent unemployment information, buyers are desperately anticipating price cuts this 12 months, which may decrease the excessive yield charges, probably inflicting Bitcoin to reclaim its larger worth ranges.

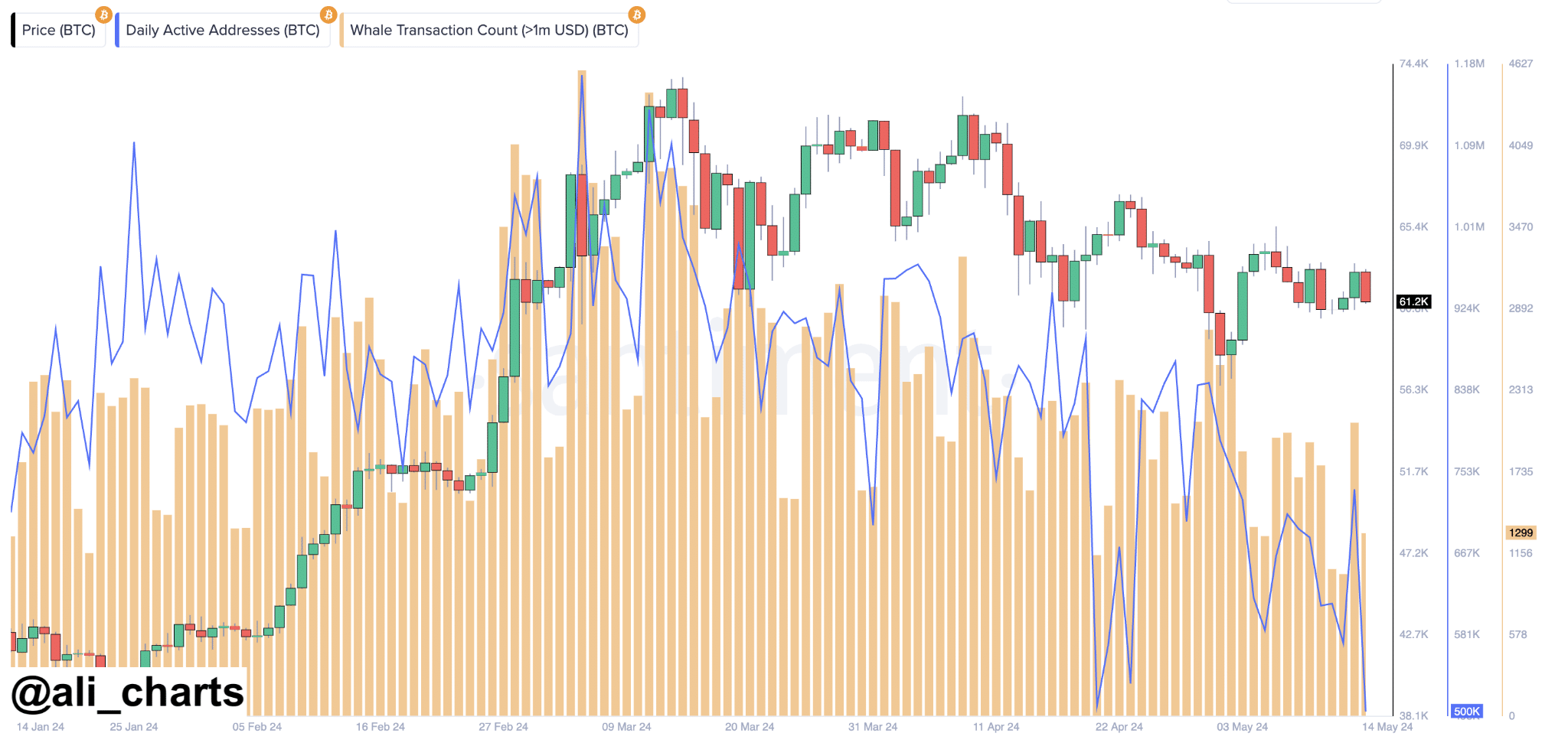

Having a look at Bitcoin’s exercise, we’re seeing some intriguing adjustments. Based on latest information from Santiment, the Bitcoin community exercise is on a decline.

This features a lower within the variety of large transactions, also called whale actions.

The whales seem like taking a step again, probably ready for extra favorable market circumstances earlier than making giant strikes, therefore making the market much more risky.

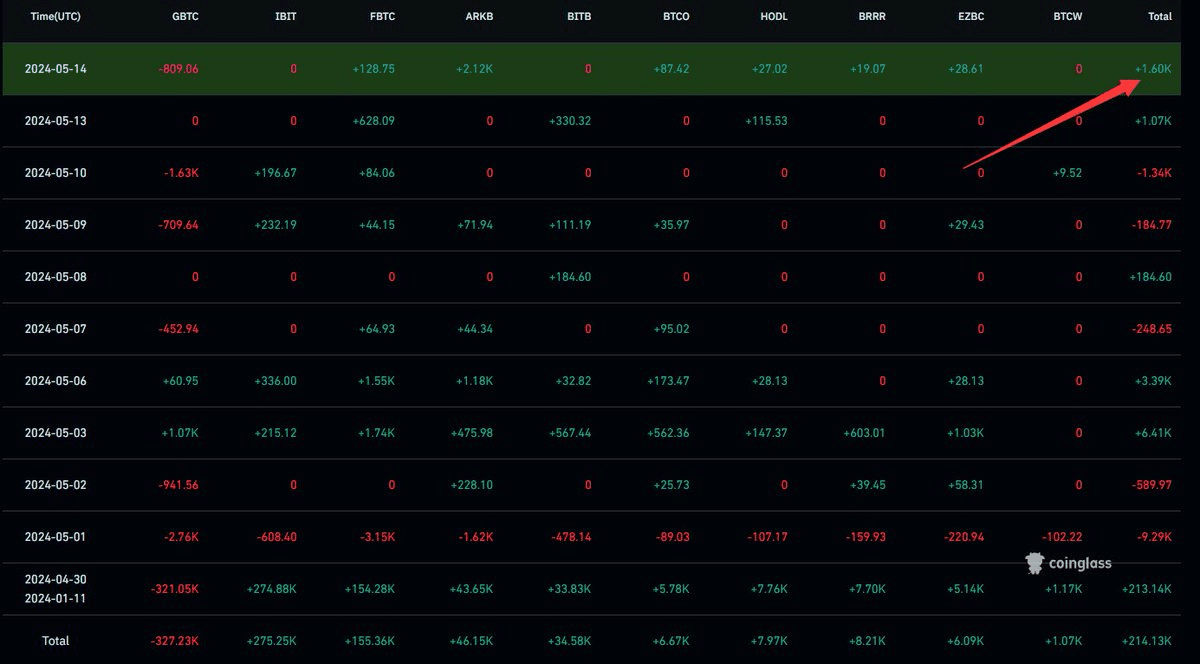

In the meantime, Bitcoin ETFs are additionally displaying some notable traits.

The final 24 hours alone noticed a web influx of roughly 1.60K BTC, which interprets to about $100.50 million at press time costs, as per information from Coinglass.

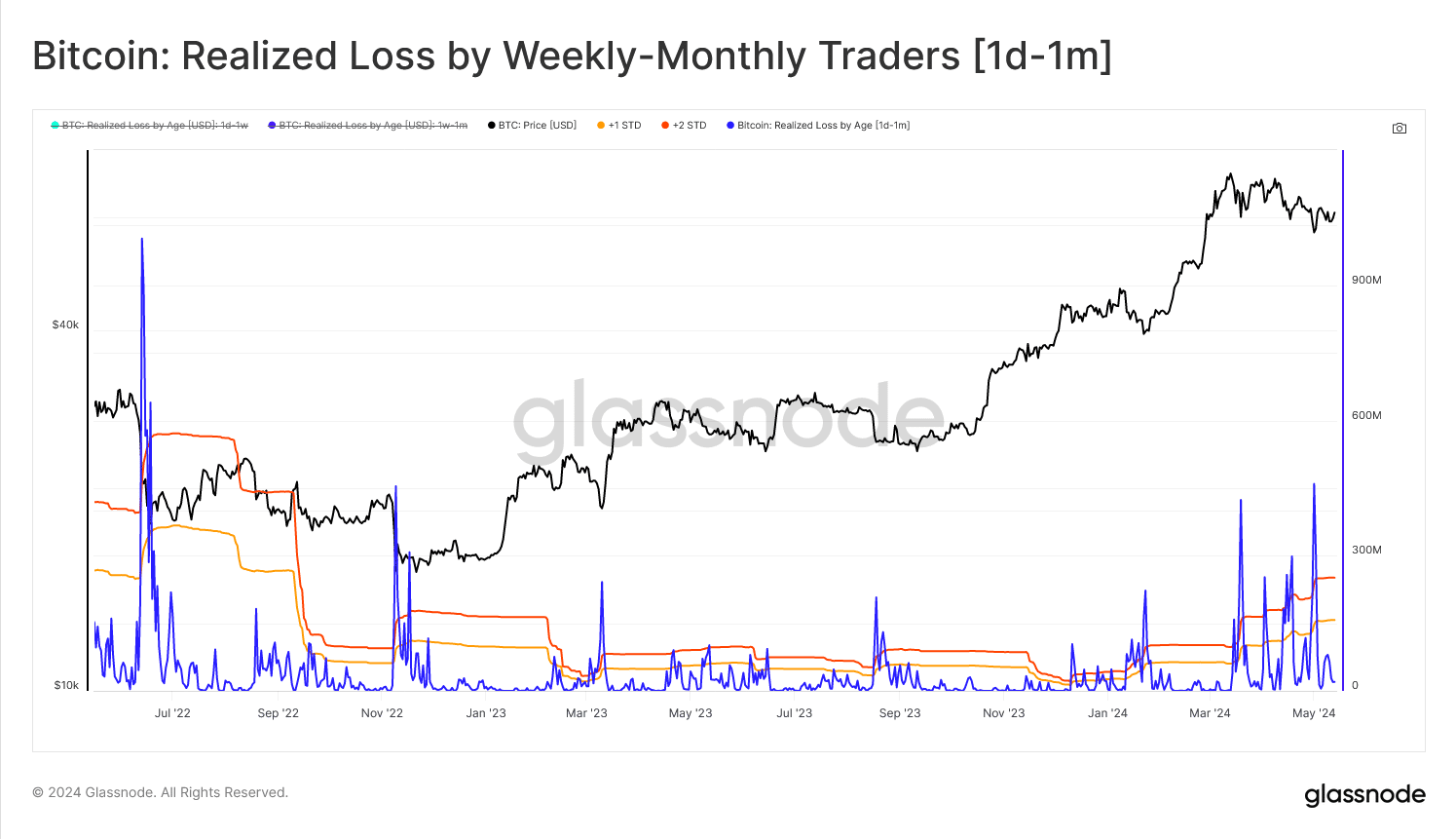

Glassnode’s new ‘Breakdown by Age’ metric gave us a deeper understanding of investor habits throughout present market circumstances.

In a bull market, it’s usually the long-term buyers who see essentially the most income, leaving the short-term holders to face losses.

These short-term losses can sign a turning level available in the market. As you possibly can see under, there was an upward development at first of 2024 when the market was bullish.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Bitcoin’s worth makes no transfer

Given the latest habits, if Bitcoin maintains the help stage round $62,700 immediately and market sentiment stays constructive, it may try one other push in the direction of the $63,000 mark and better.

Nonetheless, if it breaks under the $62,700 help, there may very well be an additional decline as merchants may safe income, resulting in elevated promoting strain.