- MicroStrategy boosted its Bitcoin holdings to 331,200 BTC, price $30 billion, resulting in a inventory surge.

- This coincided with MicroStrategy’s acquisitions beneath its formidable “21/21 plan” and Bitcoin hitting $90K.

MicroStrategy Inc. has as soon as once more made headlines with its aggressive Bitcoin [BTC] acquisition technique. The agency bought $4.6 billion price of Bitcoin.

In alignment with its dedication to increasing BTC holdings, the enterprise software program big acquired roughly 51,780 Bitcoin between November eleventh and seventeenth, in keeping with a latest SEC submitting.

This newest buy follows acquisitions in October and September, bringing the corporate’s complete BTC holdings to a powerful $30 billion.

MicroStrategy’s founder, Michael Saylor, additionally shared his ideas on X (previously Twitter), stating,

This led to MicroStrategy’s inventory (MSTR) surging by roughly 13% on 18th November, hitting a document closing excessive.

Influence on MicroStrategy’s inventory value

This exceptional efficiency highlights the corporate’s 2024 success, with MSTR shares up over 500% year-to-date. This considerably outpaces Microsoft’s 11% development throughout the identical interval, in keeping with Yahoo Finance.

At the moment buying and selling at $384.79 per Google Finance, MicroStrategy’s aggressive BTC technique is yielding substantial returns. This consists of inventory appreciation and the rising worth of its cryptocurrency holdings.

Moreover, the corporate plans to boost $1.75 billion by a non-public providing of zero-interest convertible senior notes. These notes will mature in December 2029, reinforcing its dedication to increasing its Bitcoin investments.

Group response

Observing the agency’s vital strides, an X person remarked,

“Big moves! MicroStrategy’s playing chess while others are stuck on checkers.”

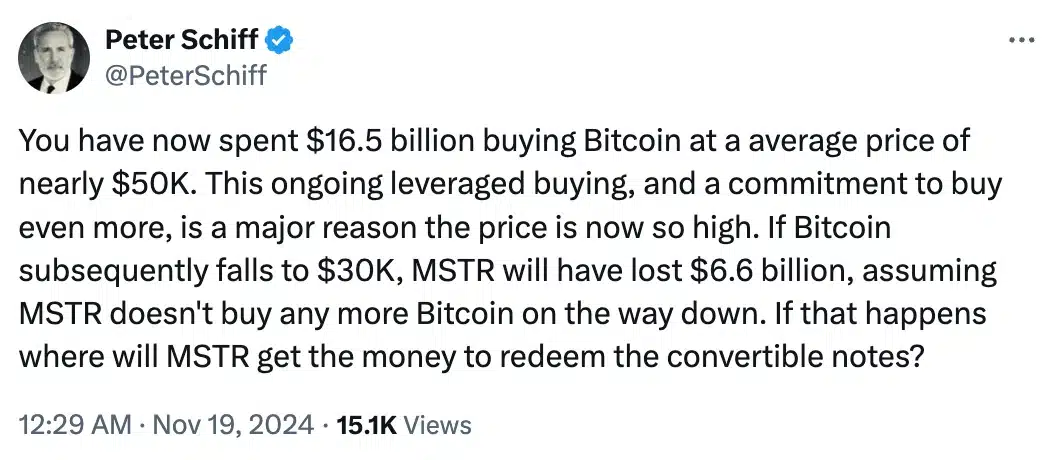

Nonetheless, critics like Peter Schiff seized the chance to weigh in, stating,

Regardless of going through criticism from figures like Schiff, MicroStrategy has solidified its place as the most important institutional Bitcoin holder, with a powerful 331,200 BTC acquired at a cumulative value of $16.5 billion—considerably under the present market worth.

This milestone comes as Bitcoin trades at unprecedented highs, surpassing $90,000 following the U.S. election.

As of the newest replace, BTC was valued at $91,767.56, reflecting a minor 0.03% dip previously 24 hours however sustaining robust weekly and month-to-month beneficial properties of two.72% and 34.19%, respectively, as per CoinMarketCap.

MicroStrategy’s roadmap forward

MicroStrategy’s newest Bitcoin acquisition was funded by promoting roughly 13.6 million firm shares. This transfer aligned with its formidable “21/21 plan.”

The technique goals to boost $42 billion by fairness and fixed-income choices over three years. This displays the corporate’s dedication to increasing its BTC holdings.

Since adopting Bitcoin as a core reserve asset in August 2020, MicroStrategy has used it to hedge towards inflation and diversify its treasury.

Its open-source BTC reserve technique has impressed different public corporations, corresponding to Marathon Digital Holdings and Semler Scientific, to undertake related approaches, signaling a rising pattern in company Bitcoin funding.