Market Overview: EURUSD Foreign exchange

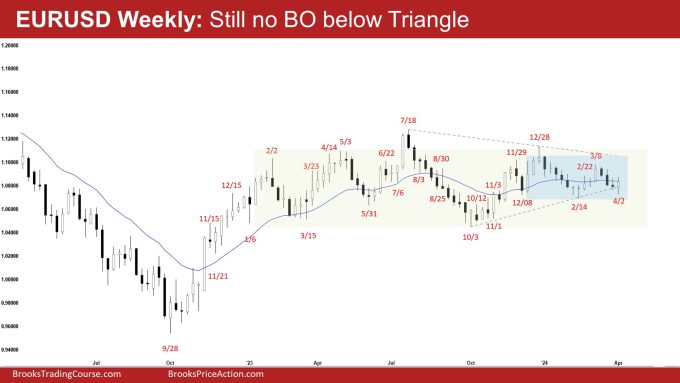

On the weekly chart, there was nonetheless no EURUSD breakout under the triangle. The bulls need a reversal from a double backside bull flag (Feb 14 and Apr 2) or a wedge bull flag (Dec 8, Feb 14, and Apr 2). The bears hope that this week was merely a pullback and hope to get at the very least one other small leg to retest the March 29 low.

EURUSD Foreign exchange market

The Weekly EURUSD chart

- This week’s candlestick on the weekly EURUSD Foreign exchange chart was a bull bar with a distinguished tail above closing in its higher half and across the 20-week EMA.

- Final week, we stated that the percentages barely favor the market to commerce at the very least a bit of decrease. Merchants will see if the bears can create a breakout under the triangle or will the market commerce barely decrease however discover help across the bull pattern line space.

- The market traded decrease earlier within the week however discovered help across the bull pattern line space.

- Beforehand, the bears received a reversal from a wedge bear flag (Nov 3, Nov 29, and Dec 28) and a decrease excessive main pattern reversal (Dec 28).

- They then received one other leg down from a decrease excessive main pattern reversal (Mar 8).

- Up to now, they haven’t but been in a position to create a powerful breakout from the triangle sample.

- They hope that this week was merely a pullback and hope to get at the very least one other small leg to retest the March 29 low.

- The bulls received a 2-legged sideways to up pullback (Mar 8) from a double backside bull flag (Dec 8 and Feb 14).

- They see that the present transfer is solely a pullback and need a retest of the March 8 excessive adopted by a breakout above.

- They need a reversal from a double backside bull flag (Feb 14 and Apr 2) or a wedge bull flag (Dec 8, Feb 14, and Apr 2) and wish the 20-week EMA or the bull pattern line to behave as help.

- Since this week’s candlestick was a bull bar closing in its higher half, it’s a purchase sign bar for subsequent week albeit weaker (distinguished tail above).

- The bulls must create a follow-through bull bar closing above the 20-week EMA to extend the percentages of a retest of the March Excessive.

- The market is buying and selling across the center of the buying and selling vary which could be an space of steadiness.

- For now, merchants will see if the bulls can create a follow-through bull bar or will the market proceed to stall across the 20-week EMA space.

- Poor follow-through and reversals are hallmarks of a buying and selling vary.

- The EURUSD is in a 71-week buying and selling vary. (Trading vary excessive: July 2023, Trading vary low: Oct 2023).

- The EURUSD has been in a smaller buying and selling vary within the final 21 weeks.

- Merchants will proceed to BLSH (Purchase Low, Promote Excessive) inside a buying and selling vary till there’s a breakout with follow-through promoting/shopping for.

The Each day EURUSD chart

- The EURUSD traded decrease earlier within the week however reversed increased from Tuesday onwards. Thursday and Friday have been consecutive doji(s) buying and selling across the 20-day EMA.

- Beforehand, we stated that the percentages barely favor the market to commerce at the very least a bit of decrease. Merchants will see if the bears can create follow-through promoting under the bull pattern line or not.

- Whereas the market has traded under the bull pattern line, the bears haven’t but been in a position to create a powerful breakout with follow-through promoting.

- Beforehand, the bulls received a TBTL (Ten Bars, Two Legs) pullback forming a decrease excessive (Mar 8).

- They hope to get one other leg up from a double backside bull flag (Feb 14 and Apr 2) or a wedge bull flag (Dec 8, Feb 14, and Apr 2).

- They need the 20-day EMA or the bull pattern line to behave as help. Up to now, the bull pattern line is performing as help.

- The bulls need a retest of the March 8 excessive adopted by a powerful check and breakout above the bear pattern line.

- The bears see the latest transfer (to March 8) merely as a two-legged pullback and a purchase vacuum check of the small buying and selling vary excessive space.

- They received a reversal from a decrease excessive main pattern reversal (Mar 8) and a double high bear flag (Jan 11 and Mar 8).

- They need a retest of the February 14 low (even when it solely finally ends up as the next low). They received what they wished and the retest fashioned the next low (Apr 2).

- If the market trades increased, the bears hope to get a reversal from a double high bear flag with the March 8 excessive.

- For now, merchants will see if the bulls can create follow-through shopping for following this week’s shut above the 20-day EMA.

- The EURUSD has been buying and selling in a smaller buying and selling vary within the final 21 weeks. This week, the market reversed increased from across the low of the smaller buying and selling vary.

- The market can be buying and selling across the center of the bigger buying and selling vary which may very well be an space of steadiness.

- Poor follow-through and reversals are hallmarks of a buying and selling vary.

- Merchants will proceed to BLSH (Purchase Low, Promote Excessive) inside a buying and selling vary till there’s a breakout with follow-through promoting/shopping for.

Market evaluation studies archive

You’ll be able to entry all weekend studies on the Market Evaluation web page.