- Bitcoin’s stablecoin inflow hints at rising shopping for energy and potential value breakout

- A 36% improve in short-term holders’ “HODL” conduct strengthens Bitcoin’s upward potential

Bitcoin [BTC] has not too long ago been buying and selling inside a slim vary, with resistance at $98,804 and help round $94,603. Nonetheless, rising on-chain indicators recommend that the main cryptocurrency could possibly be gearing up for a major upward transfer.

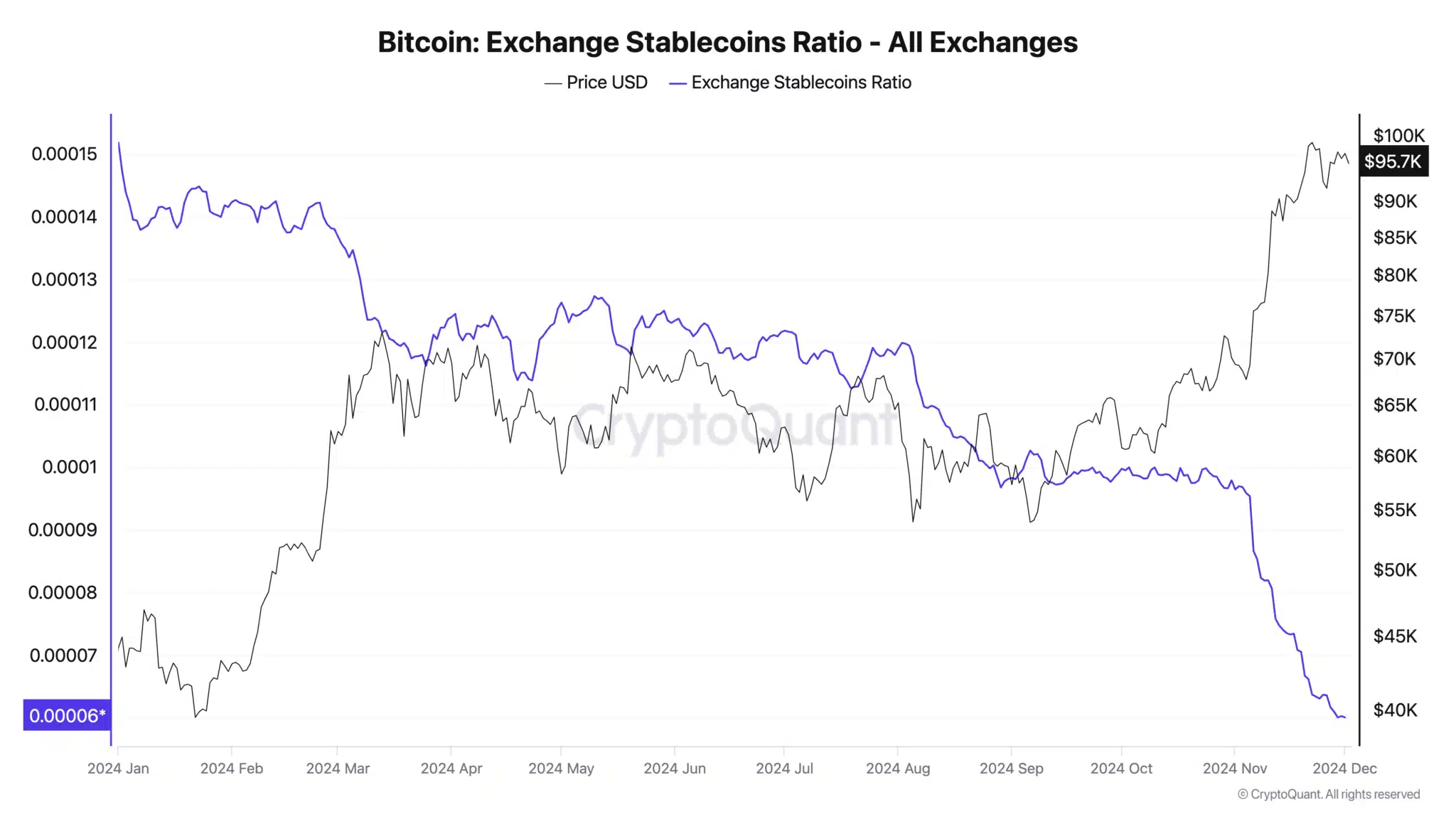

Notably, the Change Stablecoins Ratio has seen a pointy decline, pointing to a rise in shopping for energy on exchanges. This shift in market dynamics has sparked hypothesis that Bitcoin could also be poised for a rally, probably breaking via its present value vary and transferring towards new highs.

Because the market braces for potential development, investor sentiment is rising more and more optimistic.

A glance into BTC’s efficiency

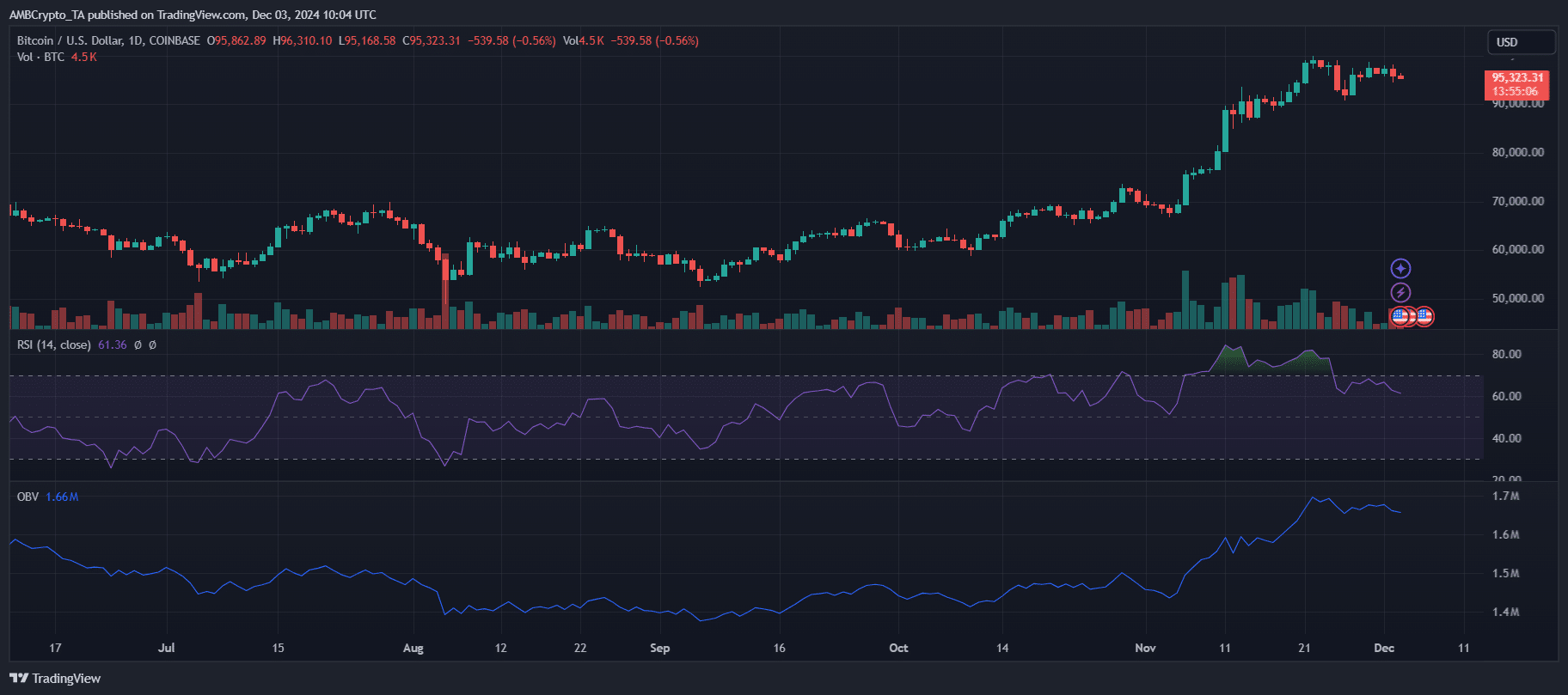

Bitcoin’s latest buying and selling vary displays a consolidating market, with value struggling to breach the $98,804 resistance stage whereas holding agency above $94,603 help.

The each day RSI at 61.41 suggests reasonably bullish momentum, although a transparent breakout sign stays absent. Notably, buying and selling volumes have proven minor declines, indicating a cautious market awaiting a decisive transfer.

OBV maintains an upward trajectory, highlighting sustained shopping for stress regardless of value stagnation. This divergence between value and OBV hints at latent bullish potential.

Moreover, the Change Stablecoins Ratio’s decline reinforces this outlook, suggesting a buildup of buying energy on exchanges.

A breach of the $98,804 resistance might catalyze a push towards $100,000, however failure to keep up momentum dangers a revisit to decrease help ranges.

Change stablecoins ratio and hodling impression

The Change Stablecoins Ratio, now at 0.000060, its lowest stage in 2024, underscores important shopping for energy on exchanges. This metric displays the rising provide of stablecoins relative to Bitcoin, signaling that buyers are well-positioned to amass BTC.

Traditionally, such circumstances have preceded bullish value motion as demand outpaces provide.

Moreover, the rise in hodling conduct amongst short-term Bitcoin holders is a notable issue. CryptoQuant information reveals a 36% improve of their common holding interval over the previous month.

This reduces instant promoting stress, fostering shortage available in the market and strengthening value stability.

Collectively, these dynamics – low Change Stablecoins Ratio and heightened holder confidence – improve Bitcoin’s potential to interrupt previous $98,804 resistance, with $100,000 more and more inside attain.

What to anticipate from Bitcoin?

At press time, Bitcoin was buying and selling at $95,323, barely beneath its key resistance stage of $98,804. The inflow of stablecoins on exchanges, mirrored within the low Change Stablecoins Ratio, suggests important shopping for energy that might drive demand.

If short-term holders preserve their “HODL” technique and investor sentiment stays optimistic, Bitcoin could overcome this resistance and edge nearer to the psychological $100,000 mark.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Nonetheless, any improve in promoting stress might see BTC consolidating inside its present vary or retracing to its essential help stage of $94,603 earlier than trying one other breakout.

The market’s trajectory hinges on whether or not demand sustains its momentum within the coming periods.