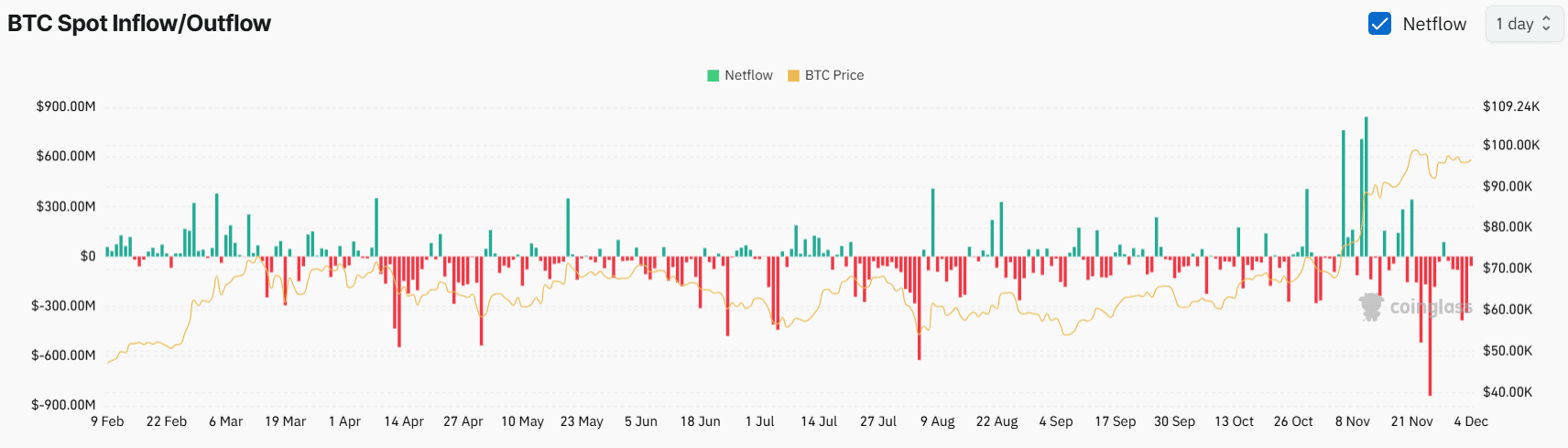

- BTC spot influx/outflow knowledge reveals that exchanges have seen a big outflow of $860.52 million.

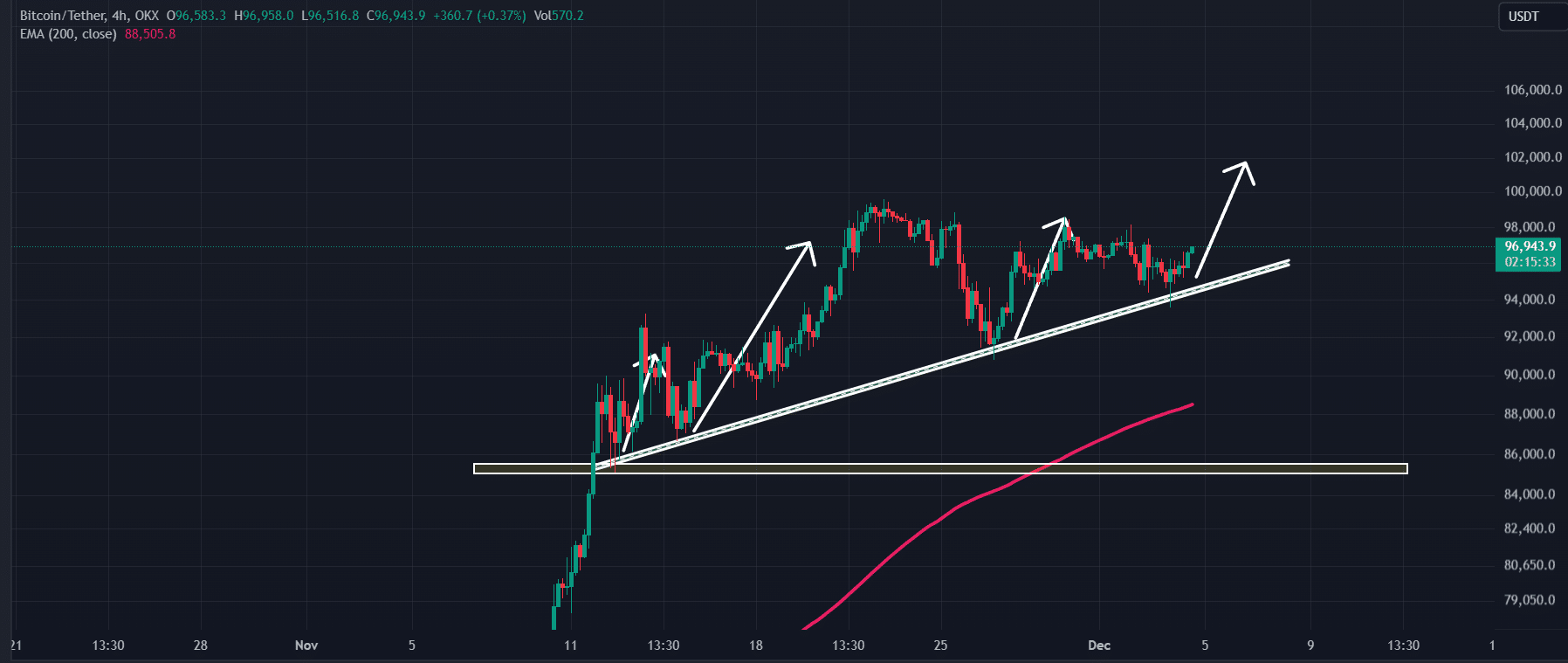

- BTC’s current worth motion signifies that it may rise by 3% to achieve the $99,588 degree.

Bitcoin [BTC], the world’s greatest cryptocurrency by market capitalization, seems to be in a hazard zone as reported by an important on-chain metric.

At press time, the general market appears to be recovering after experiencing a modest worth decline following South Korean president’s declaration of martial regulation.

Bitcoin MVRV metric sends a warning

In line with the on-chain analytics agency Santiment, the typical returns of Bitcoin wallets lively prior to now 30 days have entered a hazard zone.

This hazard zone happens when BTC’s MVRV approaches or exceeds +5%. As of this writing, the metric stands at +4.2%, indicating that the value is nearing a correction.

MVRV is a vital on-chain metric that merchants and traders use when constructing positions. If the MVRV is close to +5%, it signifies a possible worth correction.

Conversely, if the MVRV is near -5%, it suggests a possible shopping for alternative and indicators {that a} worth bounce could also be imminent.

$860 million of outflow from exchanges

Regardless of BTC’s worth being within the hazard zone, whales and establishments have proven sturdy curiosity and confidence within the asset. Coinglass’s BTC spot influx/outflow knowledge reveals that exchanges have seen a big outflow of $860.52 million over the previous 4 days.

This substantial outflow means that whales or traders have withdrawn tokens from exchanges to their wallets, intending to carry them for the long run.

Trade outflows additionally trace at a bullish signal, as they cut back the probability of promoting stress and entice new traders.

Bitcoin technical evaluation and key degree

In line with AMBCrypto’s technical evaluation, BTC is in an uptrend. It has not too long ago discovered assist from an upward-sloping trendline and is now heading towards its all-time excessive close to $100,000.

Based mostly on current worth motion, there’s a sturdy chance that it may rise by 3% to achieve the $99,588 degree within the coming days.

On the optimistic facet, the asset’s Relative Energy Index (RSI) is at 55, which is under the overbought territory. This means that BTC nonetheless has sufficient room to rally within the coming days.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

At press time, BTC was buying and selling close to $96,900 and has registered an upside momentum of 1.75% prior to now 24 hours.

Throughout the identical interval, its buying and selling quantity elevated by 7.5%, indicating a modest rise in participation from merchants and traders amid a bullish outlook.