- Bitcoin was buying and selling under $66k at press time, with analysts pointing to $71k as a key degree for a bullish reversal.

- Brief-term holder provide declines, indicating rising confidence out there, whereas open curiosity sees combined alerts.

Bitcoin [BTC] has skilled a slight decline, presently buying and selling at round $61,639, down by 3.5% previously day. This lower comes shortly after the main cryptocurrency made a notable restoration final week, reaching as excessive as $66,000.

Regardless of the latest dip, Bitcoin was nonetheless up by 9.4% over the past two weeks.

Whereas no clear elements have been recognized for the present downward motion, analysts are observing a number of traits and key ranges that Bitcoin holders ought to take note of as they consider the asset’s future worth trajectory.

Key ranges and shifts amongst Bitcoin holders

Veteran dealer Peter Brandt lately shared his evaluation on the Bitcoin market, emphasizing an important degree for bulls to reclaim.

In line with Brandt, Bitcoin holders and traders ought to monitor whether or not BTC closes above $71,000, confirmed by a brand new all-time excessive (ATH), to point that the upward pattern since November 2022 remains to be in drive.

Brandt talked about in his put up,

“The recent rally in Bitcoin did NOT disturb the 7-month sequence of lower highs and lower lows.”

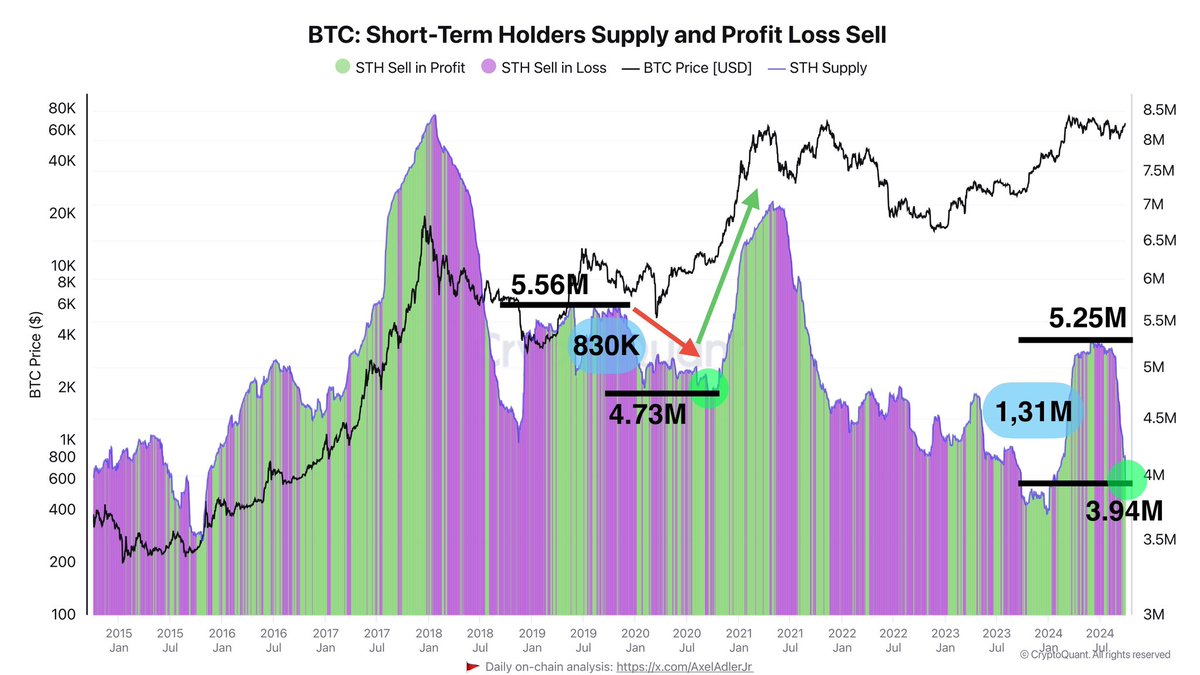

In the meantime, latest information from CryptoQuant has highlighted a shift amongst Bitcoin holders, notably short-term holders (STHs). The entire provide of Bitcoin held by STHs has decreased by roughly 1.31 million BTC (round $83 billion).

Axel Adler Jr, a CryptoQuant analyst, elaborated that this decline suggests “growing market confidence,” as fewer BTC are circulating amongst STHs who’re opting to carry their belongings (HODL).

Moreover, whereas some short-term holders have realized income by promoting their cash, the final pattern signifies a transfer in the direction of longer-term holding methods.

Including to the dialogue on market sentiment, outstanding crypto analyst Willy Woo shared his ideas on the present and future construction of Bitcoin’s worth.

He advised that the mid-term outlook is shifting from bearish to impartial, and might be on its strategy to turning into bullish. Woo additionally predicted {that a} new all-time excessive for Bitcoin might take time, with the subsequent bullish try doubtlessly coming after a “cool-off” interval of 1-3 weeks.

In his view, October would possibly stay flat, however the months of November and December may see elevated bullish exercise.

Open curiosity and energetic addresses point out combined traits

Past the insights of particular person analysts, market metrics present extra perspective on the state of Bitcoin.

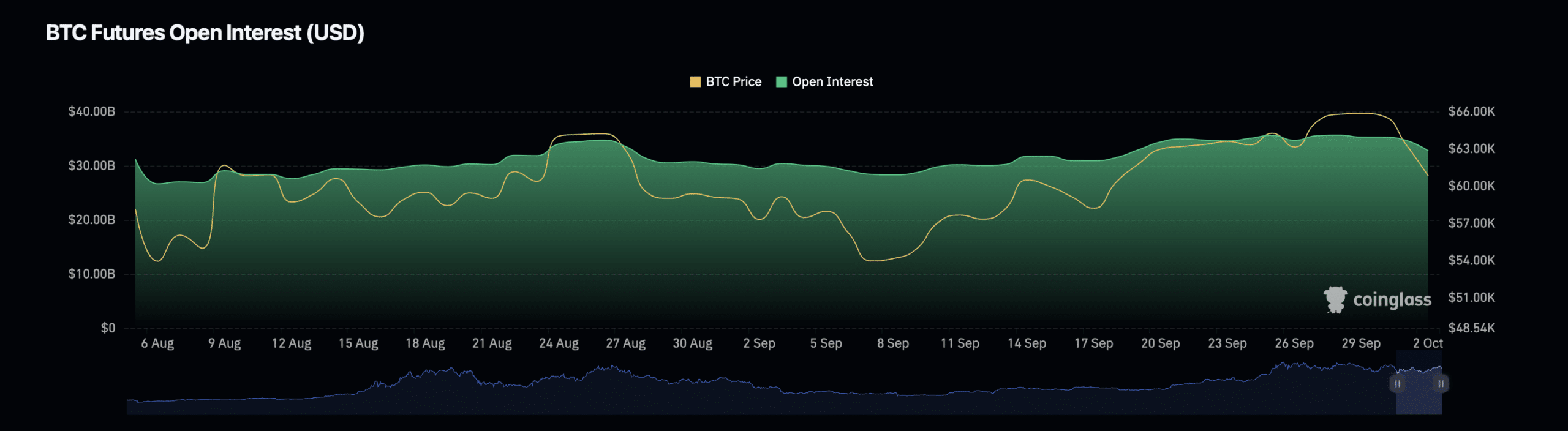

Open curiosity, a key indicator of the overall variety of excellent by-product contracts, is one space intently watched by Bitcoin holders.

In line with information from Coinglass, Bitcoin’s open curiosity has lately declined by 4.52%, standing at $32.92 billion.

Conversely, open curiosity quantity has seen a surge, rising by 61.23% to succeed in $101.57 billion. This enhance in quantity, regardless of the dip in general open curiosity, means that buying and selling exercise and curiosity in Bitcoin derivatives are rising, though it stays unclear if this development will translate right into a sustained worth rally.

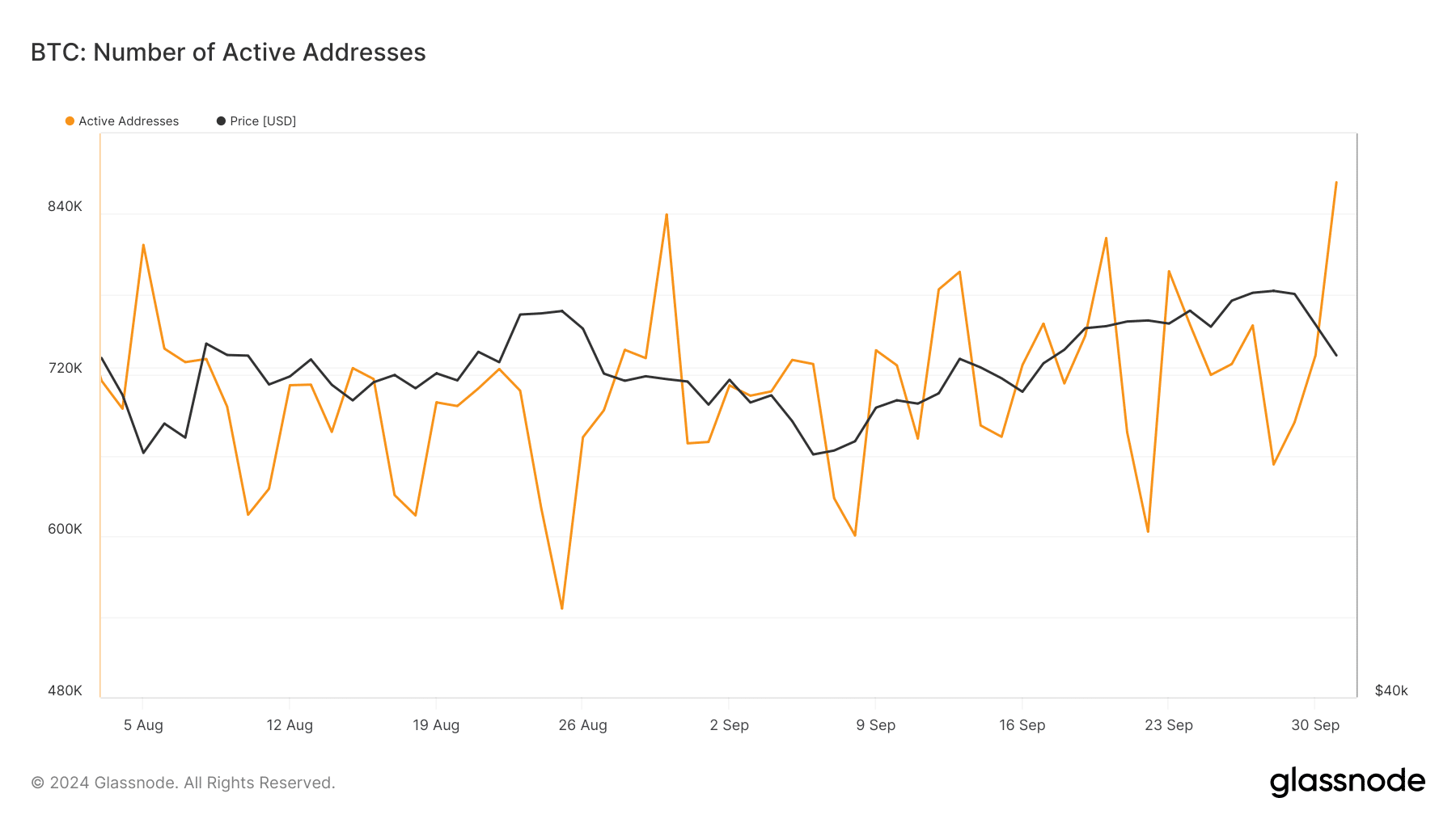

One other key metric is the variety of energetic Bitcoin addresses, which has been displaying indicators of restoration.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

The metric has elevated considerably, with over 863,576 energetic addresses as of press time, marking a considerable rise from the 603,000 energetic addresses seen early final month.

This rise in exercise could also be an indicator of renewed market engagement and doubtlessly alerts a shift in the direction of elevated utilization and buying and selling amongst Bitcoin holders.