- MicroStrategy plans a $700 million convertible word providing amid Bitcoin market uncertainty.

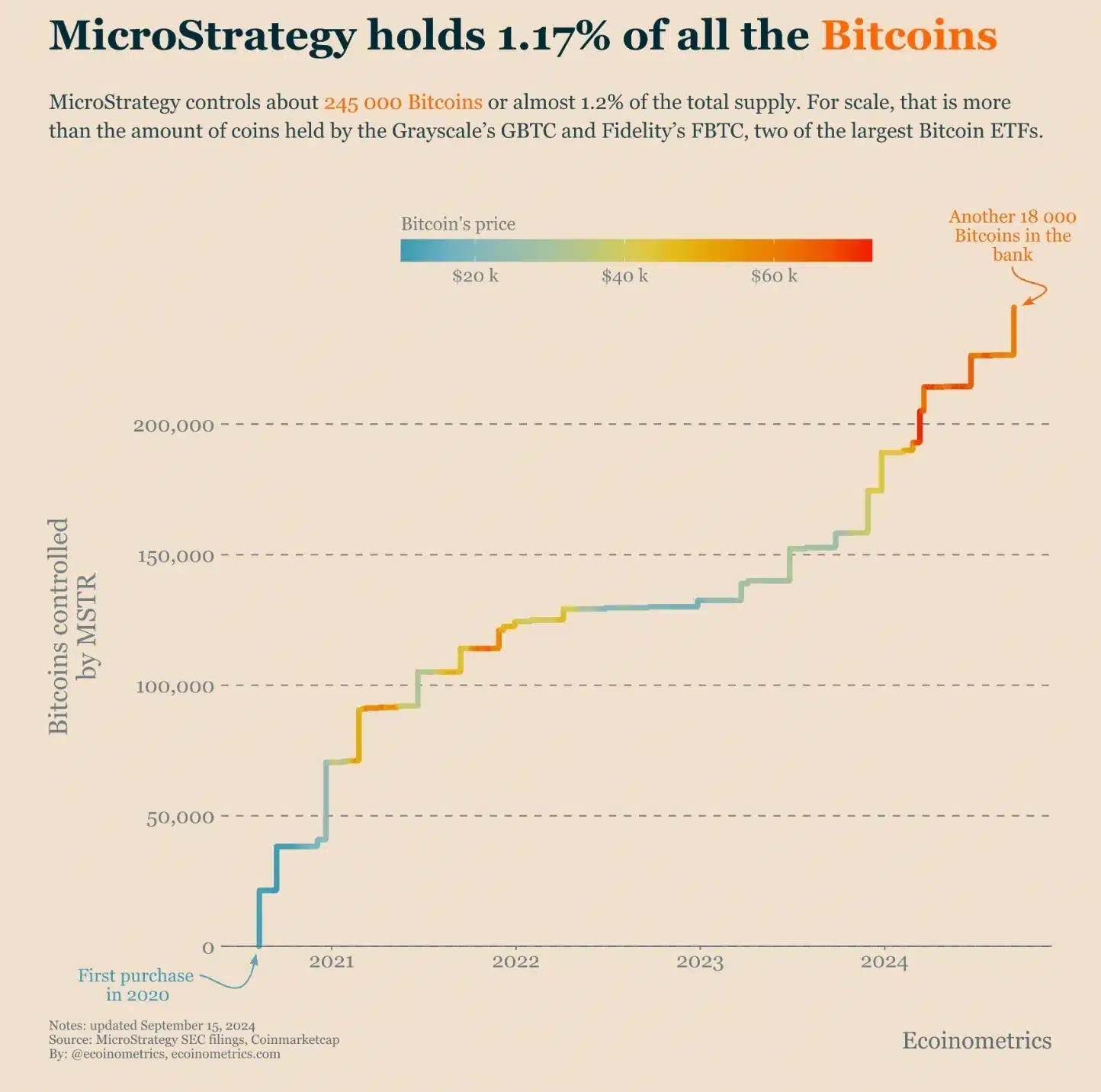

- MicroStrategy now holds 1.17% of the overall Bitcoin provide, growing its crypto dominance.

MicroStrategy, a distinguished Bitcoin [BTC] growth agency listed on Nasdaq, revealed plans to supply $700 million value of convertible senior notes due in 2028.

This announcement comes at a time when BTC’s worth is going through resistance across the $60,000 mark.

Regardless of this, the cryptocurrency confirmed constructive motion, with its worth rising by 1.02% prior to now 24 hours to $59,173.

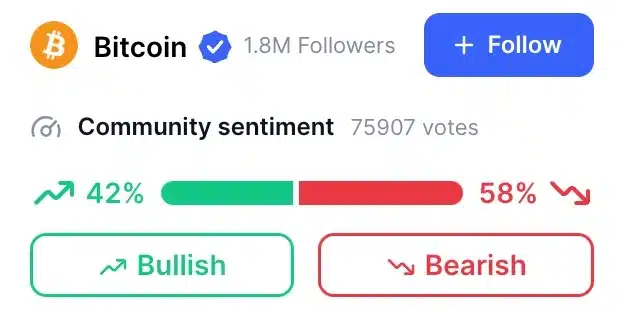

Nonetheless, sentiment throughout the Bitcoin group stays divided.

In accordance with CoinMarketCap, 42% of traders preserve a bullish outlook on BTC, whereas 58% maintain a bearish perspective, reflecting the uncertainty out there.

Microstrategy’s Bitcoin technique

In accordance with the press launch these notes shall be provided in a personal sale to institutional traders who qualify underneath Rule 144A of the Securities Act of 1933.

Convertible senior notes are a type of debt that may later be transformed into fairness (shares of the corporate) underneath sure situations, and being “senior” means they take precedence over different money owed within the occasion of liquidation.

The non-public nature of this providing, geared toward certified institutional consumers, permits the corporate to bypass extra intensive public providing laws, with the aim of securing funds by means of this debt instrument whereas giving traders the choice to transform it into firm inventory.

Group reacts

Nonetheless, Bitcoin critic Peter Schiff seemed to be unfazed by this growth, as evidenced by his submit on X, the place he identified,

“Not again. What happens when MSTR is the only buyer left? There is a limit to how much debt MSTR can issue to keep the pyramid from collapsing.”

Amid the continued developments, Ecoinometrics additionally reported that MicroStrategy now holds a formidable 1.17% of your complete BTC provide.

The corporate continues to steadily improve its Bitcoin reserves, positioning itself forward of most BTC ETFs by way of holdings.

Different corporations following Microstrategy’s path

Following MicroStrategy’s daring Bitcoin technique, different corporations have begun to undertake related approaches.

Metaplanet, a publicly-listed funding and consulting agency based mostly in Japan, continues its “buy the dip” strategy regardless of BTC’s current struggles.

The corporate just lately acquired an extra 38.46 BTC for $2.1 million, bringing its whole Bitcoin holdings to almost 400 BTC, valued at roughly $23 million.

Since Metaplanet initiated its BTC funding technique in April, its inventory worth has soared by 480%, in response to MarketWatch.

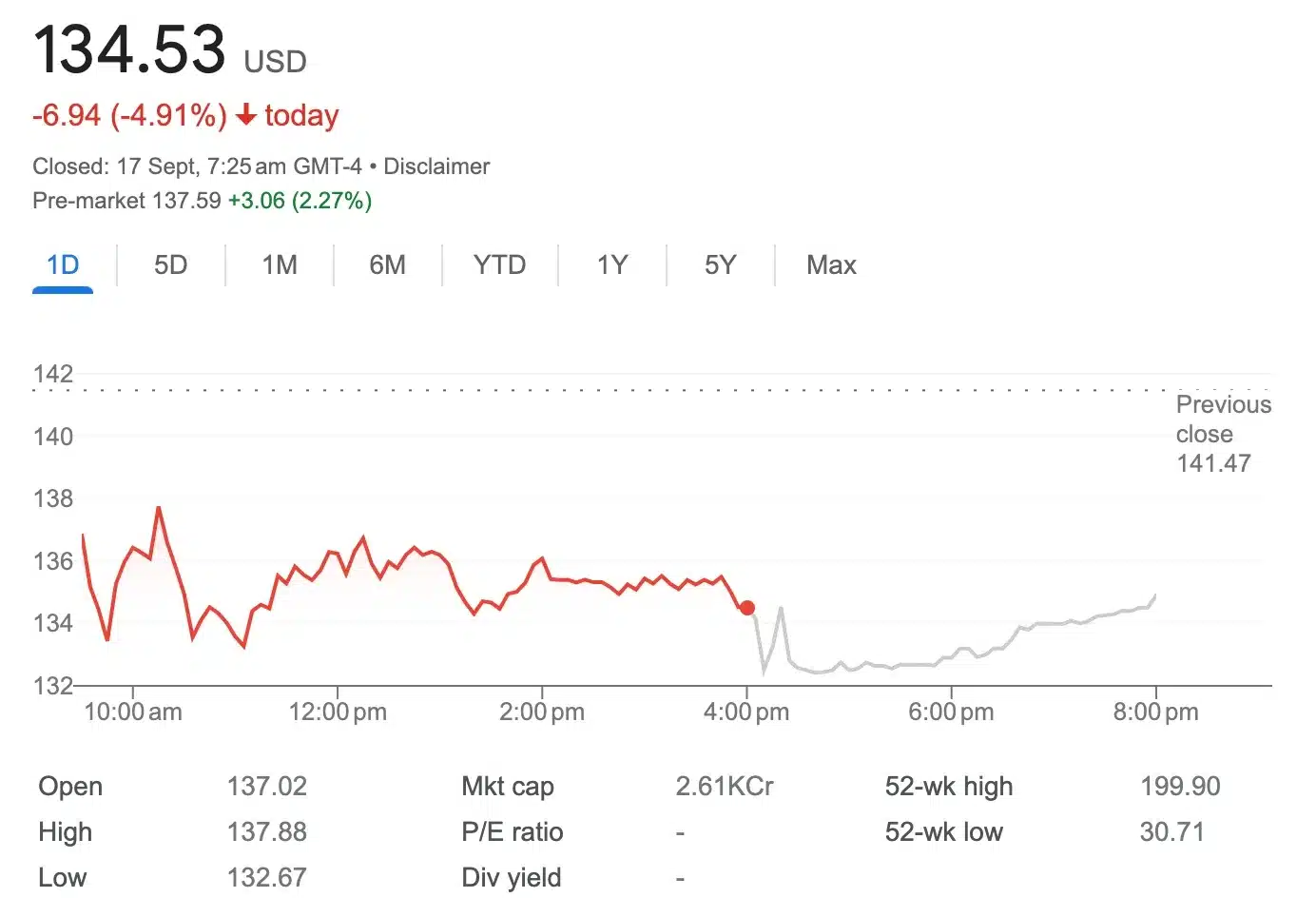

In distinction, MicroStrategy’s inventory noticed a 4.91% drop on seventeenth September, although it has surged 294.98% over the previous yr, as reported by Google Finance.

Therefore, MicroStrategy’s constant accumulation of Bitcoin reinforces its long-term dedication to the cryptocurrency, solidifying its presence as one of many main institutional gamers within the digital asset house.