- BTC and ETH noticed a surge in lengthy liquidation quantity with the value drop within the final buying and selling session.

- The property have began the brand new month with optimistic strikes.

Bitcoin [BTC] and Ethereum [ETH] ended September on a unstable be aware, with each property experiencing declines. Quick-position merchants dominated the market, driving lengthy liquidation volumes greater.

Regardless of these drops, the absence of a major sell-off signifies a optimistic signal for the market.

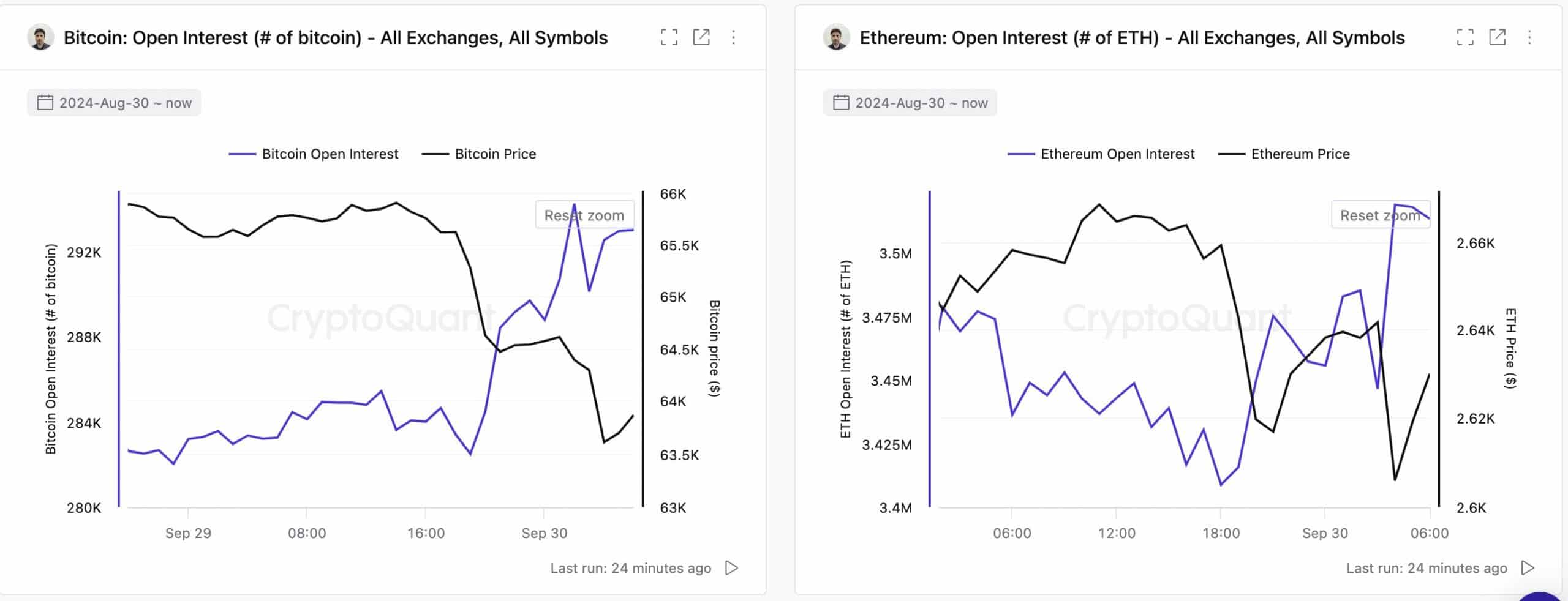

Bitcoin and Ethereum open curiosity declines

In accordance with CryptoQuant, Bitcoin and Ethereum’s open curiosity (OI) noticed notable declines over the past buying and selling session. Bitcoin’s open curiosity dropped from $18.6 billion to $18.1 billion, indicating that merchants have been closing futures positions.

This lower in OI typically indicators decrease liquidity, volatility, and curiosity in derivatives buying and selling, which might doubtlessly result in a protracted/brief squeeze.

Equally, Ethereum’s open curiosity additionally noticed a slight decline, although much less important than Bitcoin’s. As of now, BTC’s open curiosity has bounced again to $18.3 billion, and ETH’s OI has risen to $9.4 billion, reflecting renewed market exercise.

Bitcoin and Ethereum costs observe OI tendencies

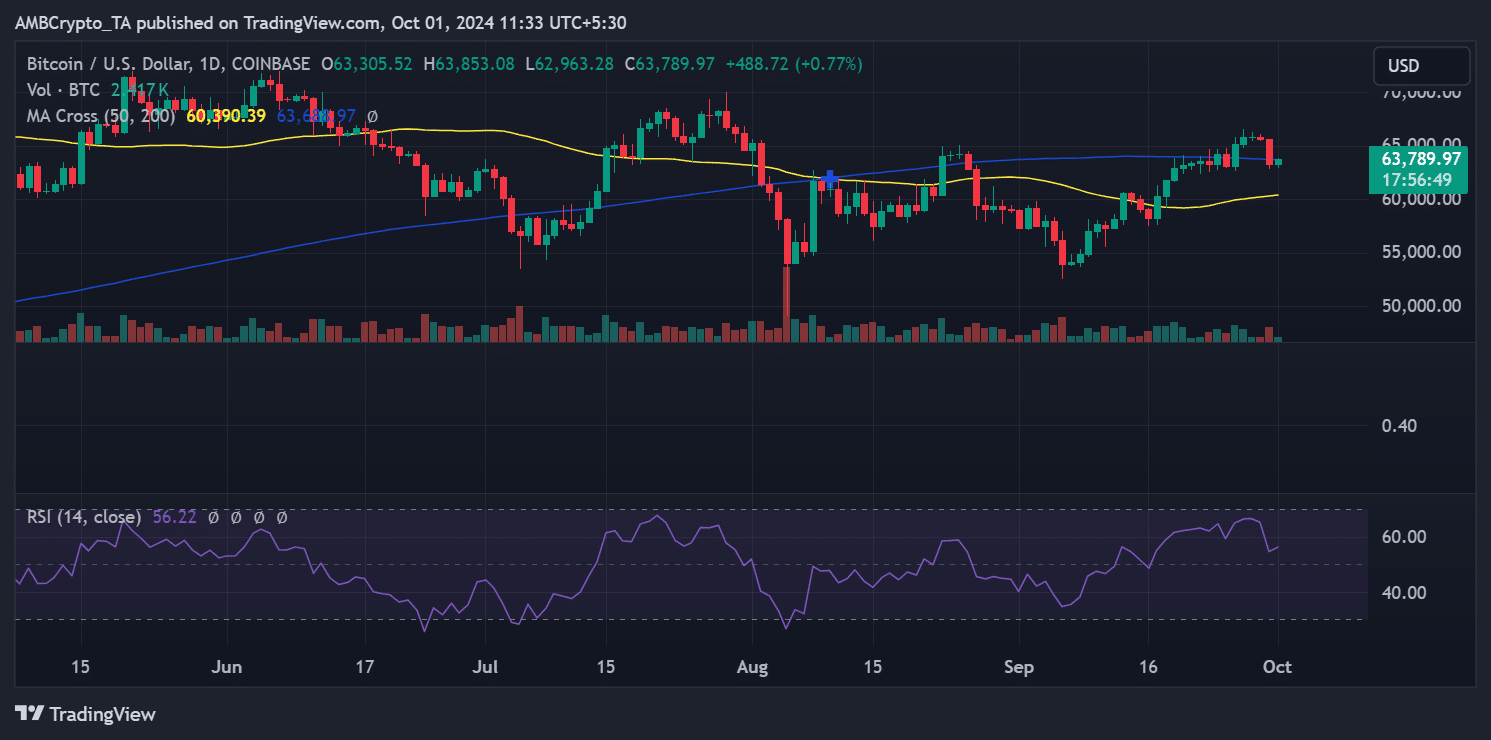

The drop in open curiosity had a direct impression on each Bitcoin and Ethereum costs. Bitcoin skilled a 3.50% decline, falling from $65,600 to $63,301, dipping under its 200-day shifting common.

Equally, Ethereum dropped by 2.13%, from $2,657 to $2,601, staying under its 200-day shifting common however nonetheless above the 50-day shifting common.

As of this writing, each property have proven a slight rebound. Bitcoin was buying and selling at $63,789 with a 0.7% enhance, whereas Ethereum gained over 1%, buying and selling round $2,639.

Alternate flows stay steady

Regardless of the latest declines, there hasn’t been a major sell-off. Knowledge from CryptoQuant reveals that Bitcoin recorded a damaging change movement, indicating a balanced movement of BTC between exchanges and private wallets.

Alternatively, Ethereum noticed a slight enhance in change inflows, with 14,000 ETH flowing into exchanges over the past buying and selling session.

Nevertheless, this quantity wasn’t sufficient to set off a serious sell-off. Presently, the movement has turned damaging once more, with over 23,000 ETH being withdrawn from exchanges, signaling lowered promoting stress.

Learn Ethereum (ETH) Value Prediction 2024-25

Conclusion

Whereas Bitcoin and Ethereum confronted notable declines within the ultimate days of September, the shortage of a serious sell-off and the slight worth rebound counsel a comparatively steady market.

Open curiosity tendencies and change flows point out that buyers are usually not speeding to exit their positions, displaying potential for restoration within the close to time period.