- Stablecoin market reaches a historic $169 billion in market cap, setting the stage for a possible Bitcoin value enhance.

- Regulatory challenges in Europe contribute to a decline in stablecoin buying and selling volumes regardless of market development.

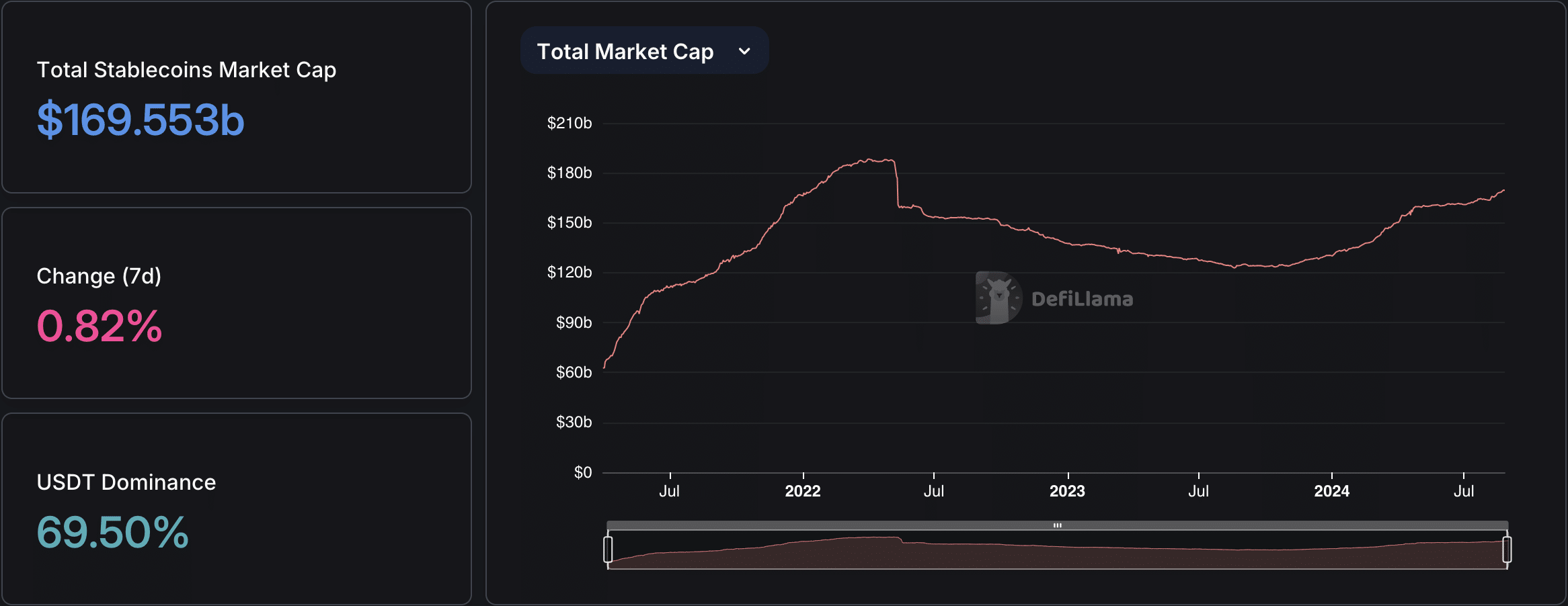

The stablecoin market has reached an unprecedented milestone, with its market capitalization hovering to $169.553 billion. This determine represents the best level in historical past, marking 11 consecutive months of development.

In accordance with information from DefiLlama, this new peak surpasses the earlier document of $167 billion, which was set in March 2022 earlier than a major downturn later that yr.

The present market cap excludes algorithmic stablecoins, which depend on algorithms quite than exterior property for his or her worth.

Supply: DefiLlama

Stablecoin surge boosts Bitcoin potential

Tether [USDT] has been a key driver within the stablecoin market’s latest development. Beginning 2024 with a market cap of $91.69 billion, USDT has seen constant month-to-month will increase, culminating in a market cap exceeding $117.844 billion in August.

Circle’s USD Coin (USDC) has additionally skilled development, reaching a market cap of over $34.338 billion. Whereas that is the best level for USDC in 2024, it stays beneath its all-time excessive of $55.8 billion recorded in June 2022.

The surge in stablecoin issuance has introduced renewed consideration to its potential results on Bitcoin’s [BTC] value. The rise in liquidity from dollar-pegged tokens has been seen as a possible alternative for Bitcoin to rise.

As of press time, Bitcoin was buying and selling at $63,645, down barely from the day past’s excessive of $64,879. The elevated liquidity could take time to replicate in Bitcoin’s value motion, as market dynamics modify to the inflow of latest stablecoin capital.

Europe’s crypto guidelines sluggish buying and selling

Regardless of the rising market cap, stablecoin buying and selling volumes have seen a decline. In accordance with a report by CCData, buying and selling volumes fell by 8.35% to $795 billion in July, largely on account of decreased exercise on centralized exchanges.

The report attributes this drop to the introduction of the Markets in Crypto-Property (MiCA) Regulation in Europe, which has raised considerations about the way forward for stablecoins like USDT within the area.

This downward pattern in buying and selling quantity continued into August, with present figures standing simply above $50 billion, as reported by CoinMarketCap.

Because the stablecoin market grows, issuers like Tether and Circle have more and more turned to US Treasury payments as their most popular back-up property, in response to a latest AMBCrypto report.

Identified for his or her security and liquidity, these property have change into a cornerstone in making certain the 1:1 backing of stablecoins.

This pattern has solidified Tether and Circle’s roles as key gamers available in the market, as they work to take care of the soundness and reliability of their tokens.