- Most market indicators regarded bearish on Bitcoin.

- In case of a development reversal, BTC would possibly transfer in direction of $100k once more.

Whereas Bitcoin [BTC] struggled underneath $96k, the coin’s trade exercise has additionally witnessed an enormous drop. Subsequently, AMBCrypto deliberate to analyze additional to search out out whether or not this newest growth could have a continued damaging influence on the king coin’s value.

Bitcoin transfers hit a file low!

Woominkyu, an analyst and creator at CryptoQuant, not too long ago posted an evaluation highlighting a notable growth. As per the evaluation, BTC’s exchange-to-exchange transactions have dropped considerably.

The evaluation talked about, “The notable spikes in transaction quantity align with important value modifications. Particularly, the peaks in trade transactions marked within the crimson circles precede or coincide with sharp value actions.

The primary highlighted peak in 2017 corresponds with Bitcoin’s historic value surge, whereas the second peak round 2021 matches one other important value motion.”

Lately, the transaction quantity has decreased considerably, indicating decrease buying and selling exercise in comparison with earlier years.

The place is BTC headed?

Will this decline in exchange-to-exchange transactions hurt the coin’s value within the close to time period? Let’s discover out.

In keeping with our evaluation of CryptoQuant’s knowledge, Bitcoin’s web deposits on exchanges had been decrease in comparison with the final seven days’ common, hinting at an increase in promoting strain. The coin’s aSORP was additionally crimson, indicating that extra traders had been promoting at a revenue. In the course of a bull market, this could recommend a market prime.

BTC’s Binary CDD identified that long-term holders’ motion within the final seven days was larger than the typical. If these actions had been for promoting, it might have a damaging influence.

Nevertheless, Glassnode’s knowledge revealed a distinct story. The platform’s accumulation development rating indicator confirmed a worth of over 0.93 at press time.

A price nearer to 1 signifies excessive shopping for strain on BTC, which is a constructive sign, as excessive shopping for exercise sometimes leads to value hikes.

Nonetheless, Coinglass’s knowledge identified one other bearish metric. BTC’s Lengthy/Quick Ratio registered a pointy decline within the 4-hour timeframe.

This meant that there have been extra brief positions available in the market than lengthy positions, which may push the coin’s value down within the brief time period. If the worth decline continues, BTC would possibly drop to $91k.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

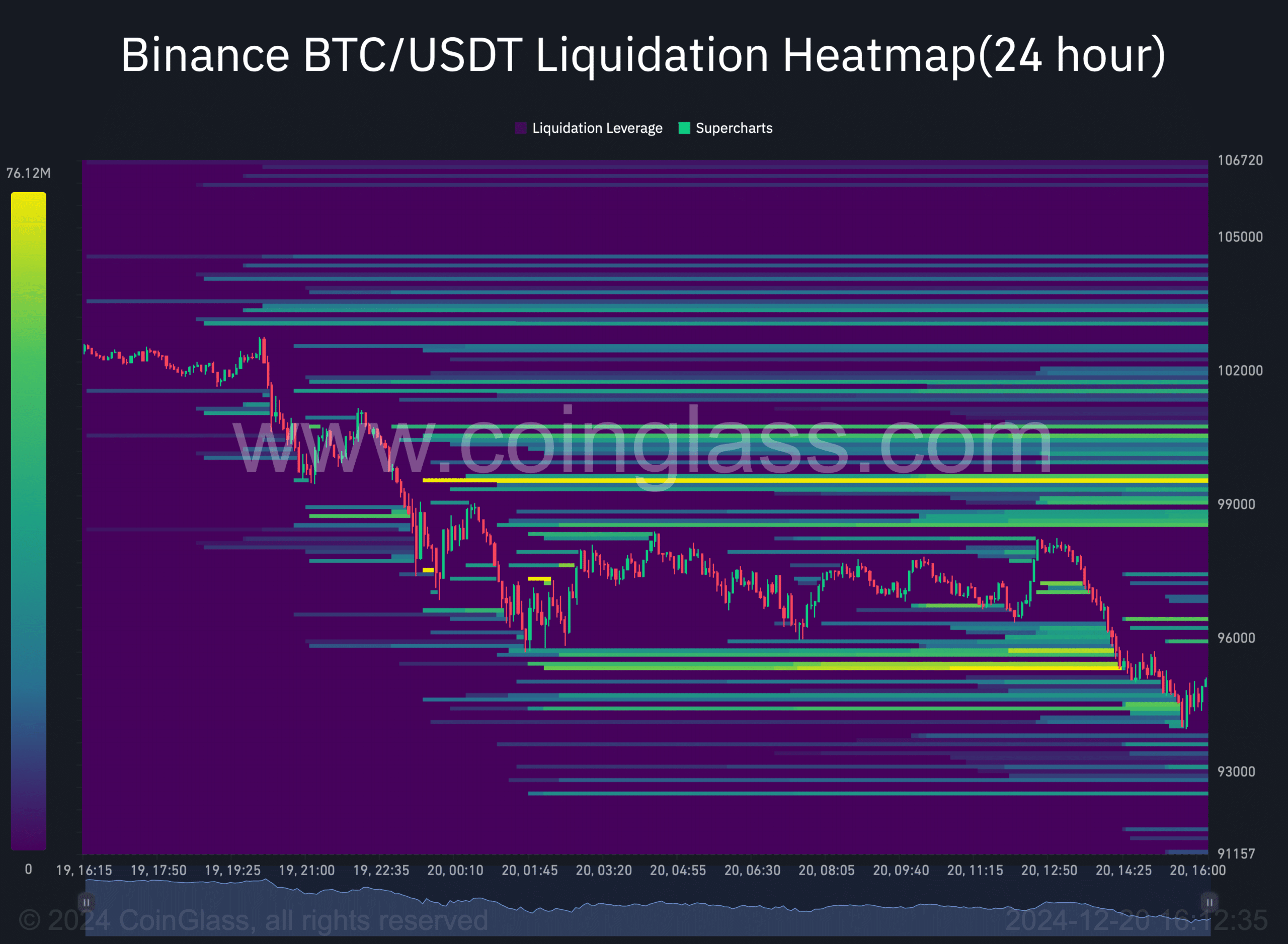

Nevertheless, if the bulls provoke a development reversal, BTC may doubtlessly retouch the $99.5k-$100k mark, as advised by the king coin’s liquidation heatmap.