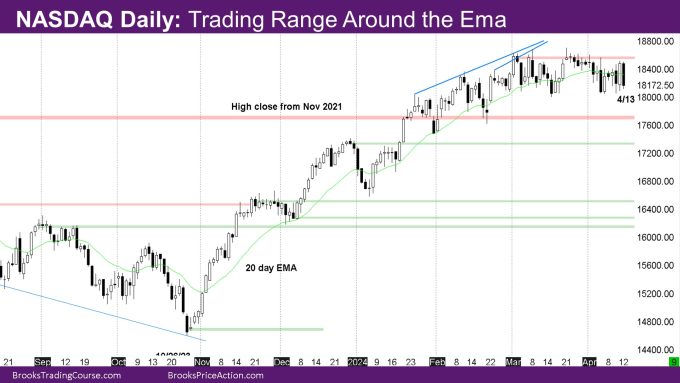

Market Overview: NASDAQ 100 Emini Futures

The NASDAQ Emini futures week is a bear doji inside bar. The market continues to be sideways since 2-26, though bears did handle 3 consecutive bear bars since September 2023.

On the every day chart, the market oscillated across the exponential transferring common (EMA). As was talked about final week, it has been unable to shut above the excessive shut of March 1 at 18588.75. It will possible result in decrease costs to try to shut the November 2021 bull hole.

Thus far, the month is a small inside bear bar with tails. As talked about earlier than, the month-to-month chart is in a bull micro-channel so there must be consumers under prior development bull bars.

NASDAQ 100 Emini futures

The Weekly NASDAQ chart

- The week is a bear doji inside bar.

- It’s a promote sign bar for what might be the twond leg down.

- As has been the theme for the previous 6 weeks, the November 2021 shut remains to be in play because it at the moment represents an open bull hole.

- The market is probably going going sideways until the exponential transferring common (EMA) goes above the November 2021 hole, wherein case bulls will possible purchase if the market will get to the EMA. This manner bulls will nonetheless be capable to preserve the hole open.

The Every day NASDAQ chart

- The market is in a buying and selling vary across the EMA – neither aspect is getting consecutive development bars.

- The market seems to wish to take a look at the November 2021 excessive shut.

- Probably the market will then be in a buying and selling vary between the November 2021 shut and the excessive shut of March 1.

- Monday and Tuesday have been doji bars with small our bodies.

- Wednesday was a doji with a much bigger bear physique.

- Thursday and Friday fashioned 2 bar bear reversal the place Thursday was a bull development bar and Friday was a bear development bar whose physique overlapped with Thursday.

Market evaluation experiences archive

You may entry all weekend experiences on the Market Evaluation web page.