This text will delve into what precisely put/name parity is, the precise formulation for calculating it, and the way changing into aware of this idea can deepen your understanding of the choices market.

What’s Put/Name Parity?

Put/name parity is an idea that defines the mathematical relationship between the costs of put choices and name choices which have the identical strike value and expiration date. In different phrases, if a name choice is buying and selling at X, the put choice of the identical strike and expiration date needs to be buying and selling at Y, and vice versa.

Put merely, put/name parity realizes that you need to use completely different combos of choices to create the identical place and formalizes this mathematical relationship between places and calls.

For example, combining shares of the underlying with an at-the-money put is sort of an identical to purchasing an at-the-money name. Put/name parity assumes these two an identical portfolios ought to value the identical.

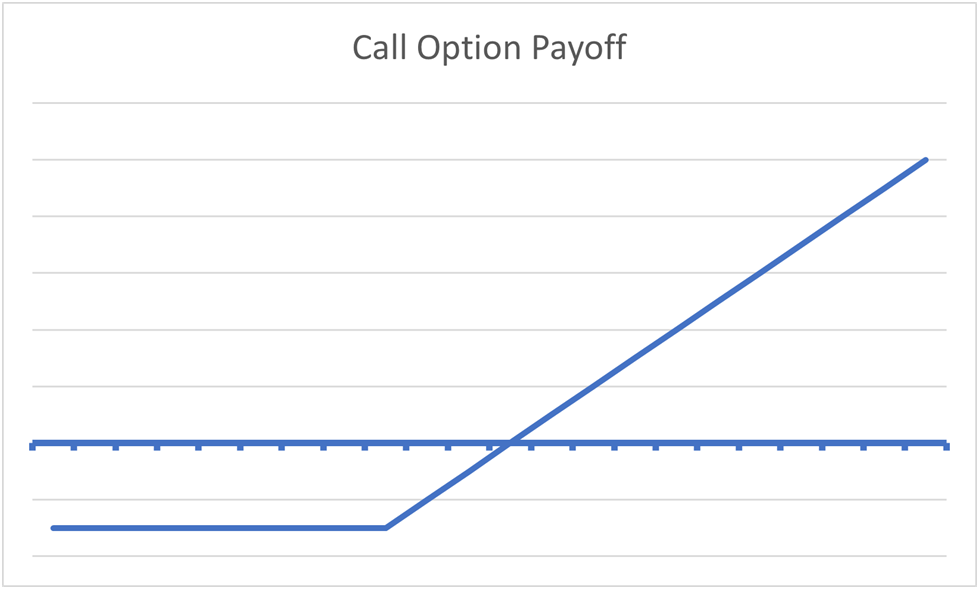

To offer you a visible, each our “synthetic call” place and shopping for a name choice outright have an an identical payoff, as you’ll be able to see within the payoff diagram under:

Put/name parity formalizes the arithmetic behind places and calls and provides every choice a definitive intrinsic worth. The introduction of synthetics means that there is a direct arbitrage element to choices, making certain that opportunistic merchants at all times maintain the costs of choices in line.

For example, a risk-free arbitrage alternative exists if an artificial name choice could possibly be bought cheaper than the decision choice outright, incentivizing merchants to push costs again to their truthful values.

Put/Name Parity Formulation

Put/name parity has a simple formulation that primarily means that you can value out the truthful worth of a put choice relative to its equal (similar strike value and expiration date) name choice and vice versa.

Put/name parity solely applies to choices with the identical strike value and expiration date. For instance, utilizing this formulation, you’ll be able to examine the $101 strike put and name that each expire in 21 days, however you can’t examine the $101 strike put and $103 strike name with completely different expirations.

The put/name parity is as follows:

C + PV(x) = P + S

The place:

● C = the worth of the decision choice

● P = the worth of the put choice

● PV (x) = the current worth of the strike value

● S = present value of the underlying asset

So let’s plug in some precise numbers into the formulation and stroll by it. We’ll begin with the worth of the underlying.

Let’s assume the underlying is buying and selling at $61.66, and we’re wanting on the $70 strike name choice, which is buying and selling for $1.45 and expires in 25 days.

So let’s revise our formulation by plugging in $1.45 for C, which is the worth of the decision choice, and $61.66 for S, which is the worth of the underlying.

$1.45 + PV(x) = P + 61.66

Now we’ve two values left to find out. PV(x) refers back to the current worth of the strike value. However what does that imply? As a result of an choice is an settlement to purchase or promote at a specified value at a date sooner or later, we’ve to low cost the strike value to the current to account for the time worth of cash. We use the risk-free rate of interest (mostly the annualized price of a 3-month US treasury invoice) to low cost the strike value to the current. On the time of writing, that price is at 4.7%, so the maths would seem like this:

PV(x) = S / (1 + r)^T

The place:

● S = the strike value of the underlying

● R = the risk-free rate of interest in decimals

● T = time to expiration in years, in decimals

To show our time-to-expiration right into a decimal, we merely divide our time-to-expiration by 365 as in 25/365 = 0.068

So our formulation would seem like this:

PV(x) = $70 / (1 / 0.047)^0.068 = $69.79

So this brings the current worth of the strike value to $4076.16. So let’s plug within the final worth to our formulation:

$1.45 + 69.79 = P + 61.66

So to resolve for P, or the worth of the same-strike, same-expiration put choice, we sum our name choice value and the current worth of our strike, which brings us to 71.24. Then we subtract the spot value of the underlying from 71.24, which is 9.58.

Being formulated within the Nineteen Sixties, the put/name parity formulation has some essential limitations within the fashionable period.

Put/Name Parity Applies to European Choices

The unique put/name parity formulation launched by Hans Stoll in 1969 applies particularly to European choices. When introducing American-style choices, the maths modifications a bit as a result of you’ll be able to train them anytime till expiration.

If it’s essential to get extra aware of the distinction, learn our article on Choices Settlement, which matches into the variations between European and American-style choices.

However in brief, European choices are cash-settled and might solely be exercised at expiration. American choices are bodily settled, which suggests settlement includes the precise switch of the underlying asset, and they are often exercised at any time till expiration.

Index and futures choices are European-style, whereas inventory choices are American-style choices.

There’s nonetheless a put/name parity relationship in American choices. The maths is only a bit completely different. See these NYU lecture notes to see a breakdown of the maths.

Put/Name Parity Doesn’t Account for Dividends or Curiosity Funds

The subsequent level is that the put/name parity formulation does not take into account any money flows accrued by holding the underlying asset, like curiosity funds or dividends. These additionally alter the calculation.

In case you had been to plug in a bond or dividend-paying inventory into the put/name parity formulation, you’d discover that the numbers would not add up. That is as a result of the formulation does not account for the current worth of money flows like dividends or curiosity funds. You can even adapt the formulation to work with money flows, however that is past the scope of this text.

Put/Name Parity Doesn’t Account For Transaction Prices or Charges

And eventually, the put/name parity doesn’t take any transaction prices, taxes, commissions, or another extraneous prices into consideration.

Artificial Replication

Within the introduction to this text, we talked about how you need to use completely different combos of choices to create two portfolios with an identical payoffs. We talked about how combining a put choice and the underlying inventory offers you a similar payoff as shopping for a name choice.

This concept is named artificial replication. You would create a place with an an identical payoff and threat profile, albeit with a special mixture of securities. Getting a tough understanding of synthetics offers choices merchants a greater grasp of the true nature of choices and the way they are often infinitely mixed to change your market view.

Utilizing the constructing blocks of quick/lengthy places or calls and quick/lengthy the underlying asset, you’ll be able to replicate almost any choices place. Listed here are the essential examples:

● Artificial Lengthy Underlying: quick put + lengthy name

● Artificial Brief Underlying: quick name + lengthy put

● Artificial Lengthy name: lengthy underlying + lengthy put

● Artificial Brief Name: quick underlying + quick put

● Artificial Lengthy Put: quick underlying + lengthy name

● Artificial Brief Put: lengthy underlying + quick name

From right here, we are able to focus on conversions, reversals, and field spreads, that are all arbitrage methods merchants use to use choice costs once they deviate from put/name parity. Do not forget that your common dealer won’t ever make these trades, however studying how they work offers you a deeper appreciation of the choices market.

Put/Name Parity: The Beginnings of Choices Math

To offer you just a little background, again within the Nineteen Sixties, the choices market was very small. Even probably the most astute merchants did not know how you can value choices, and it was a wild west. Hans R. Stoll was one of many few lecturers to essentially dig into the weeds of choices pricing in his seminal paper The Relationship Between Put and Name Possibility Costs printed in 1969.

His work predated the work of Black, Scholes, and Merton’s groundbreaking Black-Scholes mannequin in 1973.

Stoll discovered that typically these artificial positions could possibly be bought for cheaper than the precise positions. For example, if the market was very bullish on a inventory and merchants had been shopping for calls, you can purchase the underlying with an at-the-money and create an artificial name choice for cheaper than shopping for an at-the-money name choice. Basically, an arbitrage existed inside the choices market that would not exist inside an environment friendly market.

The Precept of No-Arbitrage

Put/name parity is a elementary idea in choices pricing, which assumes that two portfolios with an identical payoffs ought to have the identical value.

That is an extension of one of the vital essential ideas in monetary idea: the precept of no arbitrage. Put merely, it is the idea which you can’t make risk-free income by exploiting market inefficiencies.

To narrate issues on to put/name parity, below the regulation of no-arbitrage, it is best to by no means have the ability to replicate the payoff of one other portfolio and purchase it for cheaper. For example, an artificial inventory ought to value the identical as shopping for the underlying inventory.

All spinoff pricing fashions use the precept of no arbitrage as a built-in assumption, permitting the mannequin to make estimates primarily based on the financial actuality that merchants will exploit and shut any pure arbitrage alternatives as they come up.

Backside Line

Put/name parity is a elementary idea that each one intermediate choices merchants ought to turn out to be aware of. It is often the case that any name/put will be reconstructed utilizing another inventory plus put/name (respectively) mixture. Understanding put/name parity won’t ever make a dealer cash, however studying these ideas is a part of creating a broader consciousness of how the choices market works.

Associated articles

Subscribe to SteadyOptions now and expertise the complete energy of choices buying and selling at your fingertips. Click on the button under to get began!