- ORDI surged instantly after Bitcoin’s halving

- Nonetheless, metrics recommend its worth rally could also be short-lived on the charts

Cryptocurrency token ORDI, intently linked to the Bitcoin Ordinals protocol, has recorded a double-digit worth rally during the last 24 hours, based on CoinMarketCap. The token’s worth hike follows the completion of Bitcoin’s fourth halving occasion in the course of the early buying and selling hours of 20 April and the launch of the Runes Protocol.

The Runes protocol, created by Bitcoin Ordinals originator Casey Rodmarmor, is a brand new option to create fungible tokens on the Bitcoin blockchain. Its launch coincided with the Bitcoin halving occasion, sending transaction charges to new highs as customers tried to “etch” and mint new tokens on the community.

In keeping with Rune Alpha, 1447 Runes had been “etched” on the Bitcoin community at press time, and $16.41 million had been spent on charges.

Will ORDI prolong its positive factors?

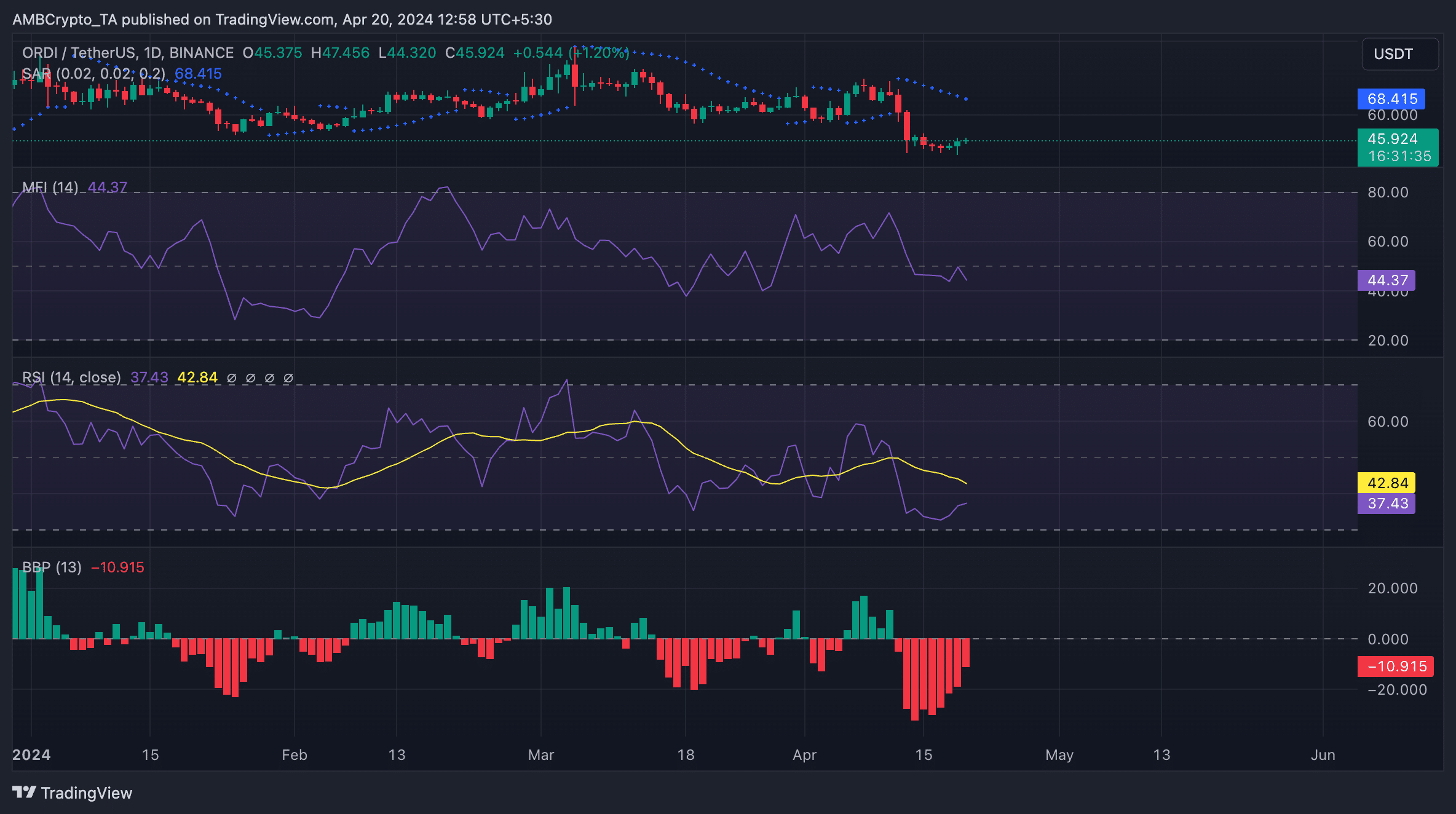

An evaluation of ORDI’s key indicators on the 24-hour chart prompt that the value positive factors could also be short-lived as demand for the token stays considerably low. The truth is, readings from its key momentum indicators revealed that market contributors favoured token sell-offs over accumulation. For instance, its Relative Power Index (RSI) had a studying of 37.46 whereas its Cash Circulation Index (MFI) had considered one of 44.36.

On a downtrend at press time, the values of those indicators highlighted that promoting strain considerably outpaced shopping for exercise.

Moreover, the token’s Elder-Ray Index, which measures its bull/bear energy, revealed that bearish sentiment was vital. The indicator has returned solely detrimental values since 12 April. When this indicator traits on this method, it means that the market is on a downtrend, and there’s a chance that the decline will proceed.

Likewise, the dots that make up ORDI’s Parabolic SAR indicator had been pegged above its worth. This indicator identifies an asset’s potential pattern course and reversals.

When its dots are above an asset’s worth, the market is claimed to be in a decline. It signifies that the asset’s worth has been falling and will proceed to take action.

Is your portfolio inexperienced? Take a look at the ORDI Revenue Calculator

Shorters take place

In ORDI’s Futures market, its open curiosity climbed by 10% within the final 24 hours, as per Coinglass information. At press time, ORDI’s Futures open curiosity was $211 million.

Nonetheless, its funding fee throughout crypto-exchanges was detrimental throughout the identical interval. This underlined that whereas Futures market contributors have taken up buying and selling positions, they’ve positioned bets in favor of ORDI’s worth fall.