- July’s U.S. CPI was softer than anticipated, at 2.9% in opposition to an estimated 3.0%.

- The U.S. authorities’s $593M BTC transfer might have spooked the markets.

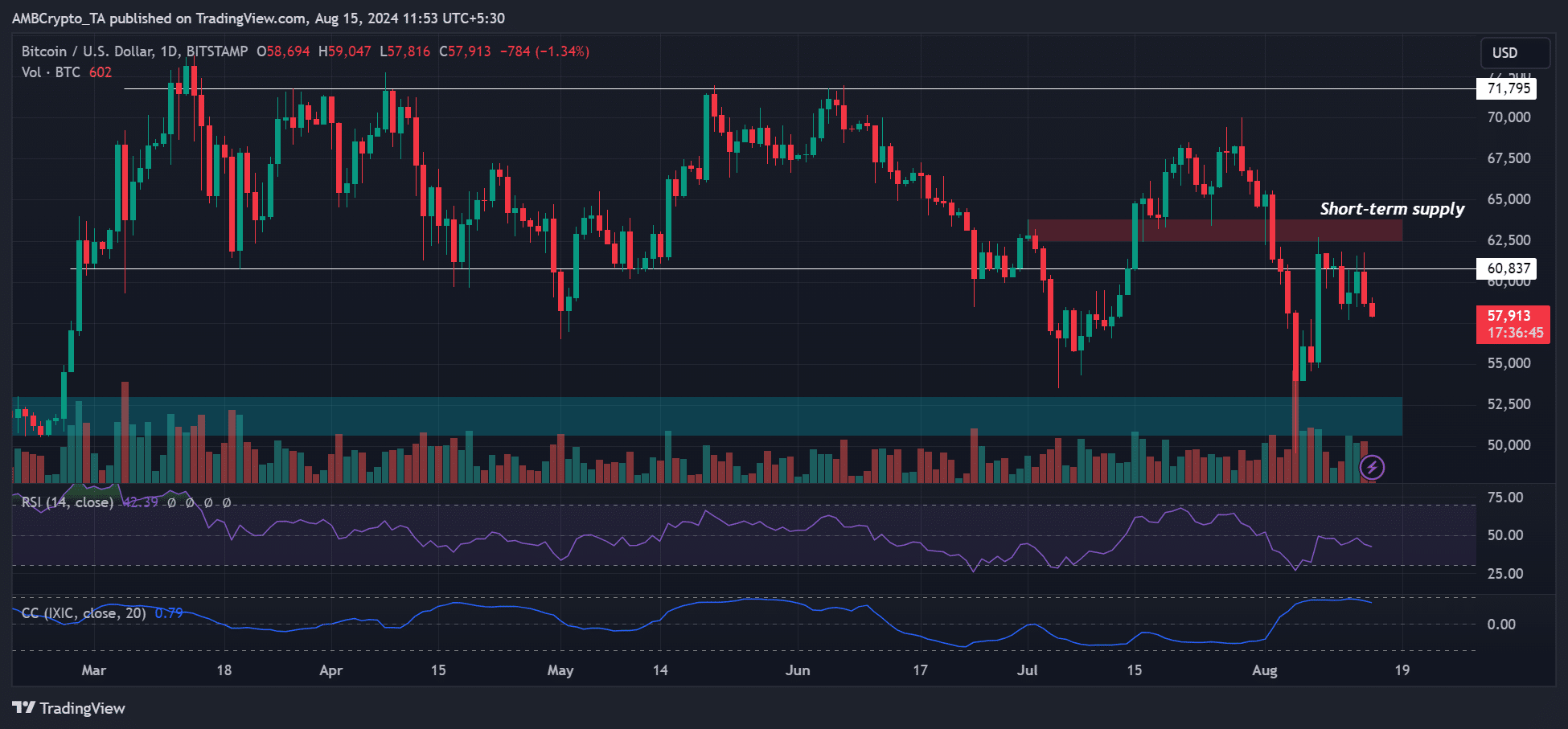

Bitcoin [BTC] failed to remain above $60K regardless of a softer July U.S. CPI (Shopper Value Index) information, which got here in at 2.9% YoY (year-over-year) in opposition to the anticipated 3.0%.

The softer inflation information tipped a slight reduction bounce throughout the U.S. equities market, together with the tech-heavy Nasdaq Composite (IXIC).

Nevertheless, BTC, which has a powerful constructive correlation to the Nasdaq Composite, went in the other way.

It shed 3%, dropping from $61.8K to $58.8K on the 14th of August. On the time of writing, it was weakly holding above the $58k stage.

The softer CPI information remains to be bullish for BTC

Regardless of BTC’s sluggish intraday session on the 14th of August, market insiders had been nonetheless upbeat that the CPI print was bullish for BTC.

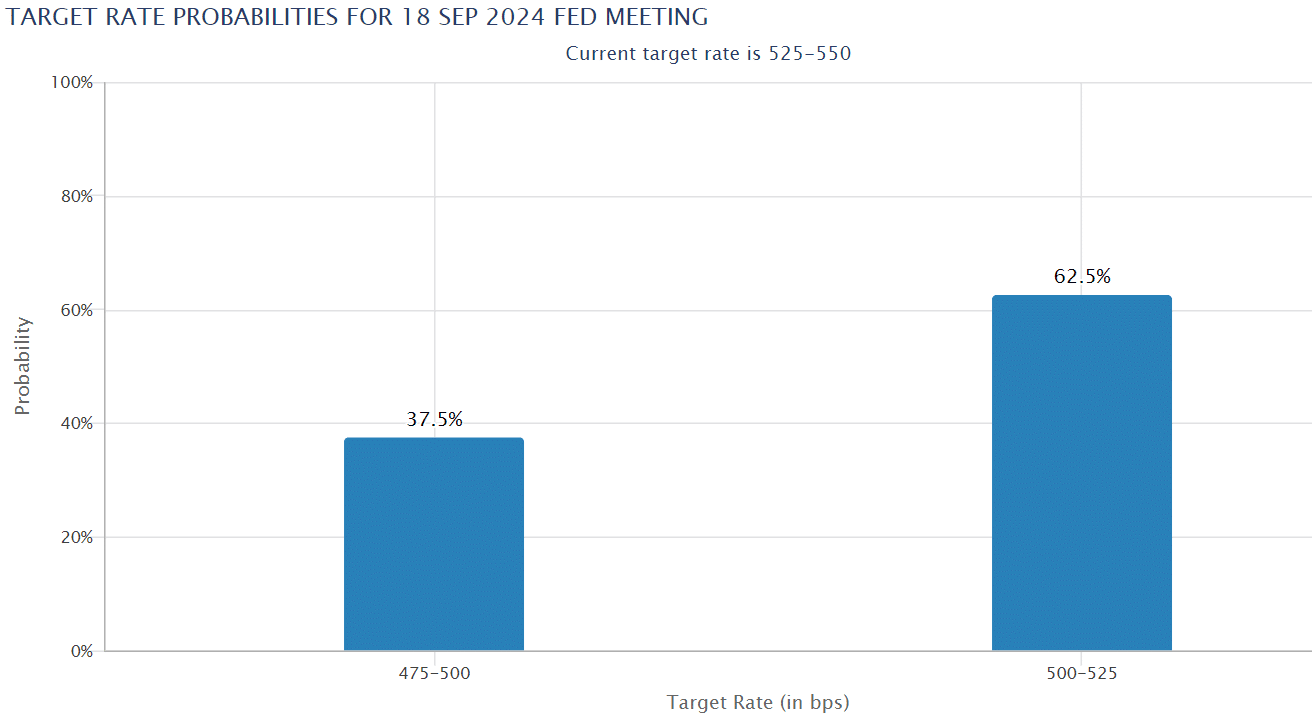

Eliezer Ndinga, VP, Head of Technique and BD at digital asset supervisor 21Shares, informed AMBCrypto that the softer CPI would enhance the chances of a Fed fee reduce in September and increase the crypto markets.

“With inflation coming in as expected, the likelihood of a smaller 25bps rate cut by the Fed has increased, which may support risk-on assets.”

Bitwise’s CIO Matt Hougan echoed the identical outlook,

“The Fed will start cutting rates in September; 3% is the new baseline for inflation, not 2%. Both are bullish for Bitcoin.”

On the time of writing, rate of interest merchants had been pricing a 62% odds of 25 foundation level (bps) Fed fee reduce by September.

$593M BTC transfer by U.S. spooks market once more?

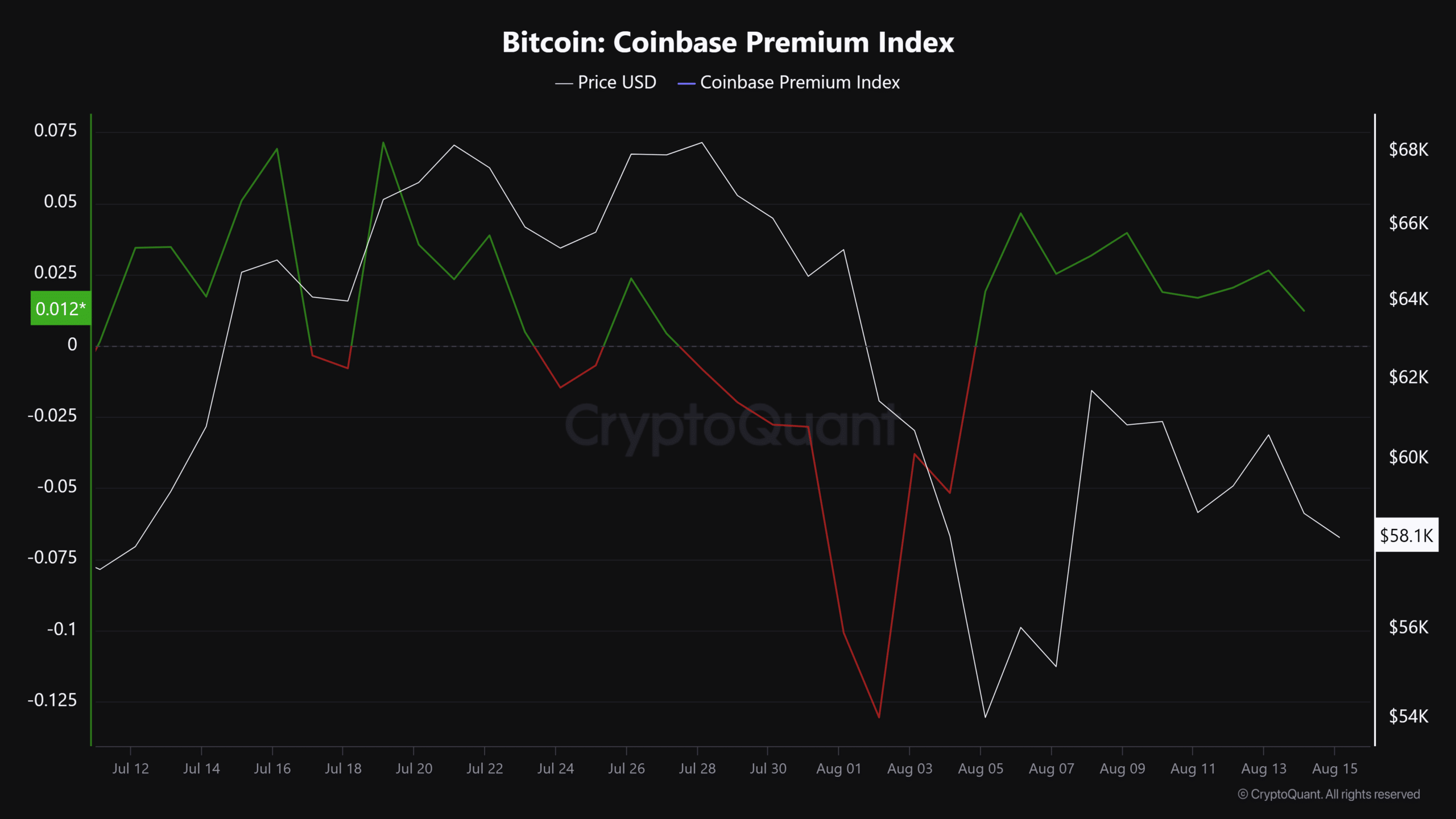

In the meantime, the U.S. authorities moved 10K BTC, value over $590M, to a different Coinbase Prime on Thursday, per Arkham information.

Regardless of reportedly being for custody functions, an analogous switch by the U.S. authorities spooked the markets about two weeks in the past and dragged BTC decrease.

In consequence, FundStrat Insights claimed that the U.S. authorities motion might have dented the anticipated bounce from the softer CPI information.

Within the meantime, the Coinbase Premium Index was nonetheless constructive on the time of writing amidst the declining restoration momentum. It instructed that the most important digital asset nonetheless had slight demand from U.S. traders.