Ethereum is flat at press time, transferring inside a slender $400 vary with caps at $2,300 on the decrease finish and $2,800 because the higher restrict. Though traders are upbeat, anticipating costs to soar within the coming periods, uncertainty continues to engulf the market.

Ethereum Finds Help At $2,300: Over 52 Million ETH Purchased

The second world’s most useful coin is bearish, dumping by over 50% from July highs and unable to interrupt the native resistance at $3,500. As merchants intently monitor how value motion pans out, one analyst has picked an fascinating improvement from market knowledge.

Associated Studying

Citing IntoTheBlock knowledge on October 11, the analyst observes that over 52 million ETH has been acquired by merchants at across the $2,300 degree. Contemplating the quantity of cash within the palms of merchants at this value, this zone is the fast assist.

As such, if patrons have the higher hand, lifting costs from this level, this degree will anchor the uptrend. If sellers double down, as has been the case prior to now few buying and selling months, the likelihood of ETH dropping beneath Q3 2024 lows can be elevated.

Presently, the sentiment is bearish, as seen within the CoinMarketCap ballot. Over 65% of ETH holders and merchants anticipate costs to battle within the quick time period.

Due to this fact, how costs react on the native assist will form the quick to medium-term formation. A surge, lifting ETH above $2,800, can be essential in driving demand, offering the much-needed tailwinds for optimistic merchants.

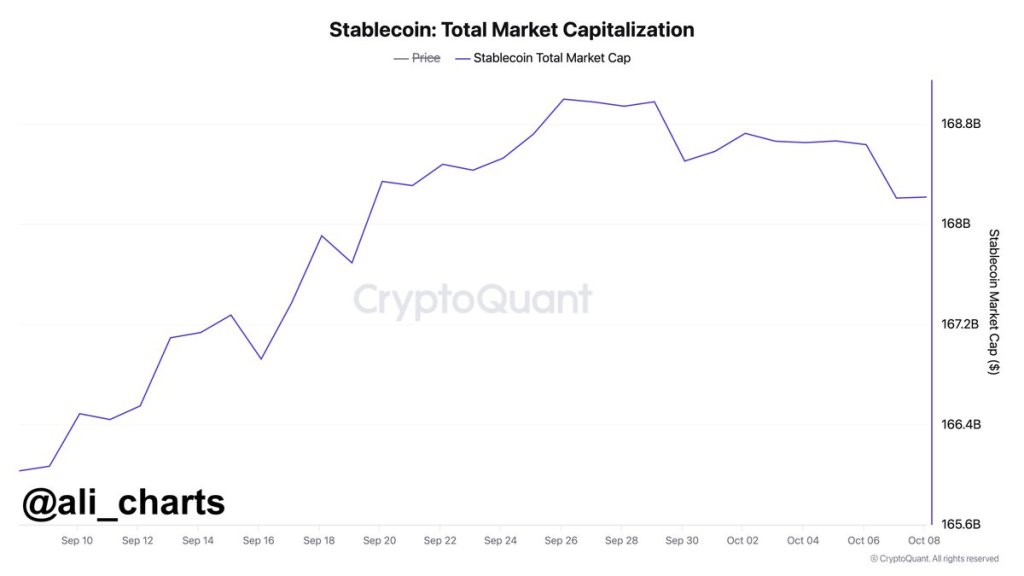

USDT, USDC, And Stablecoin Market Cap Falling: Is Shopping for Energy Dwindling?

Though optimism is excessive, different associated market knowledge factors to weak spot. Over the previous few buying and selling weeks, the market capitalization of stablecoins like USDT and USDC has been falling. As of October 10, the analyst notes it was down $780 million from current swing highs, pointing to a potential drop in shopping for energy.

Normally, at any time when USDC, USDT, and even DAI transfer to centralized exchanges, extra customers are eager on shopping for crypto property, together with ETH and BTC. Nonetheless, if there’s an outflow or its market cap dwindles, it could imply that extra customers are cautious and intently monitor occasions earlier than committing.

Usually, extra cash, together with stablecoins, have a tendency to search out their technique to centralized exchanges when there are issues about market prospects. Such inflows are likely to precede a market-wide correction.

Associated Studying

For now, inflows of ETH to centralized exchanges haven’t been picked. Nonetheless, what’s been occurring is that extra holders have been staking. By mid this week, market knowledge revealed that over 34 million ETH stay locked, incomes holders a 3.3% APY.

Function picture from DALLE, chart from TradingView