- Analyst believes altcoins would possibly proceed to underperform in opposition to Bitcoin because the market deviates from earlier patterns

- Solana could be the rationale why the altcoin market cap has not fashioned decrease lows

Altcoins have underperformed in opposition to Bitcoin (BTC) this yr with a lot of the high ten altcoins, in addition to Binance Coin (BNB) and Toncoin (TON), failing to reclaim their earlier highs.

In actual fact, based on Andrew Kang, Associate at Mechanism Capital, the market has not been following its earlier patterns. Historically, at any time when Bitcoin varieties a brand new all-time excessive, altcoins observe go well with. Nevertheless, this didn’t occur for many altcoins earlier this yr when BTC hit an ATH of $73k on the charts.

“Altcoin market caps (and ETH) should be making new highs in new cycles. It’s increasingly clear that this is not the case… Even if Bitcoin goes to new highs this doesn’t mean altcoins will keep up.”

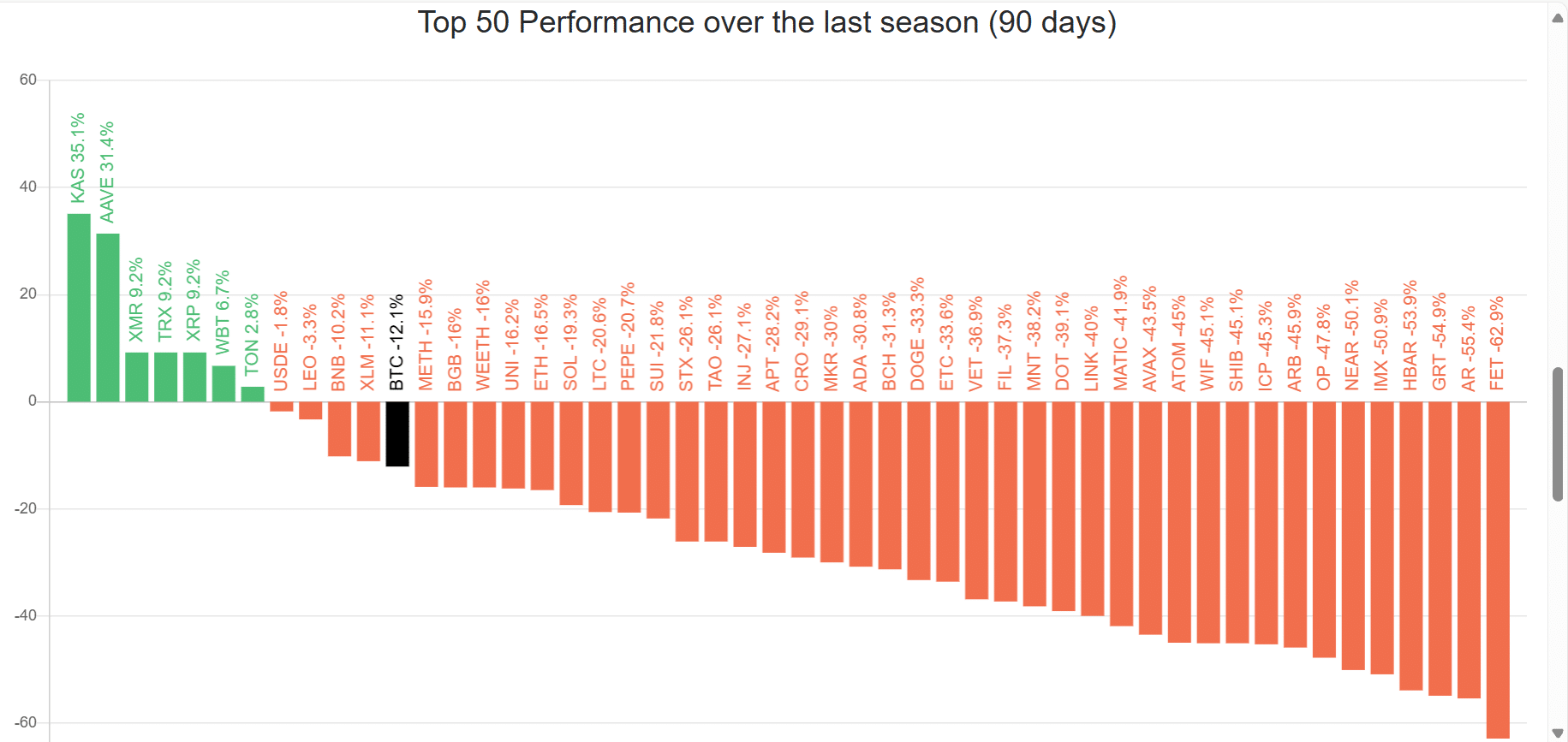

A have a look at knowledge from Blockchain Heart revealed that solely 11 out of the highest 50 altcoins outperformed Bitcoin over the past 90 days.

ETH varieties yearly lows in opposition to Bitcoin

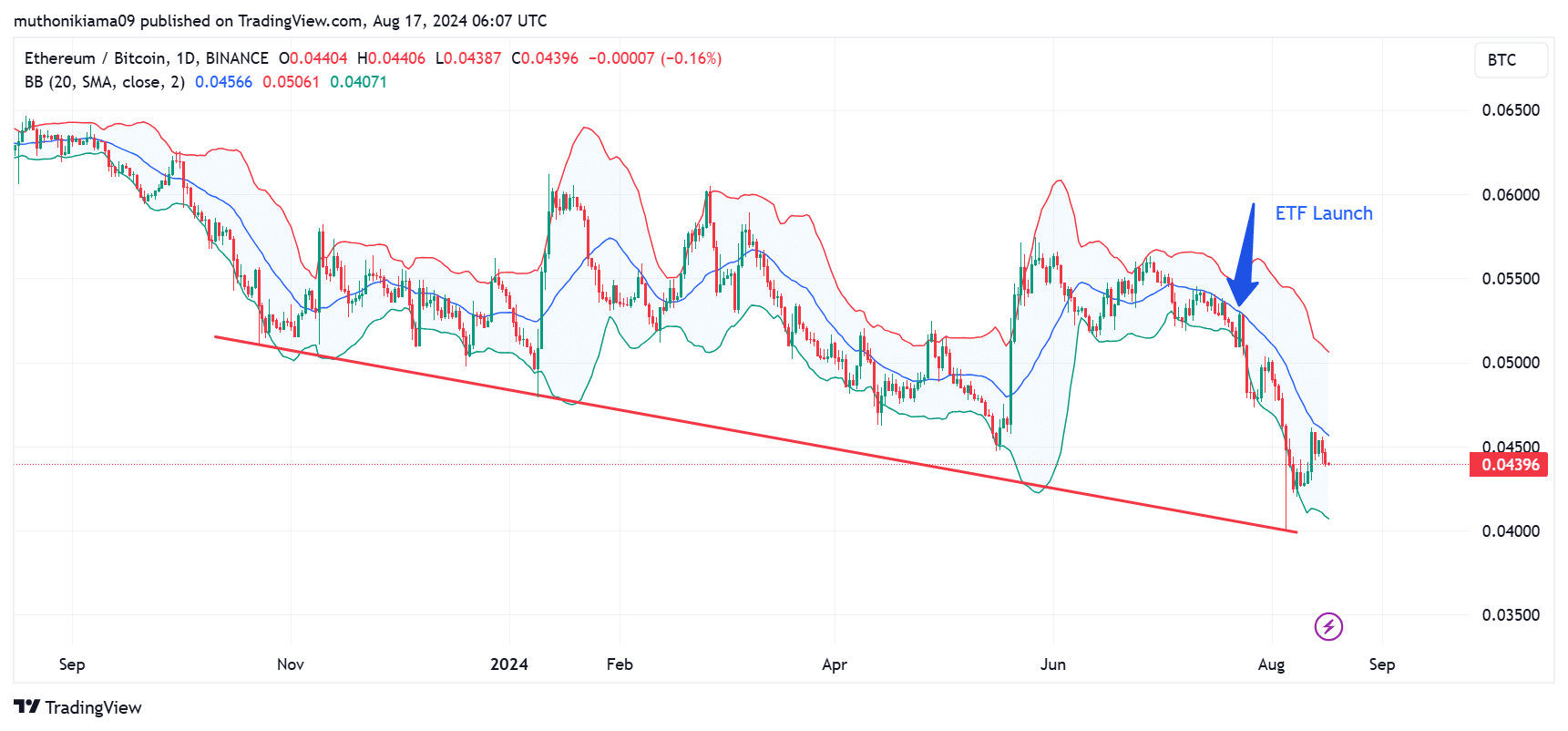

Kang’s evaluation comes on the again of Ethereum forming a yearly low in opposition to Bitcoin on 9 August. The ETH/BTC every day chart additionally revealed that the biggest altcoin has been forming decrease lows in opposition to BTC since October final yr.

Furthermore, since spot Ether exchange-traded funds (ETFs) began buying and selling in July, ETH has didn’t bounce from the center Bollinger band (20-day Easy Transferring Common). That is simply one other signal of underperformance.

In response to Kang although, altcoins will seemingly discover a backside in 2025, earlier than making a bullish rebound.

Solana is the security internet?

That’s not all although as Kang believes that Solana (SOL) is the only real purpose why altcoins’ market cap, at the moment at round $1 trillion, has not fashioned a decrease low on the charts.

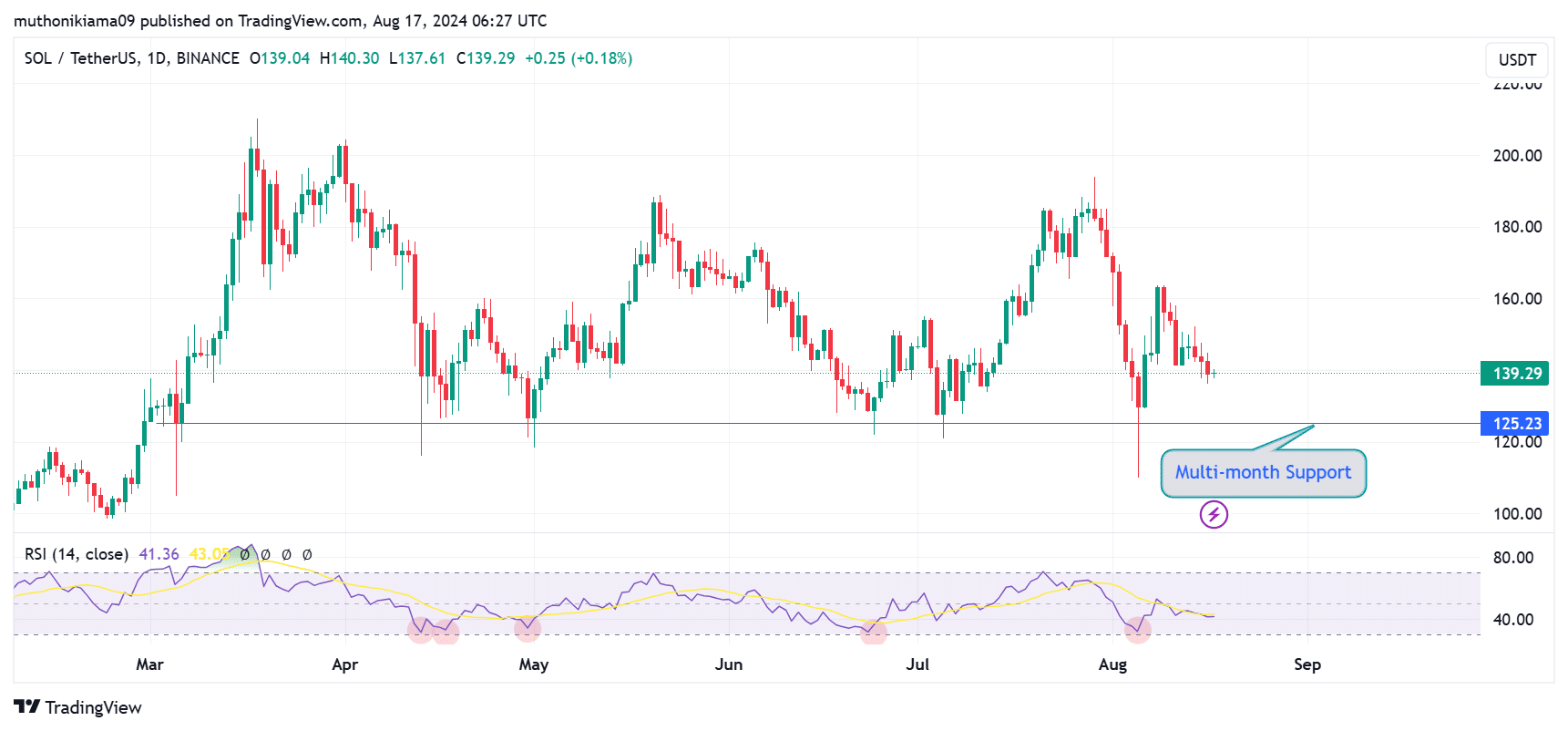

In actual fact, Solana has defended a multi-month assist degree at $125 since March 2024.

The $125 psychological degree is a vital value to observe because it confirmed that regardless of downward stress, SOL has established a steady base stopping steep declines.

The Relative Power Index (RSI) has additionally sustained ranges above 30 since March – An indication that SOL has not been oversold for an prolonged interval.

This development indicated that patrons have prevented important draw back threat. This robust assist for SOL helps Kang’s thesis that Solana’s value is much less more likely to type a decrease low.

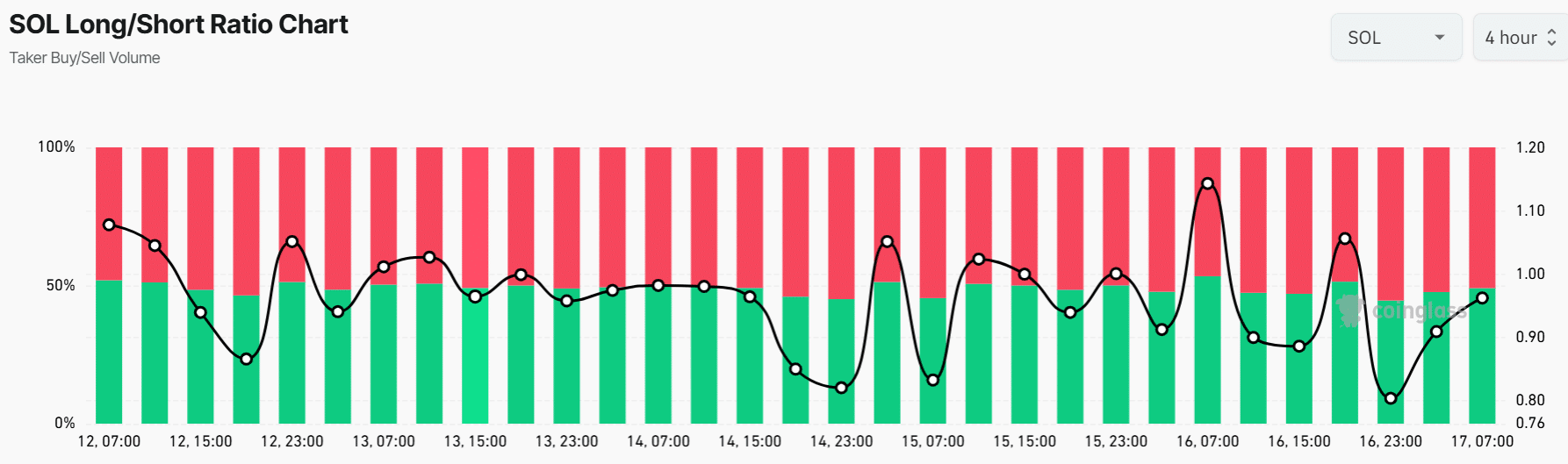

Moreover, the Futures market demonstrated a virtually balanced sentiment round SOL by merchants. The lengthy/quick ratio for SOL, at press time, was at 0.97, indicating quick positions are barely larger than lengthy positions.

However, Solana’s energy has not been sufficient to assist the altcoin market. On the time of writing, the Altcoin Season Index had a price of twenty-two, suggesting that the market is favoring Bitcoin over altcoins proper now.