- BTC surged to $62K because the Fed’s easing cycle started.

- Analysts remained cautious after the Fed’s ‘aggressive’ 0.50% fee reduce.

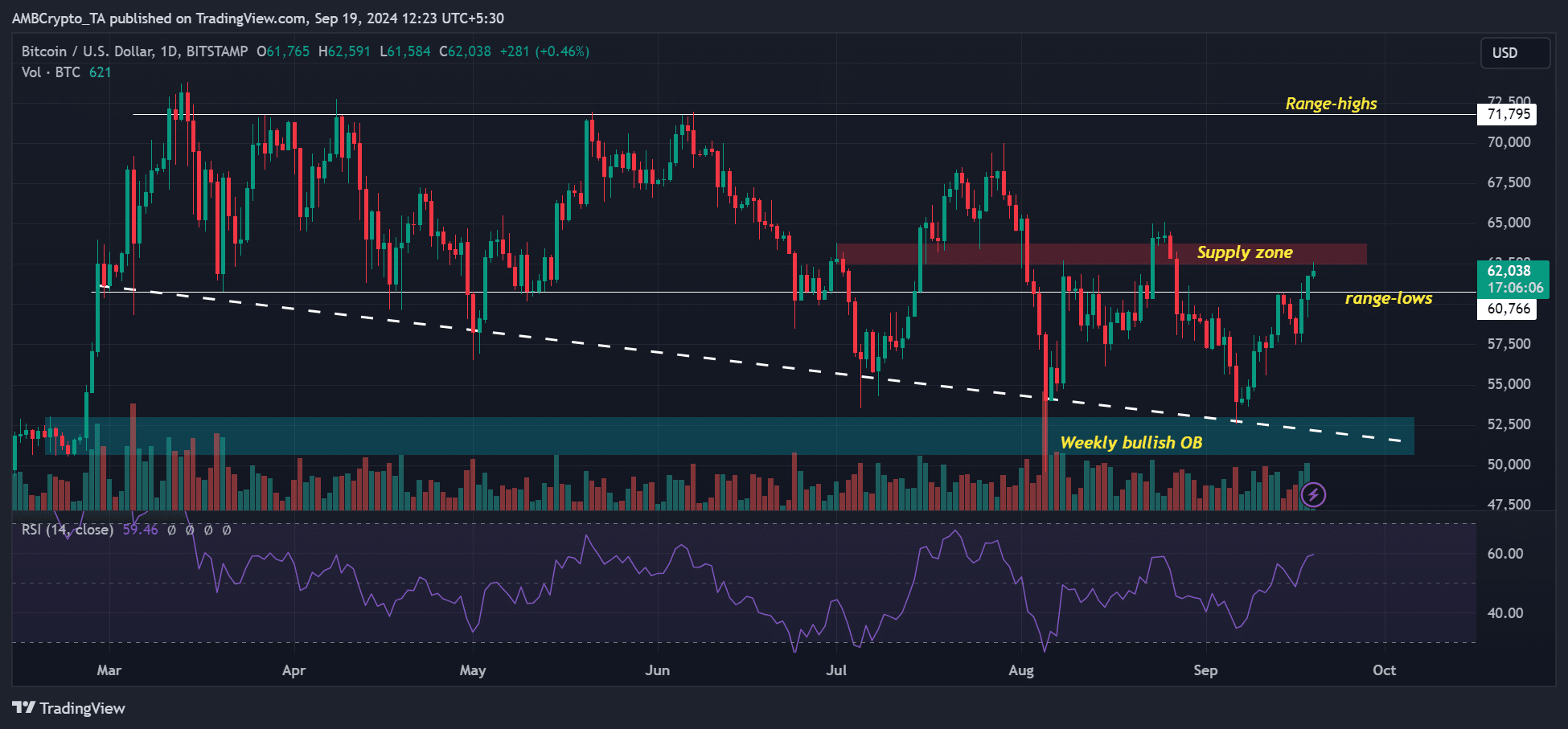

Bitcoin [BTC], the world’s largest cryptocurrency by market cap, surged to $62K on the 18th of September after a shock 0.50% Fed fee reduce.

BTC hit $62.5K, a two-week excessive that elevated September’s restoration positive aspects to almost 18%.

Nevertheless, the aggressive fee reduce caught even economists polled by Bloomberg off guard. A latest Bloomberg ballot confirmed that extra economists leaned in the direction of a 25 foundation level (bps) reduce, with solely 9 out of 114 economists anticipating a 50 bps reduce.

Though the Fed Fund Futures precisely predicted the Fed’s 50 bps reduce, the upper odds for aggressive cuts solely modified earlier within the week.

What’s subsequent for BTC?

Reacting to the 0.50% rate of interest reduce, Fed chair Jerome Powell argued it was meant to keep up low unemployment charges now that inflation has cooled off.

The coverage shift successfully kicked off the start of the central financial institution easing cycle that would enhance danger property, particularly BTC.

Nevertheless, market pundits remained cautious because the aggressive reduce signaled recession worries.

BitMEX founder Arthur Hayes famous that the 50 bps reduce was a “nuclear catastrophe for financial markets,” signaling a deeper rot within the international monetary system.

He added that property would possibly rally within the first or second day, adopted by depressed costs afterward.

The identical cautious outlook was echoed by 21Shares’ Crypto Analysis Strategist Mett Mena. Nevertheless, Mena informed AMBCrypto that the easing cycle was bullish for BTC in the long run. He stated,

“In the short term, a 50 bps rate cut could signal to the market that the economy is slowing…However, over the long term, Bitcoin and other digital assets have historically thrived in low-interest-rate environments.”

One other reason for market concern for BTC was the strengthening of the Japanese Yen in opposition to the U.S. Greenback (USD), given the large sell-off witnessed in early August after the carry commerce unwinds.

With the upcoming BoJ (Financial institution of Japan) determination scheduled for the twentieth of September, Hayes prompt monitoring this entrance to gauge BTC’s value course.

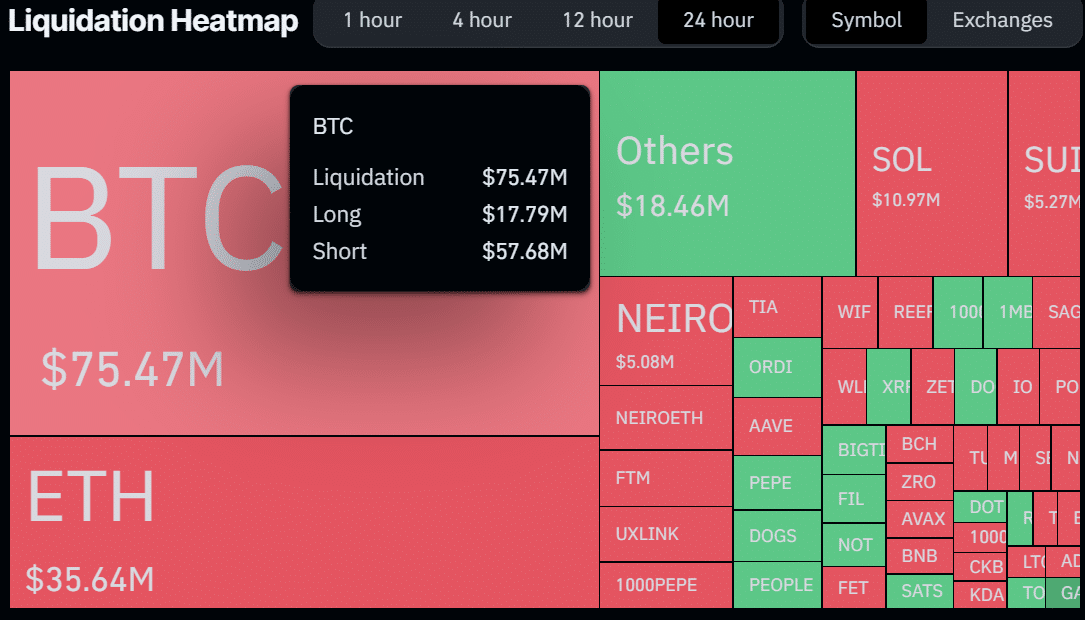

Within the meantime, the upswing to $62K liquidated over $57 million price of quick positions out of $75.5 million, reinforcing a short-term bullish sentiment within the Futures market.