Market Overview: Nifty 50 Futures

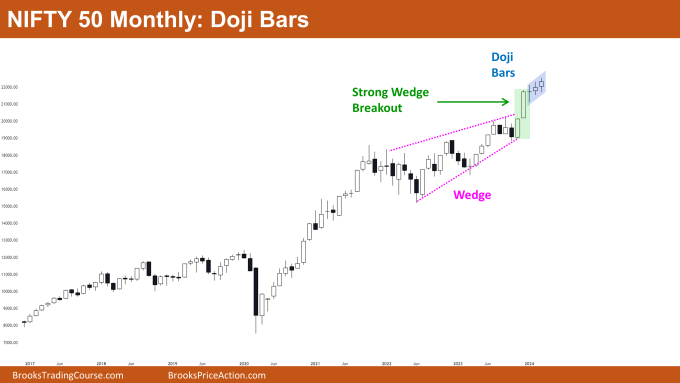

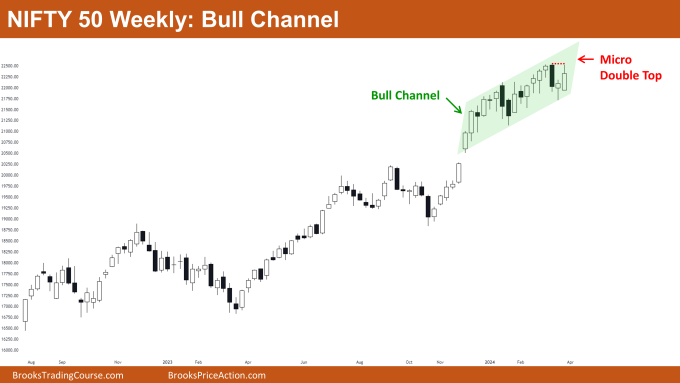

Nifty 50 Doji Bars on the month-to-month chart. The market has fashioned the third consecutive small doji bar this month. Regardless of the bull breakout of the wedge high, bulls are struggling to keep up robust follow-through upward momentum. This might doubtlessly sign weak point to bears, prompting them to provoke brief positions. On the day by day chart, Nifty 50 is at present buying and selling inside a bull channel and has lately fashioned a micro double high. Moreover, the weekly chart signifies the market starting to exhibit buying and selling vary worth motion. If bulls fail to generate a sturdy bull bar within the upcoming week, Nifty 50 could transition right into a buying and selling vary or expertise a minor reversal.

Nifty 50 futures

The Month-to-month Nifty 50 chart

- Common Dialogue

- Nifty 50 on the month-to-month chart signifies a sturdy bull development, minimizing the probability of a major development reversal.

- With such a powerful development, it’s advisable for bears to chorus from promoting for a swing place. At greatest, they might encounter a buying and selling vary however not a significant development reversal.

- Regardless of a possible pullback resulting from lowering upside momentum, bulls can nonetheless make strategic entries by putting restrict orders on the low of bars.

- In circumstances the place a bull bar is notably robust and shutting close to its excessive, bulls also can think about coming into on the excessive of the bar utilizing cease orders.

- Deeper into Value Motion

- The forceful bull breakout of the wedge high presents a low likelihood occasion, akin to a shock prevalence.

- In cases like these, the place the market experiences such occasions, the probability of a second leg up earlier than a significant development reversal is critical.

- This implies that even with an entry level on the peak of the development, bulls can handle to exit the commerce at breakeven in the event that they deal with their trades prudently.

- Patterns

- Ought to bears handle to kind strong bear bars with an in depth close to the low within the upcoming month, the likelihood of a small buying and selling vary will rise.

- The bull breakout of the wedge high is considered a shock occasion because of the rarity of bull breakouts from such formations, with solely a 25% probability of prevalence.

The Weekly Nifty 50 chart

- Common Dialogue

- Nifty 50 is buying and selling inside a bull channel. The tightness of this channel makes it troublesome for bears to revenue.

- Bears are cautioned towards taking brief positions until there’s a transparent and robust bear breakout from the bull channel.

- The market is exhibiting an increasing buying and selling vary in its worth motion on the weekly chart. This implies that bulls also needs to chorus from coming into lengthy positions till robust bull bars reappear, closing close to their highs.

- Deeper into Value Motion

- It’s notable that throughout the bull channel, greater than 80% of bars have lengthy tails, indicating an impending buying and selling vary.

- With the market buying and selling near the numerous spherical variety of 22000, merchants ought to anticipate buying and selling vary worth motion on the weekly chart within the coming weeks.

- Patterns

- Nifty 50 is exhibiting indicators of forming a micro double high sample. Given the power of the bull development, this micro double high isn’t prone to set off a significant development reversal.

- Essentially the most bears can anticipate from this micro double high is a small buying and selling vary.

Market evaluation stories archive

You may entry all weekend stories on the Market Evaluation web page.